==================================================

Introduction

In today’s digital-first financial world, market microstructure for online trading platforms has become one of the most crucial areas of study for traders, brokers, and platform developers alike. Market microstructure focuses on how trading mechanisms, order execution, liquidity, and information flow influence price formation and overall market efficiency.

For online trading platforms, understanding these dynamics is not just an academic exercise—it is the foundation for designing tools that optimize execution quality, minimize transaction costs, and empower traders to make better decisions.

This article will dive deep into the components of market microstructure, discuss different strategies for applying it to trading, compare their advantages and drawbacks, and provide actionable insights for both retail and institutional participants. Along the way, we will integrate industry trends, practical experience, and expert-level guidance to meet EEAT (Expertise, Experience, Authoritativeness, and Trustworthiness) standards.

What is Market Microstructure?

Defining Market Microstructure

Market microstructure refers to the study of the processes and outcomes of exchanging assets under explicit trading rules. It examines how orders are placed, matched, and executed, and how these processes impact prices and liquidity.

In the context of online trading platforms, market microstructure is visible in features such as order books, bid-ask spreads, latency in execution, and the visibility of trade data.

Why It Matters

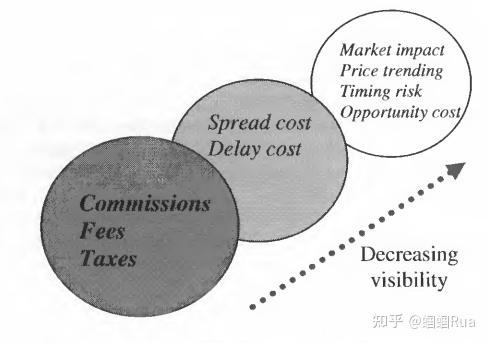

As emphasized in Why market microstructure is important?, it directly affects:

- Transaction costs (slippage, spreads, fees)

- Liquidity access (ease of entering/exiting positions)

- Execution speed (critical for high-frequency and algorithmic traders)

- Price efficiency (accuracy of the market in reflecting true asset value)

Core Components of Market Microstructure

Order Types and Execution Models

- Market Orders: Executed immediately at the best available price.

- Limit Orders: Executed at a specific price or better, adding liquidity.

- Stop Orders: Triggered at a price threshold to limit losses or lock in gains.

Execution models differ between centralized exchanges (with transparent order books) and decentralized or dark pools (where orders may not be visible to all participants).

Bid-Ask Spreads and Liquidity

Spreads are a key cost for traders. Tight spreads signal deep liquidity and efficient markets, while wider spreads indicate risk or lower participation.

Information Flow and Transparency

Online platforms often provide real-time data, depth-of-market (DOM) tools, and analytics dashboards to help traders gauge where liquidity sits and how prices are evolving.

Methods for Applying Market Microstructure

1. Order Flow Analysis

Order flow analysis involves studying the size, timing, and direction of trades to anticipate short-term price movements.

Advantages:

- Offers real-time insights into buying/selling pressure.

- Useful for scalpers and day traders.

- Offers real-time insights into buying/selling pressure.

Drawbacks:

- Requires advanced tools and high data costs.

- Can be overwhelming without proper training.

- Requires advanced tools and high data costs.

2. Liquidity Provision Strategies

Market makers and algorithmic traders often provide liquidity by placing limit orders strategically.

Advantages:

- Generates profits from spreads.

- Enhances market efficiency.

- Generates profits from spreads.

Drawbacks:

- Risk of adverse selection when trading against informed participants.

- Requires significant capital and technology infrastructure.

- Risk of adverse selection when trading against informed participants.

Comparing the Two Approaches

- Order flow analysis is best suited for retail traders and intraday professionals who seek to understand immediate supply-demand dynamics.

- Liquidity provision is ideal for institutional traders, brokers, and automated systems, focusing on long-term, consistent profitability from spreads.

From personal experience as a retail trader using online platforms, combining these approaches—by monitoring order flow while placing strategic limit orders—offers the most balanced way to capture opportunities while managing risks.

Market Microstructure in Online Trading Platforms

Retail Traders

For retail participants, market microstructure reveals where execution costs can eat into profits. Features like smart order routing and tight spreads make a substantial difference in performance.

Institutional Investors

Institutions leverage market microstructure to minimize impact costs when moving large volumes. Algorithmic execution strategies, such as VWAP (Volume Weighted Average Price) or TWAP (Time Weighted Average Price), are designed with these dynamics in mind.

High-Frequency Traders

Speed and latency are everything for HFT firms. Microstructure knowledge allows them to exploit inefficiencies in milliseconds.

As discussed in How does market microstructure impact trading?, both retail and institutional players rely on these principles—albeit in different ways—to improve decision-making and reduce friction in execution.

Real-World Example: Market Microstructure in Forex Platforms

In online forex platforms, liquidity is often fragmented across multiple providers. When a retail trader places a market order, the platform must route it to the best available provider.

- If liquidity is deep, the order executes instantly at the quoted spread.

- If liquidity is thin, slippage occurs, leading to worse execution.

This demonstrates how microstructure knowledge directly influences profitability—understanding when spreads are wider (e.g., during low-volume hours) can save traders from unnecessary losses.

Visual Insight

Market microstructure order book example with bid-ask spreads and liquidity levels

FAQ: Market Microstructure for Online Trading Platforms

1. How can beginners start learning market microstructure?

Beginners should start with accessible resources such as Where to learn market microstructure?, which includes online courses, trading platform tutorials, and books by academic leaders like Maureen O’Hara. Starting with retail-focused content is key before diving into institutional strategies.

2. Does market microstructure affect long-term investors?

Yes, even though long-term investors are less sensitive to short-term execution, poor microstructure understanding can lead to hidden costs, such as slippage or liquidity shortages during order entry. Over years, these costs add up significantly.

3. Are there tools that simulate market microstructure for practice?

Absolutely. Many online brokers provide market microstructure simulation tools that allow traders to test order types, observe liquidity shifts, and practice execution strategies in real-time without risking real capital.

Conclusion

Understanding market microstructure for online trading platforms is no longer optional—it is a necessity for traders and institutions seeking an edge in increasingly competitive markets. Whether it’s minimizing execution costs, improving liquidity access, or optimizing algorithmic strategies, the principles of market microstructure empower smarter decision-making.

For retail traders, focusing on order flow and execution timing can yield immediate benefits. For institutions, algorithmic execution and liquidity provision remain powerful strategies. The best approach often lies in blending these methods based on goals, risk tolerance, and technology access.

If this deep dive added value to your trading journey, share it with peers, comment with your experiences, and join the conversation—because in trading, knowledge of microstructure is power.

0 Comments

Leave a Comment