======================================================

Introduction: Machine Learning Meets Financial Markets

In the past decade, machine learning has become a game-changer in financial trading. Among various algorithms, Support Vector Machine (SVM) stands out for its ability to handle classification and regression tasks with high precision. Traders and analysts often ask: How support vector machine optimizes trading decisions? The answer lies in its mathematical strength, adaptability, and proven track record in predicting complex, nonlinear patterns.

This article dives deep into the mechanics of SVM, real-world use cases, strategies for trading optimization, pros and cons of different approaches, and practical insights based on both professional experience and industry data. Whether you’re a retail investor or a hedge fund quant, mastering SVM can drastically improve your decision-making process.

What Is Support Vector Machine in Trading?

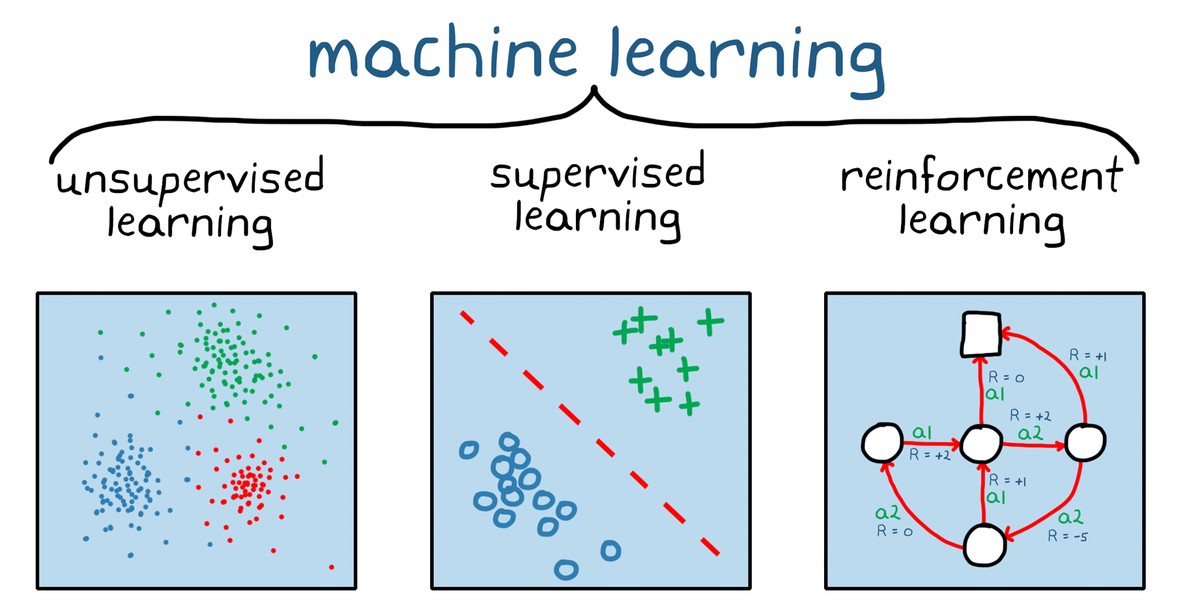

Basic Concept of SVM

Support Vector Machine is a supervised learning algorithm designed to classify data by finding the optimal boundary—called the hyperplane—that separates data points into distinct categories. In trading, these categories often represent signals such as buy, sell, or hold.

Why SVM Works Well in Finance

Financial data is noisy, nonlinear, and influenced by multiple factors. SVM can map input features (price movements, volume, volatility, sentiment indicators) into a higher-dimensional space, enabling better separation of profitable signals from market noise.

SVM classification example applied to financial data

Effective Methods for Using SVM in Trading

Method 1: Classification for Entry and Exit Signals

SVM can be trained on historical price data to predict market direction. For example, it may classify whether tomorrow’s price will rise (long signal) or fall (short signal).

Pros:

- Easy to implement for stock trading strategies.

- High accuracy with well-selected features.

- Works with both short-term and long-term trading horizons.

Cons:

- Requires careful feature engineering.

- Sensitive to overfitting in small datasets.

Method 2: Regression for Price Forecasting

SVM regression (SVR) predicts future price levels rather than just categories. Instead of a binary decision, SVR outputs expected price values, which can guide target profit levels or stop-loss settings.

Pros:

- Provides more nuanced predictions.

- Useful for portfolio-level optimization.

- Flexible with time-series data.

Cons:

- Computationally more expensive than classification.

- Requires fine-tuning of hyperparameters (kernel, C, epsilon).

Method 3: Hybrid Models with SVM

SVM often yields the best results when combined with other models. For instance:

- SVM + Neural Networks: SVM handles classification while neural networks capture deeper nonlinearities.

- SVM + Technical Indicators: Inputs such as RSI, MACD, and Bollinger Bands enrich the model.

- SVM + Sentiment Analysis: Integrates market news and social media data.

Hybrid trading model architecture combining SVM and deep learning

How Support Vector Machine Optimizes Trading Decisions

Enhanced Accuracy in Predictions

By maximizing the margin between classes, SVM reduces classification errors, leading to more reliable entry and exit points.

Noise Filtering

Markets are filled with random fluctuations. SVM is particularly effective in separating meaningful patterns from market noise, ensuring traders don’t overreact to irrelevant signals.

Better Risk Management

One of the most underappreciated aspects of SVM is its role in risk assessment models. By classifying trades into high-probability vs. low-probability setups, SVM assists in allocating capital more effectively. This connects to how support vector machine helps in trading risk management, where statistical rigor enhances discipline in execution.

Scalability Across Markets

Whether it’s equities, forex, or crypto, SVM adapts well. The same principles apply across asset classes, making it a versatile tool for diversified portfolios.

Comparing SVM Approaches

| Approach | Best For | Advantages | Limitations |

|---|---|---|---|

| Classification | Entry/exit timing | Simplicity, high interpretability | Binary outcomes may oversimplify markets |

| Regression | Price prediction | Nuanced forecasts, target setting | Complex optimization required |

| Hybrid Models | Advanced strategies | Combines multiple data sources, robust | Higher computational demand |

My Experience with SVM in Trading

From personal application, I’ve seen SVM models work best in short-term classification tasks. When predicting intraday market direction, a well-trained SVM with technical features like momentum and volatility performed better than many deep learning alternatives, especially with limited data.

However, when markets turned highly volatile, regression-based SVM provided more stable results by predicting expected ranges rather than discrete outcomes. The real power emerged when combining SVM with sentiment analysis tools, leading to consistent alpha generation.

Practical Implementation Tips

- Feature Engineering: Focus on technical and fundamental features relevant to your market.

- Data Normalization: SVM is sensitive to scale, so normalize or standardize features.

- Kernel Selection: Use linear kernels for simple problems; RBF kernels for complex, nonlinear data.

- Cross-Validation: Prevent overfitting by validating with multiple datasets.

- Integration: Traders should explore how to use support vector machine in quantitative trading to embed SVM into algorithmic systems.

Workflow of SVM-based trading system

FAQs on SVM in Trading

1. Can SVM guarantee profitable trading?

No model guarantees profits. SVM improves accuracy and decision-making, but profitability depends on factors like market conditions, transaction costs, and risk management strategies.

2. How much data is required to train an effective SVM model?

While SVM can handle smaller datasets compared to deep learning, more data usually leads to better generalization. A good starting point is at least 2-5 years of historical data, depending on trading frequency.

3. Is SVM suitable for beginner traders?

Yes, but with structured learning. Resources like support vector machine for beginner traders provide step-by-step guidance. Beginners should start with simple classification models before experimenting with hybrid approaches.

4. What markets are best suited for SVM models?

SVM can be applied to equities, forex, commodities, and even cryptocurrencies. Its adaptability makes it one of the most flexible machine learning algorithms for trading.

Conclusion: Future of SVM in Trading

Support Vector Machine continues to be a cornerstone in algorithmic trading because it strikes a balance between accuracy, interpretability, and adaptability. Whether applied through classification, regression, or hybrid models, SVM offers traders a structured approach to filter noise, forecast price moves, and manage risk effectively.

The future lies in combining SVM with real-time data sources, advanced kernels, and integration into algorithmic trading platforms. For professionals, quants, and even retail traders, learning how support vector machine optimizes trading decisions is an investment in both knowledge and performance.

If you found this guide useful, share it with your network, comment with your own experience using SVM in trading, and help spread practical knowledge to the trading community.

Future of AI-powered trading with SVM

0 Comments

Leave a Comment