====================================================

Introduction

Machine learning has become one of the most powerful tools in quantitative finance. For traders, it provides advanced methods to identify patterns, predict asset prices, and optimize strategies. Among the available programming languages, R stands out due to its strong statistical foundation, extensive financial libraries, and data visualization capabilities. This article will provide a comprehensive guide on how to implement machine learning with R in trading, covering essential tools, step-by-step examples, and practical strategies.

We will also compare multiple approaches to building models in R, highlight real-world applications, and explore why traders increasingly adopt R for financial analysis.

Why Use R for Machine Learning in Trading?

R is widely used in academia and the financial industry for statistical modeling and data analysis. When applied to trading, its strengths include:

- Rich ecosystem of financial packages (e.g.,

quantmod,TTR,PerformanceAnalytics).

- Machine learning frameworks like

caret,randomForest,xgboost, andkeras.

- Data visualization with

ggplot2and interactive tools likeshiny.

- Backtesting capabilities that allow traders to evaluate strategies over historical data.

Compared to Python, R often excels in statistical methods and rapid prototyping of models.

Step-by-Step Guide: How to Implement Machine Learning with R in Trading

Step 1: Data Collection and Preparation

The first step in applying machine learning is gathering high-quality financial data. This can include:

- Stock prices

- Futures contracts

- Options data

- Cryptocurrency prices

- Macroeconomic indicators

Example using quantmod in R:

r

Copy code

library(quantmod)

# Download stock data

getSymbols("AAPL", src = "yahoo", from = "2018-01-01", to = "2023-12-31")

head(AAPL)

Here, we load Apple’s stock price data directly from Yahoo Finance.

Step 2: Feature Engineering

Feature engineering transforms raw price data into meaningful signals. Common features include:

- Moving averages (SMA, EMA)

- Momentum indicators (RSI, MACD)

- Volatility measures (Bollinger Bands, ATR)

Example with R’s TTR package:

r

Copy code

library(TTR)

# Calculate moving averages

AAPL$SMA20 <- SMA(Cl(AAPL), n = 20)

AAPL$RSI14 <- RSI(Cl(AAPL), n = 14)

These engineered features serve as predictors for machine learning models.

Step 3: Model Selection

There are multiple ways to apply machine learning with R in trading. We’ll compare two popular approaches:

1. Supervised Learning (Classification & Regression)

Models like random forests, gradient boosting, and support vector machines predict whether prices will go up or down.

r

Copy code

library(caret)

# Prepare dataset

data <- na.omit(data.frame(

Return = dailyReturn(Cl(AAPL)),

SMA20 = AAPL$SMA20,

RSI14 = AAPL$RSI14

))

# Binary classification: 1 = Up, 0 = Down

data$Direction <- ifelse(data$Return > 0, 1, 0)

# Train/test split

set.seed(123)

trainIndex <- createDataPartition(data$Direction, p = 0.8, list = FALSE)

trainData <- data[trainIndex, ]

testData <- data[-trainIndex, ]

# Train random forest

model <- train(Direction ~ SMA20 + RSI14, data = trainData, method = "rf")

This example trains a random forest to predict price direction based on technical indicators.

2. Time Series Forecasting

Models like ARIMA, LSTM neural networks, or Prophet focus on forecasting future prices.

Example with ARIMA:

r

Copy code

library(forecast)

# Convert closing prices to time series

tsData <- ts(Cl(AAPL), frequency = 252)

# Fit ARIMA model

fit <- auto.arima(tsData)

forecast_prices <- forecast(fit, h = 10)

plot(forecast_prices)

Step 4: Backtesting Strategies

Backtesting is critical to test if your machine learning strategy works historically. R provides specialized packages like PerformanceAnalytics and quantstrat.

r

Copy code

library(PerformanceAnalytics)

# Strategy returns

returns <- ifelse(predict(model, testData) == testData$Direction, testData$Return, -testData$Return)

charts.PerformanceSummary(xts(returns, order.by = index(testData)))

This evaluates cumulative returns and drawdowns of your ML-based strategy.

Step 5: Deployment

Once validated, machine learning models can be deployed in real trading environments. With R Shiny, traders can build dashboards to monitor signals and execute trades automatically.

Comparing Two Machine Learning Approaches in R

Approach 1: Technical Indicator-Based Models

- Pros: Easy to implement, interpretable, suitable for short-term trading.

- Cons: May overfit, limited in adapting to structural market changes.

Approach 2: Deep Learning and Time Series Forecasting

- Pros: Captures complex nonlinear patterns, works well with large datasets.

- Cons: Requires more computational resources, less interpretable.

Best choice: A hybrid approach, combining technical indicators with deep learning models, often produces the most robust results.

Real-World Use Cases of R in Machine Learning for Trading

- Algorithmic Trading – Hedge funds use R to develop machine learning models for intraday trading.

- Risk Management – Predicting volatility spikes using regression and classification models.

- Portfolio Optimization – Applying reinforcement learning for dynamic portfolio rebalancing.

- Crypto Trading – Using LSTM models to capture momentum in volatile digital assets.

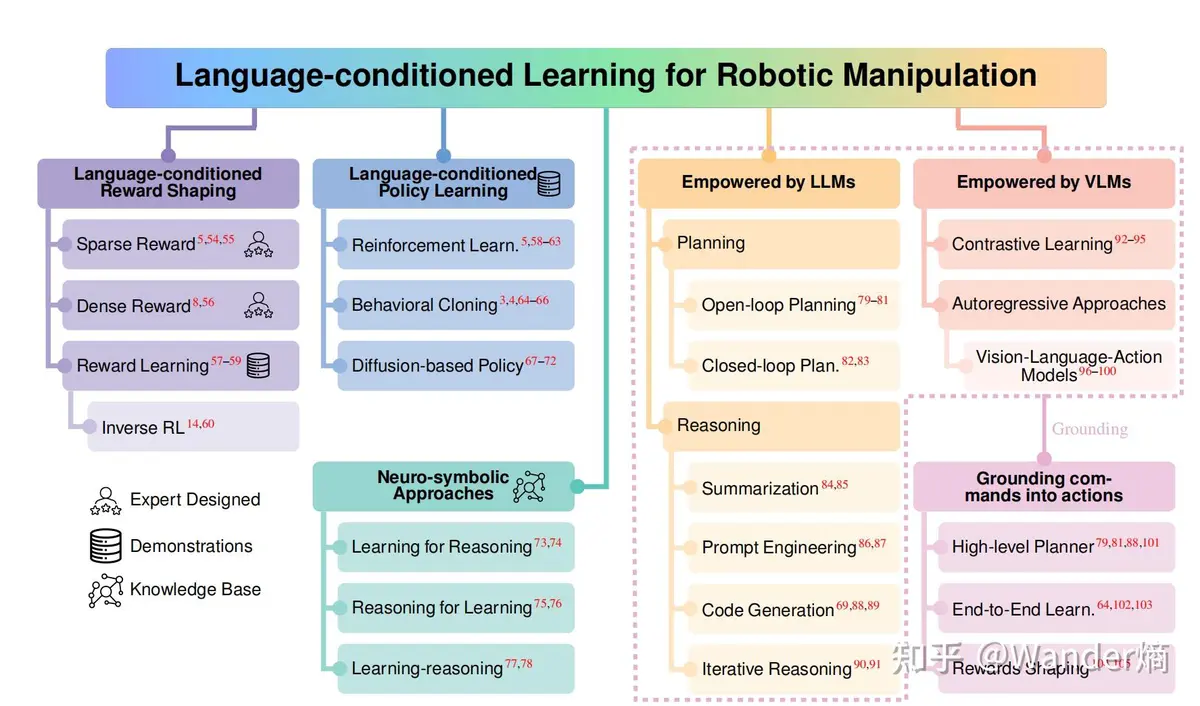

Visual Example

Typical workflow of machine learning implementation in R for trading.

Advanced Techniques for R-Based Trading

- Ensemble Models: Combining multiple ML algorithms to improve predictive accuracy.

- Reinforcement Learning: Training agents to make sequential trading decisions.

- Bayesian Methods: Incorporating uncertainty into trading predictions.

- Natural Language Processing (NLP): Analyzing financial news sentiment using R’s

tmortext2vecpackages.

These advanced techniques show why R is preferred for algorithmic trading by many quants.

Learning Resources for Traders Using R

- Online platforms like DataCamp and Coursera provide R tutorials for data scientists in finance.

- Blogs such as QuantInsti and R-bloggers publish practical guides.

- GitHub repositories with quant traders’ guide to R packages showcase code for trading strategies.

If you’re just starting, it’s worth checking Where to learn R for quant trading? as many structured courses exist to accelerate learning.

0 Comments

Leave a Comment