==============================================

Introduction

Quantitative trading has revolutionized the financial markets by introducing systematic, data-driven methods that reduce human error and increase efficiency. One of the biggest advantages of this approach lies in risk reduction. By relying on statistical models, algorithmic execution, and advanced risk management frameworks, traders can minimize exposure to unforeseen market volatility. This article explores how to reduce risks using quantitative trading, highlights proven methods, compares strategies, and provides actionable insights for investors seeking stability and profitability.

Understanding Quantitative Trading and Risk

What is Quantitative Trading?

Quantitative trading, often called algo trading, is a trading method that relies on mathematical models, data analysis, and algorithms to make decisions. Instead of depending on intuition or emotions, quantitative strategies execute trades based on historical data patterns, predictive analytics, and statistical models.

The Role of Risk in Trading

Risk is inherent in any trading activity. Market fluctuations, liquidity shortages, and sudden news events can drastically impact portfolio performance. In quantitative trading, risk management is integrated into the strategy design itself, ensuring systematic checks against losses.

Why Risk Reduction Matters

Uncontrolled risk leads to overexposure, margin calls, and catastrophic drawdowns. Traders who fail to manage risk may lose their capital despite having profitable strategies. Thus, incorporating robust risk management in quantitative trading is essential for sustainable success.

Methods to Reduce Risks Using Quantitative Trading

1. Diversification Through Portfolio Optimization

One of the primary methods of reducing risk in quantitative trading is diversification. Instead of relying on a single asset or strategy, traders distribute capital across multiple assets, markets, and strategies.

- How it works: Algorithms use techniques like mean-variance optimization and risk parity models to construct balanced portfolios.

- Advantages: Reduces correlation risk, protects against asset-specific crashes, and smooths returns.

- Disadvantages: May reduce overall returns if diversification is overextended.

Recommendation: Use dynamic rebalancing models to adjust portfolio weights in real-time based on changing volatility and correlation structures.

2. Volatility-Based Position Sizing

Position sizing is a crucial risk control technique in quantitative trading. Instead of assigning equal weights to trades, algorithms size positions according to the volatility of each asset.

- How it works: Assets with high volatility receive smaller allocations, while stable assets receive higher allocations.

- Advantages: Prevents oversized exposure to risky instruments.

- Disadvantages: May reduce profits in trending, volatile assets if risk is underestimated.

Recommendation: Combine volatility-based sizing with stop-loss algorithms to create multi-layered protection.

3. Stress Testing and Backtesting

Before deploying strategies, quant traders conduct rigorous backtesting and stress testing under different market conditions.

- Backtesting: Tests strategies on historical data.

- Stress Testing: Evaluates performance during extreme scenarios such as financial crises or flash crashes.

- Advantages: Identifies weaknesses before real capital is at risk.

- Disadvantages: Overfitting risk—strategies may perform well in backtests but fail in real markets.

Recommendation: Apply out-of-sample testing and walk-forward analysis to ensure strategies remain robust.

4. Risk Factor Modeling

Advanced quantitative systems incorporate risk factor models, such as Fama-French or multi-factor frameworks, to understand and hedge exposures.

- How it works: Identifies portfolio sensitivity to factors like interest rates, inflation, or market sentiment.

- Advantages: Allows targeted hedging using derivatives or opposite positions.

- Disadvantages: Requires accurate estimation of factor loadings.

Recommendation: Regularly recalibrate models to adjust for evolving macroeconomic environments.

5. Automated Stop-Loss and Take-Profit Rules

Risk reduction also involves automated execution rules that enforce discipline.

- Stop-Loss Orders: Prevents excessive drawdowns by exiting trades automatically.

- Take-Profit Orders: Locks in gains before market reversals.

- Advantages: Removes emotional bias and ensures consistent discipline.

- Disadvantages: May trigger premature exits in volatile but profitable trades.

Recommendation: Use adaptive stop-loss levels based on volatility bands instead of static thresholds.

Comparing Two Risk Reduction Strategies

Strategy A: Portfolio Diversification

- Strengths: Smooths returns, protects against single-point failure.

- Weaknesses: Dilutes returns if over-diversified.

Strategy B: Volatility-Based Position Sizing

- Strengths: Adjusts dynamically, aligns exposure with real-time market conditions.

- Weaknesses: May miss high-risk/high-reward opportunities.

Best Approach: A hybrid method that combines diversification with volatility-based sizing provides balanced risk management, offering both stability and opportunity.

Latest Industry Trends in Quantitative Risk Management

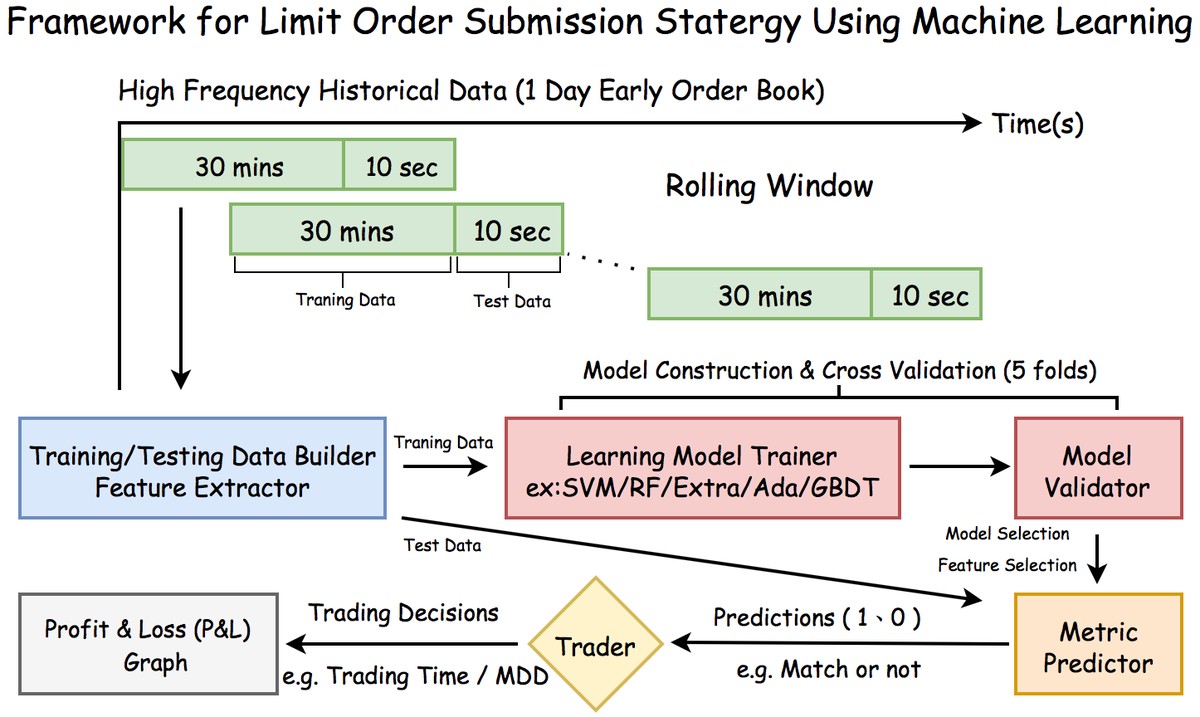

- AI and Machine Learning: Advanced models predict tail risks and identify anomalies more effectively than traditional methods.

- Real-Time Risk Dashboards: Institutional traders now rely on live dashboards powered by big data for immediate risk insights.

- Blockchain Data Integration: In crypto markets, quant traders integrate on-chain metrics with trading models to detect liquidity risks earlier.

- Cloud-Based Risk Engines: Startups and hedge funds leverage cloud platforms for scalable, low-latency risk analysis.

Embedded Insights with Internal Links

Effective quant traders understand that how to implement risk management in quantitative trading is not just about theory but execution. Proper execution requires tools, frameworks, and continuous model validation. Moreover, traders must appreciate why is risk management important in quantitative trading, as neglecting this aspect often leads to failures even for technically advanced strategies.

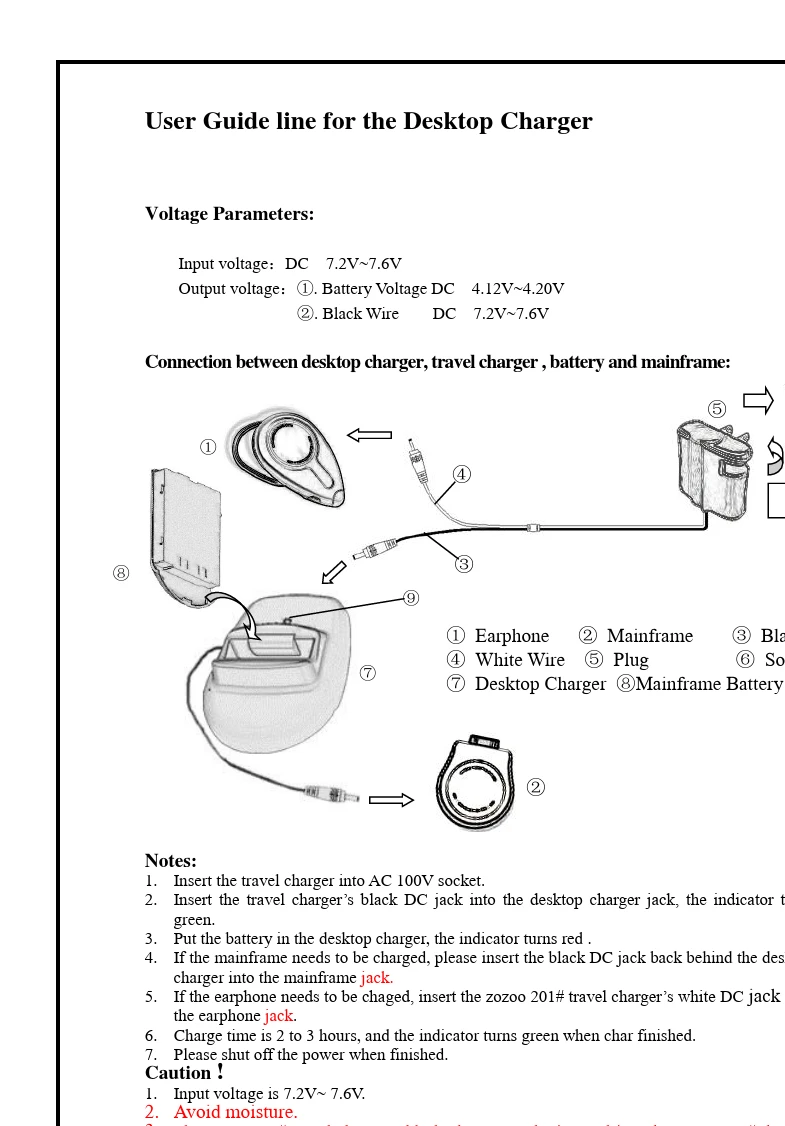

Visual Illustrations

Portfolio Optimization in Quantitative Trading

Portfolio diversification reduces risks across asset classes

Volatility-Based Position Sizing

Position sizing based on volatility ensures balanced exposure

Stress Testing Results Example

Stress testing scenarios show portfolio behavior in crisis events

FAQ: How to Reduce Risks Using Quantitative Trading

1. Can quantitative trading completely eliminate risks?

No. Quantitative trading reduces risks but cannot eliminate them. Market shocks, data errors, or model overfitting can still cause unexpected losses. The key is risk minimization, not total elimination.

2. What is the most effective risk management strategy in quantitative trading?

A combination of portfolio diversification and volatility-based sizing tends to be the most effective. This hybrid approach balances stability and profitability across different market regimes.

3. How do beginners apply risk management in quant trading?

Beginners should start small, focus on backtesting, use simple position-sizing rules, and gradually incorporate risk factor models. Leveraging existing tools and tutorials can help accelerate the learning curve.

Conclusion

Learning how to reduce risks using quantitative trading is vital for every trader who wants sustainable profitability. By employing diversification, volatility-based sizing, automated stop-loss mechanisms, and advanced stress testing, traders can safeguard their portfolios. With AI-driven tools, blockchain analytics, and cloud-based infrastructures, the industry is moving toward more dynamic and effective risk frameworks.

Now it’s your turn: Which risk reduction strategy have you found most effective in your trading journey? Share your experiences in the comments, and don’t forget to share this article with fellow traders who want to trade smarter, not riskier.

0 Comments

Leave a Comment