==========================================

Neural networks have become a powerful tool in analyzing stock patterns and predicting market trends. They are increasingly used in quantitative trading strategies, offering a way to identify complex relationships in data that might be too intricate for traditional methods. By leveraging deep learning techniques, neural networks can help traders and investors gain valuable insights into the stock market.

In this article, we will explore how neural networks are used to analyze stock patterns, the different types of neural networks applied in trading, their advantages and limitations, and how you can implement them for improved trading accuracy.

Understanding Neural Networks in Stock Market Analysis

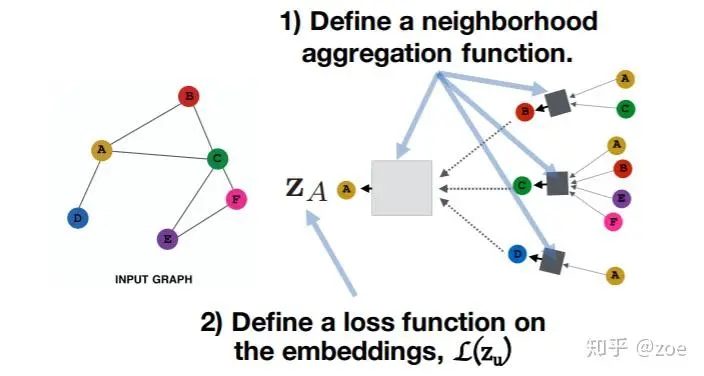

Neural networks are a subset of machine learning, inspired by the human brain’s neural structure. They consist of layers of interconnected nodes or “neurons” that process input data and make predictions based on patterns recognized from previous data. Neural networks are particularly effective in analyzing stock patterns due to their ability to detect nonlinear relationships, which is crucial for predicting stock prices or trends.

How Neural Networks Work in Stock Market Analysis

Neural networks take historical stock price data and other relevant market information as inputs. These inputs are passed through multiple layers, where the network adjusts its internal parameters (weights) to minimize prediction errors.

The most common types of neural networks used in stock market analysis include:

- Feedforward Neural Networks (FNNs): These are simple neural networks where data moves in one direction—from input to output. They are often used in pattern recognition tasks, such as identifying price movements based on historical data.

- Recurrent Neural Networks (RNNs): Unlike FNNs, RNNs have feedback loops that allow them to retain information from previous time steps, making them ideal for time-series data like stock prices.

- Convolutional Neural Networks (CNNs): Typically used in image processing, CNNs are increasingly being applied to financial market data by treating market time series data as “images” for pattern recognition.

- Long Short-Term Memory (LSTM) Networks: A specialized type of RNN, LSTMs are designed to capture long-term dependencies in data, making them particularly well-suited for predicting stock trends over longer periods.

Why Neural Networks Are Effective in Stock Analysis

Neural networks excel at stock pattern analysis due to their ability to:

- Identify Nonlinear Relationships: Stock prices are influenced by complex and nonlinear factors. Neural networks can capture these complex patterns that traditional statistical methods may miss.

- Handle Large Data Sets: Neural networks are designed to handle massive amounts of data, which is essential when analyzing large stock market databases.

- Adapt to Market Changes: Neural networks can continuously learn from new data, making them highly adaptable to changing market conditions.

Methods for Analyzing Stock Patterns with Neural Networks

1. Predicting Stock Prices with Neural Networks

One of the most popular applications of neural networks in stock trading is price prediction. Neural networks can take historical stock price data and use it to forecast future price movements.

How It Works:

- Data Input: The neural network is fed historical stock prices, trading volumes, and technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands.

- Training: The network is trained on past data to learn patterns in stock price fluctuations.

- Prediction: Once trained, the neural network can predict the future direction of a stock’s price movement.

Advantages:

- Accurate Predictions: Neural networks can provide accurate price predictions when trained on high-quality, relevant data.

- Adaptability: These models can adapt to changing market conditions over time.

Disadvantages:

- Data-Dependent: The accuracy of predictions heavily relies on the quality of input data.

- Overfitting: Neural networks may overfit to historical data, making them less reliable in unseen market conditions.

2. Classifying Market Trends with Neural Networks

Neural networks can also be used to classify stock market trends, such as identifying bullish, bearish, or neutral trends based on historical patterns.

How It Works:

- Feature Selection: Key market indicators and technical analysis data, such as moving averages, volume analysis, and momentum indicators, are used as inputs.

- Classification: The neural network learns to categorize market conditions into predefined categories (e.g., bullish, bearish, or sideways).

Advantages:

- Trend Detection: Neural networks are highly efficient at detecting market trends and fluctuations, which are crucial for traders.

- Real-Time Analysis: Neural networks can be used for real-time market analysis and decision-making.

Disadvantages:

- Complex Models: Building effective classification models can be complex and requires advanced understanding of machine learning.

- Market Noise: Stock markets are often noisy, which can confuse the model and reduce prediction accuracy.

3. Sentiment Analysis and Stock Pattern Recognition

Neural networks are also used in sentiment analysis to determine how market sentiment (positive or negative) influences stock prices. Sentiment analysis involves analyzing text data from news articles, social media, and financial reports to understand how public perception affects the market.

How It Works:

- Data Sources: Textual data from news articles, financial reports, and tweets is analyzed using Natural Language Processing (NLP) techniques.

- Neural Network Processing: The neural network processes the data to identify trends in market sentiment and how they correlate with price movements.

Advantages:

- Holistic Analysis: Combines both qualitative and quantitative data for comprehensive market analysis.

- Predictive Power: Identifying sentiment-driven price movements can provide traders with a significant edge.

Disadvantages:

- Data Overload: Analyzing vast amounts of unstructured textual data can be overwhelming and may require significant computational resources.

- Sentiment Inaccuracy: Sentiment analysis can sometimes misinterpret the tone or context, leading to inaccurate predictions.

How to Build a Neural Network for Stock Pattern Analysis

1. Data Collection and Preprocessing

To train a neural network effectively, you need to collect relevant market data. This includes:

- Historical Stock Prices: Prices over different time frames (daily, weekly, monthly).

- Technical Indicators: Data such as moving averages, RSI, and MACD.

- Market News: News sentiment can also play a role in stock movements.

Preprocessing data is crucial to clean it for training. This involves:

- Normalization: Scaling data so that all input features are within a similar range.

- Data Augmentation: Generating additional data by introducing slight modifications to the existing dataset to improve the model’s robustness.

2. Model Training

Once the data is prepared, it’s time to train the model. This involves:

- Splitting the Data: Dividing data into training, validation, and test sets to evaluate model performance.

- Choosing the Right Model: Depending on your needs (e.g., price prediction, trend classification), you may choose different types of neural networks such as RNNs, CNNs, or LSTMs.

3. Model Evaluation and Optimization

After training the model, evaluate its performance using metrics like Mean Squared Error (MSE) for regression tasks (price prediction) or accuracy for classification tasks (trend classification). You may need to fine-tune hyperparameters like learning rates, batch sizes, and network architecture to improve performance.

4. Deployment

Once optimized, the model can be deployed for live trading, making real-time predictions based on incoming market data.

FAQ: Common Questions About Neural Networks in Stock Analysis

1. How Can Neural Networks Be Used to Improve Quantitative Trading?

Neural networks enhance quantitative trading by providing a sophisticated method of predicting stock price movements and trends. Their ability to analyze vast amounts of market data and adapt to changing market conditions gives them a significant advantage over traditional quantitative models.

2. How Do Neural Networks Handle Market Volatility?

Neural networks can be trained to recognize and adjust to high volatility periods by incorporating volatility measures as input features. By learning from past volatile periods, they can predict similar events in the future, allowing for better risk management.

3. Can Neural Networks Be Used for Real-Time Stock Market Analysis?

Yes, neural networks can be used for real-time stock market analysis. By processing live data streams, they can make instant predictions, enabling traders to act quickly on market opportunities.

Conclusion

Neural networks have proven to be a powerful tool in stock pattern analysis, offering the ability to detect complex relationships in market data that traditional methods cannot. Whether you’re predicting stock prices, identifying trends, or analyzing sentiment, neural networks provide significant advantages for traders and investors. By understanding how these models work and how to implement them effectively, you can unlock new opportunities in the stock market.

Share Your Thoughts

Have you used neural networks in stock market analysis? How has it impacted your trading strategies? Share your experiences and insights in the comments below!

0 Comments

Leave a Comment