==================================================================

Quantitative trading has become one of the most popular methods for making decisions in the financial markets. It combines mathematical models, statistical analysis, and algorithmic systems to predict market movements and make trades with minimal human intervention. If you’re wondering how to implement quantitative trading strategies, this comprehensive guide will walk you through the process, providing insights into the methods, tools, and strategies used by both beginners and professionals.

- What is Quantitative Trading?

——————————–

1.1 Understanding Quantitative Trading

Quantitative trading, often referred to as “quant trading,” uses mathematical models to identify profitable trading opportunities based on historical data. The goal is to build models that can predict price movements with accuracy, enabling automated trades that follow these predictions. This strategy is commonly used by hedge funds, institutional investors, and increasingly, retail traders who are familiar with data analysis and coding.

1.2 Key Components of Quantitative Trading

Quantitative trading typically involves:

- Data Analysis: Using historical price data, trading volumes, and financial indicators to find patterns and correlations.

- Algorithmic Trading: Writing algorithms that automatically execute trades based on the signals generated by the models.

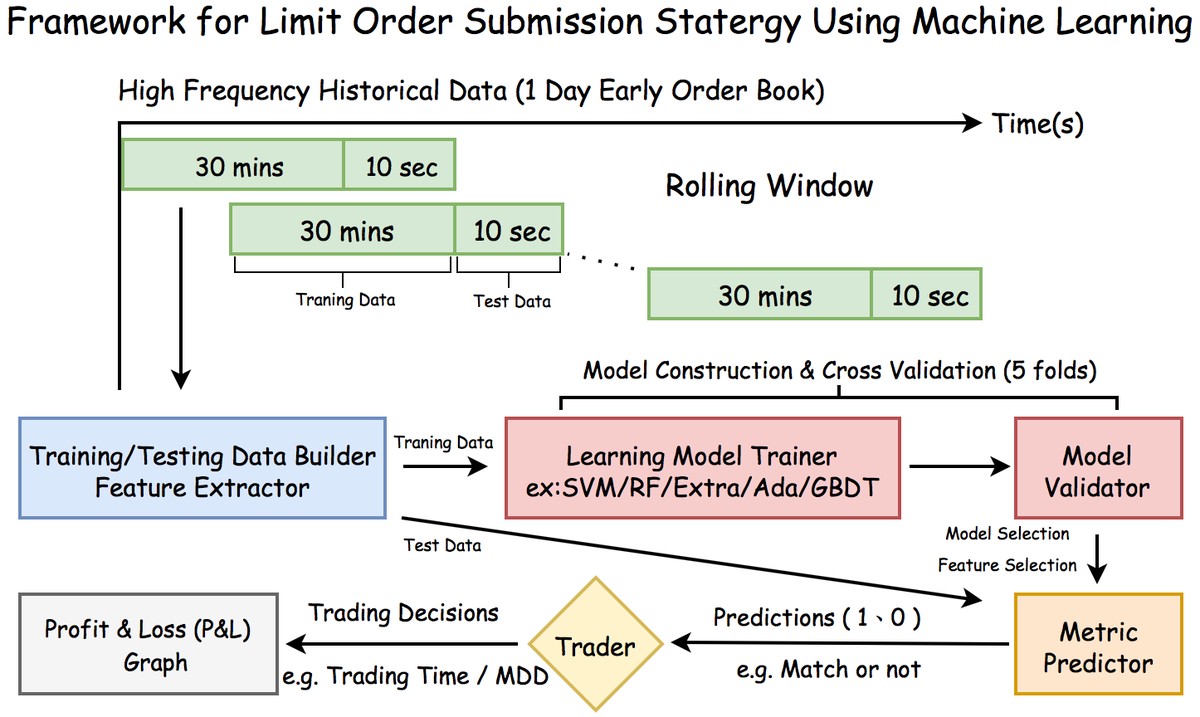

- Statistical Models: Applying statistical techniques such as regression analysis, machine learning, and time-series analysis to forecast price movements.

1.3 Advantages of Quantitative Trading

- Automation: Reduces human error and emotion-driven decisions.

- Scalability: Can be scaled up to trade large volumes or apply multiple strategies at once.

- Efficiency: Faster execution of trades allows for capturing small opportunities in milliseconds.

- Core Quantitative Trading Strategies

—————————————

2.1 Statistical Arbitrage

Statistical arbitrage involves exploiting price inefficiencies between related financial instruments. The strategy uses statistical models to predict price movements and capitalizes on short-term mispricing.

Example of Statistical Arbitrage:

- Pairs Trading: If two correlated stocks diverge in price, the strategy involves buying the underperforming stock and shorting the overperforming stock, betting that they will eventually converge.

Advantages:

- Can work well in both trending and range-bound markets.

- Relatively low risk when properly executed.

Disadvantages:

- Requires constant monitoring and high-frequency execution.

- Can be exposed to systemic risks if correlations break down unexpectedly.

2.2 Trend Following

Trend following strategies aim to identify and trade in the direction of the current market trend. These strategies often use technical indicators like moving averages, momentum oscillators, and other trend indicators to predict future price movements.

Example of Trend Following:

- Moving Average Crossovers: A simple strategy involves using the crossing of short-term and long-term moving averages to signal buy or sell trades.

Advantages:

- Simple and easy to implement.

- Can generate profits in strongly trending markets.

Disadvantages:

- May underperform in sideways or choppy markets.

- False signals can occur, especially in volatile conditions.

2.3 Mean Reversion

Mean reversion strategies assume that asset prices will eventually revert to their historical averages. When an asset’s price deviates significantly from its average, the strategy bets that the price will revert back toward the mean.

Example of Mean Reversion:

- Bollinger Bands: When an asset’s price hits the upper or lower Bollinger Band, traders might expect the price to revert to the middle band.

Advantages:

- Works well in range-bound or stable markets.

- Can be a low-risk strategy if applied correctly.

Disadvantages:

- Risky in strong trends or extreme market conditions.

- Requires careful timing to avoid getting caught in a volatile market swing.

- Tools and Platforms for Quantitative Trading

———————————————–

3.1 Programming Languages and Libraries

To implement quantitative trading strategies, you’ll need proficiency in programming. Python is one of the most widely used programming languages for quantitative trading due to its simplicity and rich ecosystem of data science libraries.

- Python: Used to write algorithms and handle data analysis.

- R: Preferred for statistical analysis and data visualization.

- MATLAB: Often used in academia and research for complex financial modeling.

Popular Libraries for Quantitative Trading:

- Pandas: For data manipulation and analysis.

- NumPy: For numerical computing.

- SciPy: For scientific computing.

- TA-Lib: For technical analysis of financial data.

- Scikit-learn: For machine learning models.

3.2 Trading Platforms

While coding your strategies is critical, you’ll need a reliable platform for backtesting and executing trades. Here are some commonly used platforms:

- MetaTrader 4⁄5: Popular among retail forex traders, it supports algorithmic trading through Expert Advisors (EAs).

- QuantConnect: An algorithmic trading platform that allows backtesting strategies using historical data.

- Interactive Brokers: A brokerage that offers robust APIs for quantitative trading strategies.

- AlgoTrader: A comprehensive trading platform that supports the development, backtesting, and execution of strategies.

- Implementing Quantitative Trading Strategies

———————————————–

4.1 Backtesting Your Strategy

Before deploying your strategy in a live market, it is essential to backtest it against historical data. Backtesting allows you to simulate how your strategy would have performed in the past and understand its potential risk and return.

Steps for Backtesting:

- Collect Historical Data: Obtain accurate historical data for the assets you wish to trade.

- Write the Algorithm: Develop the algorithm using the programming language of your choice.

- Simulate the Trades: Execute the algorithm on historical data to see how it would have performed.

- Analyze Results: Look at key metrics like Sharpe ratio, maximum drawdown, and win/loss ratio to evaluate performance.

4.2 Risk Management and Position Sizing

Quantitative trading strategies often involve high-frequency trading, so effective risk management is crucial. One key aspect is position sizing, which involves determining how much capital to allocate to each trade based on the level of risk.

Risk Management Techniques:

- Stop-Loss Orders: Automatically close a position if the price moves against you by a certain percentage.

- Risk-Reward Ratio: Set a target profit for every trade that is significantly higher than the risk you’re willing to take.

- Portfolio Diversification: Avoid putting all capital into one asset class or strategy, and spread your risk across different markets or instruments.

4.3 Optimizing Your Strategy

Once your strategy is live, continual optimization is necessary to ensure long-term profitability. Strategies that work well in one market condition may underperform in another, so regularly adjusting parameters and adapting to market changes is essential.

Optimization Techniques:

- Parameter Tuning: Adjust parameters (such as moving average periods or threshold levels) to improve strategy performance.

- Walk-Forward Optimization: Test the strategy on multiple periods and adapt the model to changes in market conditions.

- Common Challenges and How to Overcome Them

———————————————

5.1 Overfitting

Overfitting occurs when a model is too closely fitted to historical data and fails to generalize well to new data. It’s a common pitfall in quantitative trading and can lead to poor performance in live markets.

Solution: Use cross-validation techniques and avoid making the model too complex. Ensure that the model focuses on core market dynamics rather than noise.

5.2 Data Quality

The success of quantitative trading heavily depends on the quality of the data used. Poor-quality or incomplete data can lead to faulty models and losses.

Solution: Use reliable data sources, and clean your data thoroughly before using it in the model. Check for missing values, outliers, and inconsistencies.

5.3 Execution Speed

Quantitative trading often relies on quick execution to capitalize on small price movements. Slow execution can erode profits, especially in high-frequency trading.

Solution: Use high-performance computing resources and direct market access (DMA) for faster order execution.

- FAQ: Frequently Asked Questions

———————————-

6.1 How much capital do I need to start quantitative trading?

The amount of capital required depends on the strategy you’re implementing and the market you’re trading in. For retail traders, starting with a few thousand dollars is feasible for basic strategies, but larger capital might be required for high-frequency or more advanced strategies.

6.2 What are some risks associated with quantitative trading?

Some risks include model risk (where the model doesn’t perform as expected), overfitting (models being too specific to past data), and operational risk (including technology failures). Effective risk management strategies and constant monitoring can mitigate these risks.

6.3 Can quantitative trading strategies work for beginners?

Yes, beginners can implement quantitative strategies, especially with the help of free resources, educational materials, and platforms that offer backtesting tools. However, beginners should start with simpler strategies and gradually advance as they gain experience.

- Conclusion

————-

Implementing quantitative trading strategies can be highly rewarding for investors willing to put in the effort to learn and adapt. With the right tools, algorithms, and risk management techniques, quantitative trading can provide profitable opportunities in the financial markets. Whether you’re a beginner or an experienced trader, understanding the key strategies and continuously optimizing your approach will help you succeed in this data-driven trading world.

0 Comments

Leave a Comment