In the rapidly evolving world of financial markets, neural network solutions for trading automation are transforming how traders, analysts, and institutions operate. By leveraging artificial intelligence, traders can process vast amounts of market data, identify patterns, and execute strategies with unprecedented speed and precision. This article explores the real-world applications of neural networks in trading automation, compares multiple strategies, highlights their pros and cons, and provides actionable insights for both novice and professional traders.

Understanding Neural Networks in Trading

What Are Neural Networks?

Neural networks are computational models inspired by the human brain, designed to recognize patterns, classify data, and make predictions. In trading, they analyze historical market data, price movements, and financial indicators to generate actionable signals.

Why Neural Networks Are Crucial for Trading Automation

The main advantages of neural networks in trading include:

- Predictive Power: Anticipate market trends before they occur.

- Pattern Recognition: Detect complex, non-linear relationships in price data.

- Automation: Execute trades with minimal human intervention, improving efficiency.

Modern quantitative trading often integrates neural networks with algorithmic systems to enhance speed and accuracy. Resources such as how neural networks improve quantitative trading provide in-depth understanding for traders looking to optimize their strategies.

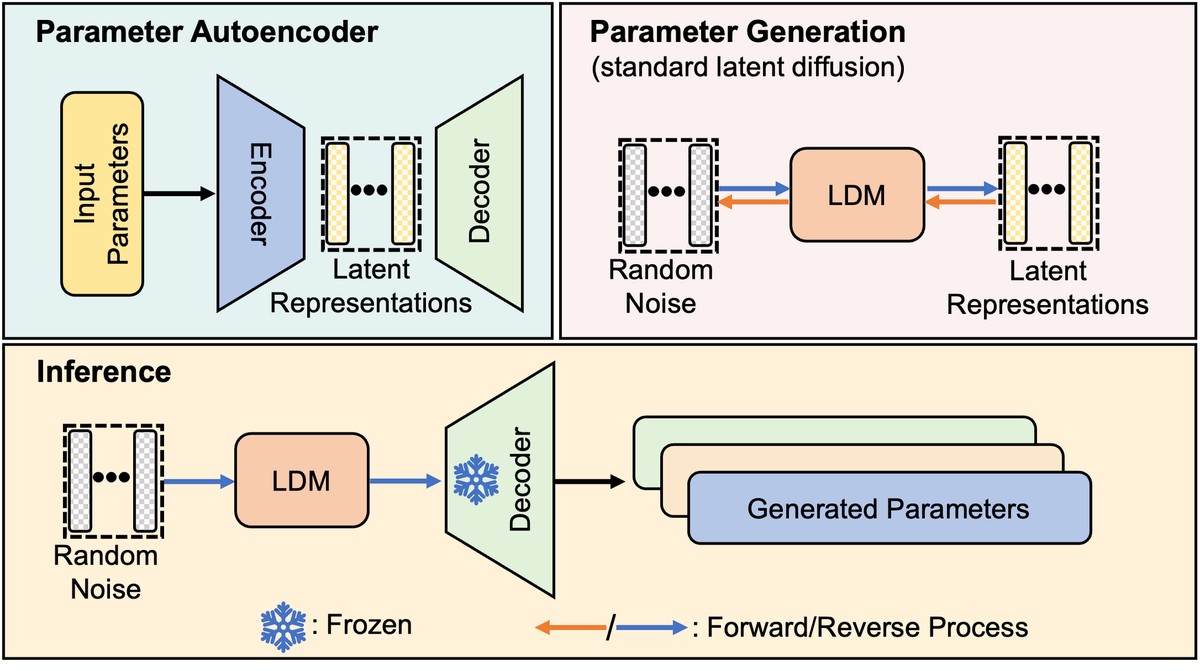

Illustration of a typical neural network architecture applied to trading automation, showing input features, hidden layers, and predicted outputs.

Key Neural Network Approaches for Trading Automation

1. Feedforward Neural Networks (FNNs)

How FNNs Work

Feedforward neural networks process inputs through multiple layers to produce an output. In trading, inputs can include historical prices, technical indicators, and macroeconomic variables. The network then predicts price movements or trading signals.

Advantages

- Simple architecture suitable for beginners.

- Good for short-term predictions in stable markets.

- Can be trained relatively quickly.

Disadvantages

- Limited ability to handle temporal dependencies in sequential data.

- Less effective in highly volatile or complex markets.

2. Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) Networks

How RNNs and LSTMs Work

RNNs and LSTMs are designed to handle sequential data, making them ideal for time series analysis in trading. They maintain memory of previous inputs, allowing the model to learn temporal patterns in market behavior.

Advantages

- Excellent for predicting trends over time.

- Can capture long-term dependencies in price movements.

- Highly effective for Forex, equities, and cryptocurrency markets.

Disadvantages

- Computationally intensive and slower to train.

- Requires large datasets for optimal performance.

Advanced traders often refer to guides on how to use neural networks in algorithmic trading to understand the practical implementation of RNNs and LSTMs for automated systems.

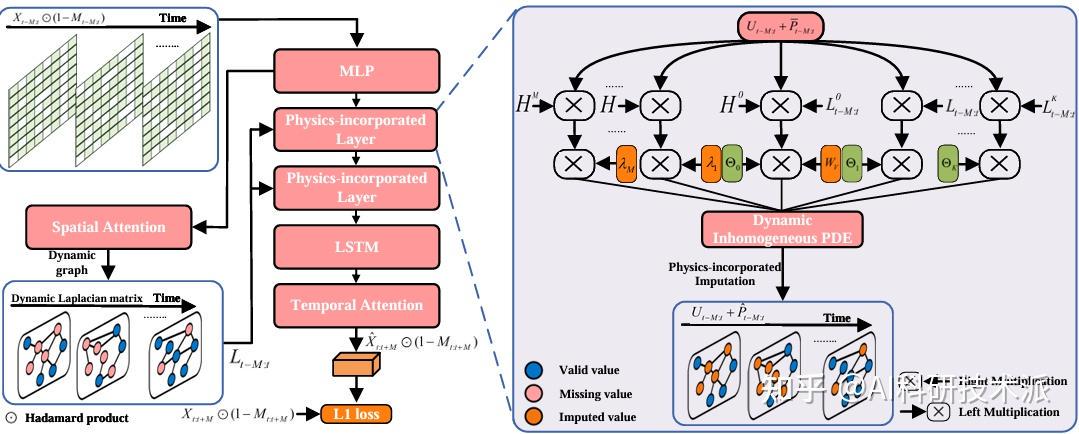

Comparison of FNN, RNN, and LSTM models highlighting their suitability for different trading scenarios and data types.

Implementing Neural Networks in Trading Automation

Step 1: Data Collection and Preprocessing

High-quality data is critical. Traders should gather:

- Historical price data

- Technical indicators

- Volume and liquidity metrics

- Economic and sentiment data

Preprocessing includes normalization, handling missing values, and feature engineering to enhance model performance.

Step 2: Model Selection and Training

- FNNs: Use for simpler, short-term predictions.

- LSTMs: Preferred for sequential and complex market data.

- Regularly backtest models to avoid overfitting.

Step 3: Integration with Trading Systems

Neural network outputs should feed directly into automated execution systems. Key considerations include:

- Latency: Ensure real-time decision-making.

- Risk Management: Apply stop-loss and position-sizing rules.

- Monitoring: Track performance metrics continuously.

Best Practices

- Start with simpler architectures and gradually introduce complexity.

- Continuously update models with new market data.

- Use ensemble models to combine predictions from multiple neural networks for more robust performance.

Workflow of neural network-based trading automation, including data preprocessing, model prediction, and automated execution.

Neural Network Strategies Comparison

| Strategy | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|

| FNN | Fast, simple, easy to train | Limited memory, less accurate in volatile markets | Short-term, low-frequency trading |

| LSTM | Handles sequential data, captures long-term dependencies | High computational cost, requires large datasets | Trend prediction, Forex, crypto, equities |

| Ensemble | Robust predictions, reduces overfitting | Complex to manage | Multi-asset trading, risk-averse strategies |

FAQ

1. How do neural networks predict market trends?

Neural networks analyze historical price movements, technical indicators, and external variables. LSTM networks, in particular, excel at learning sequential patterns to forecast future trends.

2. Where to find neural network trading strategies?

Reliable sources include academic research, quantitative trading platforms, specialized forums, and courses focusing on neural networks for financial engineers.

3. How to implement neural networks in trading systems?

Implementation involves:

- Collecting and preprocessing data

- Selecting an appropriate network (FNN, RNN, LSTM)

- Training and backtesting the model

- Integrating predictions into an automated trading execution system with proper risk management

Conclusion

Neural network solutions for trading automation provide a significant edge in modern markets by enhancing prediction accuracy, automating execution, and enabling complex quantitative strategies. By selecting the appropriate network architecture, integrating robust data pipelines, and continuously optimizing models, traders can leverage AI to maximize efficiency and profitability.

Share your experiences and thoughts on neural network trading automation in the comments, and discuss these strategies with peers to enhance collective market intelligence.

0 Comments

Leave a Comment