===========================================

Introduction

Quantitative trading has revolutionized financial markets by relying on data, algorithms, and statistical models rather than gut feelings. Among the most powerful instruments for quantitative traders are futures contracts. These derivative instruments allow market participants to speculate, hedge, and arbitrage across commodities, equities, interest rates, and cryptocurrencies. The question, “how to do quantitative trading with futures”, has become increasingly relevant for retail traders, hedge funds, and institutional investors alike.

This comprehensive guide explores the fundamentals of futures in quantitative trading, strategies to apply, tools to use, and pitfalls to avoid. Drawing on both professional experience and recent industry trends, we’ll evaluate multiple approaches, compare their strengths and weaknesses, and provide actionable recommendations for traders at different levels.

Understanding Futures in Quantitative Trading

What Are Futures Contracts?

A futures contract is a standardized agreement to buy or sell an asset at a predetermined price and date in the future. Unlike spot markets, futures allow traders to speculate on price movements without owning the underlying asset.

- Underlying assets: commodities, equity indexes, currencies, bonds, or digital assets.

- Standardization: traded on exchanges with fixed contract sizes and expiration dates.

- Leverage: allows traders to control large positions with smaller margin requirements.

Why Use Futures in Quantitative Trading?

Quantitative traders use futures for three main purposes:

- Leverage and efficiency – Futures allow large exposures with smaller capital.

- Hedging – Protect portfolios against market volatility.

- Liquidity – Futures markets are deep and liquid, essential for algorithmic execution.

This is why many professionals emphasize why futures are important for quantitative traders: they provide a versatile framework for implementing systematic strategies.

Core Components of Quantitative Futures Trading

1. Data Collection and Preprocessing

Quantitative futures trading begins with robust data pipelines. Historical data includes price, volume, open interest, and market depth. Alternative data, such as macroeconomic indicators or sentiment analysis, adds predictive power.

2. Model Development

Traders design statistical or machine learning models that forecast price direction, volatility, or spreads between instruments.

3. Backtesting and Simulation

Before deploying capital, strategies must be stress-tested across historical and synthetic data to verify robustness. Many professionals rely on futures simulation software for quantitative traders to refine strategies before going live.

4. Execution and Risk Management

Algorithmic execution ensures orders are filled efficiently with minimal slippage. Risk management techniques, including stop-losses, position sizing, and dynamic hedging, protect against adverse movements.

Strategies for Quantitative Futures Trading

1. Statistical Arbitrage

Statistical arbitrage exploits temporary mispricings between correlated futures contracts.

- Example: Trading the spread between Brent crude and WTI crude futures.

- Advantages: Market-neutral, less exposed to systematic risk.

- Disadvantages: Requires high-frequency execution and robust data infrastructure.

2. Trend-Following Strategies

Trend-following is one of the oldest and most successful quantitative futures strategies. Algorithms detect sustained directional moves and ride the trend until it reverses.

- Example: Commodity Trading Advisors (CTAs) use moving averages and momentum filters.

- Advantages: Simple, scalable across assets, historically profitable.

- Disadvantages: Vulnerable to whipsaws during sideways markets.

3. Mean Reversion

Mean reversion assumes that futures prices oscillate around a fair value and tend to revert after deviations.

- Example: Buying S&P 500 futures when the RSI signals oversold conditions.

- Advantages: Profitable in range-bound markets.

- Disadvantages: Dangerous during strong trends; requires precise entry signals.

4. Machine Learning-Based Forecasting

Modern traders increasingly use machine learning to capture nonlinear relationships and hidden patterns in futures markets.

- Techniques: Random forests, gradient boosting, recurrent neural networks.

- Advantages: Adaptive to changing market conditions, high predictive potential.

- Disadvantages: Risk of overfitting, high computational costs, interpretability challenges.

This approach aligns with how to predict futures in quantitative trading, as advanced models often outperform traditional statistical methods when properly validated.

Comparing Trend-Following vs Machine Learning Approaches

| Aspect | Trend-Following | Machine Learning Forecasting |

|---|---|---|

| Complexity | Low – rule-based indicators | High – requires coding & model training |

| Data Requirements | Low – historical prices | High – alternative + historical data |

| Robustness | Proven over decades | Promising but sensitive to overfitting |

| Scalability | Easily applied across markets | Limited by computational resources |

Recommendation: For beginners, trend-following provides a solid foundation. For professionals, a hybrid strategy combining machine learning signals with trend-following rules offers strong diversification benefits.

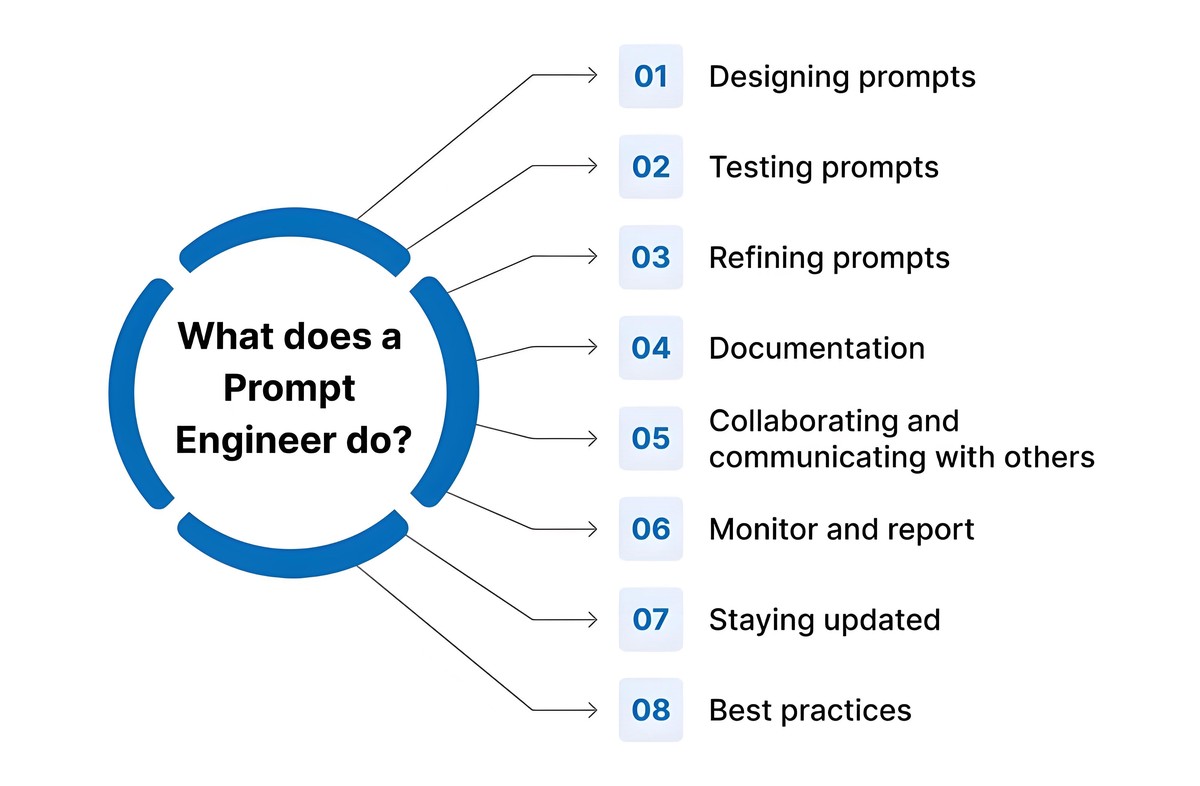

Visualizing Futures Quantitative Trading

Quantitative trading workflow with futures: data, modeling, backtesting, execution, and monitoring.

Practical Tools and Platforms

- Backtesting Frameworks: QuantConnect, Backtrader, Zipline.

- Execution Platforms: Interactive Brokers API, CQG, Trading Technologies.

- Risk Management Tools: Monte Carlo simulations, Value-at-Risk calculators.

- Research Resources: Academic databases and where to learn futures quantitative analysis online through specialized courses.

Risk Management in Quantitative Futures Trading

Key Risks

- Leverage Risk: Amplified losses due to small margin requirements.

- Liquidity Risk: Thinly traded contracts may cause slippage.

- Model Risk: Incorrect assumptions or overfitted models can collapse in live trading.

Mitigation Techniques

- Position sizing to cap downside exposure.

- Portfolio diversification across asset classes.

- Regular recalibration of models.

Frequently Asked Questions (FAQ)

1. How much capital do I need to start quantitative futures trading?

It depends on your broker and chosen markets. While micro futures contracts allow entry with as little as a few thousand dollars, serious quantitative trading often requires $50,000+ to absorb drawdowns and maintain margin buffers.

2. Can retail traders effectively use machine learning in futures?

Yes, but success depends on access to quality data and proper validation. Many retail traders start with simple models before scaling to advanced deep learning architectures. Cloud-based platforms now make computational resources more accessible.

3. What’s the best strategy for beginners in futures quantitative trading?

Trend-following strategies are the most beginner-friendly. They are easy to implement, historically robust, and offer a clear risk-reward framework. As traders gain experience, they can expand into statistical arbitrage and machine learning.

Conclusion

Learning how to do quantitative trading with futures requires a deep understanding of data, models, and execution. Futures contracts provide leverage, liquidity, and flexibility—making them an ideal instrument for both beginners and professionals in quantitative finance.

While strategies like trend-following, mean reversion, and arbitrage remain effective, integrating machine learning and big data offers a powerful edge for advanced traders. The best approach combines proven models with innovative methods, underpinned by rigorous risk management.

If this guide has sparked your interest, share it with fellow traders, leave a comment below, and continue the discussion on building better futures trading strategies through quantitative methods.

Would you like me to also generate an SEO meta description (150–160 characters) and social media captions to boost this article’s ranking and shareability?

0 Comments

Leave a Comment