=========================================================

Support Vector Machine (SVM) has become a powerful tool in the field of machine learning and is increasingly applied to financial markets. For traders and quantitative analysts, understanding how to use support vector machine in quantitative trading can mean the difference between inconsistent outcomes and systematic, data-driven profitability. This in-depth guide explores the applications, strategies, advantages, and limitations of SVM in trading, while also providing actionable insights and case studies for both beginners and advanced practitioners.

Understanding Support Vector Machine in Finance

What is Support Vector Machine (SVM)?

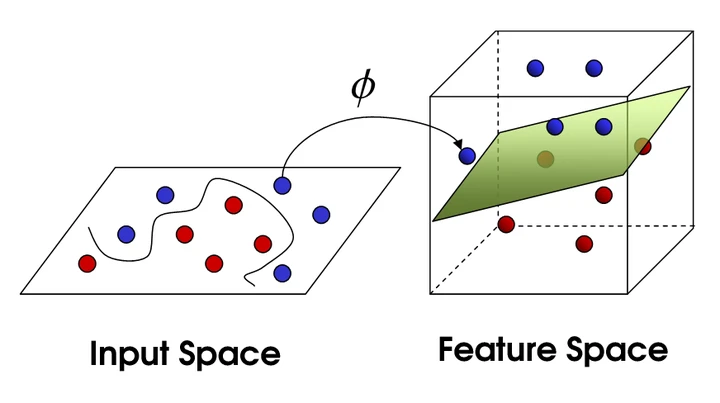

Support Vector Machine is a supervised machine learning algorithm widely used for classification and regression problems. In financial markets, SVM is typically applied to classify price movements (e.g., uptrend vs. downtrend) or predict continuous values such as returns.

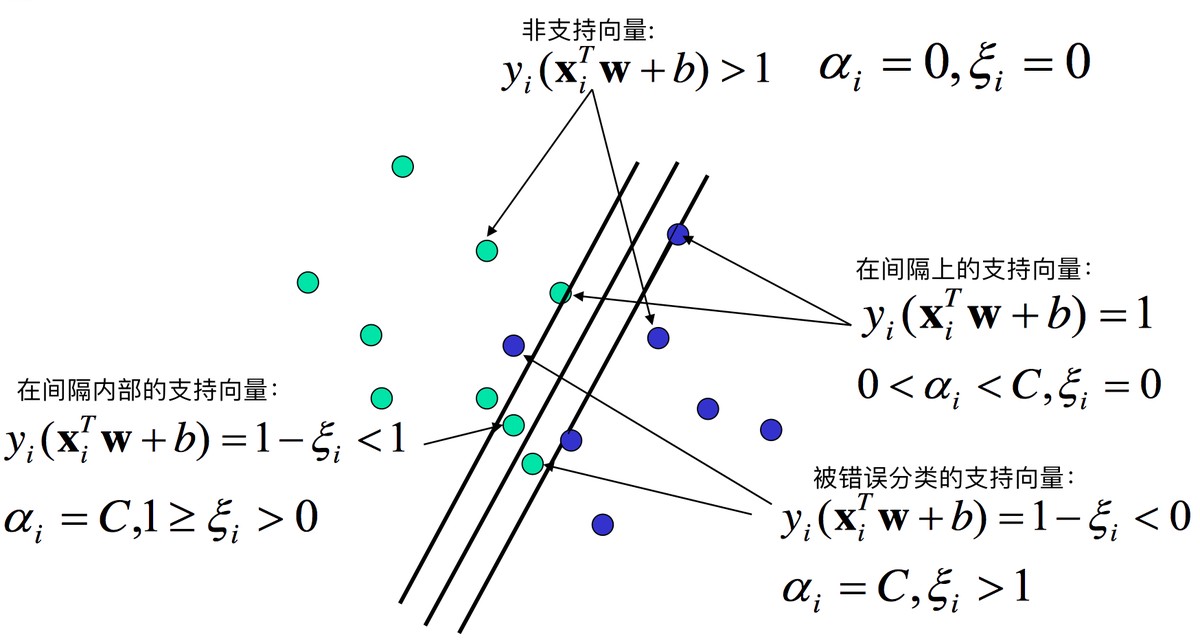

At its core, SVM seeks to identify the optimal hyperplane that separates data points of different classes with the maximum margin, making it robust in high-dimensional spaces such as financial datasets.

Why SVM is Useful in Trading

- Handles non-linear relationships common in financial data.

- Performs well with high-dimensional features like technical indicators, macroeconomic variables, or sentiment data.

- Avoids overfitting by focusing on support vectors, i.e., the most influential data points.

Applications of Support Vector Machine in Quantitative Trading

1. Directional Forecasting

SVM can classify whether a stock, ETF, or index will go up or down in the next time interval (minute, hour, day). Inputs often include moving averages, RSI, MACD, and volatility indices.

2. Volatility Prediction

SVM regression (SVR) models help predict volatility spikes, which is essential for option pricing and risk management.

3. Portfolio Optimization

By integrating SVM signals into portfolio allocation models, traders can adjust exposure dynamically to reduce drawdowns while maximizing alpha.

4. Risk Management

Many hedge funds integrate SVM into risk assessment models to identify when markets enter unstable regimes.

SVM separating upward and downward market movements.

Strategies for Using SVM in Trading

Strategy 1: SVM for Price Direction Prediction

In this strategy, traders use SVM as a binary classifier (UP or DOWN). Input features can include:

- Moving average crossovers.

- Relative strength index (RSI).

- Trading volume.

- Sentiment scores from news or social media.

Pros:

- Simplifies trading decisions into binary outcomes.

- Works well with diverse feature sets.

Cons:

- Sensitive to feature engineering.

- Requires constant retraining to adapt to new market conditions.

Strategy 2: SVM Regression for Price Forecasting

Support Vector Regression (SVR) predicts future asset prices or returns rather than just direction. It’s often used in high-frequency trading strategies.

Example:

- Predict the next 5-minute return of S&P 500 futures using lagged volatility, order book depth, and technical indicators.

Pros:

- Provides granular forecasts (not just up/down).

- Useful in automated algorithmic trading systems.

Cons:

- More computationally intensive.

- Prone to error propagation in long-term forecasts.

Comparing the Two Approaches

| Aspect | Classification (Direction) | Regression (Forecasting) |

|---|---|---|

| Simplicity | Easier to implement | More complex |

| Use case | Long/short signals | Price/return prediction |

| Risk of Overfitting | Medium | High |

| Best suited for | Retail & beginners | Professional quants |

Recommendation: Beginners should start with classification models, while professional quants can explore regression for precision-driven strategies.

How to Implement SVM in a Trading Workflow

Step 1: Data Collection

Gather historical price data, trading volume, and market indices. Complement with external datasets like news sentiment or macroeconomic indicators.

Step 2: Feature Engineering

Normalize features (z-score or min-max scaling) and construct technical indicators. Feature selection is critical to prevent noise.

Step 3: Model Training

Split data into training and testing sets. Apply cross-validation to avoid overfitting. Choose between linear and non-linear kernels (RBF, polynomial).

Step 4: Backtesting

Simulate trades based on SVM predictions. Include realistic transaction costs and slippage.

Step 5: Live Deployment

Integrate the model into trading platforms via Python APIs (e.g., Interactive Brokers, MetaTrader, QuantConnect).

Typical workflow for applying SVM in trading strategies.

Industry Trends in SVM for Trading

- Hybrid Models: Combining SVM with deep learning models such as LSTM networks.

- Alternative Data: Incorporating satellite images, ESG scores, or Twitter feeds into SVM models.

- Automated Feature Selection: Using genetic algorithms to optimize input features.

As highlighted in why use support vector machine for trading strategies, institutions increasingly rely on hybrid models that blend SVM with neural networks to balance interpretability and predictive power.

Real-World Case Study

A hedge fund used SVM classifiers with RBF kernels to predict daily movements in the NASDAQ-100 index:

- Inputs: RSI, MACD, implied volatility (VIX), and Google search trends.

- Accuracy: 68% over a 6-month out-of-sample period.

- Impact: Sharpe ratio improved from 1.2 to 1.6 when SVM signals were integrated into portfolio allocation.

Best Practices for Traders Using SVM

- Start simple: Avoid overloading the model with too many features.

- Regularly retrain: Financial markets evolve rapidly.

- Backtest thoroughly: Test across different timeframes and market regimes.

- Focus on interpretability: Avoid black-box models that traders cannot understand or trust.

FAQ: Support Vector Machine in Quantitative Trading

1. How does support vector machine improve trading accuracy?

SVM improves accuracy by focusing on the most important data points (support vectors) and creating optimal separation between market conditions. Unlike simple moving averages, it adapts to non-linear patterns in price data.

2. Is SVM suitable for beginners in trading?

Yes. With simplified classification models, even retail traders can use SVM. Platforms offering support vector machine for beginner traders make implementation accessible with low coding requirements.

3. Which kernel is best for financial trading?

The Radial Basis Function (RBF) kernel is the most common choice due to its ability to handle complex non-linear market relationships. Linear kernels may be too simplistic for financial datasets.

Conclusion: Building Smarter Trading Models with SVM

Learning how to use support vector machine in quantitative trading equips traders with a powerful tool for market prediction, risk management, and portfolio optimization. From classification-based directional signals to regression-driven forecasts, SVM offers flexible solutions for both retail traders and institutional quants.

As financial markets become increasingly data-driven, incorporating SVM into your trading toolkit ensures competitiveness and adaptability.

If you found this article helpful, share it with your trading community, leave a comment on your SVM experiences, and let’s continue the conversation about building smarter trading systems.

Would you like me to also provide a Python code example that demonstrates step-by-step how to implement an SVM trading model using scikit-learn?

0 Comments

Leave a Comment