==========================================

Understanding how neural networks analyze stock patterns has become essential for modern quantitative traders, portfolio managers, and retail investors. With the rapid adoption of artificial intelligence (AI) in financial markets, neural networks are being used to identify subtle price dynamics, detect trading opportunities, and optimize execution strategies. Unlike traditional technical analysis, which relies heavily on visual pattern recognition and indicator-based decision-making, neural networks can capture nonlinear relationships and hidden dependencies in market data that are often invisible to the human eye.

In this article, we’ll explore how neural networks analyze stock patterns, compare different approaches, and provide practical insights on implementation. We will also connect this discussion to broader applications such as how neural networks improve quantitative trading and how neural networks predict market trends.

Why Neural Networks Are Changing Stock Pattern Analysis

Neural networks are designed to mimic the human brain’s ability to recognize patterns, learn from examples, and adapt to new situations. When applied to stock market data, they can process vast amounts of price, volume, and sentiment information to identify structures that indicate potential price moves.

Unlike traditional models (e.g., ARIMA, linear regression), neural networks:

- Handle non-linearities: Markets are not linear; they react differently to similar events under different conditions. Neural networks capture this complexity.

- Process high-dimensional data: They can analyze multiple inputs simultaneously (e.g., historical prices, order book depth, economic indicators, news sentiment).

- Adapt to changing environments: Neural networks learn continuously, making them suitable for evolving financial markets.

Neural networks process stock data in layers, identifying complex patterns beyond human recognition

Core Methods: How Neural Networks Analyze Stock Patterns

1. Time-Series Forecasting with Recurrent Neural Networks (RNNs)

Recurrent Neural Networks (RNNs), especially Long Short-Term Memory (LSTM) models, are widely used in stock pattern recognition because they excel at handling sequential data. Stock prices are time-dependent, and LSTMs can remember previous states while predicting future movements.

How RNNs analyze stock patterns:

- Track historical price movements and volatility.

- Recognize repeating cycles (e.g., seasonal patterns, earnings announcements).

- Capture dependencies between past and present market conditions.

Advantages:

- Excellent for trend and momentum detection.

- Effective at modeling long-term dependencies.

- Can incorporate multiple timeframes (intraday vs. daily).

Limitations:

- Sensitive to noisy financial data.

- Requires careful tuning to prevent overfitting.

- Computationally intensive for high-frequency trading.

2. Pattern Recognition with Convolutional Neural Networks (CNNs)

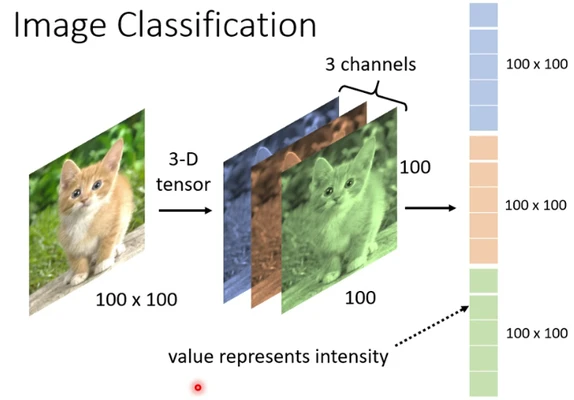

Convolutional Neural Networks (CNNs) are typically associated with image recognition but have proven highly effective in analyzing stock patterns, especially candlestick formations and chart structures. By transforming financial data into images (heatmaps, chart patterns), CNNs can “see” the market as a visual problem.

How CNNs analyze stock patterns:

- Detect classic chart patterns like head-and-shoulders, double tops, or triangles.

- Identify hidden micro-patterns invisible to traditional technical analysis.

- Analyze multiple correlated assets by treating them as multi-channel images.

Advantages:

- Superior in recognizing visual technical patterns.

- Works well in combination with RNNs for hybrid modeling.

- Can be applied to alternative data (e.g., satellite images, sentiment word clouds).

Limitations:

- Less effective at long-term sequential forecasting.

- Requires large datasets for training.

- May struggle in highly efficient markets with minimal visible patterns.

3. Hybrid Models: Combining CNNs and RNNs

Many researchers and practitioners combine CNNs and RNNs to create hybrid neural networks that capture both temporal and spatial features of stock data.

For example:

- CNN layers first identify short-term chart patterns.

- RNN layers then analyze the sequence of these patterns over time.

This hybrid approach often provides the best results in complex markets.

Workflow showing how CNNs and RNNs can be combined for stock market analysis

Practical Applications in Stock Trading

Short-Term Pattern Recognition

Day traders use neural networks to detect micro-patterns in intraday charts, predicting price reversals or breakouts.

Long-Term Forecasting

Institutional investors employ LSTMs to forecast quarterly or yearly stock performance by integrating fundamental and macroeconomic factors.

Risk Management

Neural networks can analyze volatility patterns, improving portfolio hedging and execution cost management.

Comparing Neural Network Strategies

| Approach | Best For | Strengths | Weaknesses |

|---|---|---|---|

| RNNs / LSTMs | Sequential time-series forecasting | Captures long-term dependencies, momentum analysis | Sensitive to noise, computationally heavy |

| CNNs | Visual stock pattern detection | Strong in chart/candlestick recognition | Weak in sequential forecasting |

| Hybrid (CNN + RNN) | Advanced pattern recognition across time and visuals | Best of both worlds, adaptable | Requires more data and computing power |

Case Example: Detecting Bullish Reversals

Imagine an LSTM model trained on S&P 500 stocks that identifies oversold conditions. The same dataset is transformed into candlestick images, and a CNN confirms bullish reversal formations. When combined, the system produces a high-confidence signal, reducing false positives and enhancing profitability.

This highlights why firms increasingly integrate how neural networks predict market trends into their trading models.

Key Considerations for Implementation

- Data Quality Matters: Neural networks are only as good as their inputs. Clean, high-frequency, and alternative data sources improve accuracy.

- Avoid Overfitting: Markets change; models that work today may fail tomorrow. Regular retraining is essential.

- Interpretability Challenges: Neural networks are black-box models. Explainable AI techniques (e.g., SHAP values) are vital for regulatory and investor trust.

- Execution Integration: Beyond prediction, traders must embed models into execution systems, balancing costs and slippage.

FAQ: How Neural Networks Analyze Stock Patterns

1. Can neural networks consistently beat the stock market?

Neural networks improve forecasting but do not guarantee profits. Markets are partially efficient and influenced by unpredictable events. Their strength lies in providing statistical edges, which when combined with risk management, can yield sustainable returns.

2. What type of neural network is best for stock market analysis?

It depends on the use case:

- LSTMs are best for trend forecasting.

- CNNs excel at visual candlestick and chart pattern recognition.

- Hybrid models often deliver the best performance by combining both approaches.

3. Do I need massive datasets to train neural networks for trading?

Large datasets improve performance, but transfer learning and pre-trained models allow smaller traders to leverage neural networks effectively. Many successful applications use medium-sized datasets enriched with alternative data sources (e.g., sentiment, fundamentals).

Conclusion: The Future of Stock Pattern Analysis with Neural Networks

Neural networks are reshaping how traders and investors interpret stock market dynamics. By leveraging RNNs, CNNs, and hybrid approaches, market participants can uncover patterns hidden in price movements, candlestick charts, and correlated assets. While challenges such as data quality, interpretability, and overfitting remain, the trajectory is clear: AI-driven stock analysis is here to stay.

If you’re exploring deeper applications, consider resources on how neural networks improve quantitative trading or advanced guides on how neural networks predict market trends.

📢 Join the conversation: How do you see neural networks changing the future of stock analysis? Share this article with your network, leave a comment with your insights, and spark a discussion with fellow traders and analysts!

Would you like me to also design original infographic-style images (e.g., CNN vs. RNN comparison, hybrid workflow diagrams) so the article stands out visually beyond stock photos?

0 Comments

Leave a Comment