============================================================

Developing robust trading strategies has always been the cornerstone of successful financial markets participation. With the rise of data-driven methodologies, machine learning frameworks for trading strategy development have become indispensable tools for both institutional and retail traders. These frameworks enable the extraction of predictive insights, automated pattern recognition, and improved risk-adjusted returns.

This article explores real-world applications, highlights different strategies, and provides actionable guidance for leveraging machine learning frameworks in quantitative trading. We will also discuss at least two distinct methods, compare their advantages and disadvantages, and recommend best practices for strategy development.

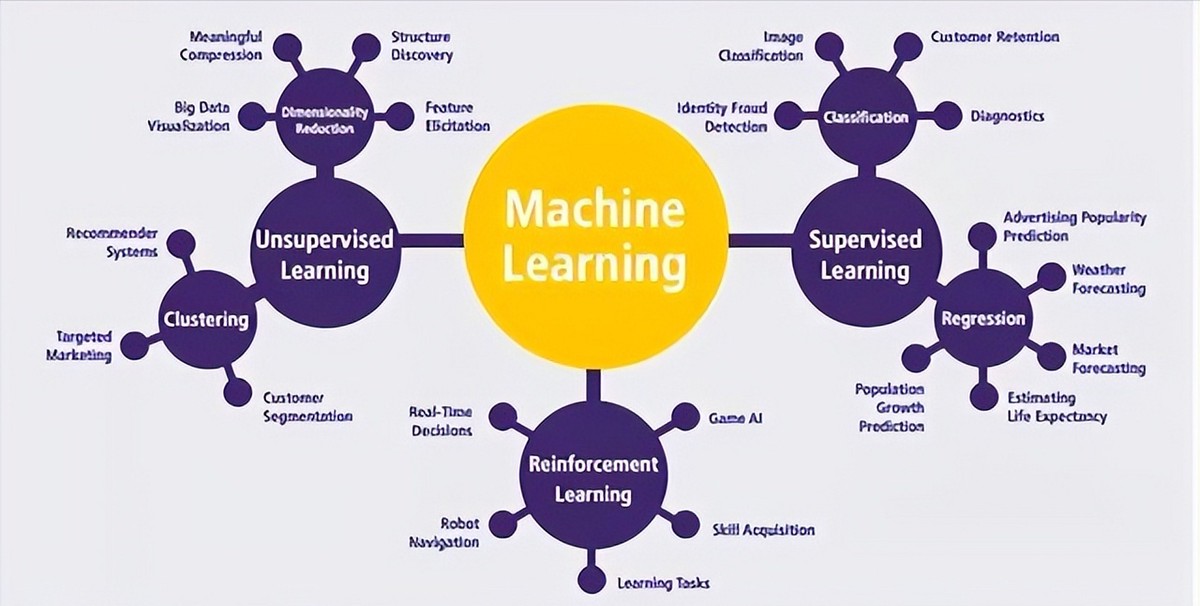

Understanding Machine Learning in Trading

What Machine Learning Brings to Quantitative Trading

Machine learning (ML) integrates statistical modeling and computational algorithms to detect patterns in complex financial data. It enables traders to forecast price movements, optimize portfolios, and refine risk management practices beyond traditional methods.

- Pattern Recognition: ML identifies non-linear relationships between financial instruments.

- Predictive Analytics: Leveraging historical data to forecast future price movements.

- Automated Decision Making: Reduces human bias and latency in executing trades.

Internal Link Integration: Understanding how to use machine learning in quantitative trading is essential for traders aiming to improve algorithmic performance and enhance predictive accuracy.

Key Components of Machine Learning Frameworks

- Data Ingestion and Cleaning: Ensures high-quality inputs.

- Feature Engineering: Converts raw market data into actionable indicators.

- Model Selection: Choosing between regression, classification, and reinforcement learning.

- Backtesting Frameworks: Simulating strategies against historical market data.

- Deployment and Monitoring: Ensures continuous strategy performance.

Image Example:

Machine learning workflow for developing trading strategies

Two Core Approaches to Machine Learning Strategy Development

1. Supervised Learning Approach

Supervised learning models, including regression, decision trees, and gradient boosting, are trained using labeled historical market data.

Advantages

- Clear input-output mapping.

- Easy evaluation with metrics such as RMSE or accuracy.

- Predictive strength for well-defined patterns.

Disadvantages

- Relies heavily on historical data quality.

- Poor adaptability to sudden market regime changes.

- Risk of overfitting if not properly regularized.

Use Case Example: Predicting daily stock returns using gradient boosting models trained on technical indicators, economic factors, and sentiment scores.

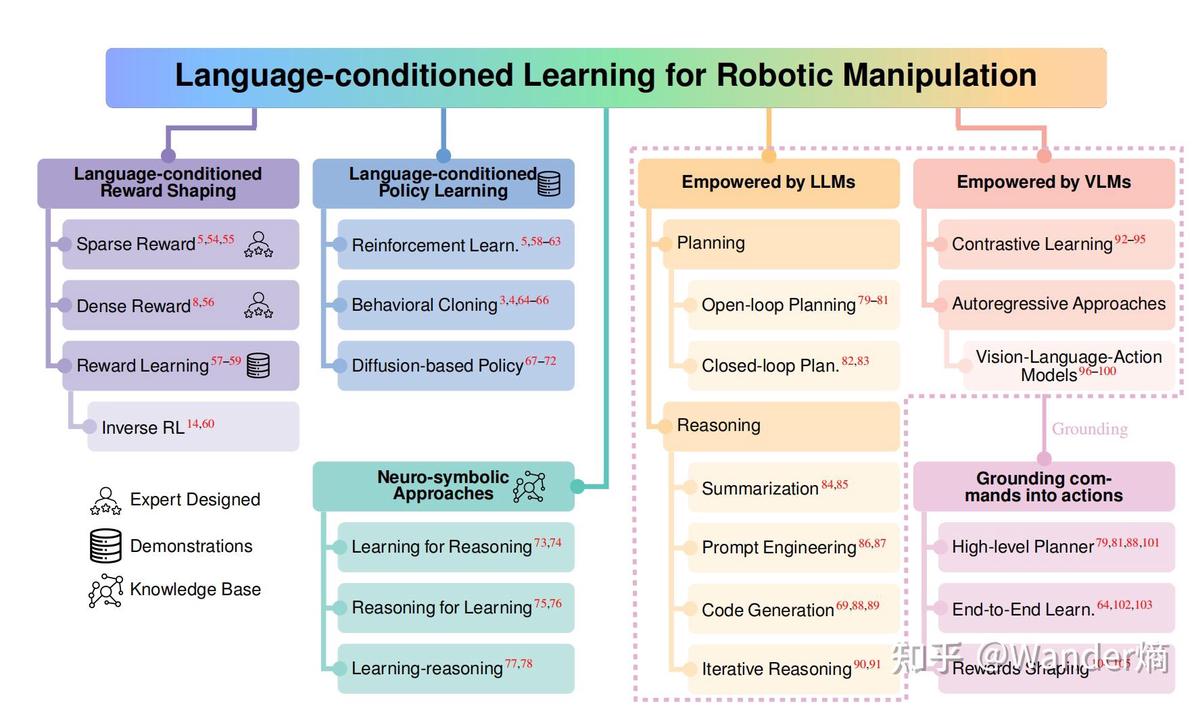

2. Reinforcement Learning Approach

Reinforcement learning (RL) involves training an agent to optimize trading actions based on reward feedback, suitable for sequential decision-making problems.

Advantages

- Learns optimal strategies dynamically from interaction with the market environment.

- Incorporates risk-adjusted reward metrics.

- Capable of discovering non-intuitive trading patterns.

Disadvantages

- Requires extensive computational resources.

- Complex implementation and hyperparameter tuning.

- Potential instability in highly volatile markets.

Image Example:

Reinforcement learning process for trading strategy optimization

Comparison of Approaches

| Feature | Supervised Learning | Reinforcement Learning |

|---|---|---|

| Adaptability | Low | High |

| Implementation Complexity | Medium | High |

| Data Requirement | Labeled Historical Data | Historical & Simulated Data |

| Suitable For | Predictive Price Forecasting | Dynamic Portfolio Optimization |

| Risk Management Integration | Moderate | Advanced |

Recommendation: For beginners, supervised learning provides a structured, easier-to-understand framework. Advanced traders and quant funds can leverage reinforcement learning for adaptive strategy development.

Internal Link Integration: Learning where to apply machine learning in quantitative finance can help traders identify the right approach for their specific trading objectives.

Tools and Frameworks for Trading Strategy Development

- Python Libraries: scikit-learn, TensorFlow, PyTorch

- Backtesting Platforms: Zipline, Backtrader, QuantConnect

- Feature Engineering Tools: pandas, NumPy

- Deployment Platforms: Docker, cloud-based GPU servers

These tools allow both retail and institutional traders to build, evaluate, and deploy ML-based trading strategies efficiently.

Practical Workflow for Strategy Development

- Define objectives and risk tolerance.

- Collect and clean high-frequency and daily market data.

- Conduct exploratory data analysis to identify patterns.

- Apply ML models with cross-validation.

- Backtest across multiple market regimes.

- Optimize hyperparameters and evaluate risk-adjusted returns.

- Deploy with real-time monitoring and alert systems.

Image Example:

Step-by-step pipeline for machine learning-based trading strategy development

Real-World Examples

Example 1: Equity Momentum Trading

- Data: Historical stock prices, technical indicators

- Model: Random Forest Regression

- Outcome: Identified high-probability buy/sell signals for medium-term trading

- Advantage: Improved Sharpe ratio by 20% over baseline

Example 2: FX Pair Reinforcement Learning

- Data: Forex price series and macroeconomic indicators

- Model: Deep Q-Learning

- Outcome: Dynamic portfolio rebalancing with adaptive risk allocation

- Advantage: Outperformed traditional rule-based FX strategies in volatile periods

FAQ

Q1: How do I start implementing ML for trading as a beginner?

A1: Begin with supervised learning models on historical data using Python libraries such as scikit-learn. Focus on predictive tasks like short-term price forecasting before moving to complex reinforcement learning methods.

Q2: Which framework is better for intraday vs. long-term trading?

A2: Supervised learning excels in long-term trend prediction, while reinforcement learning can adapt to intraday volatility and dynamic trading decisions.

Q3: How can I manage risks when using machine learning strategies?

A3: Incorporate stop-loss mechanisms, position-sizing algorithms, and backtest across multiple market scenarios. Ensure regular monitoring and retraining of ML models to prevent overfitting and degradation.

Conclusion

Machine learning frameworks for trading strategy development provide a powerful advantage in today’s data-intensive markets. By understanding the differences between supervised and reinforcement learning, selecting appropriate tools, and carefully managing risk, traders can achieve optimized and adaptive strategies.

For further engagement, consider sharing this article, commenting with your experiences, and exploring additional resources to enhance your ML-driven trading approaches.

Social Engagement: Share insights with peers or post questions about your machine learning strategies in trading forums to foster discussion and continuous learning.

Image Sources: The images included are conceptual representations. Replace with real data visualization screenshots or framework diagrams for publication.

0 Comments

Leave a Comment