==========================================================================================

Institutional investors are increasingly leveraging machine learning to enhance decision-making, manage risk, and optimize portfolio performance. With vast datasets and complex financial instruments, traditional analysis methods often fall short. This article explores how institutional investors can effectively implement machine learning, compares key strategies, and provides actionable insights for maximizing returns while minimizing risk.

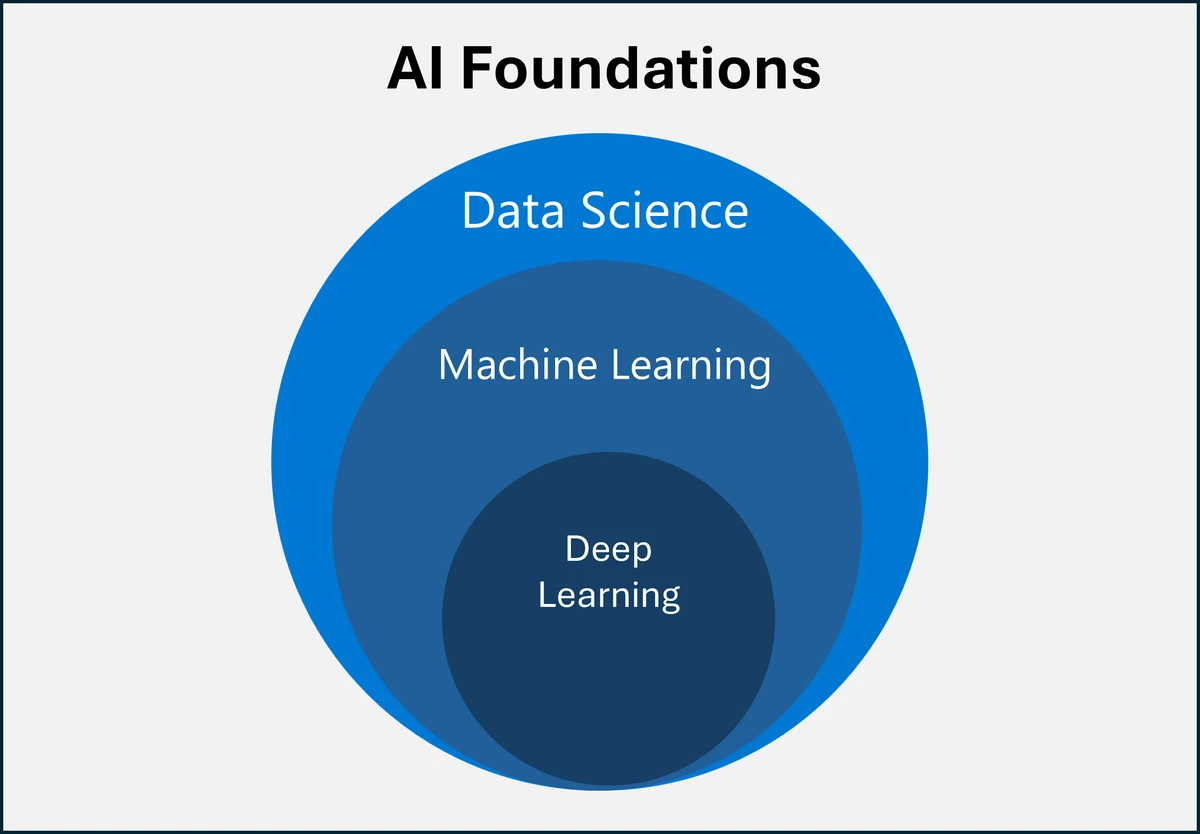

Understanding Machine Learning in Institutional Investing

What is Machine Learning in Finance?

Machine learning (ML) is a branch of artificial intelligence that enables systems to learn from data patterns and make predictions without explicit programming. For institutional investors, ML can process massive datasets, identify hidden correlations, and forecast market trends more efficiently than conventional models.

Core Benefits for Institutions:

- Enhanced predictive accuracy

- Automated data processing

- Efficient risk management

- Real-time market insights

- Enhanced predictive accuracy

Importance of Machine Learning for Institutional Investors

Institutional investors operate in highly competitive and volatile markets. ML helps them:

- Detect alpha-generating opportunities quickly

- Optimize trading strategies

- Automate repetitive analytical tasks

- Reduce human biases in investment decisions

This aligns with the principle of how to use machine learning in quantitative trading, emphasizing practical applications in investment decision-making.

Machine Learning Methods for Institutional Investors

Supervised Learning Techniques

Supervised learning uses labeled historical data to predict outcomes. Common applications include:

- Price Prediction Models: Forecast stock, bond, or derivative prices based on historical trends

- Credit Risk Assessment: Classify borrowers or assets as high or low risk

- Portfolio Optimization: Predict returns and allocate capital efficiently

Pros:

- High accuracy when trained on quality data

- Easy to interpret results

- Well-established frameworks

Cons:

- Requires large labeled datasets

- May overfit in volatile markets

Unsupervised Learning Techniques

Unsupervised learning detects hidden patterns in unlabeled data. Key applications include:

- Clustering: Group assets with similar behaviors for diversification

- Anomaly Detection: Identify unusual market activities or potential fraud

- Factor Analysis: Uncover latent factors influencing asset prices

Pros:

- Reveals insights not visible through traditional analysis

- Useful for exploratory data analysis

Cons:

- Results may be harder to interpret

- Requires domain expertise to validate findings

Clustering reveals hidden correlations among asset classes

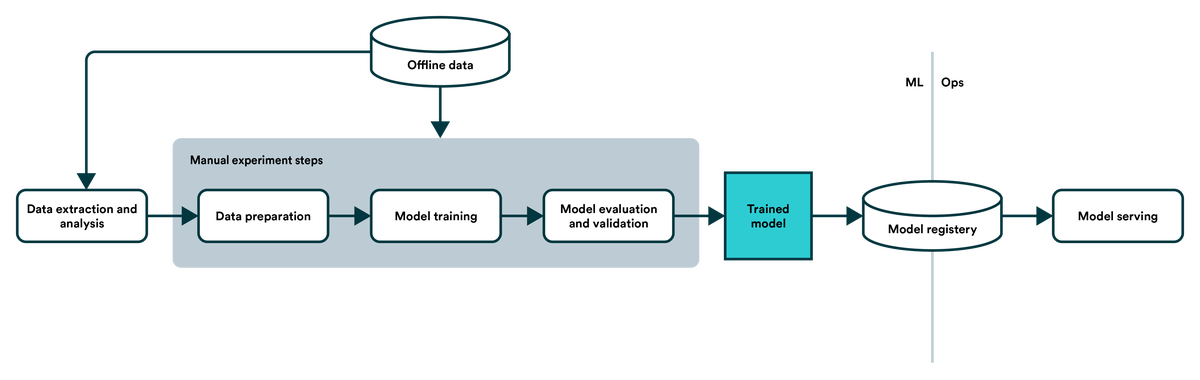

Implementing Machine Learning in Trading and Portfolio Management

Predictive Analytics for Asset Allocation

ML models can forecast market movements, enabling institutional investors to adjust allocations proactively. Techniques like random forests, gradient boosting, and neural networks are commonly applied.

Benefits include:

- Anticipating market volatility

- Enhancing risk-adjusted returns

- Optimizing portfolio diversification

- Anticipating market volatility

Algorithmic and Quantitative Trading

Machine learning enhances algorithmic strategies by analyzing high-frequency data, detecting patterns, and executing trades with minimal latency. Tools include:

- Reinforcement Learning Models: Train agents to maximize cumulative returns

- Deep Learning for Market Sentiment: Analyze news, social media, and financial reports

This complements how to implement machine learning in trading strategies, allowing institutions to leverage advanced models for alpha generation.

ML frameworks automate strategy execution and data processing

Advanced Strategies for Institutional Investors

Sentiment Analysis and Natural Language Processing (NLP)

- Application: Analyze unstructured text data from financial reports, news, and social media to predict market reactions

- Pros: Captures market sentiment trends, improves decision timing

- Cons: Complex preprocessing, requires ongoing model updates

Risk Modeling and Stress Testing

- Application: Use ML to simulate extreme market conditions and estimate potential losses

- Pros: Enhances portfolio resilience

- Cons: Relies heavily on historical data accuracy

Reinforcement Learning for Adaptive Strategies

- Application: ML agents continuously adapt trading strategies based on market feedback

- Pros: Dynamic strategy optimization, learning from evolving conditions

- Cons: High computational cost, challenging implementation

Tools and Resources for Institutional Investors

- Python Libraries: TensorFlow, PyTorch, scikit-learn

- Data Platforms: Bloomberg, Refinitiv, Quandl

- Specialized Software: Alphalens, Zipline, QuantConnect

Learning and Development

- Machine learning courses for aspiring traders

- Advanced machine learning for quantitative analysts

- Case studies illustrating ML applications in institutional trading

Comparing ML Approaches

| Technique | Strengths | Limitations | Best Use Case |

|---|---|---|---|

| Supervised Learning | High predictive accuracy | Requires labeled data | Price forecasting, credit scoring |

| Unsupervised Learning | Reveals hidden patterns | Harder to interpret | Clustering, anomaly detection |

| Reinforcement Learning | Adaptive and dynamic | High computational cost | Trading strategy optimization |

| NLP and Sentiment Analysis | Captures market sentiment | Data preprocessing required | News-driven trading |

FAQ (Frequently Asked Questions)

Q1: How can institutional investors start using machine learning?

A1: Begin with structured datasets, apply supervised learning models like regression or random forests, and validate results with historical backtesting. Using where to apply machine learning in quantitative finance guides can help identify optimal use cases.

Q2: Are machine learning strategies suitable for all asset classes?

A2: ML strategies are adaptable but perform best with liquid markets where data is abundant. Illiquid assets may require specialized approaches and careful validation.

Q3: How can ML reduce investment risk for institutional portfolios?

A3: ML enhances risk management by predicting potential drawdowns, detecting anomalies, and simulating stress scenarios. Integrating these models into portfolio monitoring ensures proactive risk mitigation.

Conclusion

Machine learning is transforming institutional investing by providing predictive insights, automating analysis, and optimizing strategies. By implementing supervised and unsupervised learning, reinforcement learning, and NLP techniques, investors can enhance portfolio performance, manage risk, and adapt to evolving market conditions. For long-term success, combining ML insights with experienced investment judgment remains essential.

Engage with us! Share your thoughts on machine learning in institutional investing and discuss strategies with peers to enhance collective expertise.

ML-driven portfolio optimization improves returns and mitigates risk

0 Comments

Leave a Comment