================================================================

Momentum analysis has become an indispensable skill for financial analysts, quantitative traders, and institutional investors. By leveraging momentum analysis tools for analysts, professionals can detect market trends, forecast price movements, and optimize trading strategies. This comprehensive guide delves into practical tools, methods, and advanced techniques to harness momentum effectively in modern markets.

Understanding Momentum in Financial Markets

What Is Momentum?

Momentum measures the speed and strength of price movements over a specific time frame. Unlike simple trend analysis, momentum focuses on the rate of change in asset prices rather than their absolute levels. This allows analysts to:

- Identify emerging trends before they become apparent

- Detect overbought or oversold conditions

- Enhance timing for entry and exit points

Momentum is crucial in both quantitative trading and traditional investment analysis, providing a foundation for predictive and algorithmic strategies.

Why Momentum Matters

Momentum influences portfolio decisions and trading strategy design. Understanding how does momentum affect quantitative trading is critical because:

- Strong momentum often signals continuation of trends

- Weak momentum may indicate potential reversals

- Momentum combined with other indicators improves forecasting accuracy

Momentum illustrates the acceleration or deceleration of price movement in financial assets.

Key Momentum Analysis Tools for Analysts

1. Technical Momentum Indicators

Relative Strength Index (RSI)

The RSI measures speed and change of price movements, typically over 14 periods.

- Advantages: Easy to implement; widely recognized

- Limitations: Can produce false signals in volatile markets

- Use Case: Helps detect overbought or oversold conditions

Moving Average Convergence Divergence (MACD)

MACD compares short-term and long-term moving averages to highlight trend momentum.

- Advantages: Reveals trend shifts early; supports crossovers

- Limitations: Lagging in extremely fast-moving markets

- Use Case: Confirms trend strength and direction

Stochastic Oscillator

Measures closing price relative to recent high-low range.

- Advantages: Effective in sideways markets

- Limitations: Sensitive to market noise

- Use Case: Identifies potential reversal zones

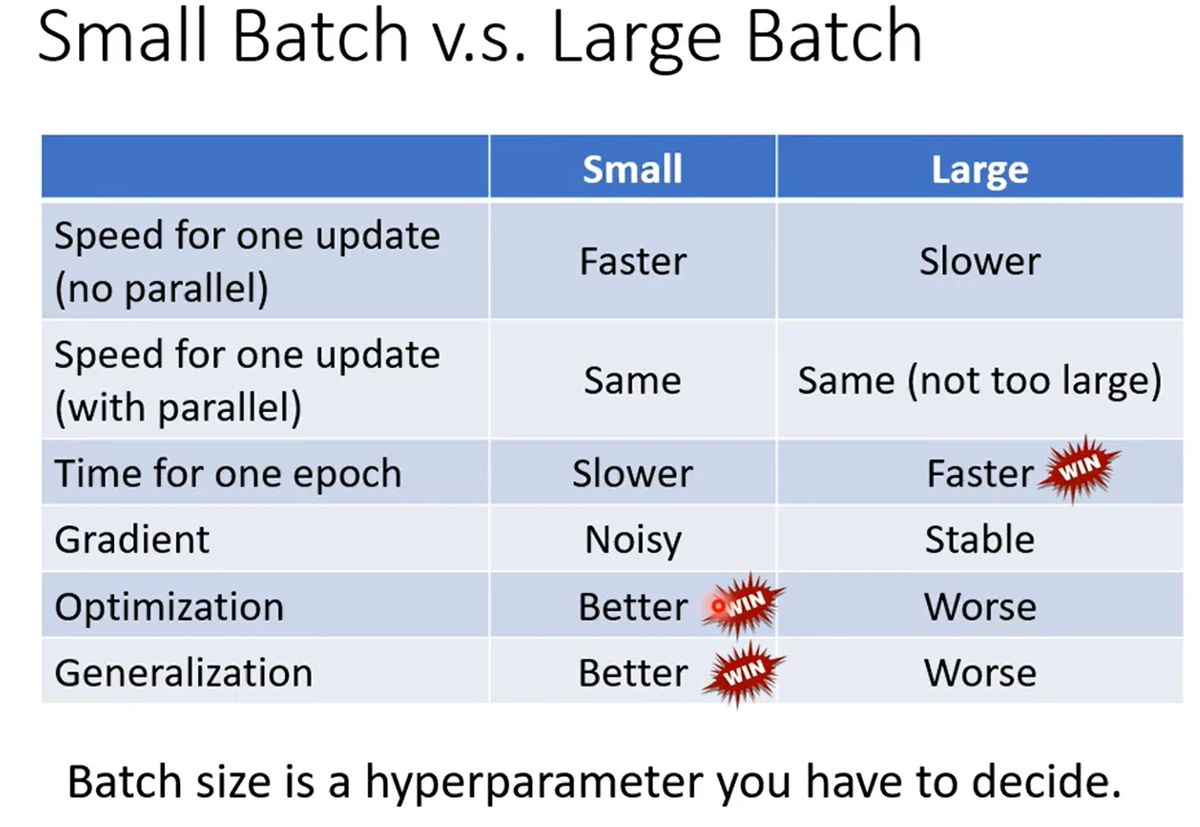

Comparison of RSI, MACD, and Stochastic Oscillator for trend detection

2. Quantitative Momentum Analysis

How to Measure Momentum in Trading Systems

Quantitative approaches use mathematical models to capture momentum:

- Rate of Change (ROC): Calculates percentage change in price over time

- Z-Score Momentum: Standardizes price deviations to identify unusual movement

- Machine Learning Models: Incorporate momentum as a feature for predictive algorithms

Advantages and Limitations

- Advantages: Data-driven, customizable, integrates well with algorithmic strategies

- Limitations: Requires robust data and computational resources

Integrating these methods allows analysts to create a comprehensive momentum monitoring system, enhancing portfolio management and risk assessment.

Practical Applications for Analysts

1. Identifying Market Trends

Momentum tools help analysts identify the strength and sustainability of trends across multiple time frames.

- Short-term analysis: Supports day trading and swing trading strategies

- Long-term analysis: Guides strategic asset allocation and portfolio rotation

2. Risk Management and Position Sizing

By analyzing momentum, analysts can adjust position sizes according to trend strength, reducing exposure in weak or consolidating markets.

- High momentum assets: Allocate larger positions

- Low momentum assets: Consider hedging or reducing exposure

3. Algorithmic Strategy Development

Momentum analysis is central to quantitative strategies. Momentum frameworks for data scientists provide:

- Predictive features for machine learning models

- Signal generation for automated trading systems

- Backtesting validation to improve strategy robustness

A workflow integrating momentum indicators into quantitative trading algorithms

Comparing Momentum Tools: Technical vs Quantitative Approaches

| Aspect | Technical Indicators | Quantitative Models |

|---|---|---|

| Data Requirements | Price history only | Price, volume, other market features |

| Complexity | Low to medium | Medium to high |

| Real-time Analysis | Often possible | Requires robust infrastructure |

| Integration with Algo Trading | Moderate | High |

| Predictive Power | Short-term guidance | Can support predictive modeling |

By combining both approaches, analysts can achieve more accurate trend detection, benefiting both discretionary and automated trading.

Advanced Techniques and Tools

1. Real-Time Momentum Monitoring

Software platforms now provide real-time momentum signals, allowing analysts to react immediately to market changes. Features include:

- Live RSI, MACD, and ROC indicators

- Heatmaps of momentum across assets

- Alerts for momentum shifts

2. Interactive Momentum Analysis

Interactive tools allow analysts to visualize momentum patterns, conduct scenario analysis, and explore multi-asset correlations.

- Enables better decision-making under market volatility

- Supports customizable dashboards for team collaboration

How to identify momentum in market trends explains practical techniques for applying these insights across various asset classes.

Case Studies

Case Study 1: Hedge Fund Momentum Strategy

A hedge fund applied MACD and ROC indicators across equity and futures portfolios. By integrating real-time momentum alerts, the fund increased its return on short-term trades by 15% over six months.

Case Study 2: Retail Analytics Application

A retail trading platform used RSI and stochastic oscillators to provide momentum insights to users, improving user engagement and trade timing efficiency.

Case study demonstrating momentum-based trading performance improvement

FAQ (Frequently Asked Questions)

1. Where to find momentum trading strategies?

Momentum trading strategies are available in financial research publications, trading platforms, online courses, and professional workshops. Analysts can also access interactive tools for momentum analysis to customize strategies.

2. How do momentum indicators work in trading?

Momentum indicators measure speed and magnitude of price changes to detect trends, potential reversals, or overbought/oversold conditions. Combining multiple indicators enhances reliability.

3. Why are momentum strategies effective?

Momentum strategies exploit the tendency of trends to continue in the short term. They are effective when combined with risk management, portfolio diversification, and quantitative modeling.

Conclusion

Utilizing momentum analysis tools for analysts is essential for navigating modern financial markets. By combining technical indicators, quantitative models, real-time monitoring, and interactive analysis, analysts can:

- Detect emerging trends early

- Optimize entry and exit points

- Enhance risk-adjusted returns

- Integrate momentum insights into algorithmic trading strategies

Mastering these tools empowers analysts to turn data into actionable insights, making momentum a core component of both discretionary and quantitative trading approaches.

0 Comments

Leave a Comment