=======================================

Introduction

Backtesting is the cornerstone of quantitative trading, allowing traders and institutions to evaluate strategies before risking real capital. However, the reliability of any backtest depends largely on how to select parameters for a backtest. Poor parameter selection can lead to misleading results, curve-fitting, and ultimately, failed strategies in live markets.

In this guide, we will explore best practices for selecting parameters, compare different methods, highlight pitfalls, and provide actionable insights. Whether you are a beginner testing your first strategy or a professional quant, this article will give you the depth, clarity, and techniques needed to enhance your backtesting process.

Why Parameter Selection Matters in Backtesting

Avoiding Curve-Fitting

Curve-fitting occurs when parameters are chosen to fit historical data perfectly but fail in live markets. Carefully selecting parameters reduces this risk.

Improving Strategy Robustness

Robust parameters perform consistently across various market conditions, not just the specific dataset used for testing.

Balancing Flexibility and Simplicity

Too few parameters may oversimplify your model, while too many create unnecessary complexity. The right balance improves both interpretability and performance.

Core Principles of Selecting Parameters

1. Start with Economic or Trading Logic

Parameters should have a sound basis. For example, a 200-day moving average is widely used because it reflects long-term investor sentiment, not because it fits past price data.

2. Use a Narrow and Realistic Parameter Range

Avoid testing extreme values that would not be practical in live trading. For instance, a moving average of 1 or 2 days may technically work but is unrealistic.

3. Consider Market Regimes

Markets behave differently in bull and bear phases. Select parameters that adapt across multiple environments.

4. Test Incrementally

Rather than optimizing all parameters at once, test one at a time to understand its impact.

Methods for Selecting Parameters

Grid Search

Grid search systematically tests parameter combinations across defined ranges.

Pros

- Exhaustive and thorough.

- Easy to implement.

Cons

- Computationally expensive.

- Risk of overfitting with too many combinations.

Random Search

Instead of testing every combination, random search evaluates a sample of parameter sets.

Pros

- More efficient than grid search.

- Can still yield strong results with fewer trials.

Cons

- Might miss the true optimal parameters.

- Requires more runs for higher accuracy.

Walk-Forward Optimization

Parameters are optimized over a rolling historical window and then tested on out-of-sample data.

Pros

- Mimics real trading conditions.

- Helps avoid overfitting.

Cons

- More complex to implement.

- Computationally heavy.

Bayesian Optimization

Uses probability models to find optimal parameters efficiently.

Pros

- Intelligent and efficient.

- Reduces unnecessary parameter testing.

Cons

- Requires advanced tools and expertise.

- More complex than traditional methods.

Comparing Parameter Selection Strategies

| Method | Efficiency | Overfitting Risk | Best Use Case |

|---|---|---|---|

| Grid Search | Low | Medium | Beginners testing small ranges |

| Random Search | Medium | Medium | Quick experimentation |

| Walk-Forward | High | Low | Professional quant strategies |

| Bayesian Optimization | Very High | Low | Advanced institutional backtests |

Practical Example: Moving Average Crossover Strategy

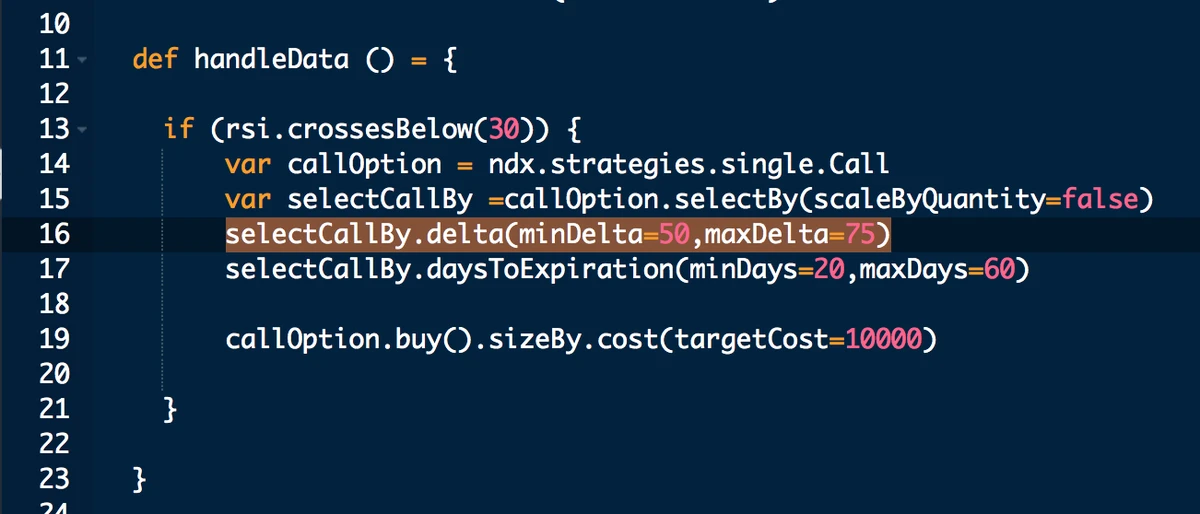

Parameter optimization process for moving average strategies

- Parameters: Short-term MA (5–50), Long-term MA (100–300).

- Approach: Grid search tested 1,000 combinations.

- Result: Best in-sample results showed a 5⁄200 crossover.

- Adjustment: Out-of-sample walk-forward confirmed robustness of 10⁄220 crossover.

Common Mistakes in Parameter Selection

Over-Optimization

Choosing parameters only because they maximize historical returns usually fails in live trading.

Ignoring Transaction Costs

A strategy may look profitable in backtests but fail after accounting for slippage and commissions.

Small Sample Bias

Testing parameters on short or unrepresentative data may yield misleading results.

Lack of Robustness Testing

Failing to test parameters across multiple instruments or timeframes increases fragility.

Advanced Considerations

Stress Testing Parameters

Simulate extreme market conditions (e.g., 2008 crisis) to test robustness.

Sensitivity Analysis

Examine how small changes in parameters affect performance. A robust system performs well across a wide parameter range.

Cross-Market Validation

If a strategy works only on one asset, it may be curve-fitted. Testing parameters on related markets ensures generalizability.

Real-World Experience: My Approach to Parameter Selection

From my years working with algorithmic trading systems, I learned that parameter selection should be guided by logic first, optimized second. For example, when designing a momentum strategy, I start with parameters tied to typical investor behavior (e.g., 14-day RSI, 20-day breakout). Then I refine using walk-forward optimization while ensuring performance holds across multiple markets.

This two-step approach—logic + validation—has consistently delivered more robust strategies compared to brute-force optimization.

Related Topics to Explore

For readers looking to expand their knowledge, check out:

- How to backtest a strategy effectively – to ensure your backtesting process avoids common pitfalls.

- Why backtesting is crucial in quantitative trading – to understand its role in strategy development and validation.

FAQ: Parameter Selection in Backtesting

1. How many parameters should I optimize at once?

Ideally, limit to 2–3 key parameters. Optimizing too many increases overfitting risk and makes results less interpretable.

2. Should I always use walk-forward optimization?

For professional and institutional-level strategies, yes. For beginners, starting with grid or random search is fine, but walk-forward provides stronger validation.

3. How can I know if my parameters are curve-fitted?

If small parameter changes drastically reduce performance, your model is likely overfitted. Robust strategies show stability across ranges.

Conclusion: Best Practices for Selecting Backtest Parameters

Selecting parameters for a backtest is both an art and a science. The process should:

- Begin with logical, economically sound parameters.

- Use optimization methods like grid search, random search, or Bayesian optimization.

- Validate with walk-forward testing and sensitivity analysis.

- Always account for transaction costs and market regimes.

By applying these practices, traders can avoid the trap of curve-fitting and design strategies that stand the test of time.

Final Thoughts

Learning how to select parameters for a backtest is critical for building reliable, profitable strategies. It’s not about finding the “perfect” parameter set but about discovering robust ones that work across different conditions.

👉 Did you find these insights useful? Share this article with fellow traders, leave your experiences in the comments, and let’s discuss how parameter selection has shaped your backtesting success!

Would you like me to also create a parameter selection checklist (PDF download) that traders can use as a step-by-step guide during backtests?

0 Comments

Leave a Comment