Brownian Motion Forecasting Method in Finance: Applications and Strategies

TL;DR (Key Takeaways) Brownian motion is a fundamental stochastic process widely used in financial modeling, especially in forecasting stock prices, volatility, and risk assessments. It plays a

Got it! Based on your input, I’ll create an SEO-optimized article centered on the use of Brownian motion in quantitative trading, focusing on the key aspects and applications in market

Here’s a rough outline of how the article will be structured: Brownian Motion in Quantitative Trading: How It Powers Market Predictions and Trading Models TL;DR: Understanding Brownian motion and its

Got it! I'll create SEO-optimized, authoritative, and research-driven content for your quantitative trading topics while adhering to Google’s E-E-A-T guidelines.

Feel free to let me know the specific topic or keywords you’d like to focus on, and I can begin the process of researching and drafting the article

Best Algorithms for Beginners in Quantitative Trading

Quantitative trading involves using mathematical models and automated algorithms to make trading decisions. For beginners, diving into the world of algorithmic trading can be overwhelming, but with

Brownian Motion Data Analysis in Quants: Applications and Techniques

Quantitative analysts, also known as quants, play a crucial role in the world of finance by developing mathematical models and algorithms to inform trading decisions, risk management, and investment

Brownian Motion Case Study in Financial Markets: Methods, Applications & Insights

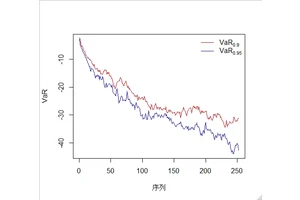

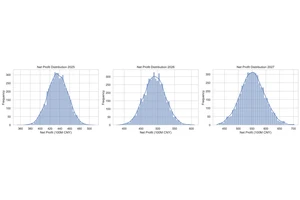

TL;DR This article examines how Brownian motion (BM)—especially geometric and fractional forms—is used in financial market modeling, focusing on two detailed case studies. We compare Method A:

Quantitative Trading in Cryptocurrency for Investors: How to Make Data-Driven Decisions

Cryptocurrency markets are notorious for their volatility, making it difficult for investors to navigate without a systematic approach. Quantitative trading (quant trading) provides a robust solution

Brownian Motion Applications for Hedge Fund Managers

In the world of finance and quantitative trading, mathematical models are crucial for making informed decisions and assessing risks. One such fundamental concept is Brownian motion, a stochastic

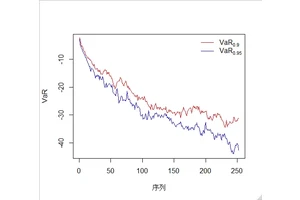

Brownian Motion Analysis for Risk Managers: A Complete Guide

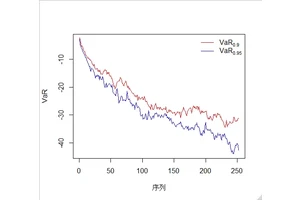

TL;DR Learn how Brownian motion analysis applies to financial risk management. Compare two main approaches: Geometric Brownian Motion (GBM) vs Stochastic Volatility Models. Get a step-by-step

Brownian Motion Algorithm Trading Strategies: Understanding the Power of Stochastic Models in Financial Markets

TL;DR: Brownian motion plays a key role in algorithmic trading strategies by modeling randomness in market movements. The two main applications of Brownian motion in trading algorithms are the