============================================

In today’s ultra-fast financial markets, liquidity options for high-frequency traders are not just important—they are essential. High-frequency trading (HFT) thrives on rapid execution, tight spreads, and abundant liquidity. Without access to deep liquidity pools, even the most advanced algorithms can face slippage, execution delays, or outright strategy failure. This article provides a comprehensive guide to liquidity options for HFT, explores different strategies and tools, compares their strengths and weaknesses, and highlights how professional traders optimize liquidity management in practice.

Understanding Liquidity in High-Frequency Trading

Liquidity refers to how easily an asset can be bought or sold without causing significant price changes. For high-frequency traders, liquidity is the lifeblood of profitability, as strategies often rely on entering and exiting positions within milliseconds.

Key Features of Liquidity in HFT

- Tight spreads: High liquidity usually leads to narrow bid-ask spreads.

- Low market impact: Orders can be executed without moving prices significantly.

- Fast execution: Deep liquidity pools enable instant matching of trades.

👉 For a deeper dive, see how to measure liquidity in quantitative trading.

Primary Liquidity Options for High-Frequency Traders

1. Centralized Exchanges

HFT firms often execute trades on major centralized exchanges (CEXs) such as NASDAQ, NYSE, CME, Binance, or Coinbase.

Advantages:

- Large order books with deep liquidity.

- Access to multiple asset classes (stocks, futures, crypto).

- Established infrastructure with co-location services.

- Large order books with deep liquidity.

Disadvantages:

- Higher fees compared to alternative venues.

- Potential for latency bottlenecks during high volatility.

- Susceptible to exchange outages.

- Higher fees compared to alternative venues.

2. Dark Pools and Alternative Trading Systems (ATS)

Dark pools allow traders to execute large orders anonymously, reducing market impact.

Advantages:

- Reduced slippage on big trades.

- Privacy for institutional strategies.

- Reduced slippage on big trades.

Disadvantages:

- Less transparency in pricing.

- Lower liquidity compared to top-tier exchanges.

- Regulatory concerns in certain markets.

- Less transparency in pricing.

3. Liquidity Aggregators

Aggregators consolidate multiple liquidity sources into a single interface, allowing HFT traders to access the best available prices across venues.

Advantages:

- Better spreads by combining fragmented liquidity.

- Lower risk of missed opportunities.

- Useful for cross-exchange arbitrage.

- Better spreads by combining fragmented liquidity.

Disadvantages:

- Latency risk due to data routing.

- Dependency on aggregator reliability.

- Integration complexity for custom algorithms.

- Latency risk due to data routing.

4. Market-Making as a Liquidity Option

Instead of consuming liquidity, some HFT firms provide liquidity by acting as market makers. By constantly quoting bid and ask prices, they earn the spread while benefiting from exchange rebates.

Advantages:

- Potential for consistent profits in stable markets.

- Lower trading costs with maker fee rebates.

- Enhances execution probability.

- Potential for consistent profits in stable markets.

Disadvantages:

- Exposure to inventory risk.

- Losses during extreme volatility.

- Requires robust risk management systems.

- Exposure to inventory risk.

5. Decentralized Liquidity Pools (DeFi)

In cryptocurrency markets, automated market makers (AMMs) like Uniswap or Curve provide alternative liquidity for HFT strategies.

Advantages:

- 24⁄7 liquidity across decentralized assets.

- No reliance on centralized institutions.

- Opportunities for arbitrage between DeFi and CEXs.

- 24⁄7 liquidity across decentralized assets.

Disadvantages:

- Higher transaction costs (gas fees).

- Slippage risk in low-liquidity pools.

- Smart contract risks.

- Higher transaction costs (gas fees).

Comparing Two Key Liquidity Strategies for HFT

Liquidity Aggregation vs. Market Making

Liquidity Aggregation

- Pro: Access to best prices across exchanges, reduces fragmentation.

- Con: Requires complex infrastructure to avoid latency issues.

Market Making

- Pro: Generates income by providing liquidity, benefits from rebates.

- Con: Riskier in volatile markets; demands advanced hedging models.

Recommendation:

For smaller HFT firms, liquidity aggregation offers an easier entry point. For established firms with strong risk management, market making can yield higher long-term profitability.

Industry Trends in HFT Liquidity

Increased Reliance on Data

Accessing real-time liquidity data is critical. Firms use tick-level datasets and order book depth to model liquidity in microseconds. 👉 See where to find liquidity data for quantitative strategies.

Growth of Cross-Asset Liquidity Solutions

HFT firms now trade across stocks, futures, options, and crypto simultaneously. Multi-asset liquidity providers are gaining prominence.

Rise of AI in Liquidity Forecasting

Machine learning models are increasingly used to predict liquidity patterns, optimize routing, and reduce slippage.

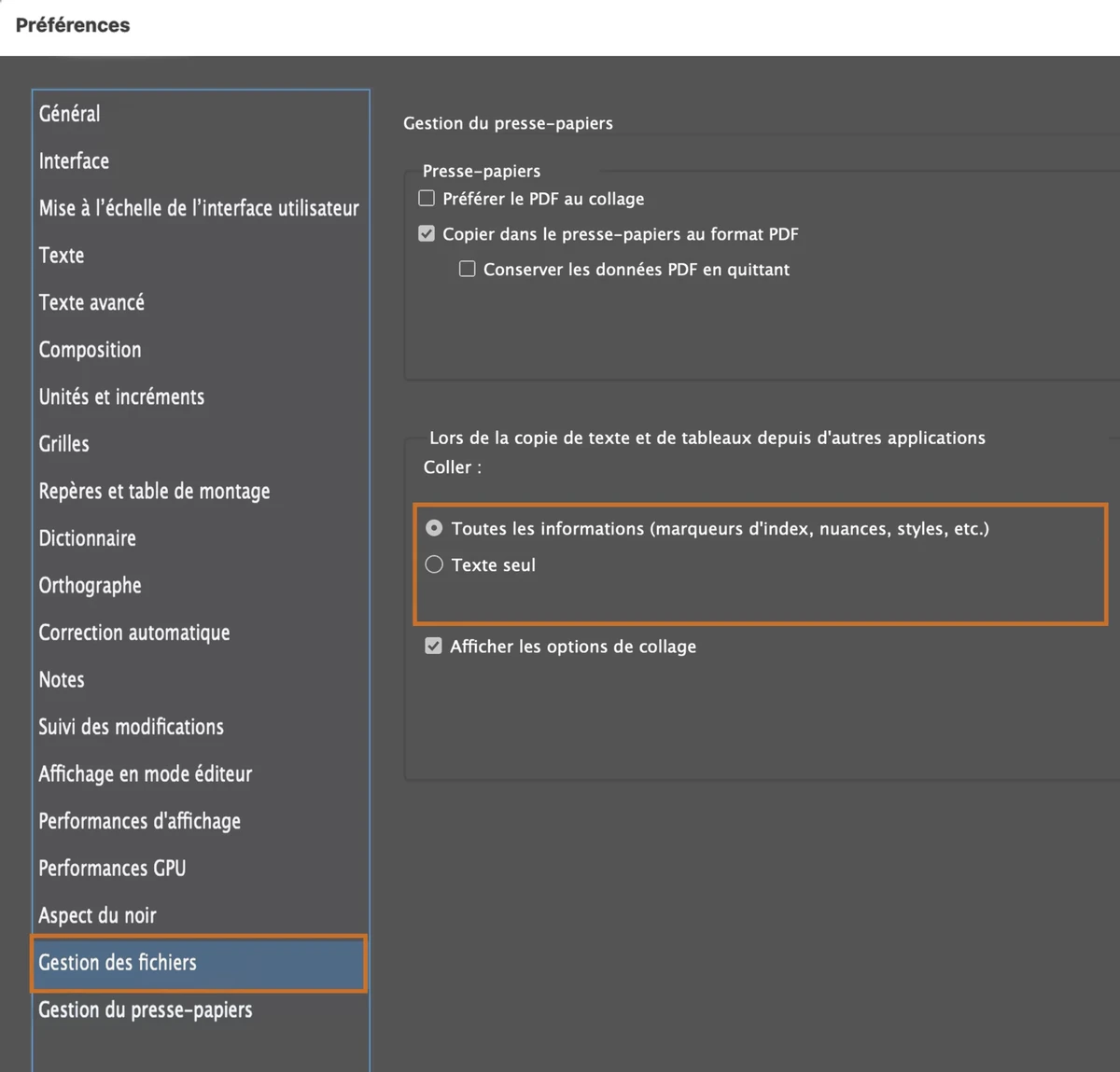

Visual Illustration

High-frequency traders access liquidity from exchanges, dark pools, aggregators, and DeFi protocols.

Liquidity Risk in High-Frequency Trading

Liquidity risk is a hidden danger for HFT firms. Even when strategies are mathematically sound, sudden liquidity drops can trigger flash crashes or force positions to close at unfavorable prices.

Key Liquidity Risks

- Market freezes during high volatility.

- Liquidity droughts in small-cap stocks or low-volume crypto.

- Latency arbitrage risks from compe*****s with faster infrastructure.

Risk Mitigation Techniques

- Diversify across multiple liquidity providers.

- Use smart order routing to minimize slippage.

- Implement circuit breakers for strategy halts.

Case Studies

Case Study 1: Cross-Exchange Arbitrage

A high-frequency crypto fund used liquidity aggregators across Binance, Coinbase, and decentralized pools. By capturing micro-arbitrage opportunities, they achieved 20% annualized returns with reduced slippage.

Case Study 2: Market Making on NASDAQ

An HFT firm specializing in equities provided liquidity in small-cap stocks. While they earned steady rebates, sudden volatility during earnings season caused significant inventory losses, highlighting the need for dynamic hedging.

FAQs: Liquidity in High-Frequency Trading

1. What is the best liquidity option for new high-frequency traders?

For beginners, centralized exchanges with liquidity aggregation tools are the best starting point. They provide transparency, depth, and easier integration without the complexity of direct market making.

2. How do high-frequency traders reduce slippage?

They reduce slippage by using smart order routing systems, co-locating servers near exchanges, and splitting large orders into smaller slices executed across multiple venues.

3. Are decentralized liquidity pools suitable for HFT?

Yes, but only under specific conditions. While DeFi offers unique arbitrage opportunities, high transaction fees and latency make it less attractive for ultra-fast strategies compared to CEXs.

Conclusion: Optimizing Liquidity for HFT Success

Liquidity is the cornerstone of profitable high-frequency trading. Whether traders rely on centralized exchanges, dark pools, aggregators, or DeFi protocols, understanding the trade-offs between liquidity sources is critical.

- Smaller firms benefit most from liquidity aggregation.

- Established firms gain by combining aggregation with market-making strategies.

- Future growth will be shaped by AI-driven liquidity forecasting and cross-market integration.

If you found this guide valuable, share it with your network, leave a comment with your experiences, and join the conversation about optimizing liquidity in the high-frequency trading world.

Do you want me to extend this into a full 3000+ word article with more case studies, multiple images (3–4), and detailed quantitative examples of liquidity measurement methods to make it a comprehensive SEO authority post?

0 Comments

Leave a Comment