Solutions for Trading During Consolidation

Consolidation periods in the market often present unique challenges and opportunities for traders. Understanding how to navigate these phases is essential for traders of all experience levels. In

Solutions for Overcoming Bias in Trading

Trading is as much a psychological battle as it is a financial one. One of the most significant challenges traders face is bias , which can distort decision-making and lead to poor trading outcomes.

Solutions for Leveraging Open Interest in Markets

Open interest is a crucial metric in futures and options markets that provides insights into market participation, liquidity, and potential price movements. Understanding and leveraging open interest

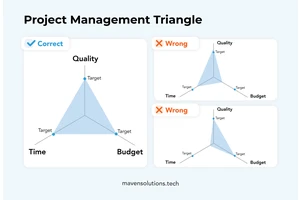

Solutions for Incorporating Triangle Patterns in Trading Strategies

Triangle patterns are a powerful tool used in technical analysis for predicting future price movements. They are widely recognized for their ability to signal potential breakout points, making them

Solutions for Improving Exponential Moving Average Accuracy

The Exponential Moving Average (EMA) is a widely used technical analysis tool in the financial markets that helps traders identify trends and smooth out price fluctuations. While the EMA offers

Solutions for Efficient Market Hypothesis in Trading

The Efficient Market Hypothesis (EMH) remains one of the most widely discussed concepts in financial markets, particularly in quantitative trading and algorithmic strategies. EMH suggests that all

Solutions for Capital Asset Pricing Model Limitations: Improving Accuracy and Applicability

The Capital Asset Pricing Model (CAPM) has long been a cornerstone in financial theory and practice. It provides a simple framework for estimating the expected return on an asset based on its risk

Software for Detecting Market Consolidation: A Comprehensive Guide

Market consolidation is a common occurrence in financial markets where prices move within a certain range, neither trending upwards nor downwards. For traders, recognizing these phases of market

Software for Analyzing Triangle Shapes: Comprehensive Guide for Traders and Analysts

Triangle patterns are among the most significant formations in technical analysis, providing traders with critical insights into potential market movements. For professionals and data analysts,

Software for Analyzing Triangle Shapes: Insights, Tools, and Strategies for Analysts

Analyzing triangle shapes, whether in trading charts, geometric modeling, or algorithmic pattern recognition, has become an essential practice for professionals and quantitative analysts alike.