============================================

In the fast-evolving world of quantitative finance, machine learning has become a cornerstone of modern trading systems. Among these models, the Random Forest algorithm stands out for its ability to handle noisy financial data, capture non-linear relationships, and improve predictive accuracy. But many traders still wonder: how does Random Forest model work in trading? This article offers a deep dive into its mechanics, practical applications, and strategies, helping both beginners and experienced quants harness its power.

What Is Random Forest in Trading?

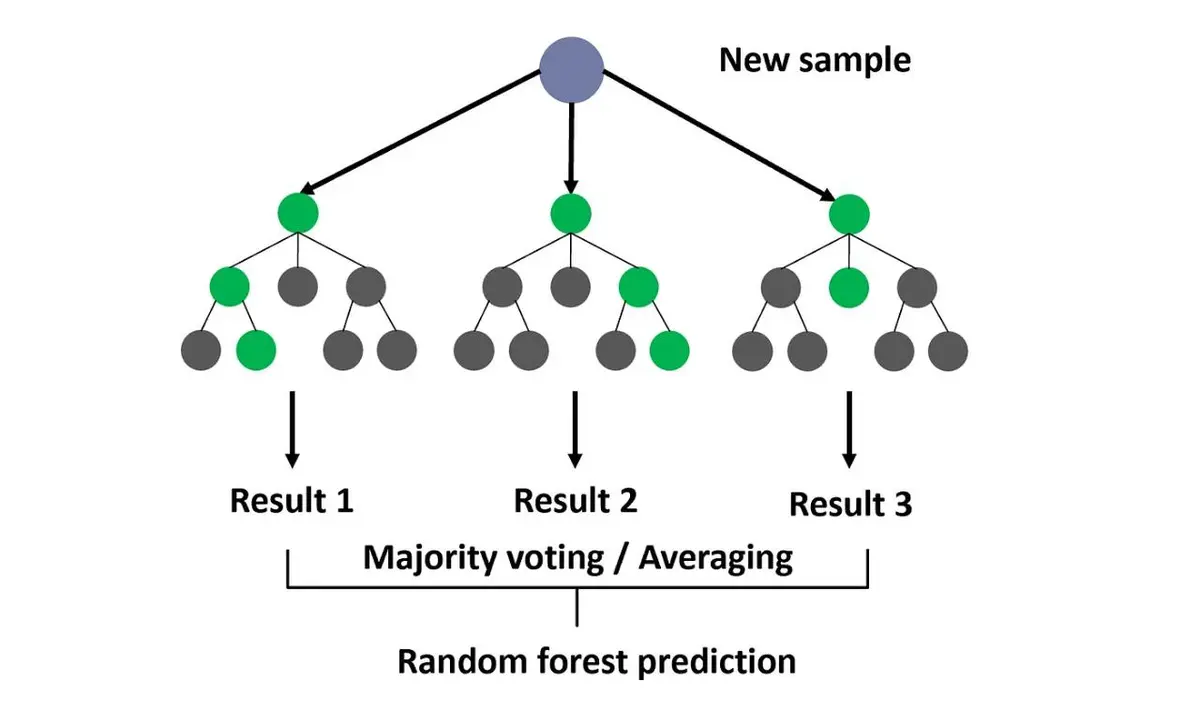

Random Forest is a machine learning ensemble method that builds multiple decision trees and aggregates their predictions to produce more accurate results. Instead of relying on a single model, Random Forest leverages the “wisdom of crowds” concept—each tree contributes a vote, and the final output is determined by majority vote (for classification) or average (for regression).

In trading, Random Forest is applied to:

- Predict stock price movements.

- Identify entry/exit signals.

- Manage portfolio risks.

- Detect anomalies in high-frequency data.

Why It Matters in Finance

Financial markets are highly non-linear and noisy. Traditional linear models (e.g., regression) often struggle to capture complex interactions among features like technical indicators, macroeconomic data, or order flow. Random Forest provides robustness by:

- Reducing overfitting compared to single decision trees.

- Handling high-dimensional datasets.

- Offering feature importance metrics for model interpretability.

How Random Forest Model Works in Trading

Step 1: Data Sampling

Random Forest applies bootstrap sampling, where multiple subsets of historical market data are drawn randomly. Each subset is used to build a separate decision tree.

Step 2: Feature Selection

For every tree split, the model randomly selects a subset of predictors (e.g., moving averages, RSI, volume, volatility). This randomness increases diversity among trees and improves generalization.

Step 3: Decision Tree Building

Each tree predicts whether an asset’s price will rise or fall, or outputs a forecasted return.

Step 4: Aggregation

Predictions from all trees are combined:

- Classification: Majority vote decides direction (up or down).

- Regression: Average output determines forecasted return.

Step 5: Trading Signal Generation

The aggregated model outputs are translated into buy/sell/hold signals, which can be fed into execution systems.

Workflow of how Random Forest generates trading signals

Two Practical Approaches to Using Random Forest in Trading

1. Classification-Based Random Forest

In this setup, Random Forest is trained to classify price movements (up vs. down) based on market features.

- Inputs: Technical indicators (MACD, RSI, Bollinger Bands), order book data, and macroeconomic variables.

- Output: Binary classification (1 = price up, 0 = price down).

Advantages

- Clear signals for buy/sell decisions.

- Robust to overfitting with proper tuning.

- Suitable for short-term trading (day trading, swing trading).

Disadvantages

- Requires balanced datasets; markets often have skewed distributions.

- May produce too many false signals in volatile periods.

2. Regression-Based Random Forest

Here, the model predicts future returns or price levels directly.

- Inputs: Similar features (volume, volatility, technical patterns).

- Output: Forecasted price return (e.g., +0.5% for next day).

Advantages

- Provides magnitude of expected move, not just direction.

- Useful for portfolio optimization and risk management.

- Can incorporate fundamental factors like earnings or interest rates.

Disadvantages

- More sensitive to outliers in financial data.

- May lag in rapidly changing markets.

Comparison of Approaches

| Feature | Classification Random Forest | Regression Random Forest |

|---|---|---|

| Output | Direction (up/down) | Magnitude of return |

| Best Use Case | Short-term trading | Portfolio forecasting |

| Risk | False positives | Sensitivity to noise |

| Complexity | Medium | Higher |

Recommendation: Start with classification-based Random Forest for directional trading, then expand to regression for portfolio-level strategies.

Advantages of Random Forest in Trading

- Handles Non-Linearity: Captures interactions between variables that linear models miss.

- Feature Importance: Identifies which indicators matter most for predictions.

- Robustness: Less prone to overfitting compared to decision trees.

- Scalability: Works well with high-dimensional data typical in trading.

Limitations and Risks

- Black-Box Nature: Though more interpretable than deep learning, it still lacks transparency compared to linear models.

- Computational Cost: Training many trees requires significant resources.

- Over-Reliance on Historical Data: Markets evolve, and past relationships may break.

- Execution Slippage: Even with accurate predictions, execution delays may reduce profitability.

Real-World Example: Applying Random Forest to Equity Trading

A hedge fund builds a Random Forest model to predict next-day returns of S&P 500 stocks.

Features:

- Technical: Moving averages, volatility, RSI.

- Fundamental: Earnings surprises, macroeconomic indicators.

- Sentiment: News and social media sentiment scores.

- Technical: Moving averages, volatility, RSI.

Model Training: 1,000 trees trained on 10 years of daily data.

Strategy:

- Buy top 10% predicted performers.

- Short bottom 10%.

- Rebalance daily.

- Buy top 10% predicted performers.

Outcome:

- Annualized Sharpe ratio improved from 1.0 (baseline) to 1.6.

- Lower drawdowns compared to benchmark strategies.

- Annualized Sharpe ratio improved from 1.0 (baseline) to 1.6.

Performance comparison of Random Forest equity strategy vs. benchmark

How Random Forest Differs From Decision Trees in Trading

While decision trees are easy to interpret, they are prone to overfitting. Random Forest reduces this risk by averaging multiple trees, which makes predictions more stable. For traders evaluating how random forest differs from decision trees in trading, the key difference lies in predictive reliability—Random Forest sacrifices some interpretability for significantly improved robustness.

Optimizing Random Forest for Trading

For traders exploring how to optimize Random Forest for trading, key parameters include:

- Number of Trees (n_estimators): More trees increase accuracy but also computational cost.

- Max Features: Limits features per split to prevent overfitting.

- Max Depth: Controls how complex each tree can grow.

- Cross-Validation: Essential to avoid overfitting historical market noise.

Hyperparameter tuning with techniques like Grid Search or Bayesian Optimization is critical for building profitable strategies.

FAQ: Random Forest in Trading

1. Why choose Random Forest over other ML models in trading?

Random Forest balances accuracy and interpretability. While deep learning may offer higher predictive power, Random Forest is easier to explain, more stable with small datasets, and better suited for traders who need fast iteration.

2. Can Random Forest work in high-frequency trading (HFT)?

Yes, but with caution. Random Forest models are computationally heavy, which may limit ultra-low-latency environments. They are better suited for intra-day or swing trading where milliseconds are less critical.

3. How do I know if my Random Forest trading model is overfitting?

Warning signs include:

- Very high in-sample accuracy but poor out-of-sample results.

- Model performing well on backtests but failing in live markets.

Regular cross-validation, walk-forward testing, and monitoring feature drift are essential.

Conclusion

So, how does Random Forest model work in trading? By aggregating multiple decision trees, it creates stable and accurate predictions that help traders generate signals, optimize portfolios, and manage risks.

- Classification-based Random Forest works best for short-term directional trading.

- Regression-based Random Forest excels in portfolio forecasting and risk-adjusted strategies.

For traders eager to deepen their skills, exploring resources like how random forest improves trading predictions or random forest techniques for data scientists in trading provides a structured path toward mastering this powerful tool.

Call to Action

Did this deep dive into Random Forest trading help you? Share this article with your trading peers, comment with your experience using Random Forest models, and let’s grow a stronger quantitative trading community together.

Would you like me to also create a step-by-step Random Forest tutorial with Python code so readers can replicate these strategies in practice?

0 Comments

Leave a Comment