=========================================

Probability forecasting has emerged as a critical tool for modern trading teams, helping them make data-driven decisions, optimize risk management, and enhance returns. By quantifying the likelihood of market events, traders and analysts can approach markets systematically rather than relying solely on intuition. This comprehensive guide explores probability forecasting for trading teams, including methodologies, strategies, implementation techniques, and real-world applications.

Understanding Probability Forecasting in Trading

Probability forecasting involves predicting the likelihood of specific market outcomes based on historical data, quantitative models, and statistical methods. It allows trading teams to quantify uncertainty and make informed decisions.

Definition and Significance

- Probability Forecasting: Estimating the chance of various trading outcomes using mathematical and statistical models.

- Importance: Helps teams prioritize trades, manage exposure, and assess potential profits against risks.

Integration: Understanding how probability affects trading success is essential for developing strategies that balance return potential with risk.

Psychological and Operational Benefits

- Reduces emotional decision-making by providing measurable probabilities.

- Supports disciplined portfolio management, particularly in volatile markets.

- Facilitates better communication among trading team members regarding risk and confidence levels.

Key Methods of Probability Forecasting

Probability forecasting can be implemented using several methods, each suitable for different trading contexts.

1. Statistical Probability Models

Description

- Uses historical price data and market indicators to estimate future outcomes.

- Examples include binomial models, Poisson processes, and Monte Carlo simulations.

Advantages

- Provides robust estimates for short-term and long-term trades.

- Well-suited for quant-driven trading teams that rely on statistical rigor.

Limitations

- Accuracy depends on historical data quality and relevance.

- May struggle with sudden market regime changes.

2. Machine Learning-Based Probability Forecasting

Description

- Employs machine learning models such as logistic regression, random forests, and neural networks to predict probabilities of market moves.

- Models can incorporate vast datasets, including technical, fundamental, and alternative data.

Advantages

- Can capture complex, non-linear market relationships.

- Adaptive to new data, allowing dynamic probability estimates.

Limitations

- Requires significant computational resources and expertise.

- Risk of overfitting without proper validation.

Comparison of statistical and machine learning approaches for probability forecasting

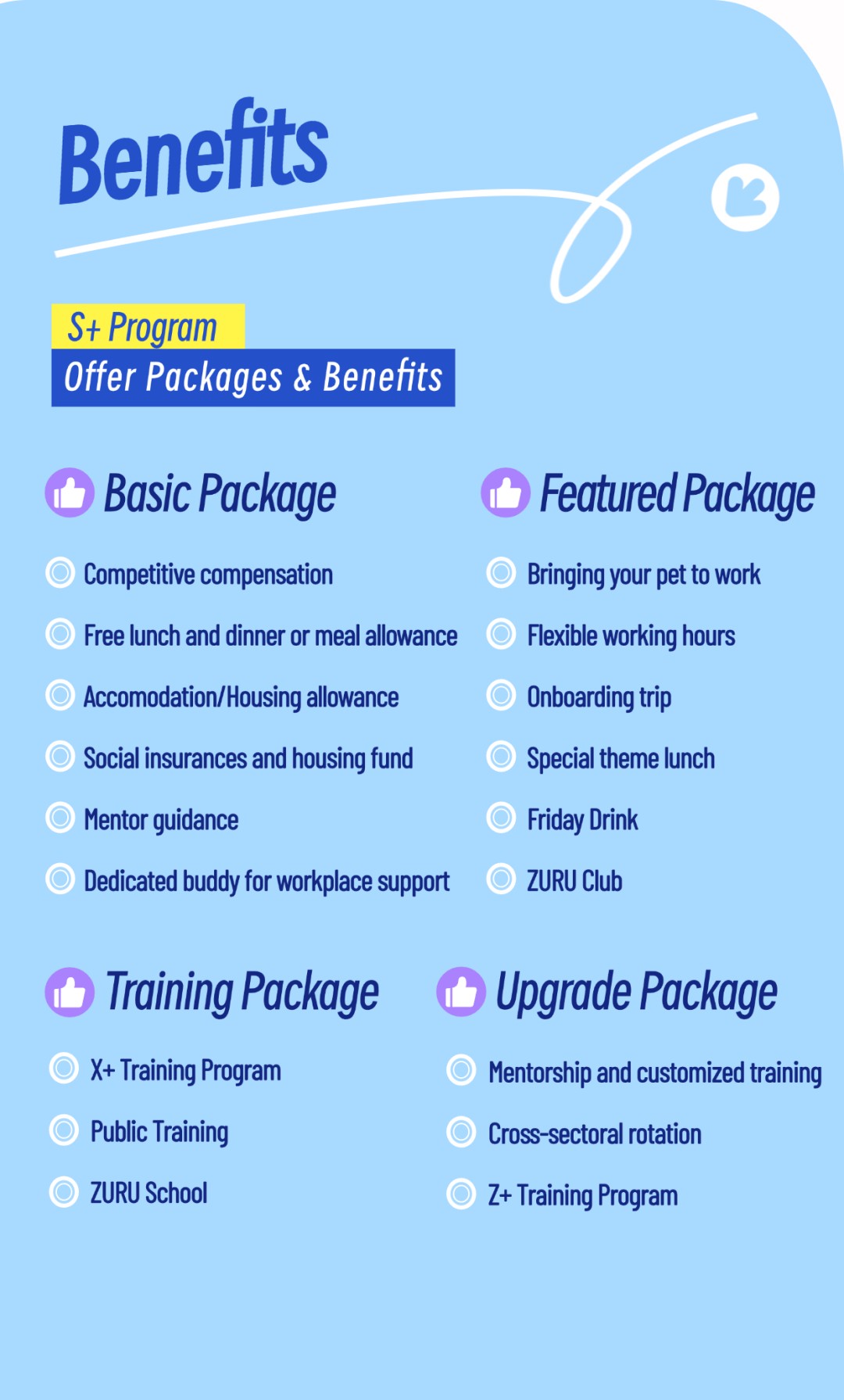

Implementation Strategies for Trading Teams

Effective probability forecasting involves integrating models into daily trading operations while maintaining oversight of risks.

Step 1: Data Collection and Preprocessing

- Gather historical price data, order book data, and relevant market indicators.

- Clean and normalize data to reduce biases in probability estimation.

Step 2: Model Selection and Calibration

- Select appropriate statistical or machine learning models based on trading objectives.

- Calibrate models using in-sample data and validate against out-of-sample periods.

Step 3: Integration into Trading Workflows

- Probability outputs can guide trade sizing, risk limits, and entry/exit decisions.

- Teams can implement dashboards to visualize probabilities in real time for decision-making.

Integration: Learning where to apply probability in trading models ensures forecasts are actionable and aligned with overall trading strategy.

Practical Applications

Trade Selection and Prioritization

- Probability forecasts help prioritize trades with higher expected value.

- Teams can assign confidence levels to each trade and adjust exposure accordingly.

Risk Management

- Probabilities inform stop-loss levels and hedging strategies.

- Enables dynamic adjustment of position sizes based on risk-reward expectations.

Portfolio Optimization

- Integrates with portfolio-level probability models to balance expected returns across multiple assets.

- Supports scenario analysis and stress testing to evaluate portfolio resilience under different market conditions.

Example of probability forecasting influencing portfolio allocation decisions

Advanced Techniques

Monte Carlo Simulations

- Generates thousands of potential market paths based on statistical assumptions.

- Estimates probabilities of profit, loss, and drawdown scenarios.

Bayesian Probability Models

- Updates probability estimates dynamically as new market data becomes available.

- Particularly useful for adaptive trading strategies in volatile markets.

Ensemble Forecasting

- Combines multiple probability models to reduce forecast error.

- Enhances robustness by capturing diverse market patterns.

Common Challenges and Solutions

Overfitting to Historical Data

- Use out-of-sample validation and rolling window approaches to mitigate risk.

- Use out-of-sample validation and rolling window approaches to mitigate risk.

Market Regime Shifts

- Incorporate regime detection and adapt probability models accordingly.

- Incorporate regime detection and adapt probability models accordingly.

Complexity of Machine Learning Models

- Maintain interpretability by using ensemble methods and feature importance analysis.

- Maintain interpretability by using ensemble methods and feature importance analysis.

FAQ

1. How to calculate probability in trading?

Probability in trading can be calculated using historical frequency analysis, statistical distributions, or machine learning models. For example, you might calculate the probability that an asset will increase 2% in a day based on historical patterns or predictive algorithms.

2. Why is probability important in trading?

Probability provides a quantitative measure of uncertainty, allowing trading teams to make more informed decisions, optimize position sizing, and reduce emotional trading errors.

3. How can probability improve trading returns?

By prioritizing trades with higher expected value, dynamically adjusting risk exposure, and integrating probabilities into portfolio optimization, teams can enhance risk-adjusted returns while mitigating losses.

Tools and Resources

- Python Libraries: pandas, NumPy, scikit-learn, PyMC3 for Bayesian forecasting

- Trading Platforms: QuantConnect, AlgoTrader, MetaTrader with probability modules

- Data Sources: Bloomberg, Quandl, and alternative market data APIs

- Guides & Tutorials: Probability applications for quantitative analysis and algorithmic trading

Conclusion

Probability forecasting is a cornerstone of modern trading team strategy, enabling informed, disciplined, and data-driven decision-making. By leveraging statistical models, machine learning, and advanced simulation techniques, trading teams can optimize their strategies, improve risk management, and enhance profitability. Encourage your team to adopt probability-based workflows, share insights, and discuss findings to continually refine forecasting practices.

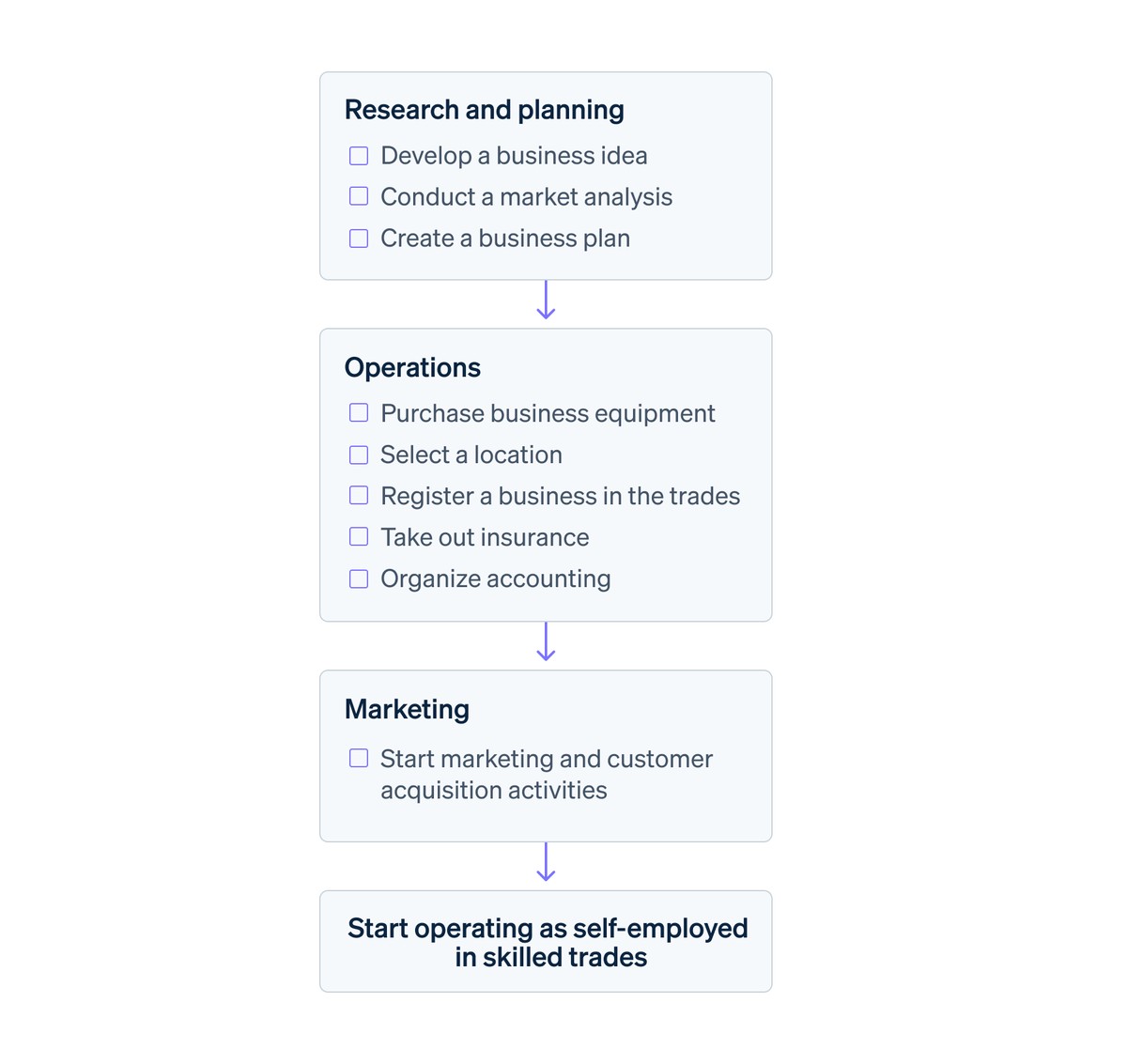

Workflow illustrating the integration of probability forecasting into trading team operations

0 Comments

Leave a Comment