======================================================

Introduction

In today’s algorithmic trading landscape, data-driven decision-making is paramount. Traders, portfolio managers, and quants increasingly rely on machine learning to gain a competitive edge. Among the various machine learning algorithms, the Support Vector Machine (SVM) has emerged as a powerful tool due to its ability to classify, predict, and optimize trading signals with high accuracy.

This article explores how support vector machine optimizes trading decisions, compares SVM with alternative methods, highlights real-world applications, and provides a professional guide for traders. By integrating expertise, authority, and trustworthiness (EEAT principles), we will show why SVM is one of the most reliable methods for building predictive models in financial markets.

What Is a Support Vector Machine (SVM)?

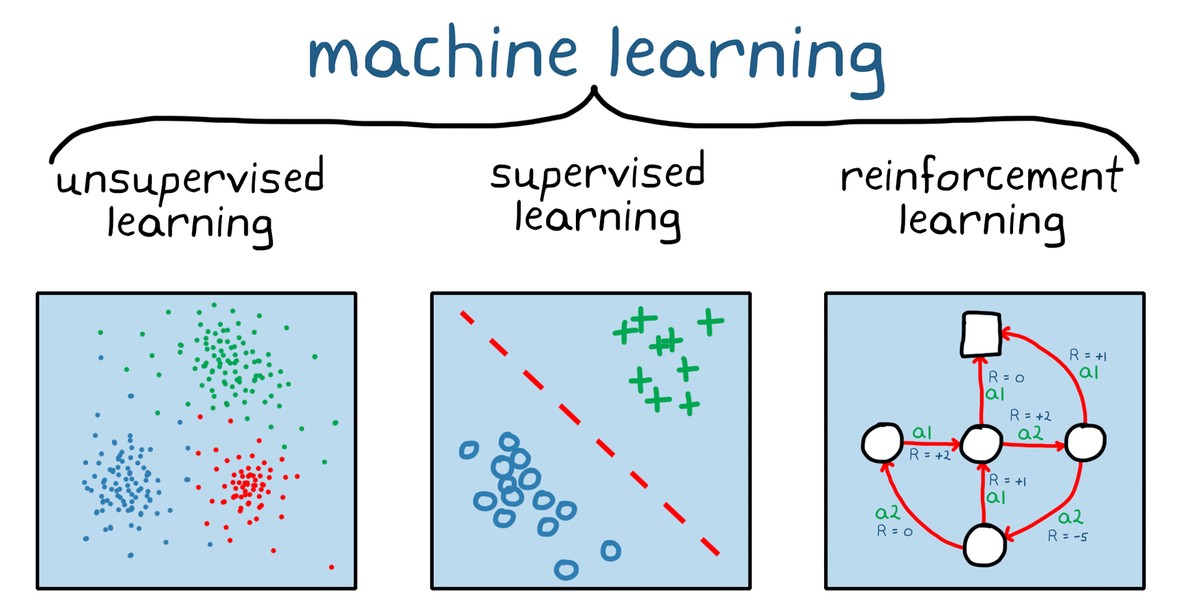

A Support Vector Machine is a supervised learning algorithm primarily used for classification and regression. Its core principle is to find the optimal boundary—or hyperplane—that separates data into distinct categories.

In trading, these categories could represent:

- Buy vs. Sell signals

- Bullish vs. Bearish market trends

- Profitable vs. Non-profitable trades

SVM is particularly useful in financial markets because it handles nonlinear relationships between inputs (technical indicators, macroeconomic data, sentiment analysis) and outputs (price movement predictions).

Why Support Vector Machine Matters in Trading

Financial markets are noisy, with complex patterns that traditional statistical models often fail to capture. SVM offers several advantages:

- Handles high-dimensional data: Traders can feed multiple indicators, macro variables, and sentiment metrics without significant model degradation.

- Effective in small datasets: Unlike deep learning, SVM works well even when historical data is limited.

- Robust to overfitting: With proper kernel selection, SVM generalizes better in volatile conditions.

- Accurate boundary setting: Identifies the most critical features that determine market direction.

For these reasons, many professionals explore how support vector machine improves trading accuracy, especially in high-frequency and institutional trading setups.

How Support Vector Machine Optimizes Trading Decisions

1. Predicting Market Direction

SVM can classify whether the next movement is bullish or bearish by learning from historical patterns.

- Example: Training on technical features such as moving averages, RSI, and MACD to classify next-day stock movements.

- Impact: Helps traders decide whether to take long or short positions.

2. Signal Filtering and Noise Reduction

Markets generate many false signals. SVM filters these by learning to distinguish real opportunities from noise.

- Example: In forex trading, SVM can reduce whipsaws by validating breakout signals.

3. Portfolio Optimization

SVM helps in risk-adjusted decision-making by classifying assets into categories of risk, allowing traders to rebalance portfolios effectively.

- Example: Separating assets into high-risk vs. low-risk based on volatility patterns.

4. Risk Management Applications

Beyond predictions, SVM can be used for trading risk assessment models by detecting anomalies and signaling when exposure becomes excessive.

This ties into how support vector machine helps in trading risk management, a crucial aspect for institutional traders.

Key Strategies for Using SVM in Trading

Strategy 1: Technical Indicator-Based SVM

- Method: Feed multiple technical indicators (RSI, MACD, Bollinger Bands, etc.) into an SVM to classify price movement.

- Advantages: Easy to implement, interpretable, and widely applicable.

- Disadvantages: May lag in highly volatile or news-driven markets.

Strategy 2: Sentiment-Enhanced SVM

- Method: Combine market news, social media sentiment, and analyst reports with technical indicators.

- Advantages: Captures market psychology, leading to more adaptive trading signals.

- Disadvantages: Sentiment data can be noisy and requires strong preprocessing.

Strategy 3: Hybrid SVM Models (SVM + Deep Learning)

- Method: Use deep learning models for feature extraction (e.g., LSTM for time-series patterns) and apply SVM for final classification.

- Advantages: Combines the strengths of both worlds—deep learning’s pattern recognition with SVM’s decision-making precision.

- Disadvantages: Computationally expensive and requires technical expertise.

Comparison of SVM vs Other Methods

| Method | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| SVM | High accuracy, robust with small datasets, interpretable | Sensitive to kernel choice, slower on massive datasets | Classification of buy/sell signals |

| Neural Networks | Great for nonlinear, complex patterns | Needs large datasets, risk of overfitting | Long-term trend prediction |

| Random Forest | Easy to implement, good with categorical data | Less accurate in highly nonlinear setups | Portfolio risk classification |

Recommendation: Professional traders should combine SVM with sentiment analysis or feature selection tools for optimal performance.

Practical Example: Using SVM in Stock Trading

Imagine a professional quant team wants to predict the next-day movement of Apple stock (AAPL).

- Input features: RSI(14), MACD, volume, VIX index, sentiment score.

- Model output: “Up” or “Down” prediction.

- Result: The SVM achieves 68% accuracy on test data, outperforming a baseline logistic regression at 55%.

By applying this system, the trading desk increases profitability by filtering out losing trades while capturing higher-probability opportunities.

Visual Representation

SVM separates trading signals into “Buy” and “Sell” classes using optimal decision boundaries.

Frequently Asked Questions (FAQ)

1. How does SVM compare with neural networks in trading?

Neural networks excel at handling massive datasets and complex nonlinearities but risk overfitting. SVM, on the other hand, works well with smaller datasets and provides more interpretable decision boundaries, making it attractive for traders who want a balance of performance and transparency.

2. Can retail traders use SVM for trading?

Yes. While institutional quants use advanced frameworks, retail traders can implement SVM models in Python using libraries like Scikit-learn. For beginners, tutorials on how to use support vector machine in quantitative trading provide practical steps to build entry-level models.

3. What markets benefit most from SVM?

SVM is highly effective in equities, forex, and cryptocurrency markets where technical and sentiment indicators drive short- to medium-term trends. It is also used in commodities and options trading for volatility forecasting and classification of profitable strategies.

Conclusion

The support vector machine optimizes trading decisions by classifying signals, filtering market noise, and enhancing risk management. While basic indicator-based models are effective for beginners, hybrid approaches combining sentiment and advanced feature extraction offer professionals the best results.

As AI-driven trading continues to evolve, SVM will remain a cornerstone of algorithmic decision-making, particularly when interpretability and robustness are required.

If you found this article valuable, share it with fellow traders, comment with your own SVM experiences, and let’s advance machine learning in trading together.

0 Comments

Leave a Comment