Introduction

The integration of neural network frameworks for trading systems has transformed the landscape of algorithmic and quantitative trading. As markets become more complex, traditional statistical models often struggle to capture nonlinear dependencies, hidden correlations, and rapid shifts in market structure. Neural networks, on the other hand, excel at identifying patterns in large datasets and adapting to dynamic environments.

From my own experience in quantitative trading, neural network frameworks not only improve predictive accuracy but also enable scalable system design. However, the choice of framework, training methodology, and integration with real-time execution platforms remain critical to success. This article explores leading neural network frameworks, compares strategies, and provides actionable guidance for traders, developers, and researchers.

What Are Neural Network Frameworks?

Definition and Importance

Neural network frameworks are software platforms or libraries that provide tools for building, training, and deploying deep learning models. In trading, they serve as the backbone for predictive analytics, risk management, and automated execution.

Core Features

- Model Architecture Tools: Define feedforward, recurrent, or convolutional networks.

- Optimization Algorithms: Provide gradient descent, Adam, RMSProp, and more.

- Scalability: Support GPU/TPU acceleration for high-frequency or large-scale trading datasets.

- Integration: API compatibility with data feeds, brokers, and trading systems.

Popular Neural Network Frameworks for Trading

TensorFlow

TensorFlow, developed by Google, is widely used in financial applications. It supports production deployment, distributed training, and complex custom models.

- Strengths: Excellent scalability, strong community, TensorFlow Serving for deployment.

- Weaknesses: Steeper learning curve compared to alternatives.

- Best Use Case: Institutions and advanced quant teams building long-term trading infrastructure.

PyTorch

PyTorch has become the preferred choice among researchers and retail developers for its flexibility and dynamic computation graph.

- Strengths: User-friendly, strong research ecosystem, rapid prototyping.

- Weaknesses: Slightly less optimized for production scaling than TensorFlow (though improving).

- Best Use Case: Strategy prototyping, academic research, and experimental trading models.

Keras

Keras provides a high-level API running on TensorFlow, making it accessible for beginners while still offering powerful capabilities.

- Strengths: Simple, intuitive syntax, quick model building.

- Weaknesses: Limited customization for highly complex models.

- Best Use Case: Beginners learning how to build neural network models for trading.

Other Notable Frameworks

- MXNet: Lightweight and efficient, popular in low-latency environments.

- CNTK: Microsoft’s framework, less common but effective in enterprise settings.

- ONNX: Focuses on interoperability across frameworks.

Neural network frameworks like TensorFlow and PyTorch are the foundation for predictive analytics in trading systems.

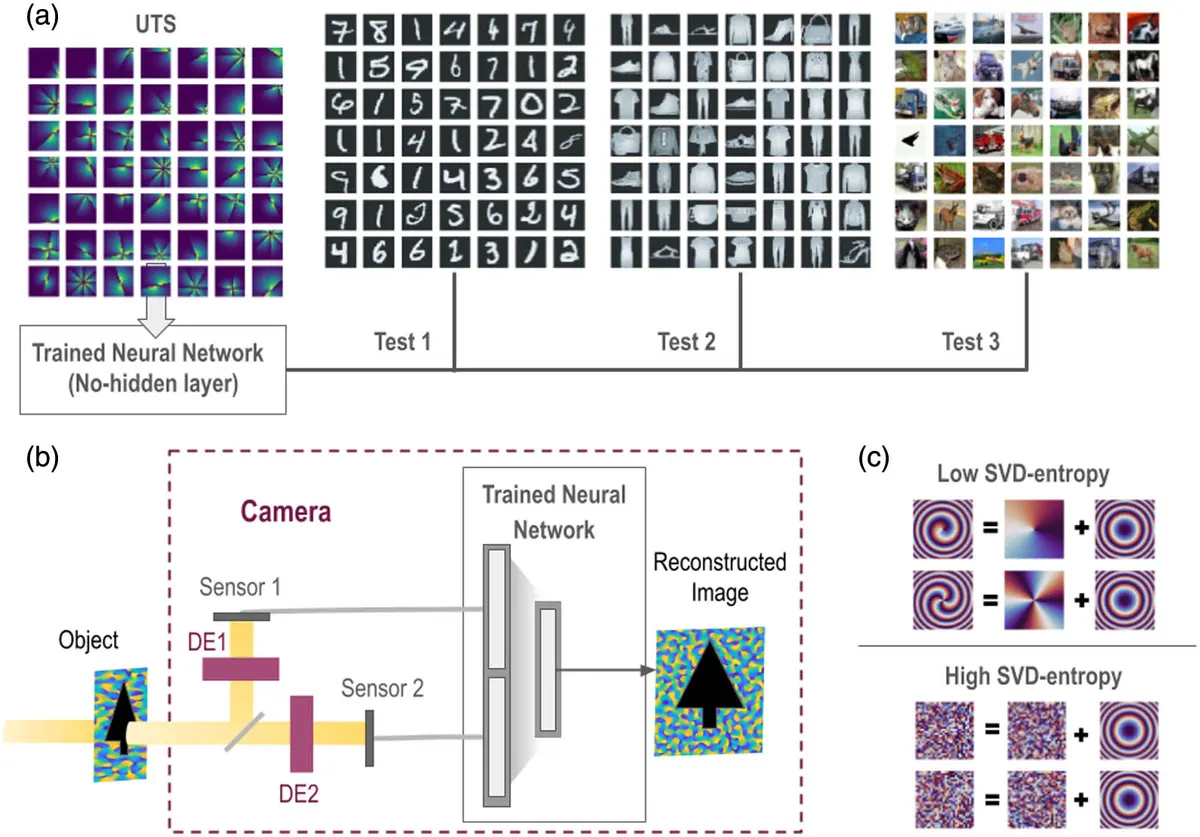

How Neural Networks Enhance Trading Systems

Pattern Recognition

Neural networks capture nonlinear dependencies that traditional models overlook, enabling better detection of hidden trends. This is especially valuable in high-noise environments like intraday forex or crypto trading.

Predictive Modeling

Frameworks enable deep architectures such as LSTMs and Transformers, which excel in sequential data modeling. These are particularly useful for how neural networks predict market trends with greater accuracy.

Risk Management

Neural networks can estimate volatility, forecast drawdowns, and optimize position sizing. These tools are vital for reducing leverage-related risks.

Two Key Strategies Using Neural Network Frameworks

Strategy 1: End-to-End Predictive Modeling

Concept: Train a neural network directly on raw price and volume data to forecast price movements.

- Advantages: Captures hidden nonlinearities, reduces feature engineering effort.

- Disadvantages: Requires massive datasets, prone to overfitting, resource-intensive.

- Best Use Case: High-frequency strategies where milliseconds of predictive power matter.

Strategy 2: Hybrid Feature Engineering + Neural Networks

Concept: Use domain knowledge to create technical indicators, fundamental features, or sentiment signals, then input them into a neural network.

- Advantages: More interpretable, requires fewer data resources, combines expertise with machine learning.

- Disadvantages: Depends on the quality of engineered features, risk of bias.

- Best Use Case: Retail and institutional traders seeking balance between interpretability and predictive power.

Comparison

| Strategy | Strength | Weakness | Best for |

|---|---|---|---|

| End-to-End | Powerful, automated | Data-hungry, complex | Institutional high-frequency trading |

| Hybrid Approach | Balanced, interpretable | Feature-dependent | Retail traders, research-driven models |

Recommendation: For most trading teams, the hybrid approach is more practical. It leverages domain expertise while still benefiting from neural network adaptability.

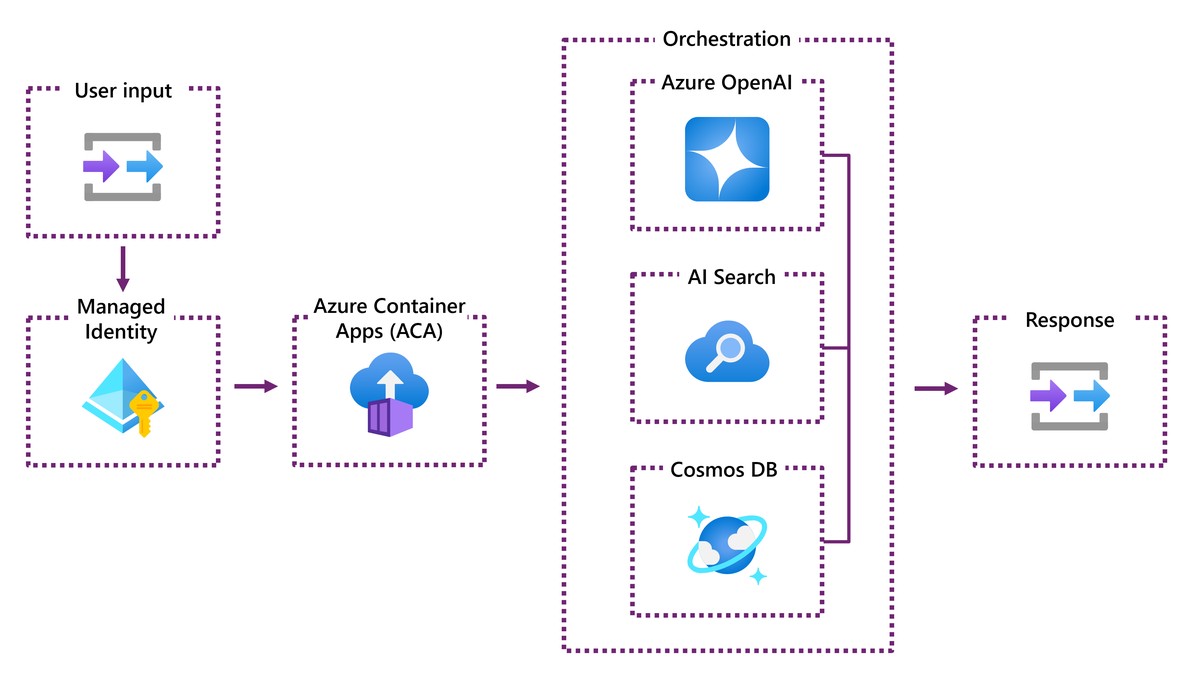

Integration with Trading Infrastructure

Real-Time Execution

Neural network predictions must connect to trading APIs (e.g., FIX, REST, WebSocket). Latency management is critical, especially in high-frequency settings.

Backtesting and Validation

Frameworks integrate with platforms like QuantConnect or custom Python pipelines to ensure robust backtesting across multiple market conditions.

Monitoring and Risk Controls

Live trading requires monitoring drift, retraining models, and setting circuit breakers to manage abnormal predictions.

Neural network trading systems combine data pipelines, model training, and real-time execution.

Real-World Use Cases

- Market Trend Prediction: Hedge funds use LSTMs to anticipate market regime shifts.

- Volatility Forecasting: Neural networks estimate intraday volatility to adjust leverage dynamically.

- Sentiment Analysis: NLP models analyze news and social media, providing real-time trading signals.

These examples highlight why neural networks are used in quantitative trading across diverse asset classes.

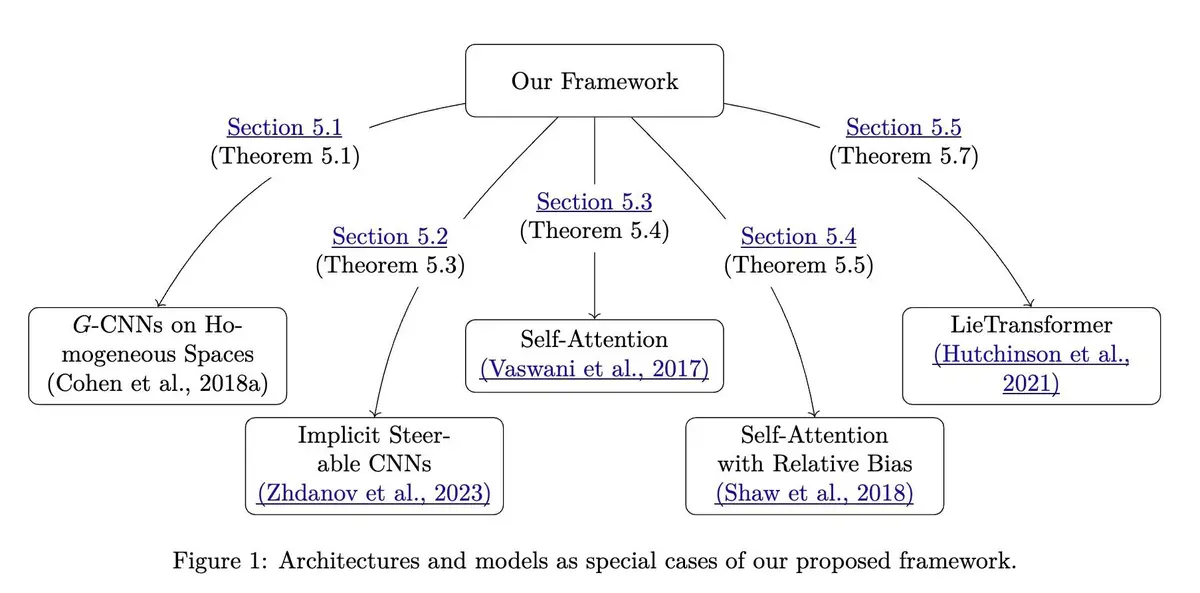

Future Trends in Neural Network Frameworks for Trading

- Transformer Architectures: Increasingly applied for sequential financial data.

- Reinforcement Learning: Agents optimize trading decisions under uncertainty.

- Explainable AI (XAI): Tools to improve transparency in neural-based trading systems.

- Edge AI: Running lightweight models closer to exchanges for ultra-low-latency strategies.

FAQs

1. Which neural network framework is best for trading system developers?

For prototyping, PyTorch offers flexibility and speed. For enterprise-grade deployment, TensorFlow is superior due to its scalability and production tools. Beginners often start with Keras.

2. How much data do I need to train a trading neural network?

It depends on the strategy. End-to-end models may require millions of data points across multiple markets. Hybrid approaches with engineered features can perform well with fewer data samples.

3. Can neural networks completely replace traditional trading models?

No. While powerful, neural networks are best seen as complements rather than replacements. They excel in capturing nonlinear patterns but should be combined with risk models, domain expertise, and traditional statistical methods.

Conclusion

Neural network frameworks are reshaping how traders and institutions design, test, and deploy trading systems. From TensorFlow’s scalability to PyTorch’s flexibility, these frameworks empower traders to build predictive, adaptive, and robust models.

Based on personal experience, a hybrid feature-engineering approach integrated with neural networks remains the most effective balance between accuracy and interpretability. As technology evolves, neural networks will become even more central in predictive modeling, volatility estimation, and trading automation.

Neural network-powered trading analytics is driving the next wave of financial innovation.

💬 Your turn!

Do you prefer end-to-end predictive models or hybrid approaches in trading? Share your experience below and forward this article to fellow traders exploring neural network frameworks.

0 Comments

Leave a Comment