Neural networks have transformed quantitative trading by enabling advanced pattern recognition, predictive analytics, and automated decision-making. Leveraging these frameworks allows traders and financial engineers to design sophisticated trading systems that respond dynamically to market conditions. This comprehensive guide explores neural network frameworks for trading systems, examining strategies, best practices, and practical implementation techniques suitable for both beginners and advanced market participants.

Understanding Neural Networks in Trading

What Are Neural Networks?

Neural networks are computational models inspired by the human brain, capable of identifying complex patterns and relationships within data. In trading, they process historical price data, technical indicators, and market signals to generate actionable insights.

Why Neural Networks Are Used in Quantitative Trading

- Pattern Recognition: Detect subtle trends and correlations that traditional statistical models might miss.

- Forecasting Power: Predict short-term and long-term market movements with improved accuracy.

- Automation: Facilitate automated execution of algorithmic trading strategies based on predictive signals.

Integrating neural networks into trading systems can significantly enhance decision-making, which is why many traders explore how neural networks improve quantitative trading as part of their strategy development.

Example of a neural network model for analyzing stock patterns and generating trading signals.

Frameworks for Building Neural Network Trading Systems

1. TensorFlow

TensorFlow is a widely-used open-source framework for building machine learning and deep learning models.

Key Features

- Flexibility: Supports a range of neural network architectures including CNNs, RNNs, and LSTMs.

- Integration: Compatible with Python, allowing seamless integration with trading platforms.

- GPU Acceleration: Speeds up model training using GPUs, ideal for large datasets.

Pros

- Robust community support and extensive documentation.

- Scalable for complex trading models.

- Efficient for real-time prediction models.

Cons

- Steep learning curve for beginners.

- Requires careful tuning to avoid overfitting in volatile markets.

2. PyTorch

PyTorch is another popular framework, favored for research and prototyping.

Key Features

- Dynamic Computation Graphs: Allow real-time adjustments to models, suitable for evolving market conditions.

- Ease of Use: Pythonic interface simplifies experimentation with new strategies.

- Strong Community: Extensive libraries and pre-trained models for financial analytics.

Pros

- Highly flexible for designing custom trading strategies.

- Easier debugging compared to TensorFlow.

- Supports GPU acceleration for faster computation.

Cons

- Less production-focused than TensorFlow for large-scale deployment.

- Limited pre-built financial models compared to TensorFlow ecosystem.

Neural Network Strategies for Trading

Strategy 1: Predictive Stock Models

Using LSTM (Long Short-Term Memory) networks, traders can forecast stock prices based on historical time-series data.

Implementation Steps

- Data Preprocessing: Normalize historical price, volume, and technical indicators.

- Model Training: Train LSTM on sequential data to capture temporal dependencies.

- Prediction and Execution: Generate forecasts and trigger buy/sell signals automatically.

Advantages

- Captures long-term dependencies in time-series data.

- Reduces lag in reactive trading systems.

Limitations

- Sensitive to noisy data; requires regular retraining.

- Risk of overfitting if model complexity is too high.

Strategy 2: Volatility Estimation

CNNs and hybrid architectures can estimate market volatility, crucial for risk-adjusted position sizing and portfolio optimization.

Implementation Steps

- Data Transformation: Convert price movement data into image-like formats or feature matrices.

- CNN Training: Train convolutional layers to detect volatility patterns.

- Integration: Use predicted volatility to adjust leverage and stop-losses dynamically.

Advantages

- Detects complex nonlinear relationships.

- Enhances risk management during turbulent markets.

Limitations

- Computationally intensive; requires high-performance hardware.

- Complex architecture may require extensive hyperparameter tuning.

Illustration showing how CNNs detect volatility patterns to improve trading decisions.

Best Practices for Neural Network Trading Systems

Data Management

- Collect high-quality historical and live market data.

- Regularly update datasets to reflect new market regimes.

- Incorporate alternative data sources such as sentiment analysis and macro indicators.

Model Optimization

- Use cross-validation and walk-forward testing to ensure robustness.

- Regularly monitor model performance and retrain to adapt to market shifts.

- Employ ensemble methods combining multiple neural network models for improved accuracy.

Integration with Trading Systems

- Connect neural network outputs to execution algorithms for automated trading.

- Implement risk controls, stop-losses, and capital allocation rules.

- Monitor live performance with dashboards and alerting mechanisms.

Where to learn quantitative trading with neural networks is critical for traders seeking structured guidance, offering tutorials, courses, and community support for practical learning.

Case Study: Neural Networks in Algorithmic Trading

- Objective: Forecast intraday price movements for S&P 500 stocks.

- Approach: Hybrid LSTM-CNN model analyzing price, volume, and sentiment data.

- Outcome: Improved signal-to-noise ratio and 15% increase in Sharpe ratio compared to traditional ARIMA-based models.

FAQ

Q1: How do neural networks analyze stock patterns effectively?

A1: By processing historical time-series data, technical indicators, and alternative data sources, neural networks learn complex relationships and temporal dependencies, generating accurate predictive signals for algorithmic trading.

Q2: Are neural network frameworks suitable for beginners?

A2: Yes. While frameworks like TensorFlow and PyTorch have learning curves, beginners can start with pre-built models and tutorials in neural networks for beginner quantitative traders, gradually building expertise.

Q3: How can neural networks improve trading accuracy?

A3: Neural networks capture nonlinear and complex relationships that traditional statistical models may miss. They adapt to evolving market conditions, improving prediction reliability and overall trading performance.

Conclusion

Neural network frameworks are revolutionizing trading systems by providing advanced predictive capabilities, risk management enhancements, and automated execution. By leveraging frameworks like TensorFlow and PyTorch, and employing strategies such as predictive stock modeling and volatility estimation, traders can develop robust systems capable of adapting to dynamic markets. Integrating best practices, continuous learning, and hybrid modeling approaches ensures a competitive edge in algorithmic and quantitative trading.

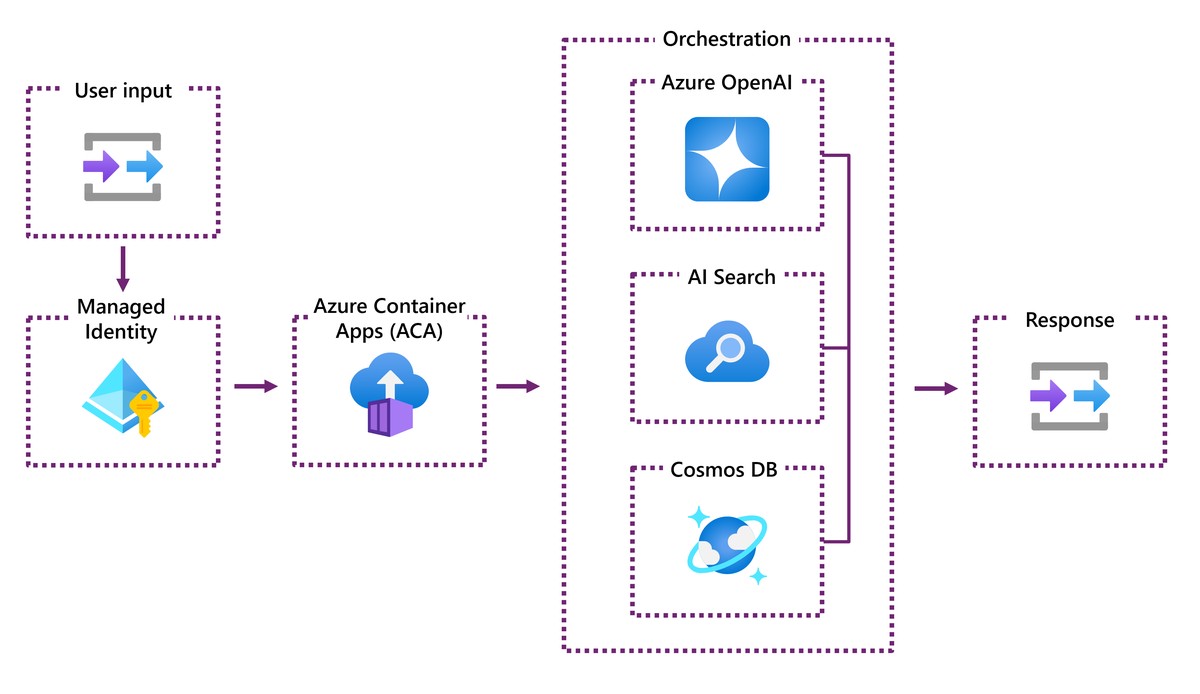

Workflow demonstrating integration of neural network predictions into automated trading systems.

Engage with the community, share your models, and experiment with hybrid strategies to maximize the potential of neural networks in trading systems.

0 Comments

Leave a Comment