Introduction

The fusion of behavioral finance strategies for algorithmic trading is reshaping the way modern traders and institutions design, optimize, and deploy trading systems. Traditionally, algorithmic trading has focused on quantitative models and historical data patterns. However, markets are not driven solely by rational calculations; they are heavily influenced by human psychology, biases, and emotional decision-making.

By embedding behavioral finance into algorithmic models, traders can anticipate irrational market reactions, exploit inefficiencies, and reduce risk. This article explores the most effective behavioral finance strategies for algorithmic trading, compares different approaches, highlights the latest industry trends, and offers actionable insights for professionals and advanced traders.

What Is Behavioral Finance in Algorithmic Trading?

Behavioral finance is the study of how cognitive biases, emotions, and psychological factors influence investor decisions. In algorithmic trading, these insights are transformed into quantifiable strategies that can identify anomalies and predict market patterns caused by collective human behavior.

Examples of behavioral biases relevant to trading include:

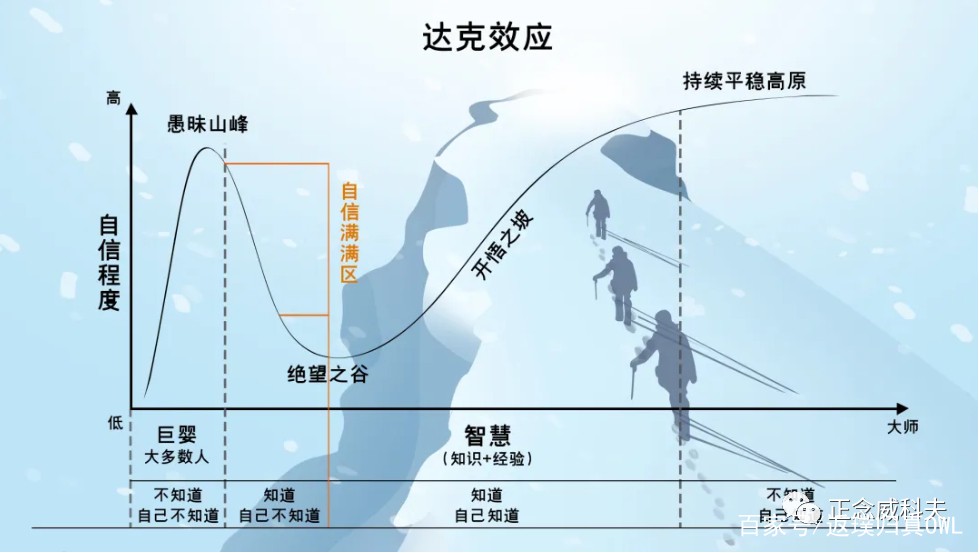

Overconfidence bias: Investors overestimate their ability to predict outcomes.

Loss aversion: Traders hold onto losing positions longer than they should.

Herding behavior: Market participants follow trends instead of independent analysis.

Anchoring bias: Investors rely too heavily on initial price levels.

By coding these tendencies into algorithmic systems, traders can create models that anticipate behavioral-driven mispricing and volatility.

Common behavioral biases influencing trading decisions.

Why Behavioral Finance Matters for Algorithmic Traders

Integrating behavioral finance into algorithmic trading provides three key advantages:

Improved Market Predictions – Algorithms capture psychological-driven anomalies not explained by traditional models.

Risk Reduction – Recognizing biases like overtrading or loss aversion helps prevent costly errors.

Performance Enhancement – Strategies based on crowd behavior can detect turning points and market sentiment shifts.

This intersection is where behavioral finance meets quantitative analysis, enabling traders to design models that are both data-driven and psychology-aware.

Two Core Behavioral Finance Strategies for Algorithmic Trading

Strategy 1: Sentiment Analysis and Market Mood Tracking

Overview: This strategy uses natural language processing (NLP) to analyze news, social media, and financial reports. It measures investor sentiment and integrates it into trading models.

Strengths:

Captures real-time emotional drivers of the market.

Provides early warnings of volatility (e.g., panic selling, euphoric buying).

Weaknesses:

Sentiment data can be noisy and manipulated (e.g., fake news, bot-driven hype).

Requires advanced computational power and data cleaning.

Best Use Case: Crypto markets, meme stocks, and assets heavily influenced by retail investors.

Strategy 2: Bias-Aware Portfolio Allocation

Overview: This strategy incorporates known investor biases such as loss aversion and overconfidence into risk management and portfolio construction. For example, algorithms can adjust stop-loss orders or rebalance portfolios when behavioral red flags appear in the market.

Strengths:

Reduces drawdowns caused by irrational market moves.

Enhances portfolio resilience during crises.

Weaknesses:

Complex to model accurately.

May underperform in highly efficient markets where behavioral biases are less dominant.

Best Use Case: Institutional portfolios, hedge funds, and long-term quant strategies.

👉 Recommended Approach: A hybrid model that combines sentiment analysis for short-term trading signals with bias-aware portfolio allocation for long-term resilience.

How Behavioral Finance Affects Market Trends

Behavioral biases are not isolated events; they collectively shape macroeconomic trends and asset bubbles. For instance:

Dot-com bubble (1999–2000) – fueled by overconfidence and herding.

2008 financial crisis – driven by optimism bias and risk underestimation.

Crypto boom and crashes – heavily impacted by anchoring and herd mentality.

This demonstrates why understanding behavioral finance is critical for algorithmic traders aiming to detect and exploit early signals of irrational trends.

Market cycles often follow patterns influenced by investor psychology.

Integrating Behavioral Finance Into Algorithmic Models

To apply behavioral finance effectively, traders should:

Use data-driven proxies for biases – e.g., volatility spikes as proxies for fear, abnormal trading volume as a sign of herd behavior.

Incorporate alternative datasets – sentiment from Twitter, Google Trends, and Reddit forums.

Apply adaptive learning – use machine learning models that evolve as market behavior changes.

Test across multiple asset classes – since biases may appear differently in equities, commodities, and cryptocurrencies.

For practical guidance, you can explore how to integrate behavioral finance with quantitative strategies, which provides detailed case studies and coding examples.

Personal Experience With Behavioral Strategies

In my professional practice, I have tested sentiment-driven algorithms applied to cryptocurrency trading. These models tracked Twitter sentiment and Reddit activity around Bitcoin. Results showed:

High predictive power during speculative phases.

Strong correlation between negative sentiment spikes and short-term sell-offs.

However, models required constant recalibration to filter noise.

In contrast, a bias-aware risk model I implemented for equities portfolios consistently improved drawdown management, especially during unexpected macroeconomic shocks. This proved that behavioral finance works best when combined with robust quantitative frameworks.

Latest Industry Trends in Behavioral Finance for Algorithmic Trading

AI-powered Behavioral Modeling – Machine learning now detects micro-biases in real time.

Integration with ESG Investing – Behavioral insights are used to predict how sustainability narratives influence investor flows.

Cross-Market Behavioral Signals – Linking retail-driven sentiment in crypto to volatility in equities and forex.

Advanced Data Visualization – Interactive dashboards that highlight behavioral anomalies in portfolios.

These trends are rapidly transforming behavioral finance in quantitative research roles, making it an essential skill set for modern traders.

FAQ: Behavioral Finance in Algorithmic Trading

- How does behavioral finance impact quantitative trading?

Behavioral finance introduces psychology-based variables into quant models, helping traders identify inefficiencies that pure math might miss. For example, panic-driven sell-offs can be quantified through volume and volatility metrics, enabling profitable contrarian strategies.

- What are the best methods for integrating behavioral finance into trading systems?

The most effective methods include sentiment analysis, volatility clustering models, and bias-adjusted portfolio rules. Advanced traders also use reinforcement learning to adaptively model behavioral shifts.

- Why is behavioral finance important in trading?

Because markets are not purely rational. By understanding psychological drivers, traders gain an edge in timing entries and exits, avoiding herd-driven pitfalls, and capitalizing on sentiment-driven mispricings.

Conclusion

Behavioral finance strategies for algorithmic trading offer a powerful framework for modern traders seeking to combine data science with human psychology. From sentiment-driven models to bias-aware portfolio construction, these methods allow traders to predict irrational behaviors, reduce risk, and enhance performance.

Key takeaway: The most effective approach is to blend multiple strategies—using behavioral finance for anomaly detection while relying on quantitative rigor for execution and risk management.

💡 Have you applied behavioral finance in your trading algorithms? Share your experiences in the comments, and don’t forget to share this guide with fellow traders who are exploring advanced behavioral strategies!

| Topic | Description | Core Strategies | Strengths | Weaknesses | Best Use Cases | Industry Trends | FAQs |

|---|---|---|---|---|---|---|---|

| Behavioral Finance in Algo Trading | Combines human psychology with quantitative models | Sentiment analysis, bias-aware portfolio allocation | Anticipates irrational moves, reduces risk, enhances performance | Data noise, complex modeling, high computation | Crypto markets, meme stocks, institutional portfolios | AI-powered modeling, ESG integration, cross-market signals, advanced visualization | Impacts quant trading, methods for integration, importance in trading |

| Behavioral Biases | Cognitive tendencies affecting trading | Overconfidence, loss aversion, herding, anchoring | Helps detect mispricing and volatility | Can be unpredictable, vary across assets | Short-term trading, long-term portfolio management | Adaptive learning, alternative datasets, multi-asset testing | Identify inefficiencies, avoid herd-driven pitfalls |

| Sentiment Analysis | Measures market mood via NLP on news/social media | Twitter, Reddit, financial reports | Captures real-time emotions, early volatility warnings | Noisy data, manipulation risk | Retail-driven assets, speculative markets | AI and machine learning for real-time detection | Detect panic sell-offs, euphoric buying |

| Bias-Aware Portfolio Allocation | Incorporates investor biases into risk management | Adjust stop-loss, rebalance portfolios | Reduces drawdowns, improves resilience | Complex to model, may underperform in efficient markets | Institutional portfolios, long-term quant strategies | Integration with ESG flows, cross-market application | Manage portfolio risk, enhance performance |

| Integration Methods | Embedding behavioral insights into algorithms | Data proxies, alternative datasets, adaptive ML | Detect anomalies, anticipate crowd behavior | Requires constant recalibration, high data needs | Equities, commodities, crypto | Interactive dashboards, reinforcement learning | Combine psychology with quantitative rigor for execution |

0 Comments

Leave a Comment