==============================================

In modern finance, data-driven strategies dominate decision-making. Traders, analysts, and investors increasingly rely on quantitative analysis models to interpret market trends, optimize portfolios, and manage risk. For beginners and professionals alike, the challenge often lies in understanding how these models work and applying them effectively. If you’ve ever wondered how to understand quantitative analysis models, this guide will walk you through the foundations, techniques, and practical strategies—equipping you with both knowledge and actionable insights.

What Are Quantitative Analysis Models?

Defining Quantitative Analysis

Quantitative analysis involves the use of mathematical, statistical, and computational techniques to evaluate financial and economic data. It’s widely used in trading, portfolio management, and risk assessment.

Purpose of Quantitative Models

These models aim to transform raw data into structured insights. By applying formulas and algorithms, analysts can identify patterns, forecast outcomes, and make evidence-based decisions.

Common Applications

- Predicting stock price movements

- Measuring portfolio risk and return

- Backtesting trading strategies

- Optimizing capital allocation

- Conducting financial valuations

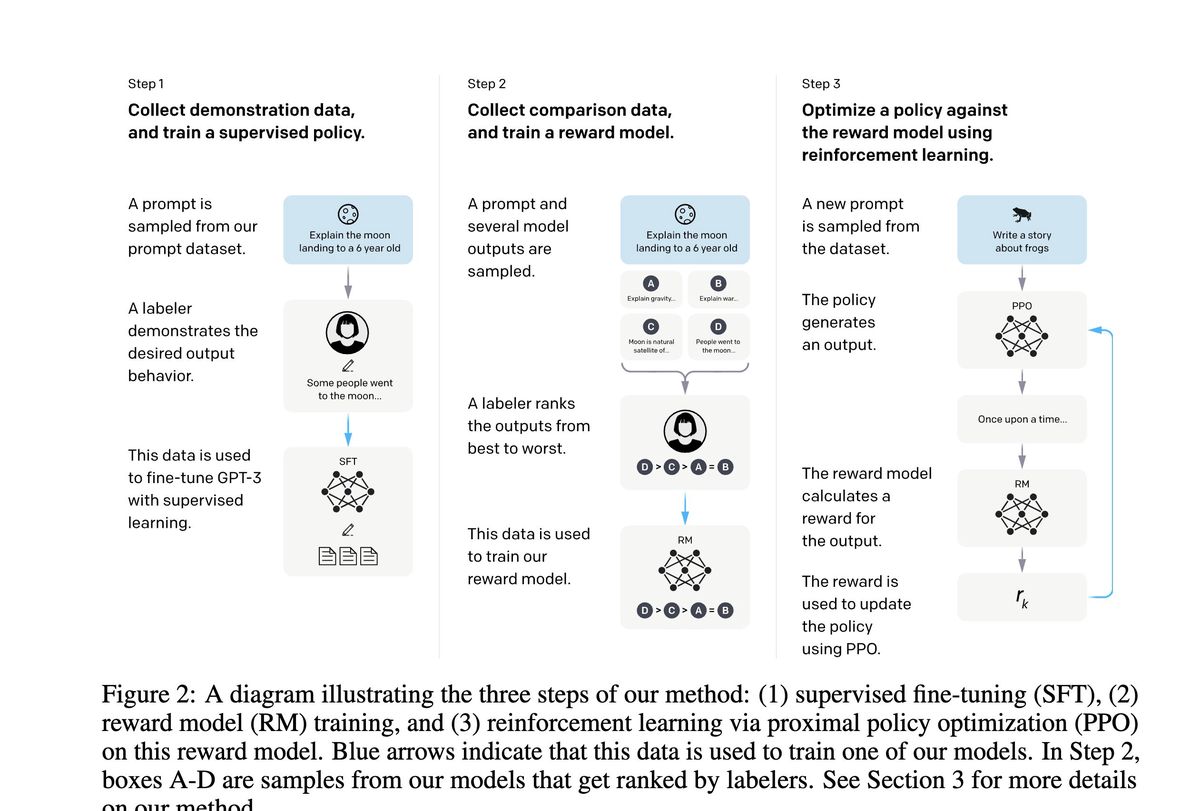

A typical workflow of quantitative analysis models, from data collection to interpretation and decision-making.

Key Components of Quantitative Analysis Models

1. Data Inputs

Every model begins with data—historical prices, volume, interest rates, macroeconomic indicators, or alternative datasets like sentiment analysis.

2. Statistical Framework

Statistical methods such as regression, correlation, and variance analysis form the backbone of most quantitative approaches.

3. Algorithms and Formulas

Models may use equations like Black-Scholes for options pricing or advanced machine learning techniques for predictive analytics.

4. Outputs and Interpretation

Outputs include risk-adjusted returns, forecasts, or probability distributions—results that analysts must carefully interpret for accuracy.

Two Main Strategies to Understand Quantitative Analysis Models

Strategy 1: Theoretical Study Through Structured Learning

Approach: Learn the mathematics, statistics, and finance theory behind quantitative models. This may involve textbooks, academic courses, or where to find quantitative analysis tutorials online.

Pros:

- Builds strong conceptual understanding.

- Enables you to evaluate model assumptions.

- Prepares you for advanced techniques in hedge funds or investment banks.

Cons:

- Time-intensive and often abstract.

- May feel overwhelming for beginners without prior math or finance background.

Strategy 2: Practical, Hands-On Learning with Tools

Approach: Use platforms like Python, R, MATLAB, or Excel to replicate models with real market data. Many courses and tutorials emphasize how to perform quantitative analysis using coding and visualization.

Pros:

- Immediate application of concepts.

- Reinforces theory through practice.

- Helps develop technical skills valued by employers.

Cons:

- Risk of learning tools without grasping underlying principles.

- Possible over-reliance on software output without critical thinking.

Best Recommendation: Combine theory with practice. Start with simplified models (like moving averages or regression analysis) and gradually move toward advanced techniques (such as Monte Carlo simulations or machine learning models).

Hands-on coding in Python or R strengthens understanding of quantitative models through real market data.

Step-by-Step Guide to Understanding Quantitative Models

Step 1: Build a Strong Foundation in Math and Statistics

Focus on probability theory, calculus, and linear algebra. These are essential for understanding formulas like Value at Risk (VaR) or Sharpe Ratio.

Step 2: Learn Core Financial Concepts

Familiarize yourself with portfolio theory, asset pricing, and derivatives. Understanding why quantitative analysis is important in trading will help contextualize models.

Step 3: Experiment with Basic Models

Try simple moving averages, regression-based forecasts, or risk-return calculations. Interpret results manually before relying on software.

Step 4: Explore Advanced Techniques

Dive into factor models, optimization frameworks, and machine learning-driven approaches.

Step 5: Interpret Outputs Critically

Ask: Does the result align with market logic? Are assumptions realistic? This stage requires both technical and financial intuition.

Practical Examples of Quantitative Models

Example 1: Regression Analysis for Stock Prediction

Analysts use regression to test how variables like GDP growth or interest rates influence stock prices.

Example 2: Monte Carlo Simulation for Risk Forecasting

This model runs thousands of scenarios to predict potential portfolio outcomes, offering a distribution of possible results.

Example 3: Black-Scholes Model for Option Pricing

A cornerstone model in derivatives trading, helping investors evaluate fair pricing of calls and puts.

Monte Carlo simulations generate thousands of possible scenarios to forecast portfolio outcomes.

My Personal Journey with Quantitative Models

When I first encountered quantitative models, I struggled with the math-heavy approach. I found myself lost in equations without understanding their practical application. To overcome this, I started experimenting with Python, replicating simple models using free datasets.

This hands-on approach bridged the gap between theory and practice. For example, by building a regression model to predict Bitcoin price volatility, I not only learned how formulas worked but also gained insights into how quantitative analysis helps in investment decision-making.

Common Mistakes to Avoid

- Overfitting Data: Creating models too tailored to historical data, leading to poor real-world performance.

- Ignoring Assumptions: Every model relies on assumptions. Misunderstanding them can lead to false conclusions.

- Overcomplicating Too Early: Beginners should not jump straight into machine learning without understanding simpler models.

- Blind Trust in Software: Always interpret outputs critically; tools assist, but human judgment is vital.

FAQ: How to Understand Quantitative Analysis Models

1. Do I need advanced math to understand quantitative models?

While a strong foundation in math helps, you can start with basic concepts. Over time, you’ll build skills in statistics and calculus as you engage with progressively advanced models.

2. Which tools should I use to practice quantitative analysis?

Beginners can start with Excel for simple models. As you advance, Python and R are excellent choices for flexibility, while MATLAB is widely used in academia and research.

3. How can I interpret quantitative model outputs effectively?

Always compare outputs with market logic and practical examples. For instance, if a risk model shows extremely low volatility during a highly uncertain market period, revisit assumptions—it may not reflect reality.

4. Is quantitative analysis only for professionals?

No. With the rise of online courses and tutorials, even beginners and retail investors can use simplified models for better decision-making.

Final Thoughts

Understanding quantitative analysis models requires patience, consistency, and a balance of theory and practice. For young traders, data scientists, or financial professionals, these models provide powerful insights when applied responsibly.

The best path forward is to combine structured theoretical study with practical experimentation. Start small, test strategies, and progressively advance into complex models.

👉 Have you tried applying a quantitative model in your trading or investment journey? Share your experience in the comments and let’s discuss how theory meets practice!

0 Comments

Leave a Comment