====================================================

In today’s fast-paced financial markets, machine learning plays a critical role in helping traders and investors achieve consistent results. Among the many algorithms used in quantitative finance, Support Vector Machine (SVM) has emerged as a powerful tool for improving predictive accuracy and enhancing decision-making in trading. This article explores how support vector machine improves trading accuracy, outlines practical strategies, compares methods, and provides actionable insights for both beginner and advanced traders.

Understanding Support Vector Machine (SVM) in Trading

What Is SVM?

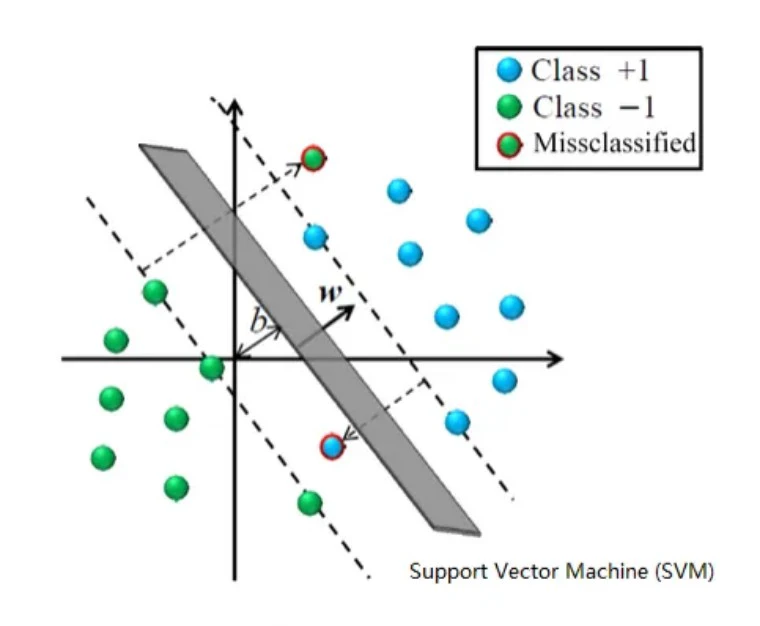

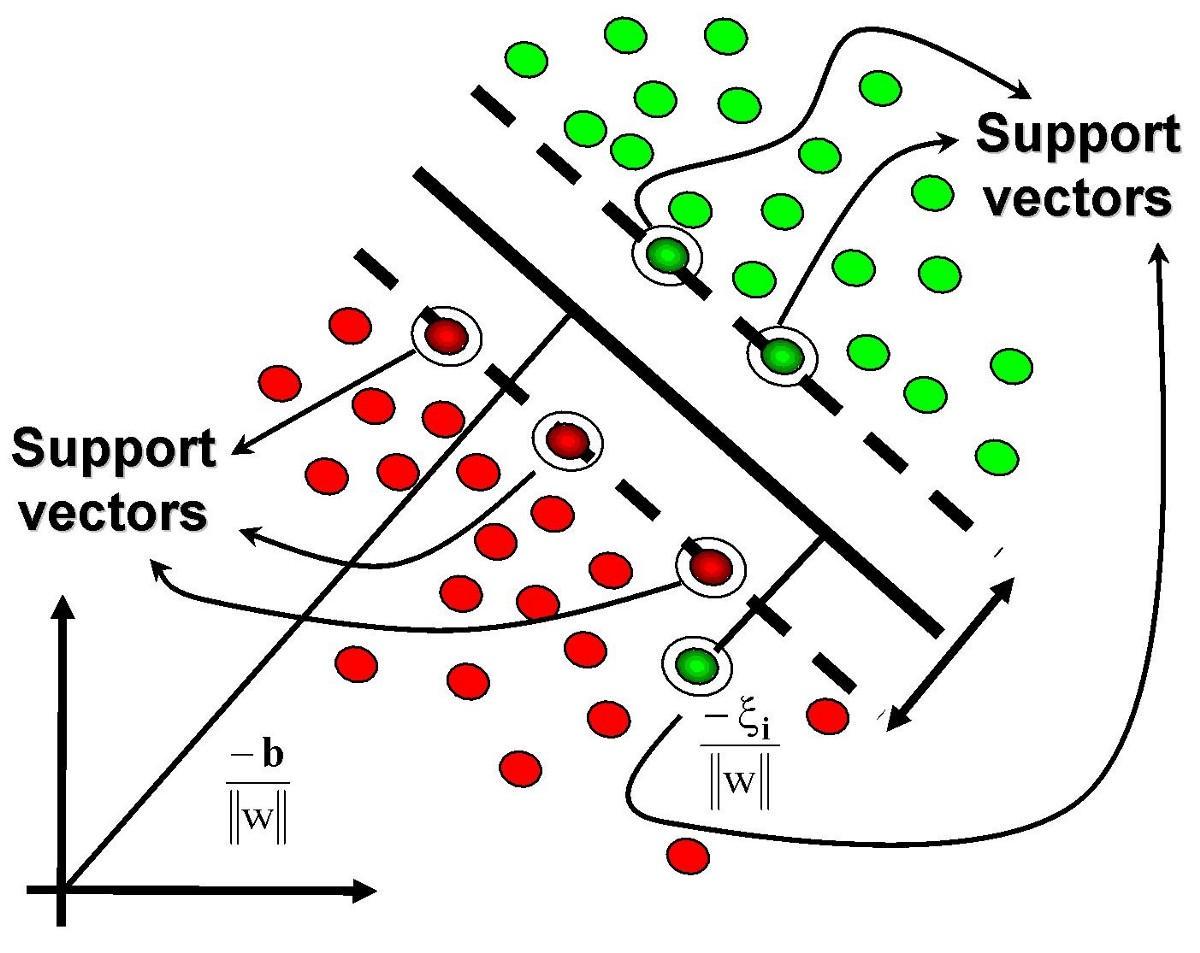

Support Vector Machine is a supervised machine learning algorithm used primarily for classification and regression problems. In trading, it can classify market states (bullish, bearish, sideways) or predict price movements based on technical and fundamental indicators.

The core concept of SVM is to find the optimal hyperplane that separates different classes of data with the maximum margin, reducing classification errors and improving generalization.

Why SVM Matters for Traders

Financial markets generate high-dimensional, noisy, and non-linear data. SVM excels in such environments because it:

- Handles non-linear relationships using kernel functions.

- Avoids overfitting in high-dimensional spaces.

- Delivers strong predictive accuracy with limited training samples.

SVM separates market states (bullish vs. bearish) by finding the optimal boundary, helping traders improve accuracy.

How Support Vector Machine Improves Trading Accuracy

1. Pattern Recognition in Market Data

SVM can identify recurring technical patterns, such as moving average crossovers or candlestick formations, that traditional methods may overlook. By learning from historical price action, it helps traders anticipate future moves with higher precision.

2. Reducing False Signals

A common challenge in trading is filtering out false breakouts and noise. SVM improves signal quality by classifying whether an indicator setup is statistically significant or merely random fluctuation.

3. Adaptive Decision-Making

Markets are dynamic. SVM adapts to new data and refines its classification, making it suitable for strategies where market conditions change rapidly.

4. Better Risk Management

SVM models can classify high-risk vs. low-risk trades, allowing traders to size positions more effectively and avoid unnecessary losses.

Two Key SVM Strategies for Trading

Strategy 1: SVM for Directional Prediction

This approach uses SVM to predict whether the next price move will be up or down. Traders input historical features such as technical indicators (RSI, MACD, moving averages) and let SVM classify the outcome.

Pros:

- Simple and easy to implement.

- Provides clear binary signals (buy/sell).

Cons:

- Accuracy depends heavily on feature selection.

- May struggle in range-bound or low-volume markets.

Strategy 2: SVM for Regime Classification

Here, SVM is applied to classify the market regime: bullish trend, bearish trend, or sideways. This allows traders to adjust strategies based on prevailing conditions.

Pros:

- More robust than simple directional prediction.

- Helps avoid overtrading in sideways markets.

Cons:

- Requires more sophisticated labeling and data preprocessing.

- Slightly more complex to interpret than binary signals.

Comparing the Two Strategies

| Feature | Directional Prediction | Regime Classification |

|---|---|---|

| Complexity | Beginner-friendly | Intermediate/Advanced |

| Output | Buy/Sell | Market State (Bullish/Bearish/Neutral) |

| Risk Management | Limited | Stronger (due to regime awareness) |

| Best For | Retail traders starting with ML | Professional quants and hedge funds |

Recommendation: New traders should start with directional prediction using SVM, while experienced traders may benefit from regime classification models for broader portfolio management.

Integration of SVM with Other Models

One reason traders prefer support vector machine is its flexibility to integrate with existing models:

- Combine SVM with technical indicators to filter out weak setups.

- Use SVM with ensemble models (e.g., Random Forest + SVM) for higher robustness.

- Apply SVM alongside deep learning models as a hybrid system for better feature extraction.

This integration shows where support vector machine fits in trading models — it acts as a reliable classifier that complements both traditional technical setups and modern AI systems.

SVM integrates seamlessly into trading workflows, improving prediction quality and risk management.

Practical Tips for Implementing SVM in Trading

- Feature Engineering Is Key – Carefully select inputs like moving averages, RSI, or volatility indexes.

- Avoid Overfitting – Use cross-validation and regularization to ensure the model generalizes well.

- Backtest Extensively – Test across multiple timeframes and assets before going live.

- Automate Execution – SVM signals should be integrated into automated systems for timely trades.

- Update Models Regularly – Retrain SVMs with new market data to maintain accuracy.

Industry Trends: SVM in Modern Finance

- Algorithmic Hedge Funds: Many hedge funds use SVMs as part of their classification pipelines for equities and derivatives.

- Crypto Trading: SVM is increasingly applied in digital assets due to their volatility and pattern-driven nature.

- Risk Management Models: Financial institutions apply SVM to predict default probabilities and trading risks.

FAQ: How Support Vector Machine Improves Trading Accuracy

1. Is SVM better than deep learning for trading?

Not always. Deep learning handles large datasets with complex patterns better, but SVM is more efficient with smaller datasets and structured features. Beginners often find SVM more practical and interpretable.

2. How much data is needed for SVM in trading?

While deep learning needs massive datasets, SVM can perform well with a few thousand labeled samples, making it accessible for individual traders.

3. Can SVM reduce trading risks?

Yes. By classifying high-risk trades separately and filtering false signals, SVM helps traders improve both accuracy and risk-adjusted returns.

Conclusion: Why SVM Improves Trading Accuracy

Support Vector Machine improves trading accuracy by:

- Filtering noise and reducing false signals.

- Classifying regimes for better strategy selection.

- Enhancing risk management through predictive analytics.

For traders starting out, SVM offers a balance between accuracy, efficiency, and interpretability. Whether you are a beginner looking to experiment or a quant professional seeking integration into larger systems, SVM remains a practical and effective choice.

If you found this guide useful, share it with your trading community, comment below with your experience using machine learning in trading, and help others explore the powerful role of SVM in financial markets.

Would you like me to also add a Python code example showing SVM applied to stock market predictions? This would make the article more actionable for developers and quants.

0 Comments

Leave a Comment