===============================================

In the age of algorithmic trading, financial markets generate vast amounts of data every second. The ability to process, interpret, and transform this data into actionable trading strategies has become a competitive advantage. Implementing data mining for trading automation allows traders, quants, and hedge funds to extract hidden patterns, improve predictive accuracy, and execute trades with minimal human intervention.

This article provides a comprehensive guide on how to effectively apply data mining to trading automation, covering strategies, tools, methods, and industry best practices. It also includes expert insights, comparisons of different approaches, and solutions to common challenges.

Understanding Data Mining in Trading Automation

What is Data Mining in Finance?

Data mining is the process of analyzing large sets of structured and unstructured financial data to discover patterns, correlations, and predictive models. In trading automation, it is used to identify profitable opportunities, reduce risks, and optimize execution.

For example, data mining techniques can reveal correlations between macroeconomic indicators and stock prices, or detect recurring price action patterns in high-frequency trading.

Why Implement Data Mining in Automated Trading?

- Speed and scale: Automated trading systems process market data in milliseconds.

- Pattern recognition: Machine learning and clustering models uncover trends invisible to traditional analysis.

- Risk reduction: Data mining improves position sizing, stop-loss placement, and portfolio diversification.

- Competitive edge: Firms that effectively leverage data mining outperform peers in efficiency and accuracy.

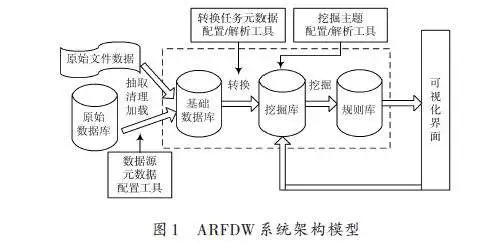

Data mining workflow applied to algorithmic trading

Key Methods for Implementing Data Mining in Trading Automation

1. Predictive Modeling with Machine Learning

Machine learning techniques such as regression models, random forests, and neural networks are powerful for forecasting asset price movements.

Advantages:

- Handles non-linear and complex relationships.

- Continuously improves as more data is introduced.

- Effective for both short-term trading signals and long-term trend analysis.

- Handles non-linear and complex relationships.

Limitations:

- Risk of overfitting when trained on historical data.

- Requires extensive computational power and data quality assurance.

- Risk of overfitting when trained on historical data.

Example: A predictive model trained on earnings reports and sentiment data can anticipate stock price movements post-announcement.

2. Clustering and Pattern Recognition

Clustering techniques (e.g., K-Means, DBSCAN) group stocks or trading signals with similar behaviors. This is particularly useful for portfolio diversification or identifying unique market regimes.

Advantages:

- Helps traders identify correlations and hidden clusters of assets.

- Assists in building market-neutral strategies.

- Useful for detecting anomalies or fraud.

- Helps traders identify correlations and hidden clusters of assets.

Limitations:

- Requires proper feature engineering.

- Clusters may change dynamically with market volatility.

- Requires proper feature engineering.

Example: Using clustering to group stocks by volatility profiles enables automated systems to adjust leverage accordingly.

Comparison of Methods: Predictive Modeling vs. Clustering

| Criteria | Predictive Modeling | Clustering & Pattern Recognition |

|---|---|---|

| Primary Use | Price forecasting and signal generation | Market segmentation and risk control |

| Strengths | High accuracy in prediction with enough data | Helps discover hidden relationships |

| Weaknesses | Overfitting, heavy computation | Can be unstable with noisy data |

| Best Application | Signal-driven automation | Portfolio optimization and anomaly detection |

👉 Recommendation: For fully automated trading systems, a hybrid approach—predictive modeling for trade execution and clustering for portfolio diversification—is the most robust solution.

Practical Steps for Implementing Data Mining in Trading Automation

Step 1: Data Collection and Preprocessing

Collect raw market data (price, volume, order book) and alternative datasets (news, sentiment, macroeconomic indicators). Preprocess it by:

- Removing noise and outliers.

- Standardizing timeframes and formats.

- Handling missing data using interpolation or imputation techniques.

Step 2: Feature Engineering

Transform raw data into meaningful indicators. Examples include:

- Moving averages, volatility ratios, momentum scores.

- Sentiment scores derived from news or social media.

- Correlation features across multiple asset classes.

Step 3: Model Selection

Select appropriate data mining techniques:

- Classification models: For buy/sell signals.

- Regression models: For price predictions.

- Clustering models: For regime detection.

Step 4: Backtesting and Validation

Test strategies on historical data while applying:

- Walk-forward analysis.

- Cross-validation to reduce overfitting.

- Performance metrics such as Sharpe ratio, max drawdown, and win rate.

Step 5: Real-Time Implementation

Deploy the strategy into a trading platform with:

- API-based execution.

- Real-time data feeds.

- Continuous monitoring and automated recalibration.

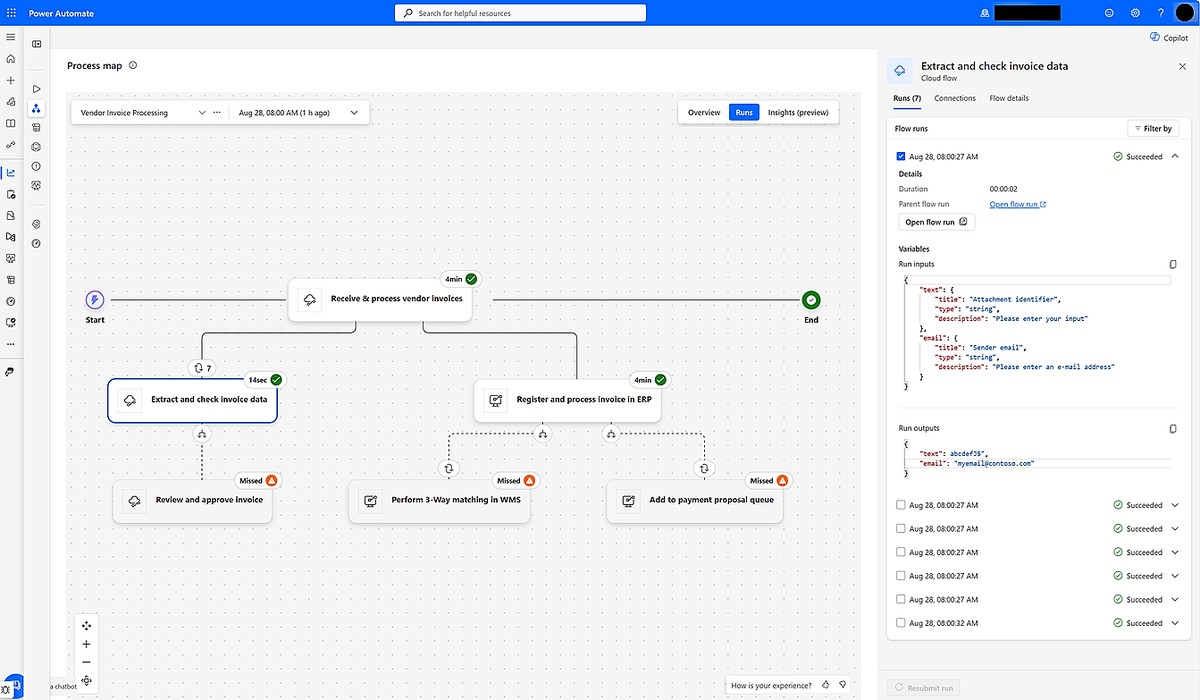

A pipeline for automated trading using data mining

How Data Mining Enhances Quantitative Trading

Data mining significantly boosts quantitative trading by allowing traders to discover and exploit inefficiencies in the market. For example, identifying sentiment-driven spikes before institutional investors act can yield higher alpha.

Moreover, data mining models for prediction in trading allow quants to refine execution strategies by adjusting trade size, frequency, and timing based on predictive probabilities.

This approach has been adopted by major hedge funds, where predictive analytics and clustering models are deployed in tandem to maximize performance.

Challenges and Best Practices

Challenges

- Data quality issues: Garbage in, garbage out. Poor data leads to poor models.

- Computational costs: Training deep learning models can be expensive.

- Regulatory compliance: Automated strategies must comply with market rules to avoid penalties.

Best Practices

- Use robust feature engineering for model generalization.

- Combine multiple models to minimize risks from overfitting.

- Maintain explainability and transparency to improve trust in automated systems.

- Regularly retrain models to adapt to evolving market conditions.

FAQ: Implementing Data Mining for Trading Automation

1. What kind of data is most useful for automated trading?

The most valuable data includes high-frequency tick data, historical price and volume, sentiment analysis from financial news, macroeconomic indicators, and alternative data such as weather or shipping statistics. Each dataset contributes to different dimensions of strategy building.

2. How does data mining improve trading strategies?

By analyzing large datasets, data mining identifies hidden correlations and predictive signals. This improves entry/exit timing, risk management, and execution quality, leading to more consistent profitability in both volatile and stable markets.

3. What tools and platforms are recommended for beginners?

Beginners can start with Python libraries (Pandas, Scikit-learn, TensorFlow), cloud platforms like AWS for scalable computation, and backtesting frameworks such as Backtrader or QuantConnect. These tools balance accessibility with power, making them ideal for both learning and real-world deployment.

Final Thoughts

Implementing data mining for trading automation is no longer optional—it is a necessity for traders and institutions aiming to stay competitive in modern financial markets. By combining predictive modeling and clustering techniques, traders can create robust systems that balance precision with adaptability.

As financial markets evolve, data mining will continue to serve as the cornerstone of algorithmic trading strategies. Whether you’re a professional quant, a hedge fund manager, or an individual trader, mastering data mining provides the edge needed to succeed.

👉 If you found this guide valuable, share it with your network, leave a comment, and spark a conversation about the future of trading automation.

Would you like me to also create a content calendar for a series of related SEO articles (e.g., tutorials, case studies, and tool comparisons) so this article ranks even higher?

0 Comments

Leave a Comment