=========================================================

Support Vector Machine (SVM) is one of the most powerful machine learning algorithms widely used in finance, particularly in quantitative trading. Traders and quants use SVM to classify market regimes, predict price movements, and optimize risk-adjusted strategies. In this article, we will explore how to use support vector machine in quantitative trading, compare different strategies, and provide actionable guidance for both beginners and professional quants.

Understanding Support Vector Machine in Quantitative Trading

What is Support Vector Machine (SVM)?

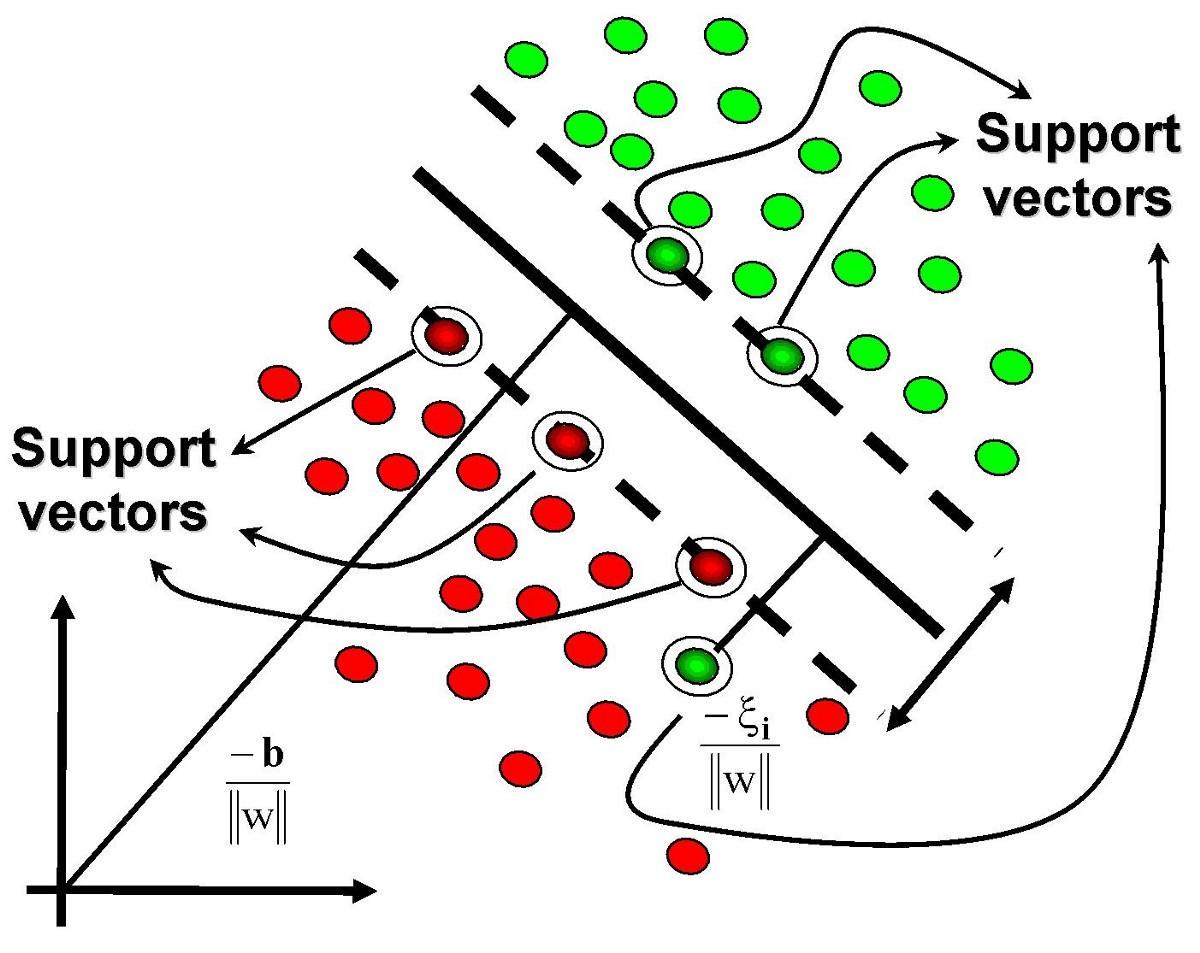

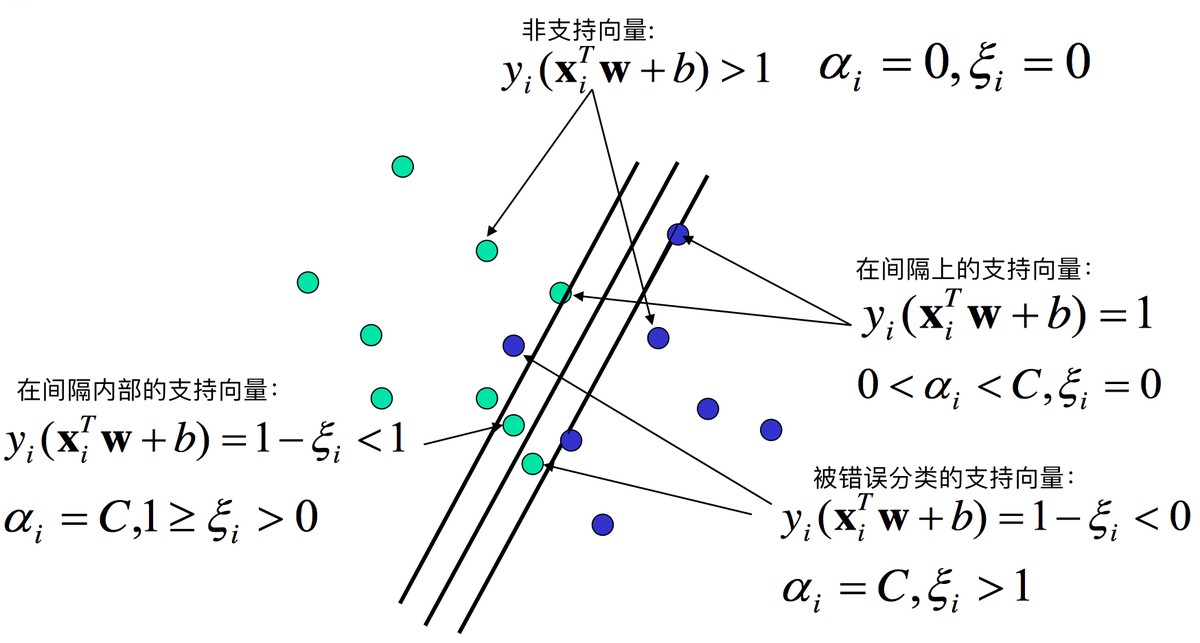

Support Vector Machine is a supervised learning algorithm designed for classification and regression tasks. In finance, it helps distinguish between market conditions (bullish vs. bearish, high-risk vs. low-risk) by finding the hyperplane that best separates data points in a multidimensional space.

Why Use SVM in Trading?

- Robust Classification: Distinguishes between profitable and unprofitable trades.

- Nonlinear Decision Boundaries: Captures complex relationships in noisy financial data.

- Dimensionality Reduction: Works effectively even with a large number of financial indicators.

For traders, SVM provides an advanced tool to improve predictive accuracy compared to linear models. As noted in many research papers, how support vector machine improves trading accuracy lies in its ability to detect subtle, nonlinear market signals.

Steps to Implement SVM in Quantitative Trading

1. Data Collection and Preprocessing

Collect historical data such as stock prices, volume, technical indicators, and macroeconomic variables. Preprocessing includes normalization, outlier removal, and feature engineering (e.g., moving averages, RSI, volatility metrics).

2. Feature Selection

Selecting relevant features is critical. Popular financial features include:

- Momentum indicators (MACD, RSI).

- Volatility measures (ATR, Bollinger Bands).

- Market sentiment data (news sentiment, Twitter feeds).

3. Model Training

SVM models require tuning hyperparameters:

- Kernel: Linear, polynomial, or radial basis function (RBF).

- C (Penalty Parameter): Controls margin flexibility.

- Gamma: Defines how far influence of a single training point reaches.

SVM model separating bullish and bearish data points

4. Backtesting

Backtesting the SVM trading strategy ensures robustness. Metrics include:

- Sharpe ratio

- Maximum drawdown

- Win/loss ratio

- Annualized returns

5. Deployment

After successful validation, the model can be integrated into automated trading systems. This requires risk management protocols to avoid overfitting and catastrophic losses.

Strategies for Using SVM in Quantitative Trading

Strategy 1: Directional Prediction

Traders can use SVM to predict the direction of price movement (up or down) based on historical features.

Advantages:

- Simple to implement.

- Effective for trend-following strategies.

Disadvantages:

- Sensitive to noise in market data.

- May underperform in sideways markets.

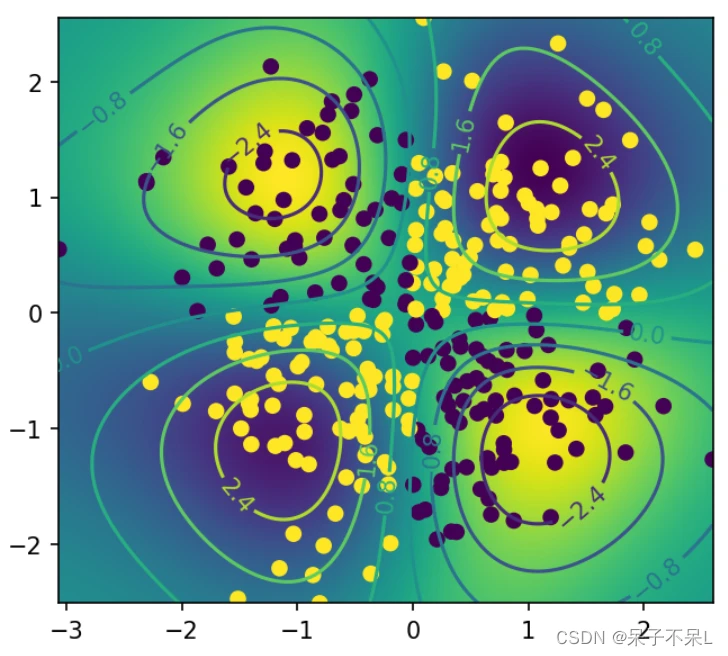

Strategy 2: Volatility and Risk Classification

SVM can classify periods of high volatility versus low volatility. This is valuable for adjusting position sizing or hedging strategies.

Advantages:

- Improves risk-adjusted returns.

- Helps in portfolio optimization.

Disadvantages:

- Requires more complex feature engineering.

- Misclassification risk can lead to incorrect hedging.

Volatility classification model in quantitative trading

Comparing the Two Strategies

- Directional Prediction works best for active day traders and scalpers seeking entry/exit signals.

- Volatility Classification suits portfolio managers and hedge funds who prioritize risk management.

From my professional experience, a hybrid approach that combines both methods often produces the most reliable results. For example, using SVM to detect high-volatility periods and then applying directional SVM predictions only when confidence is high improves performance significantly.

Best Practices and Optimization Techniques

- Use cross-validation to prevent overfitting.

- Combine SVM with ensemble methods (e.g., Random Forest or XGBoost) for robustness.

- Incorporate real-time data feeds for intraday trading.

- Regularly retrain models to adapt to changing market conditions.

For those starting, I recommend looking into where to find support vector machine tutorials for trading as a foundation before deploying capital in live markets.

Real-World Applications of SVM in Trading

- Stock Market Predictions: Predicting short-term movements of indices like S&P 500.

- Forex and Crypto Trading: Detecting currency pair volatility or classifying Bitcoin price regimes.

- Risk Management Models: SVM-based classification for credit risk and systemic risk analysis.

These applications showcase where support vector machine fits in trading models and how it enhances predictive power.

Real-world application of SVM in financial trading

FAQs About Using SVM in Quantitative Trading

1. Is Support Vector Machine better than neural networks for trading?

Not always. SVM is effective for small to medium datasets with complex boundaries. Neural networks outperform SVM in large-scale data with deep feature representation. Many professionals use SVM as a baseline model before exploring deep learning.

2. How much data is needed to train an SVM for trading?

A few thousand data points may be sufficient for simple directional models. For volatility classification, tens of thousands of points with diverse features are recommended. The key is balanced datasets with minimal bias.

3. Can SVM be combined with other trading models?

Yes. Many hedge funds combine SVM with ensemble techniques or deep learning. Hybrid approaches help mitigate weaknesses and improve predictive robustness.

Conclusion

Support Vector Machine is a powerful and versatile tool in quantitative trading. From predicting market direction to classifying volatility regimes, SVM offers traders a way to enhance decision-making, reduce risks, and improve accuracy. While challenges such as data quality and overfitting exist, best practices and hybrid approaches can unlock SVM’s full potential.

If you found this guide useful, share it with your trading community, comment with your experience using SVM, and let’s continue building smarter quantitative trading strategies together.

Machine learning workflow in trading with SVM

0 Comments

Leave a Comment