=====================================================

Algorithmic trading has transformed financial markets, enabling traders to execute thousands of orders within milliseconds, based on sophisticated mathematical models. Among the most powerful statistical tools in this space is standard deviation. It measures the dispersion of price movements from the mean and plays a critical role in risk management, volatility assessment, and strategy optimization.

In this comprehensive guide, we’ll explore how standard deviation is used in algorithmic trading, discuss two core strategies with real-world applications, highlight advantages and disadvantages, and provide expert insights into best practices. By the end, you’ll have a clear understanding of why this concept is central to modern quantitative finance.

Understanding Standard Deviation in Trading

Standard deviation (SD) quantifies how much a set of values varies from the average. In finance, it is used to measure market volatility. A higher SD indicates wider price swings, suggesting higher risk and potentially higher reward. Conversely, a lower SD implies more stable price behavior.

For traders, this metric acts as a volatility thermometer. Whether developing automated systems or making discretionary decisions, understanding SD ensures better control over risk and position sizing.

Why Standard Deviation Matters in Algorithmic Trading

Algorithmic trading thrives on precise, quantifiable metrics. Standard deviation is essential because:

- Risk Measurement: It helps traders assess whether an asset is too volatile for their risk appetite.

- Strategy Design: Many quantitative models, including Bollinger Bands and Value-at-Risk (VaR), rely on SD.

- Portfolio Diversification: By analyzing SD across multiple assets, traders can optimize asset allocation to minimize overall portfolio risk.

- Entry and Exit Signals: Sudden spikes in SD often indicate breakouts, while unusually low SD may point to upcoming trend reversals.

When evaluating why standard deviation is important in quantitative strategies, it becomes clear that no robust trading model can ignore this measure of volatility.

Methods of Using Standard Deviation in Algorithmic Trading

Traders apply standard deviation in multiple ways. Below, we focus on two widely adopted strategies that highlight its practical use.

1. Bollinger Bands Strategy

Bollinger Bands are among the most common applications of SD in trading. They consist of:

- A moving average (middle band)

- An upper band (moving average + k × SD)

- A lower band (moving average - k × SD)

How It Works

When the price touches the upper band, it may indicate overbought conditions. Conversely, when it hits the lower band, it may suggest oversold conditions. Traders build algorithms to execute trades automatically when these thresholds are reached.

Advantages

- Easy to implement in algorithmic systems

- Provides clear visual signals

- Adaptive to changing volatility

Disadvantages

- Prone to false signals in trending markets

- Works best in sideways or range-bound markets

2. Volatility Breakout Strategy

Another powerful approach is the volatility breakout strategy. Here, traders calculate the standard deviation of past price movements to define a breakout threshold.

How It Works

- Compute the SD of an asset’s returns over a specific lookback period.

- Set an entry point when the price moves beyond a multiple of this SD (e.g., 2× SD above the average).

- Use trailing stops to lock in profits once the breakout occurs.

Advantages

- Captures strong momentum moves

- Effective during high-volatility events

- Works well in algorithmic systems with automated order execution

Disadvantages

- May generate whipsaws in low-volatility conditions

- Requires robust risk management to avoid drawdowns

Comparing the Two Approaches

Both Bollinger Bands and Volatility Breakout strategies rely on standard deviation but serve different purposes.

- Bollinger Bands: Best for sideways markets, providing entry/exit signals based on overbought/oversold conditions.

- Volatility Breakout: Best for trending markets, helping capture explosive price movements after periods of consolidation.

In practice, many algorithmic traders combine both approaches. By integrating multiple volatility-based signals, they reduce the risk of false entries and improve overall strategy robustness.

Real-World Example: Risk Management with Standard Deviation

Consider a hedge fund trading the S&P 500. The fund uses SD to determine daily position limits. If volatility spikes beyond 2 standard deviations from the 30-day average, the system automatically reduces position sizes by 50%. This ensures the fund does not overexpose itself during turbulent conditions.

This practice highlights how standard deviation affects trading risk management, ensuring consistent returns without catastrophic losses.

Practical Applications for Algorithmic Traders

Backtesting with SD

Traders often backtest strategies by incorporating SD to filter out trades during abnormal volatility. This avoids misleading results and improves predictive accuracy.

Portfolio Optimization

SD is critical in determining correlation among assets. By choosing assets with low or negative correlation, traders can reduce overall portfolio risk.

Advanced Techniques

Some hedge funds customize SD calculations using exponentially weighted moving averages (EWMA) to give more weight to recent volatility. This makes the model more adaptive to current market conditions.

Step-by-Step Guide to Using Standard Deviation in Algorithmic Trading

- Collect Historical Data – Download price data from a trading platform or data provider.

- Calculate Returns – Use log returns to avoid compounding issues.

- Compute Standard Deviation – Apply the standard deviation formula or use built-in functions in Python, R, or MATLAB. (Related: how to calculate standard deviation in quantitative trading)

- Integrate into Strategy – Incorporate SD thresholds into entry/exit conditions.

- Backtest Thoroughly – Run simulations across multiple market conditions.

- Implement Risk Controls – Use SD to adjust position sizing dynamically.

Visual Insights

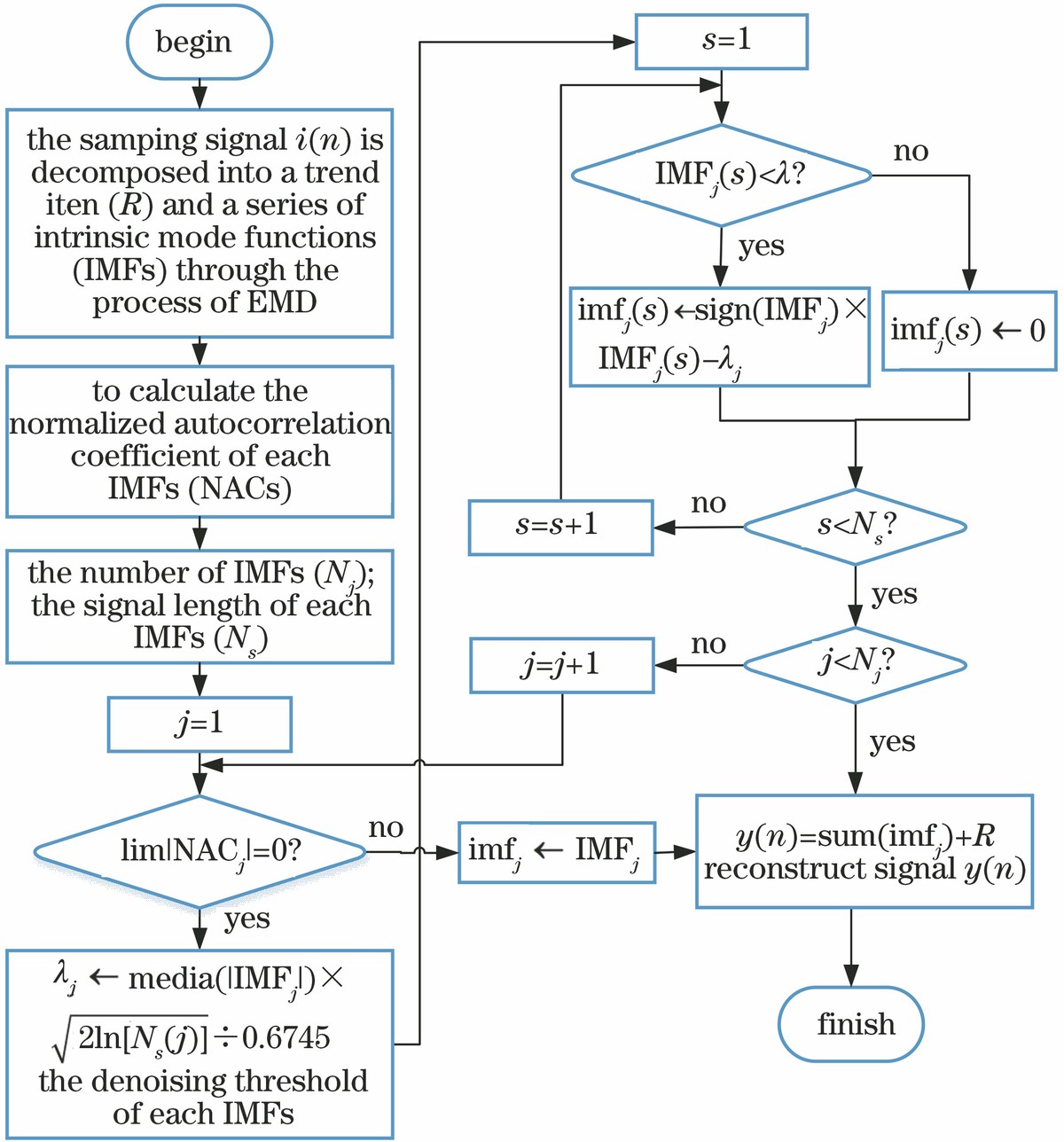

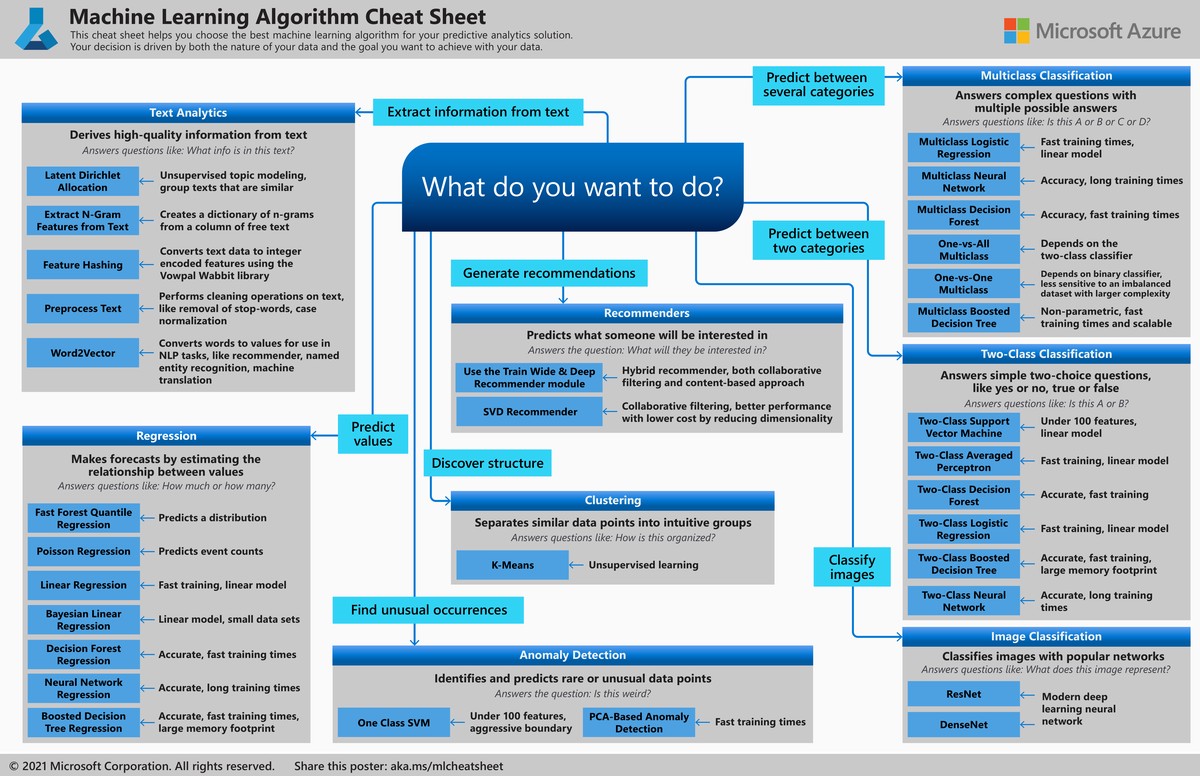

Below are some illustrative visuals to better understand how SD works in algorithmic trading.

Bollinger Bands applied to S&P 500 daily chart

Visualization of a volatility breakout triggered after a consolidation phase

Standard deviation helps in portfolio diversification and risk management

Frequently Asked Questions (FAQ)

1. How reliable is standard deviation in predicting market moves?

Standard deviation does not predict direction but measures volatility. It is reliable for understanding how far prices may deviate from the mean, but it should always be combined with trend indicators, momentum signals, and volume analysis.

2. Should retail traders use standard deviation-based strategies?

Yes, but with caution. Retail traders often lack the infrastructure of hedge funds. Using simple strategies like Bollinger Bands is effective, but risk management must be strict. Over-leveraging during volatile periods can lead to significant losses.

3. What’s the best way to learn standard deviation for trading?

The most practical method is hands-on practice. Start with simple backtests in Python or Excel. For structured learning, explore resources such as where to learn standard deviation in financial data analysis, which offer both theoretical and applied guidance tailored to traders.

Final Thoughts

Understanding how standard deviation is used in algorithmic trading is essential for anyone building robust quantitative strategies. Whether applied through Bollinger Bands or Volatility Breakouts, SD provides the backbone for volatility assessment and risk management.

From personal experience, combining SD with momentum filters and dynamic risk controls delivers the best long-term results. The goal is not to eliminate risk but to manage it intelligently.

If you found this article helpful, feel free to share it with your network, leave a comment, or start a discussion on how you integrate standard deviation into your trading strategies. Let’s build smarter, data-driven trading systems together.

0 Comments

Leave a Comment