================================================================================

Understanding market microstructure is essential for traders, quantitative analysts, and institutional investors aiming to optimize trading performance and manage risk effectively. Market microstructure analysis provides insight into how securities are traded, how prices are formed, and how liquidity and trading mechanisms affect market dynamics. This article explores key market microstructure analysis methods, their applications, and practical guidance for implementation.

Understanding Market Microstructure

What Is Market Microstructure?

Market microstructure refers to the study of the processes and mechanisms through which securities are traded, including order flows, bid-ask spreads, trade execution, and price formation. It examines the relationship between trading rules, market participants, and market outcomes.

Importance of Market Microstructure Analysis

Analyzing market microstructure helps traders understand:

- Price Dynamics: How order flows and liquidity affect short-term price movements.

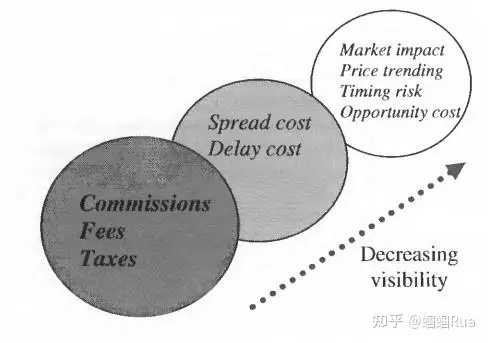

- Trading Costs: Understanding bid-ask spreads, slippage, and transaction costs.

- Market Efficiency: Assessing how information is incorporated into prices.

Market microstructure knowledge is crucial for developing effective trading strategies, especially for high-frequency and algorithmic trading.

Key Market Microstructure Analysis Methods

Method 1: Order Flow Analysis

Overview

Order flow analysis involves examining the sequence, size, and type of orders submitted to the market. This method helps identify supply and demand imbalances and potential short-term price movements.

Benefits

- Predictive Insights: Detects buying or selling pressure before price adjustments occur.

- Liquidity Assessment: Evaluates market depth and the availability of counterparties.

- High-Frequency Trading Edge: Supports algorithmic strategies that capitalize on micro price movements.

Limitations

- Data Intensity: Requires access to granular tick-level data.

- Complex Interpretation: Identifying meaningful patterns from noise is challenging.

- Market Impact: Large trades may influence the signals derived from order flow analysis.

Implementation Tips

- Use level-2 order book data to analyze depth and order cancellations.

- Employ visualization tools to track the flow of buy and sell orders.

- Combine order flow metrics with technical indicators for robust trading signals.

Visualizing order flow helps traders detect supply-demand imbalances and anticipate price movements.

Method 2: Bid-Ask Spread and Liquidity Metrics

Overview

Bid-ask spreads and liquidity metrics provide insights into market efficiency and transaction costs. Tight spreads generally indicate high liquidity, while wide spreads suggest potential volatility or market inefficiency.

Benefits

- Cost Awareness: Helps traders minimize transaction costs by targeting liquid markets.

- Market Quality Assessment: Evaluates how efficiently the market absorbs trades.

- Risk Management: Identifies periods of low liquidity where market impact is higher.

Limitations

- Dynamic Changes: Spreads and liquidity can change rapidly due to market conditions.

- Data Requirements: Continuous monitoring of multiple instruments is resource-intensive.

- Limited Predictive Power Alone: Requires integration with other microstructure indicators.

Implementation Tips

- Track historical bid-ask spreads to understand normal market conditions.

- Use liquidity metrics like order book depth, volume at best bid/ask, and turnover ratio.

- Integrate these metrics into algorithmic execution strategies to reduce slippage.

Method 3: Market Impact Modeling

Overview

Market impact models quantify the effect of large trades on asset prices. These models help traders optimize execution strategies to reduce adverse price movements.

Benefits

- Execution Optimization: Splits large orders to minimize market impact.

- Cost Reduction: Reduces slippage and execution costs for institutional trades.

- Strategy Simulation: Enables testing of trading algorithms under realistic conditions.

Limitations

- Model Risk: Incorrect assumptions can lead to underestimated costs.

- Complex Calculations: Requires high-frequency data and advanced modeling techniques.

- Market Variability: Model accuracy may decrease in volatile markets.

Implementation Tips

- Use historical trade data to calibrate impact coefficients.

- Implement volume-weighted average price (VWAP) or implementation shortfall algorithms.

- Continuously update models based on changing liquidity and volatility conditions.

Simulation of market impact allows traders to optimize order execution strategies and reduce slippage.

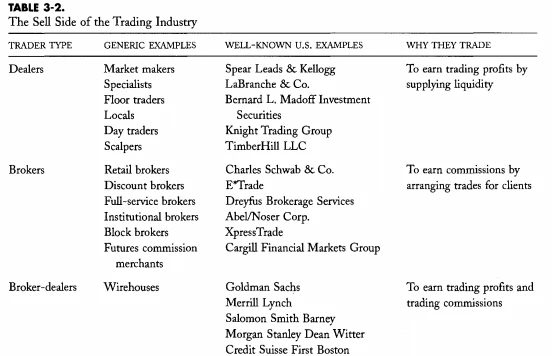

Comparative Analysis of Methods

| Method | Advantages | Limitations | Best Use Case |

|---|---|---|---|

| Order Flow Analysis | Predictive insights, liquidity assessment | Data-intensive, complex interpretation | High-frequency trading, short-term signals |

| Bid-Ask Spread & Liquidity | Cost awareness, market quality assessment | Rapidly changing metrics | Portfolio execution, risk management |

| Market Impact Modeling | Execution optimization, cost reduction | Model risk, complex calculations | Institutional large orders, algorithmic trading |

Combining these methods provides a comprehensive understanding of market microstructure, allowing traders to design strategies that balance predictive power, cost efficiency, and execution quality.

Practical Implementation for Traders

Integrating Microstructure Insights

- Use order flow to anticipate short-term price movements.

- Monitor liquidity metrics to select optimal execution times.

- Apply market impact models to execute large trades with minimal cost.

Tools and Resources

- Data Platforms: Bloomberg, Refinitiv, and market-specific APIs provide real-time and historical order book data.

- Software: Python, R, and specialized microstructure modeling tools for analysis.

- Education: Learning resources such as where to learn market microstructure courses and research papers improve strategy sophistication.

Comprehensive dashboards allow visualization of order flows, spreads, and liquidity to support informed trading decisions.

FAQ: Market Microstructure Analysis

1. How does market microstructure impact trading?

Market microstructure affects transaction costs, price formation, and liquidity, which directly influence trade profitability. Understanding these dynamics enables traders to optimize execution and minimize slippage.

2. Can retail traders apply these methods?

Yes, retail traders can use simplified versions of these methods. Tools like order book visualizers, liquidity trackers, and algorithmic backtesting platforms allow smaller-scale traders to benefit from microstructure insights.

3. Which method is most effective for algorithmic trading?

Order flow analysis combined with market impact modeling provides a strong foundation for algorithmic trading. Order flow identifies opportunities, while market impact models optimize trade execution.

Conclusion

Market microstructure analysis methods are essential for understanding trading dynamics, minimizing costs, and improving execution strategies. Combining order flow analysis, liquidity metrics, and market impact modeling offers a comprehensive approach to trading with precision. By integrating insights from these methods and leveraging resources on how to analyze market microstructure and why understand market microstructure dynamics, traders and institutions can gain a significant competitive edge.

Engage with this article by sharing your insights, commenting on strategies that worked for you, and disseminating knowledge within your professional network to strengthen collective expertise in market microstructure analysis.

0 Comments

Leave a Comment