Quantitative trading has rapidly evolved with the integration of advanced technologies, among which neural networks have become a cornerstone. These artificial intelligence (AI) models are increasingly used to enhance trading strategies, providing a powerful tool for predicting market trends, optimizing portfolios, and improving overall trading performance. In this article, we will explore how neural network strategies are used in quantitative trading, examining key techniques, their advantages and disadvantages, and how you can implement them in your trading strategy.

What Are Neural Networks in Quantitative Trading?

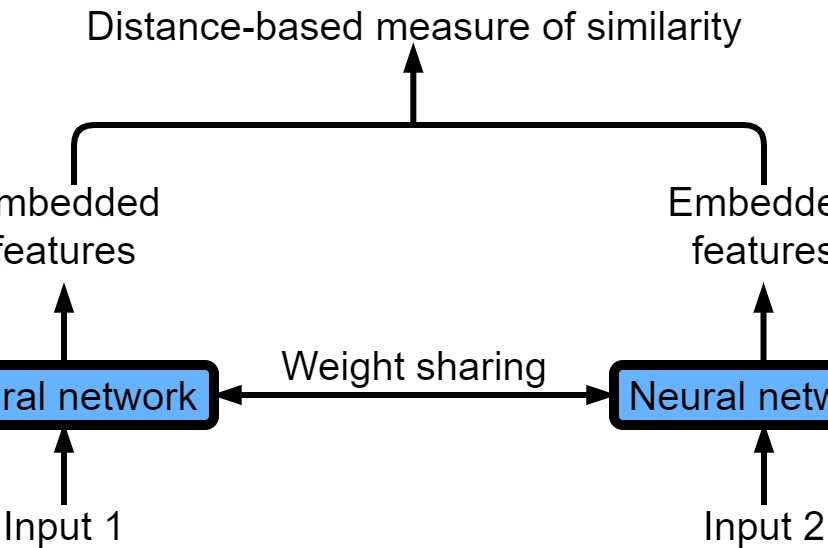

Neural networks are a type of machine learning model designed to simulate the way the human brain processes information. They consist of interconnected layers of nodes (neurons) that transform inputs into outputs through a series of mathematical operations. In the context of quantitative trading, neural networks can process vast amounts of market data, identify patterns, and generate actionable insights for traders.

How Neural Networks Improve Quantitative Trading

Neural networks can handle complex datasets that traditional models struggle with, such as:

- Price movement predictions: By analyzing historical data, neural networks can predict future price movements, helping traders to make better decisions.

- Pattern recognition: Neural networks can detect subtle patterns in market behavior, such as trends, volatility clusters, and breakout signals.

- Sentiment analysis: Using natural language processing (NLP) techniques, neural networks can analyze news articles, social media posts, and financial reports to gauge market sentiment.

This ability to process multiple types of data simultaneously allows for more accurate and timely decisions, especially when dealing with high-frequency trading (HFT) and large-scale portfolios.

Types of Neural Network Strategies Used in Quantitative Trading

There are several types of neural networks commonly used in quantitative finance. Below, we highlight the most popular models and their applications in trading.

1. Feedforward Neural Networks (FNN)

Feedforward neural networks are one of the simplest and most commonly used types of neural networks in trading. They consist of input, hidden, and output layers, and they are used for price forecasting, risk management, and portfolio optimization.

- Pros: Simple architecture and effective for price prediction tasks.

- Cons: May struggle with non-linear relationships, especially in highly volatile markets.

2. Recurrent Neural Networks (RNN)

RNNs are designed for time-series data, making them an excellent choice for market trend prediction. They can remember past inputs and use that memory to influence future predictions. This characteristic makes RNNs particularly useful for analyzing financial markets where past data often dictates future trends.

- Pros: Great for time-series forecasting.

- Cons: Can be computationally expensive and require large datasets to train effectively.

3. Long Short-Term Memory Networks (LSTM)

LSTMs are a specific type of RNN that addresses the vanishing gradient problem, allowing the model to learn from long sequences of data. They are particularly useful for stock price forecasting and volatility prediction.

- Pros: Ability to capture long-term dependencies in time-series data.

- Cons: Requires significant computational resources for training.

4. Convolutional Neural Networks (CNN)

CNNs are typically used in image recognition, but in finance, they are applied to market chart pattern recognition. By processing data in grid-like structures, CNNs can identify patterns such as head and shoulders or double bottoms.

- Pros: Effective at detecting complex patterns in data.

- Cons: Requires high-quality data and might not always generalize well to unseen market conditions.

5. Generative Adversarial Networks (GANs)

GANs consist of two networks: a generator and a discriminator. They are used to generate synthetic financial data, which can then be used to simulate trading scenarios, test strategies, and enhance backtesting processes.

- Pros: Can simulate market environments for robust backtesting.

- Cons: Complex architecture and difficult to train.

How Neural Networks Analyze Stock Patterns

Neural networks can be trained to recognize various patterns in stock price movements and market behavior, which are essential for identifying profitable trading opportunities. These patterns can be:

- Trend-following patterns: Identifying long-term bullish or bearish trends.

- Reversal patterns: Detecting when the market is likely to change direction, such as after a correction or overbought condition.

- Volatility patterns: Recognizing periods of market instability, which can present profitable opportunities for options and futures traders.

By incorporating these patterns into automated trading systems, neural networks can help reduce human error and improve consistency in trading decisions.

Key Advantages of Using Neural Networks in Trading

- Automation: Neural networks can automate trading processes by learning from historical data and making real-time trading decisions without human intervention.

- Handling Large Datasets: Neural networks can process vast amounts of data, making them ideal for high-frequency trading and other data-intensive strategies.

- Adaptability: Neural networks can adjust to changing market conditions, learning from new data and adapting their predictions accordingly.

- Reduction of Emotional Bias: By relying on data-driven models, neural networks reduce the emotional biases that often cloud human decision-making in trading.

Challenges of Using Neural Networks in Quantitative Trading

- Data Quality: The performance of a neural network heavily depends on the quality of the data fed into it. Poor or incomplete data can lead to inaccurate predictions.

- Overfitting: Neural networks are prone to overfitting, where the model becomes too tailored to the training data and fails to generalize to new, unseen data.

- Computational Cost: Training large neural networks can be resource-intensive, requiring powerful hardware and significant time.

How to Build Neural Network Models for Trading

Step 1: Data Collection and Preprocessing

The first step in building any neural network for trading is to collect relevant financial data. This can include historical prices, technical indicators, volume data, and even alternative data sources like news sentiment or social media posts. The data must be cleaned, normalized, and structured into a format suitable for model training.

Step 2: Feature Engineering

Feature engineering involves selecting and creating features (input variables) that will help the neural network make accurate predictions. Common features include:

- Moving averages (SMA, EMA)

- Relative Strength Index (RSI)

- Bollinger Bands

- On-balance volume (OBV)

Step 3: Model Selection and Training

Once the data is ready, the next step is to select the appropriate neural network model. Commonly used models include LSTMs for time-series forecasting or CNNs for pattern recognition. The model is then trained using historical data, adjusting weights and biases to minimize prediction errors.

Step 4: Backtesting and Optimization

After training the model, backtesting is essential to ensure that it performs well on historical data. Once a satisfactory model is achieved, it can be implemented into a live trading system and continuously optimized based on real-time performance.

FAQs on Neural Network Strategies for Quantitative Trading

1. What types of neural networks are best for quantitative trading?

For quantitative trading, LSTMs and RNNs are often the best choices for time-series forecasting. For pattern recognition, CNNs can be highly effective. Each model has its strengths, so the choice depends on the specific trading strategy.

2. How can neural networks predict market trends?

Neural networks predict market trends by learning from historical data, including price movements, technical indicators, and other market factors. They identify patterns and relationships in the data that are not immediately apparent to human traders.

3. Are neural network models better than traditional trading strategies?

Neural network models can provide significant advantages over traditional strategies by processing large volumes of data quickly and adapting to new information. However, they also require high-quality data and significant computational resources, and they are not foolproof.

Conclusion

Neural networks offer a promising solution for enhancing quantitative trading strategies, providing traders with the tools to analyze large datasets, predict market trends, and automate trading processes. While they come with challenges such as data quality and computational costs, the benefits of accuracy, adaptability, and automation make them invaluable for modern trading systems. By understanding the various types of neural networks and their applications in trading, you can implement a more robust and efficient trading strategy.

0 Comments

Leave a Comment