=======================================================================================

Liquidity is the lifeblood of quantitative trading. For quants, managing liquidity effectively ensures that strategies execute efficiently, risks are minimized, and returns are optimized. This guide provides a detailed framework for liquidity management for quants, exploring methods, tools, and real-world applications, and highlighting best practices for both institutional and retail quantitative traders.

Understanding Liquidity in Quantitative Trading

What Is Liquidity?

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. In quantitative trading, liquidity impacts execution quality, transaction costs, and strategy viability.

Key dimensions of liquidity include:

- Market depth: Number of buy/sell orders at different price levels

- Bid-ask spread: Narrower spreads indicate higher liquidity

- Trading volume: Higher volume assets generally allow larger positions with minimal impact

Why Liquidity Matters for Quants

Liquidity directly influences:

- Execution risk: Slippage can erode returns in illiquid markets

- Position sizing: Illiquid assets limit trade size without impacting price

- Algorithmic strategy performance: High-frequency and low-latency strategies rely on liquid markets

Internal Link Example: Learn how to measure liquidity in quantitative trading to evaluate strategy feasibility.

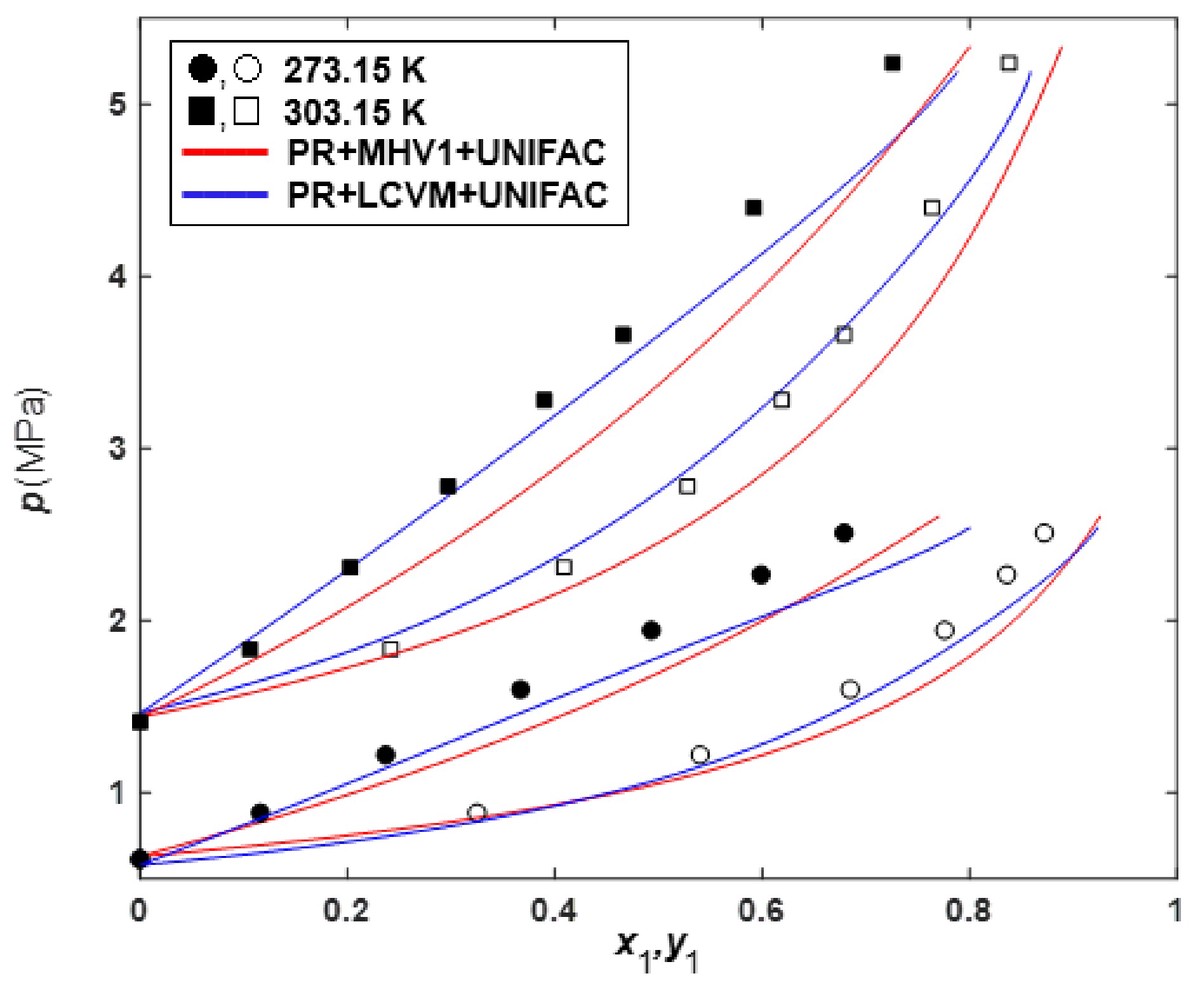

Image Example:

Market depth, spreads, and volume are key indicators of liquidity that quants monitor closely.

Core Components of a Liquidity Management Framework

1. Liquidity Assessment

Data Collection and Monitoring

Effective liquidity management begins with accurate data. Quants rely on:

- Real-time order book data

- Historical volume and price datasets

- Market microstructure metrics like VWAP (Volume Weighted Average Price)

Liquidity Metrics

Key metrics include:

- Bid-ask spread analysis

- Market depth analysis

- Price impact coefficients

- Turnover ratios

Internal Link Example: Discover where to find liquidity data for quantitative strategies to integrate into your models.

2. Liquidity Risk Modeling

Execution Risk Models

Quants quantify liquidity risk by estimating potential slippage and market impact. Models often incorporate:

- Historical order book dynamics

- Transaction cost analysis (TCA)

- Predictive volatility metrics

Stress Testing

Simulating extreme scenarios such as flash crashes or low-volume periods helps assess strategy robustness under liquidity constraints.

Image Example:

Stress testing and market impact simulations are essential for robust liquidity risk assessment.

Strategies to Optimize Liquidity Management

Method 1: Dynamic Position Sizing

Overview

Dynamic position sizing adjusts trade size based on real-time liquidity conditions, reducing the risk of excessive market impact.

Key considerations:

- Scaling trades according to order book depth

- Limiting exposure during low liquidity periods

- Integrating volatility-adjusted position limits

Pros: Minimizes slippage and reduces execution risk

Cons: May lead to missed opportunities in fast-moving markets

Method 2: Smart Order Routing (SOR)

Overview

Smart order routing uses algorithms to split orders across multiple venues to achieve optimal execution. Features include:

- Seeking the best bid-ask spreads across exchanges

- Reducing latency and partial fills

- Minimizing market impact for large orders

Pros: Optimizes execution, reduces cost

Cons: Requires sophisticated infrastructure and monitoring

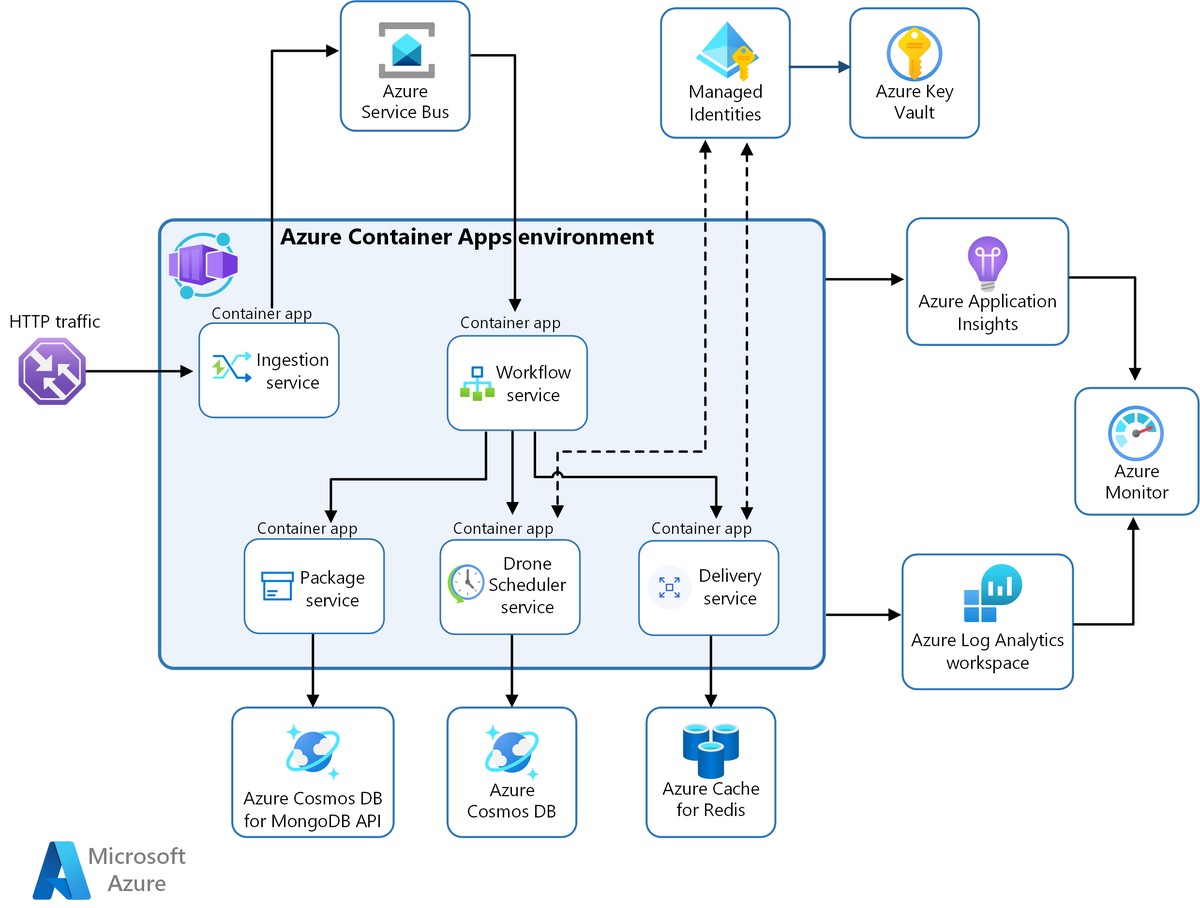

Image Example:

SOR enhances liquidity management by routing trades to optimal venues in real time.

Comparative Analysis of Liquidity Strategies

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Dynamic Position Sizing | Reduces slippage, adapts to liquidity | May limit trade size in fast markets |

| Smart Order Routing (SOR) | Optimizes execution across venues | Complex infrastructure required |

Combining both approaches often provides the most effective liquidity management for quantitative strategies.

Tools and Platforms for Quants

Algorithmic Trading Platforms

Modern platforms provide liquidity analytics, order routing, and execution monitoring:

- Advanced order book visualization

- Real-time liquidity heatmaps

- Integrated transaction cost analysis

Liquidity Optimization Tools

Quantitative traders use specialized tools to:

- Forecast liquidity shortages

- Optimize execution schedules

- Analyze historical slippage patterns

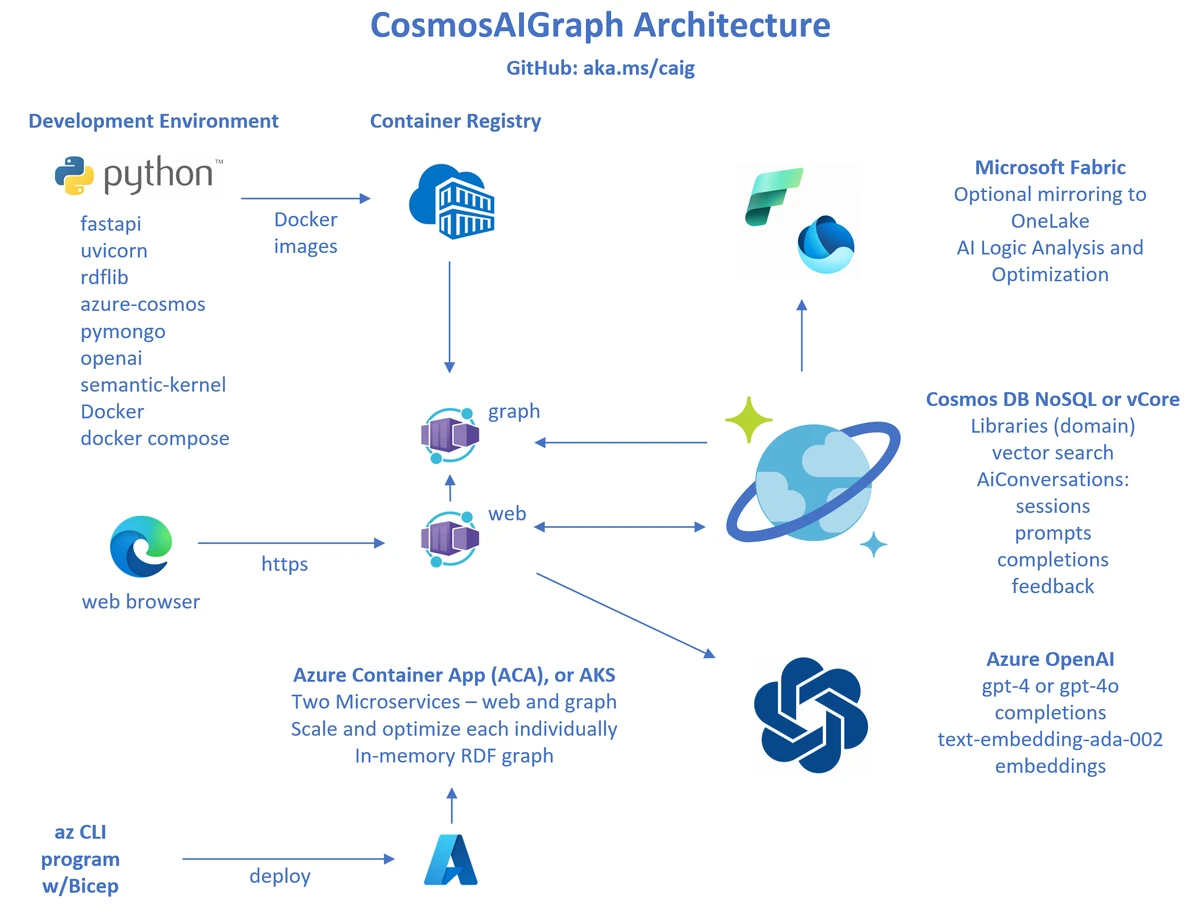

Image Example:

Quant platforms and analytics tools help traders monitor and optimize liquidity in real time.

Best Practices for Liquidity Management

- Integrate liquidity metrics into every trading model

- Continuously monitor market conditions and adjust strategy parameters

- Backtest and stress test strategies under different liquidity scenarios

- Employ a combination of position sizing and smart order routing for optimal execution

- Maintain a feedback loop for ongoing liquidity strategy improvement

FAQ (Common Questions)

1. How does liquidity affect quantitative trading models?

Liquidity directly impacts execution costs, position sizing, and strategy performance. Algorithms designed without accounting for liquidity may suffer from slippage, partial fills, and unexpected drawdowns.

2. How can quants improve liquidity management?

Quants can improve liquidity management by:

- Using dynamic position sizing

- Implementing smart order routing (SOR)

- Monitoring real-time liquidity metrics

- Backtesting under different liquidity conditions

3. Where can quants find reliable liquidity data?

Reliable sources include:

- Market exchanges offering real-time order book data

- Data vendors providing historical volume and spread information

- Quantitative research platforms with liquidity analytics modules

Case Studies and Real-World Applications

- Hedge Funds: Applied SOR combined with predictive liquidity models to reduce slippage by 20% on high-volume trades.

- Retail Quants: Dynamic position sizing allowed smaller traders to enter illiquid markets without moving prices significantly.

- Institutional Portfolios: Integrated liquidity dashboards provided real-time alerts, improving trade execution efficiency during volatile periods.

Image Example:

Real-world implementations of liquidity frameworks demonstrate improved execution and reduced market impact.

Conclusion

A robust liquidity management framework for quants is crucial for achieving consistent trading performance. By combining data-driven liquidity assessment, risk modeling, and strategic execution methods, quantitative traders can navigate complex markets effectively. Leveraging tools like dynamic position sizing, smart order routing, and advanced analytics, quants enhance execution quality, minimize risk, and maximize returns.

Engagement Tip: Share your experience with liquidity frameworks in quantitative trading, comment on strategies that worked, and explore community insights to enhance your approach.

Image Example:

Integrating assessment, strategy, and execution ensures optimal liquidity management for quantitative traders.

This guide provides quants with actionable insights and practical strategies to implement a full liquidity management framework, ensuring they thrive in today’s dynamic and fast-moving markets.

0 Comments

Leave a Comment