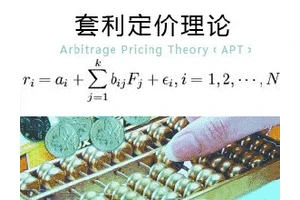

Arbitrage Pricing Theory Calculator: A Comprehensive Guide for Financial Analysts

Arbitrage Pricing Theory (APT) is a cornerstone of modern asset pricing, offering an alternative to the Capital Asset Pricing Model (CAPM). While CAPM focuses on a single factor (market risk) to

Arbitrage Pricing Theory: Application Example and Insights for Investors

Arbitrage Pricing Theory (APT) is a cornerstone concept in finance, providing a comprehensive framework to understand how different factors affect the pricing of financial assets. In this article, we

APT Trading Strategy Guide: Maximizing Returns with Arbitrage Pricing Theory

Introduction The Arbitrage Pricing Theory (APT) is a powerful financial model that offers traders an edge when identifying mispriced assets and predicting asset returns. While it is commonly used by

APT Trading Signals Explanation: How to Utilize APT in Quantitative Trading

In the ever-evolving world of quantitative finance, APT (Arbitrage Pricing Theory) has become a cornerstone for understanding asset returns. One key aspect of APT is its application to trading

APT Trading Plan Example: How to Build a Profitable Strategy with APT

The Arbitrage Pricing Theory (APT) is a fundamental concept in finance that helps traders and portfolio managers understand the relationship between risk factors and asset prices. Unlike the Capital

APT Trading Model Case Study: A Complete Guide for Quantitative Investors

Summary This article explores the APT trading model case study, designed to help investors, portfolio managers, and quantitative researchers understand how the Arbitrage Pricing Theory (APT) can be

APT Techniques for Institutional Investors: A Comprehensive Guide

Summary The Arbitrage Pricing Theory (APT) is a multi-factor asset pricing model that offers institutional investors a flexible framework to evaluate and manage portfolio risk while identifying

APT Strategies for Professional Traders: Complete Guide to Arbitrage Pricing Theory in Quantitative Finance

Summary APT strategies for professional traders are essential in today’s financial markets, especially for quants and portfolio managers who need robust models beyond the limitations of CAPM.

APT Software Tool Comparison: Choosing the Best Tool for Quantitative Trading

Introduction: What is APT and Why Does It Matter? APT, or Arbitrage Pricing Theory, is a popular model used in quantitative trading to explain asset prices based on the concept of arbitrage. This

APT Software for Data Scientists: Revolutionizing Quantitative Analysis and Trading Models

In the world of quantitative trading, APT (Arbitrage Pricing Theory) has emerged as a critical tool for data scientists and financial analysts. By leveraging complex mathematical models and financial