=========================================

Introduction: Why Probability Forecasting Matters in Trading

Probability forecasting for trading teams has become one of the most important capabilities for both institutional desks and advanced quant-driven hedge funds. With markets evolving toward higher levels of complexity, simply relying on deterministic models or gut instincts is no longer sufficient. Teams need a probabilistic framework that incorporates statistical methods, Bayesian reasoning, and real-time data analytics to evaluate uncertainty and enhance decision-making.

By embedding probability forecasting into team strategies, traders can improve risk-adjusted returns, coordinate decisions across different asset classes, and reduce exposure to uncalculated risks. In this article, we will examine multiple forecasting approaches, compare their strengths and weaknesses, explore real-world applications, and provide actionable guidance for building robust forecasting systems.

Probability distribution of trade outcomes

Understanding the Role of Probability in Trading

Defining Probability Forecasting in Finance

In the context of trading, probability forecasting refers to the process of assigning likelihoods to various market outcomes. For instance, rather than saying “the S&P 500 will rise tomorrow,” a probability forecast would estimate that “there is a 65% chance the S&P 500 closes higher tomorrow.” This framing helps trading teams evaluate multiple scenarios and plan strategies accordingly.

Why Teams Benefit More Than Individuals

Individual traders often struggle with cognitive biases such as overconfidence and loss aversion. A team-oriented probabilistic approach forces participants to challenge assumptions, share alternative probability estimates, and converge on a more rational forecast. This collective intelligence can significantly enhance decision quality and trade accuracy.

Internal Link Integration Example

To better understand how probability connects with structured trading methods, teams should study how probability supports quantitative strategies and evaluate probability tools for improving trade accuracy. Both topics provide useful models for incorporating probabilities into structured algorithmic workflows.

Key Probability Forecasting Methods

1. Bayesian Probability Forecasting

Bayesian models update probabilities as new information becomes available. For trading teams, this approach is extremely powerful when dealing with news events, earnings reports, or intraday market shocks.

Pros:

- Dynamically incorporates new data

- Excellent for uncertain and fast-changing environments

- Useful in portfolio rebalancing under uncertain market conditions

Cons:

- Requires careful prior selection

- Computationally intensive when scaled across multiple assets

2. Frequentist Forecasting with Historical Simulations

This method uses historical price and volume data to model probability distributions of returns. Monte Carlo simulations and bootstrapping are commonly employed to forecast risk ranges and expected drawdowns.

Pros:

- Strong statistical foundation

- Relatively straightforward to implement

- Well-suited for long-term probability distributions

Cons:

- Dependent on historical market similarity

- Limited adaptability to sudden structural breaks

3. Machine Learning–Based Probability Models

Modern teams increasingly rely on ML models to generate probability forecasts for trade success. Methods include logistic regression, random forests, and deep learning models predicting the likelihood of directional moves.

Pros:

- Captures nonlinear relationships

- Scales across multiple data dimensions (technical + macro + sentiment)

- Provides high-frequency probability forecasts

Cons:

- Risk of overfitting without careful validation

- Opaque models may reduce interpretability

Team collaboration in probability modeling

Comparing Methods: Which is Best for Trading Teams?

Bayesian vs. Frequentist

- Bayesian models shine in real-time trading with rapidly evolving data but require intensive computation.

- Frequentist models offer stability and interpretability but may lag in adapting to new regimes.

Bayesian vs. Machine Learning

- Machine learning captures complex dynamics and integrates diverse datasets but can act as a “black box.”

- Bayesian frameworks maintain transparency and interpretability, crucial for compliance and risk managers.

Recommended Hybrid Approach

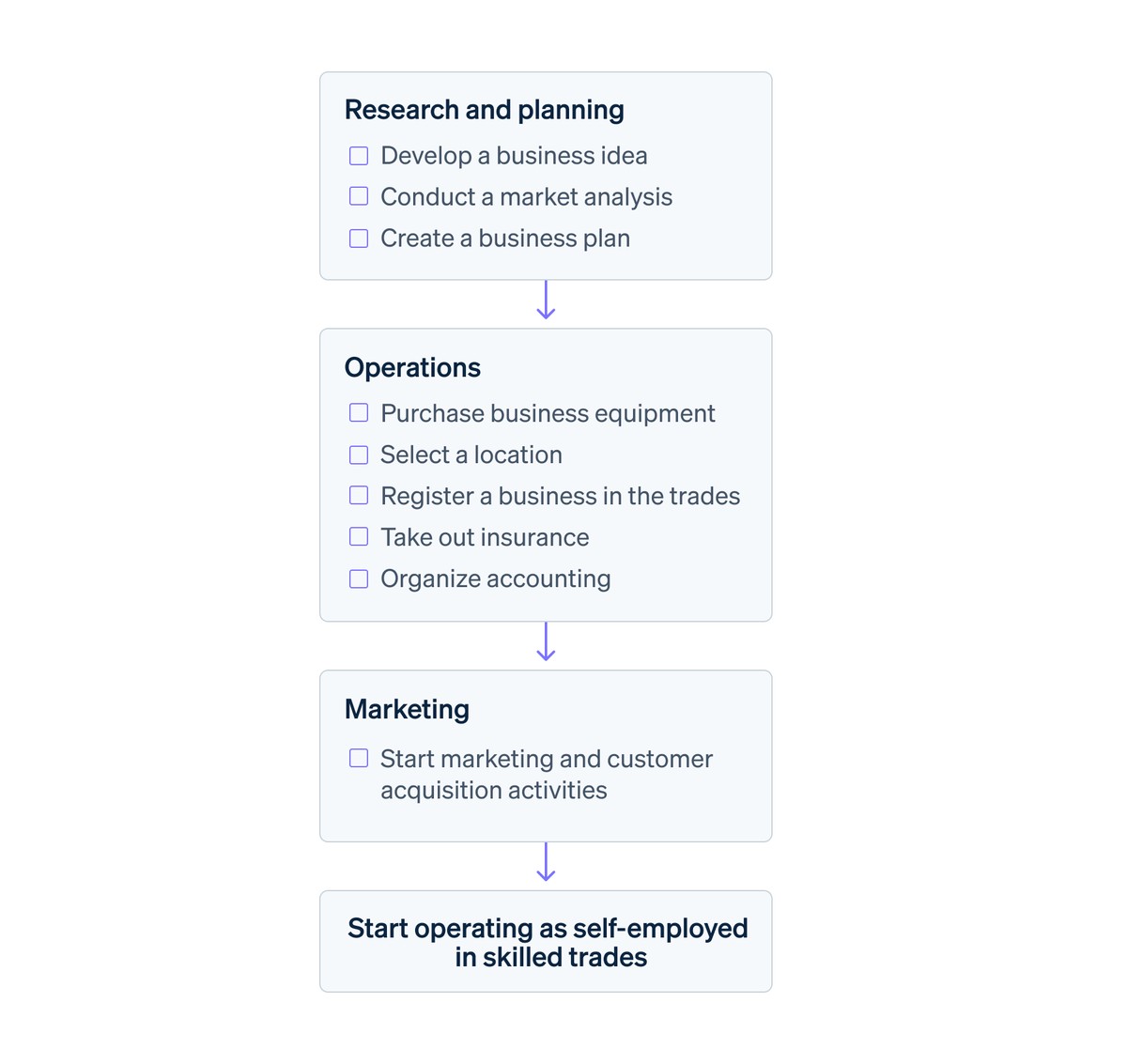

The most effective strategy for trading teams is a hybrid probability forecasting framework:

- Use frequentist simulations to establish baseline probability ranges.

- Apply Bayesian updating for intraday market changes.

- Integrate machine learning models for high-frequency signals and cross-asset forecasts.

Building a Probability Forecasting Framework for Teams

Step 1: Define Forecasting Objectives

Teams must clarify whether they want probability forecasts for:

- Trade entry/exit points

- Portfolio risk assessment

- Stress testing under macro scenarios

Step 2: Choose Appropriate Models

Select forecasting models based on trading frequency and asset class. For example:

- Equity teams may prefer Bayesian updates on earnings seasons.

- Commodity teams can rely on Monte Carlo simulations for demand/supply shocks.

- FX desks often benefit from machine learning sentiment analysis.

Step 3: Data Infrastructure

Reliable probability forecasting requires:

- High-quality historical data

- Real-time feeds for Bayesian updating

- Robust computing environments for ML workloads

Step 4: Team Coordination

Effective probability forecasting is not just technical—it’s cultural. Teams must align on:

- Standardized probability scales

- Communication protocols (e.g., daily probability briefs)

- Clear accountability in trading decisions

Data visualization for probability forecasts

Latest Industry Trends in Probability Forecasting

Integration of Alternative Data

Satellite imagery, ESG indicators, and credit card transaction data are increasingly used to refine probability forecasts.

AI-Enhanced Scenario Testing

Generative AI tools allow teams to simulate multiple “what-if” scenarios, assigning probabilities to macroeconomic shocks, geopolitical risks, or black swan events.

Regulatory Expectations

Compliance departments are demanding more transparent probability models, especially as regulators scrutinize algorithmic trading.

FAQs: Probability Forecasting for Trading Teams

1. How can trading teams avoid overconfidence in probability forecasts?

Overconfidence is a major pitfall. Teams should establish a process of forecast calibration, comparing predicted probabilities with actual outcomes. Tools like Brier scores and calibration plots help refine accuracy over time.

2. What data sources are most reliable for probability forecasting?

Reliable sources include exchange-level tick data, macroeconomic releases, and sentiment data from trusted providers. However, the key lies in blending multiple data streams to create diversified probability inputs rather than relying on a single source.

3. Can probability forecasting improve portfolio-level risk management?

Yes. By assigning probabilities to downside scenarios, portfolio managers can implement dynamic hedging strategies and adjust exposures before risk materializes. This approach is far superior to static risk measures like Value-at-Risk alone.

Conclusion: The Future of Probability Forecasting for Teams

Probability forecasting for trading teams is no longer optional—it is essential for survival in today’s competitive markets. By adopting a hybrid approach that combines Bayesian updating, frequentist simulations, and machine learning, teams can create a dynamic, reliable, and transparent forecasting system.

The future lies in integrating alternative data, AI-driven scenario planning, and fostering a culture of probability-based decision-making within teams.

If you found this article valuable, share it with your trading colleagues, leave a comment about your team’s forecasting experiences, and help expand the discussion on probability forecasting in trading.

Would you like me to also create an infographic summarizing the hybrid probability forecasting framework (Bayesian + Frequentist + Machine Learning) for quick team reference?

0 Comments

Leave a Comment