=====================================================

Introduction

Quantitative trading thrives on data. The success of a strategy often depends not only on sophisticated algorithms but also on how well traders can interpret and communicate complex market signals. This is where data visualization in quantitative trading becomes a powerful tool. By transforming raw tick-level data, order flow, and statistical outputs into intuitive visual representations, traders can detect hidden patterns, validate strategies, and communicate insights effectively.

In this article, we will explore how to use data visualization in quantitative trading, compare different approaches, discuss tools and techniques, and provide a roadmap for both beginner and professional traders to harness visualization for better trading outcomes. Along the way, we’ll also address the latest industry practices, provide personal insights, and highlight practical use cases.

Why Data Visualization Matters in Quantitative Trading

Simplifying Complex Market Data

Financial markets generate enormous volumes of data every second. Tick-by-tick transactions, bid-ask spreads, order book depth, and volatility metrics quickly overwhelm even advanced algorithms. Visualization simplifies these datasets into patterns that the human brain can grasp, enabling faster decision-making.

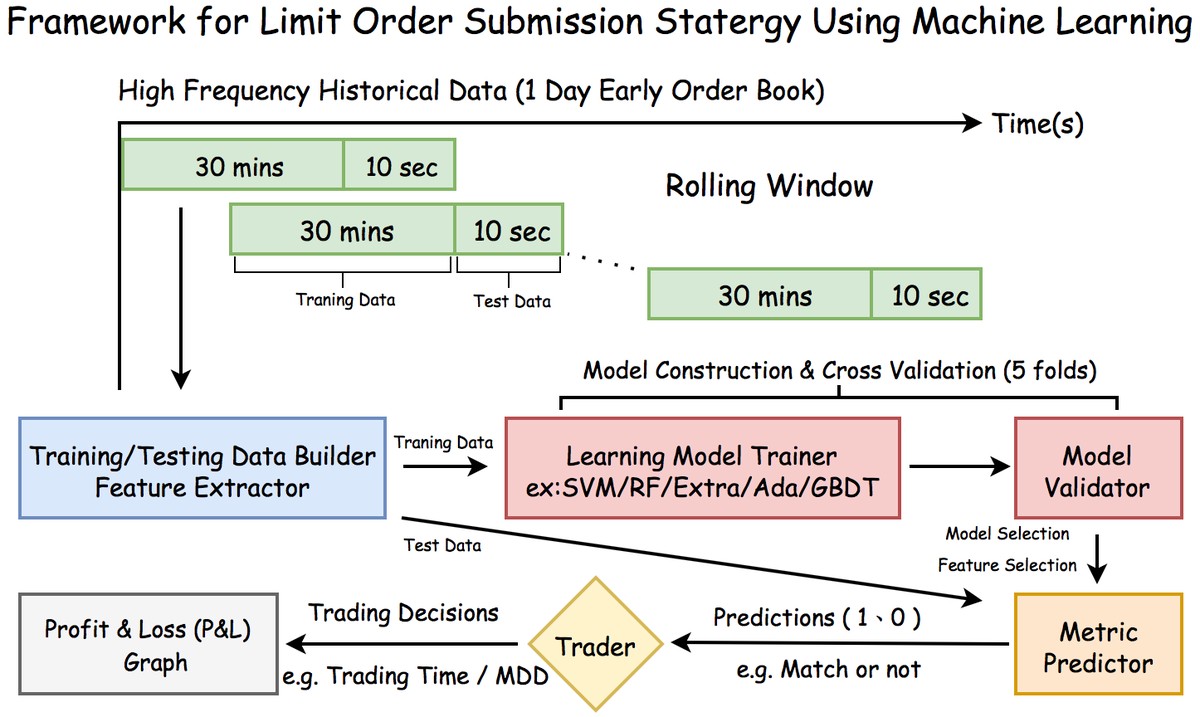

Improving Trading Strategies

Visualization acts as a bridge between statistical models and real-world trading. By plotting backtesting results, Sharpe ratios, drawdowns, and volatility clustering, traders can quickly identify whether a strategy is robust or vulnerable to specific market conditions.

Enhancing Risk Management

Effective visualization tools highlight tail risks, stress test outcomes, and liquidity traps in ways raw spreadsheets cannot. This helps traders adjust position sizing, hedge exposure, and manage downside risks more effectively.

Core Approaches to Data Visualization in Quantitative Trading

1. Time-Series and Market Structure Visualizations

Time-series plots are the foundation of quantitative trading analysis. From simple candlestick charts to advanced heatmaps of order book depth, these visualizations reveal price trends, volume spikes, and liquidity distribution.

- Pros: Easy to understand, widely supported by most trading platforms, quick to implement.

- Cons: Limited for multi-dimensional data; may oversimplify relationships.

Example use case: Overlaying volatility bands on BTC/ETH price series to detect market stress.

2. Multi-Dimensional Visualization (Heatmaps, Scatter Plots, Network Graphs)

Quant trading often involves multiple factors: momentum, volatility, correlation, sentiment, and order flow. Multi-dimensional visualization such as scatter matrices, PCA plots, and correlation heatmaps allows traders to see interactions between different indicators.

- Pros: Ideal for uncovering hidden relationships; critical for factor-based strategies.

- Cons: Can be computationally intensive; requires careful interpretation to avoid false correlations.

Example use case: Using a heatmap to track correlation shifts between crypto assets during high volatility events.

3. Interactive Dashboards for Real-Time Monitoring

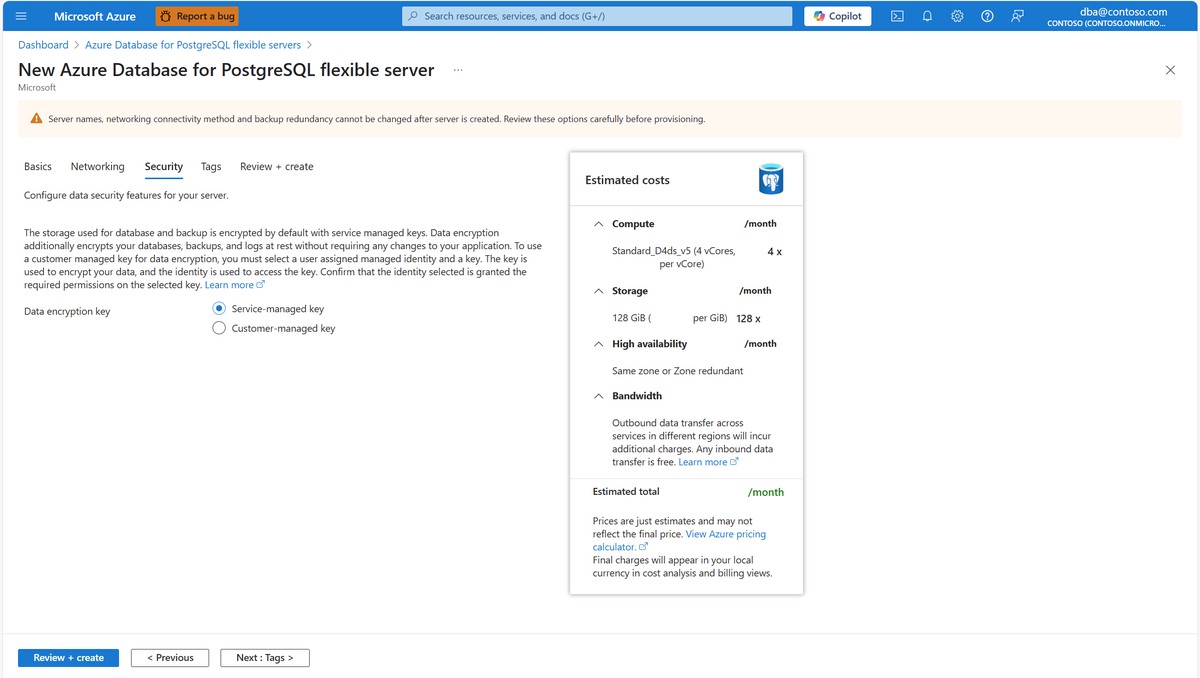

Modern quant firms increasingly use interactive dashboards built with tools like Plotly Dash, Power BI, or Tableau. These allow traders to drill down into live order flow, volatility spikes, and intraday anomalies.

- Pros: Real-time decision support; customizable for different asset classes.

- Cons: High setup cost; requires integration with trading infrastructure.

Example use case: Building a dashboard that monitors liquidity fragmentation across exchanges for arbitrage strategies.

Correlation heatmaps help traders detect regime shifts and market clustering.

How Data Visualization Enhances Quantitative Trading Strategies

Data visualization is not just about aesthetics. It directly improves strategy design, execution, and monitoring.

Identifying Patterns Beyond Code

Algorithms may flag a profitable signal, but visualization helps traders understand the “why.” For instance, plotting cumulative returns alongside drawdowns highlights how a strategy performs under different market conditions.

Facilitating Communication in Trading Teams

In institutional setups, portfolio managers, risk officers, and quants need a shared language. Visualization of backtests, stress tests, and factor exposures makes strategy communication clear and consistent.

Speeding Up Backtesting and Optimization

When paired with interactive visualizations, backtesting becomes more actionable. Traders can spot overfitting by examining how performance changes across different parameters, rather than relying only on metrics.

Comparing Two Strategies for Visualization in Quant Trading

Strategy A: Static Visualization with Python Libraries

- Tools: Matplotlib, Seaborn, Pandas plotting.

- Strengths: Quick to implement, cost-effective, flexible for research.

- Weaknesses: Not real-time; limited interactivity.

- Best for: Individual traders, research teams, and academic testing.

Strategy B: Interactive Visualization with Dashboards

- Tools: Plotly Dash, Tableau, Power BI, custom JavaScript dashboards.

- Strengths: Real-time insights, user-friendly, integrates with execution systems.

- Weaknesses: Requires infrastructure investment, may be overkill for small traders.

- Best for: Hedge funds, professional trading desks, and institutional setups.

Recommendation: Start with Python static visualization for research and gradually scale up to interactive dashboards once strategies are live and capital is at risk.

Interactive dashboards allow real-time monitoring of market flow and strategy performance.

Integration of Data Visualization into Quant Workflows

Workflow Placement

Visualization should be embedded in multiple stages of trading:

- Exploratory data analysis (EDA) – Identifying market inefficiencies.

- Model development – Evaluating factor stability.

- Backtesting – Analyzing trade distributions and slippage.

- Execution monitoring – Tracking live orders and spreads.

- Post-trade analysis – Reviewing performance attribution.

Connection with Other Tools

As highlighted in discussions on [why data visualization is crucial for quantitative analysis], visualization enhances both statistical clarity and trading performance monitoring. Similarly, in practice, knowing [where to find best tools for data visualization in trading] is critical for traders choosing between free open-source libraries and premium enterprise platforms.

Future Trends in Data Visualization for Quantitative Trading

- AI-Driven Visualization – Integrating natural language queries with visual outputs for intuitive research.

- VR/AR Trading Interfaces – Immersive visualization of order books and network flows.

- Scalable Cloud Solutions – Real-time rendering of petabyte-scale tick data.

- Custom Visualization for DeFi – Tracking liquidity across multiple chains in decentralized markets.

FAQ

1. What are the best tools for data visualization in quantitative trading?

For beginners, Python’s Matplotlib and Seaborn are excellent starting points. Professional traders often migrate to Plotly Dash, Tableau, or custom-built JavaScript dashboards for real-time interactive monitoring. The choice depends on budget, infrastructure, and trading goals.

2. How does data visualization improve trading decision-making?

Visualization transforms complex statistical outputs into actionable insights. For example, instead of reading covariance matrices, traders can quickly interpret a heatmap of asset correlations. This speeds up risk assessment and enhances strategy robustness.

3. Can data visualization prevent trading losses?

Visualization itself cannot prevent losses, but it helps spot risks early. By monitoring drawdowns, tail risk exposures, and regime shifts visually, traders can adjust positions before losses escalate. It is a risk-mitigation tool, not a guarantee of profitability.

Conclusion

Learning how to use data visualization in quantitative trading is no longer optional; it is essential for success in today’s complex markets. From time-series plots to interactive dashboards, visualization empowers traders to analyze patterns, manage risks, and communicate insights effectively.

Whether you are a retail quant or an institutional hedge fund manager, the ability to combine data science with visualization provides a decisive edge. Start small with Python-based tools, then evolve toward real-time interactive platforms as your strategies mature.

If you found this article useful, share it with fellow traders, comment with your visualization experiences, and join the discussion to improve how data visualization shapes the future of quantitative trading.

0 Comments

Leave a Comment