======================================================================

Introduction

Understanding how to identify trends with price action is one of the most crucial skills a trader can develop. Unlike indicator-heavy approaches that often lag behind real market moves, price action trading focuses on raw market data—candlesticks, patterns, and support/resistance levels. Mastering this skill helps traders make more accurate decisions, spot early trend reversals, and minimize false signals.

In this article, I’ll combine professional insights, practical experience, and the latest trading approaches to explain how you can use price action to identify trends effectively. We’ll cover multiple strategies, compare their strengths and weaknesses, and build a framework you can adapt whether you trade forex, stocks, or crypto.

What Is Price Action and Why It Matters

Price action is the study of price movement itself, without relying heavily on technical indicators. Traders read candlestick patterns, highs and lows, and structural levels to determine market direction.

Unlike lagging indicators, price action provides real-time insights. For example, a series of higher highs and higher lows confirms an uptrend, while a sequence of lower highs and lower lows signals a downtrend.

If you’ve ever wondered why price action is important in trading, the answer lies in its flexibility and universality—it works across all markets, all timeframes, and all asset classes.

Core Principles of Identifying Trends with Price Action

Higher Highs and Higher Lows

The simplest and most reliable way to identify an uptrend is to track higher highs (HH) and higher lows (HL). Each new wave of buying pushes prices to fresh highs, and the pullbacks remain above previous lows, confirming bullish momentum.

Lower Highs and Lower Lows

For downtrends, the opposite is true: lower highs (LH) and lower lows (LL) confirm bearish conditions. Sellers consistently push the market down, and buyers fail to break resistance levels.

Support and Resistance Levels

Support acts as a floor where buyers step in, while resistance is a ceiling where sellers emerge. Watching how price reacts to these levels is key in determining whether a trend will continue or reverse.

Candlestick Patterns

Patterns such as engulfing candles, pin bars, or inside bars provide additional confirmation. A bullish engulfing pattern near support can confirm an uptrend continuation, while a bearish pin bar at resistance may suggest a reversal.

Two Effective Strategies to Identify Trends

1. Market Structure Strategy

This approach focuses on swing highs and lows to determine the overall trend.

- Process: Mark recent highs and lows → Look for HH/HL or LH/LL → Confirm the trend.

- Advantages: Simple, easy to learn, applicable to all markets.

- Disadvantages: Can be subjective—different traders may mark different levels.

2. Trendline & Channel Strategy

Drawing trendlines across swing points provides visual clarity. Channels add structure by showing both support and resistance within a trend.

- Process: Connect at least two swing highs (for resistance) or two swing lows (for support). Extend to form channels.

- Advantages: Provides a clear visual roadmap and trade zones.

- Disadvantages: Trendlines can break prematurely, leading to false signals.

Comparing the Two Strategies

| Strategy | Strengths | Weaknesses | Best For |

|---|---|---|---|

| Market Structure | Universal, simple, works in all timeframes | Requires practice to avoid subjectivity | Beginners and intermediate traders |

| Trendline & Channel | Visual clarity, defines clear entry/exit zones | Can fail with choppy markets | Swing traders and technical traders |

Recommendation: Combining both strategies works best. Use market structure as your foundation, then refine entries with trendlines and candlestick signals.

Advanced Techniques for Identifying Trends

Price Action with Multiple Timeframes

Analyzing higher timeframes (e.g., daily or weekly) sets the macro trend, while lower timeframes (e.g., 15m or 1h) fine-tune entries.

Reversal and Continuation Patterns

Patterns like head and shoulders, double tops/bottoms, and flags can signal whether a trend is ending or continuing.

Volume Confirmation

Although not purely price action, volume strengthens analysis. A breakout with high volume confirms trend validity.

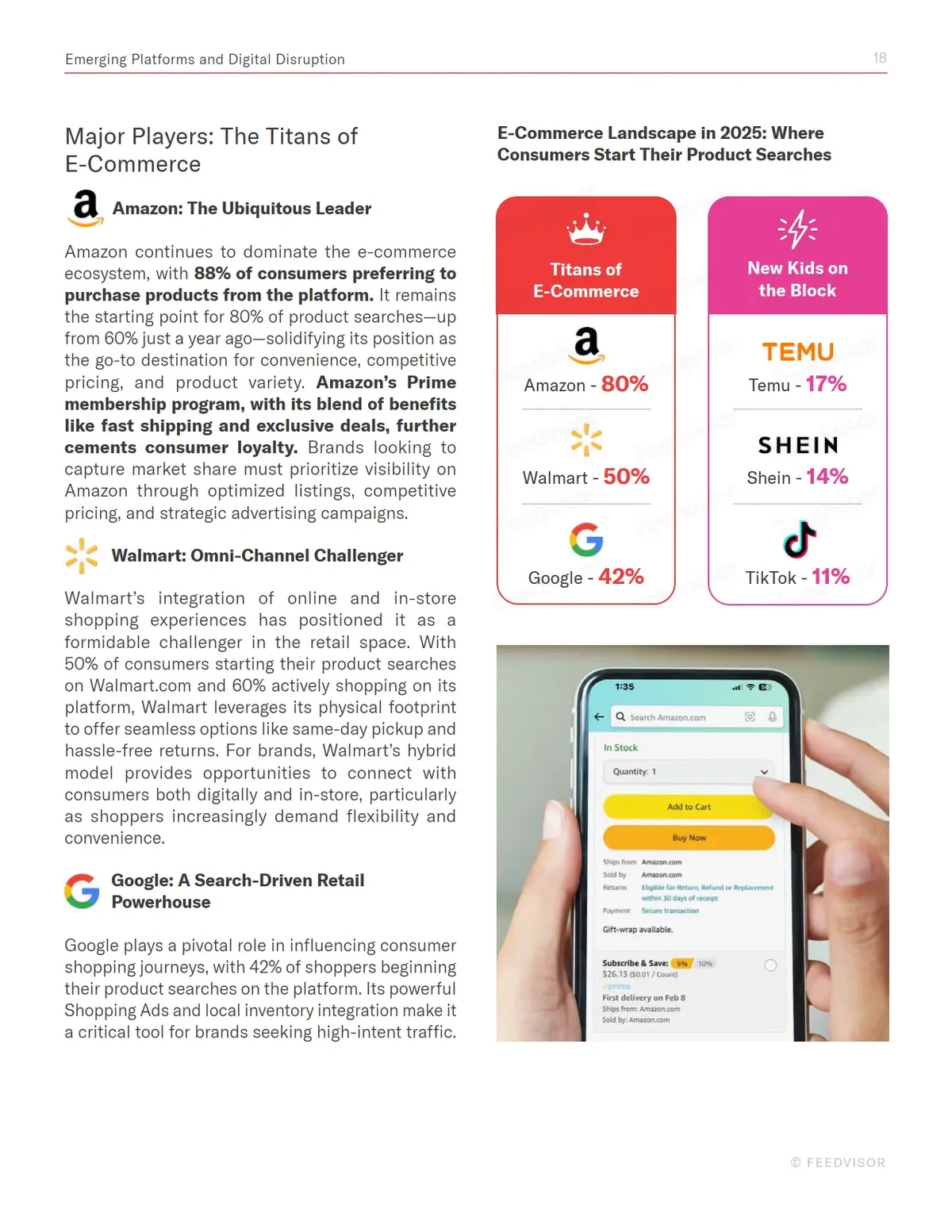

Visual Examples of Price Action Trends

Price action showing higher highs and higher lows in a strong uptrend

Practical Application in Different Markets

Forex

In forex trading, price action is particularly effective since currencies are influenced by macroeconomic trends and liquidity. For instance, price action for forex traders often involves analyzing major support/resistance zones on daily charts.

Stocks

Price action helps identify institutional buying or selling. Price action tips for stock traders include focusing on volume spikes at breakout levels.

Crypto

Due to volatility, crypto traders rely on candlestick signals and breakout levels. Patterns like fakeouts are common, making confirmation crucial.

Integrating Learning Resources

If you’re wondering where to learn price action strategies, there are many structured options available:

- Online courses and mentorship programs

- Books for professionals and beginners

- Trading journals with case studies

Pairing structured education with live chart practice ensures long-term skill mastery.

FAQ: Common Questions on Identifying Trends with Price Action

1. How do I know if a trend is real or just noise?

Focus on the bigger picture. Zoom out to higher timeframes and confirm whether higher highs/lows or lower highs/lows are consistent. Combine with candlestick confirmation to filter out false trends.

2. Can price action work without indicators?

Yes. Many professional traders rely solely on price action. However, adding minimal tools like volume or moving averages can improve accuracy, especially for beginners.

3. How long does it take to master price action?

It varies by trader, but with consistent practice and journaling, noticeable improvements often appear within 3–6 months. Full mastery may take years, depending on market exposure.

Conclusion

Mastering how to identify trends with price action is not about memorizing patterns—it’s about developing an eye for market behavior. By combining market structure with trendlines, candlestick analysis, and multi-timeframe confirmation, you can build a reliable trading system.

Whether you’re a beginner trying to learn how to read price action in trading or an experienced trader refining advanced techniques, price action is a timeless, powerful method.

If you found this article valuable, share it with fellow traders, leave a comment with your experiences, and let’s build a stronger trading community together.

0 Comments

Leave a Comment