Introduction: The Role of Quantitative Trading in Crypto Investment

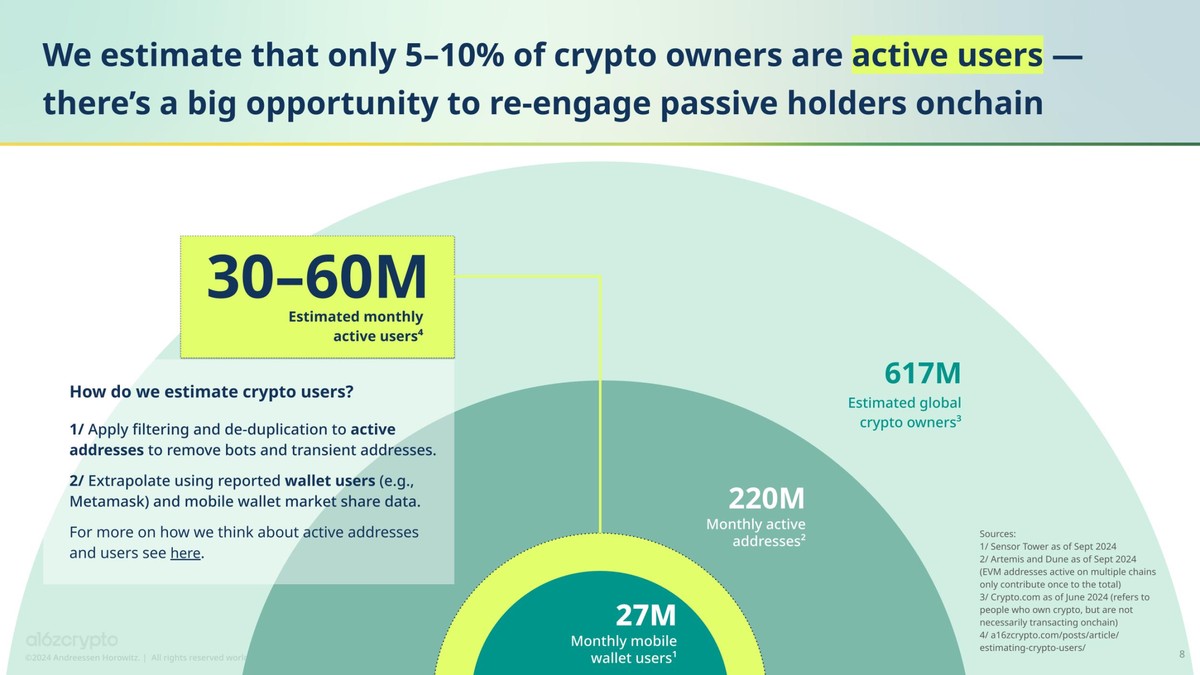

In recent years, quantitative trading has gained significant attention in the cryptocurrency market. The rise of digital assets, coupled with the volatility inherent in the crypto space, has made traditional investment strategies less reliable. As a result, many traders and investors are turning to quantitative methods to improve their chances of success.

Quantitative trading involves the use of mathematical models and algorithms to identify profitable trading opportunities. Unlike traditional methods, which rely on human intuition and analysis, quantitative trading uses data-driven approaches to make decisions. In this article, we will explore how quantitative trading improves crypto investment, compare different strategies, and recommend the best approach for investors.

Understanding Quantitative Trading in Crypto

What is Quantitative Trading?

Quantitative trading, also known as quant trading, refers to the use of mathematical models to identify and execute trades in the financial markets. In the context of cryptocurrencies, it leverages historical data, statistical models, and algorithms to predict future price movements and market trends.

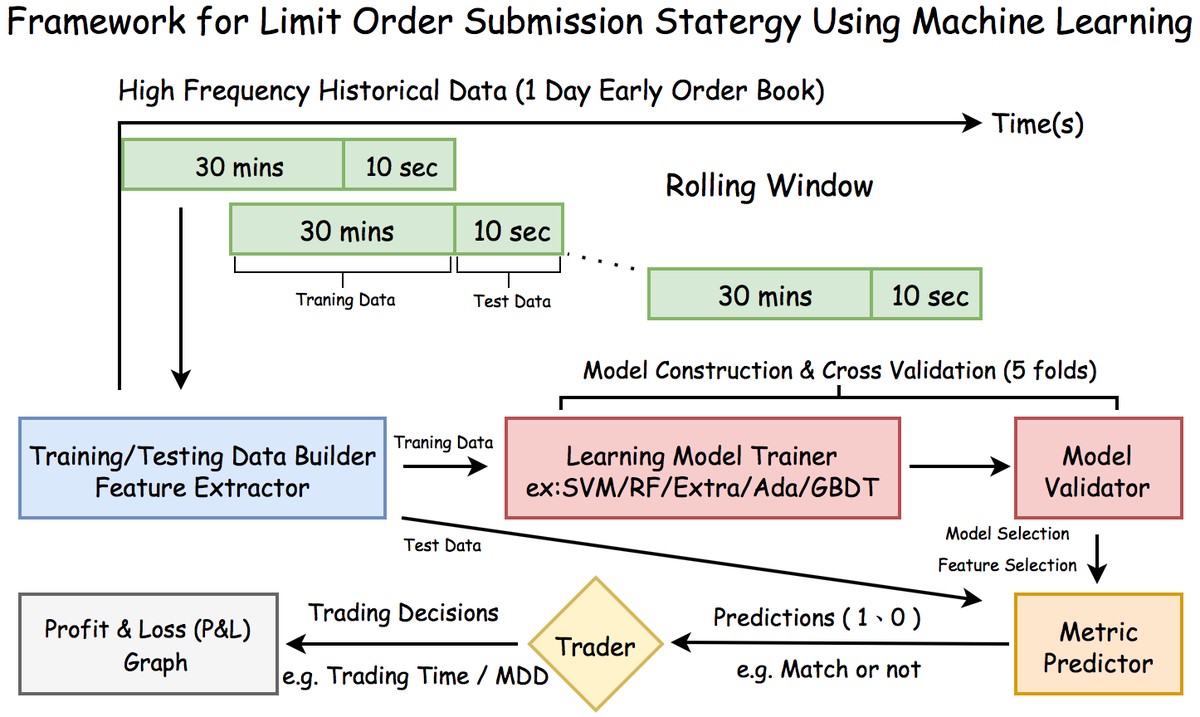

The process typically involves:

Data Analysis: Gathering and analyzing vast amounts of data, including historical price data, trading volumes, and other market indicators.

Model Development: Developing algorithms based on this data to identify patterns and predict future price changes.

Execution: Using automated systems to execute trades based on the predictions made by the models.

Quantitative trading in crypto markets offers a more systematic approach than traditional methods, which often rely on emotions, biases, and subjective analysis.

How Quantitative Trading Improves Crypto Investment

The benefits of quantitative trading in cryptocurrency investment are numerous. By using data-driven strategies, investors can reduce the risks associated with market volatility, increase the accuracy of their predictions, and ultimately enhance their profitability.

Reduced Emotional Bias: One of the key advantages of quantitative trading is the elimination of emotional biases that can cloud judgment. In volatile markets like crypto, emotions such as fear and greed often lead to poor decision-making. Quantitative trading removes this element by relying solely on data and algorithms.

Enhanced Accuracy: By analyzing vast amounts of data and applying advanced mathematical models, quantitative trading strategies are more likely to make accurate predictions about future price movements. This increases the likelihood of making profitable trades.

Speed and Efficiency: Algorithms can analyze and execute trades at a speed and efficiency that human traders cannot match. This is especially important in the fast-paced crypto market, where prices can change in seconds.

Backtesting: Quantitative trading strategies can be backtested using historical data to see how they would have performed in the past. This allows traders to refine their models and improve their strategies before deploying them in live markets.

Different Quantitative Trading Strategies for Crypto

- Trend Following Strategy

The trend following strategy is one of the most popular quantitative trading strategies. It involves identifying and following the prevailing market trend—whether bullish or bearish. Traders using this strategy seek to profit by riding the wave of the trend, buying when prices are rising and selling when prices are falling.

How It Works:

Data Analysis: The algorithm analyzes past price movements to identify long-term trends.

Signal Generation: The system generates buy or sell signals based on the trend direction.

Execution: The algorithm automatically executes trades based on the generated signals.

Pros:

Simple to implement

Often profitable in trending markets

Reduces the need for manual analysis

Cons:

Can perform poorly in sideways or range-bound markets

May lead to losses during market reversals

- Mean Reversion Strategy

The mean reversion strategy assumes that asset prices will eventually return to their historical average after deviating from it. In the context of cryptocurrency, this strategy aims to identify overbought or oversold conditions and capitalize on the reversal.

How It Works:

Data Analysis: The algorithm monitors the price of a cryptocurrency and identifies instances where the price deviates significantly from its mean (average).

Signal Generation: The system generates buy signals when prices are below the mean and sell signals when prices are above the mean.

Execution: The algorithm executes trades based on the generated signals.

Pros:

Profitable during range-bound or mean-reverting markets

Provides frequent trading opportunities

Cons:

May perform poorly in trending markets

Requires precise timing for optimal performance

Choosing the Right Quantitative Trading Strategy

When selecting a quantitative trading strategy for crypto investment, it’s important to consider the current market conditions, your risk tolerance, and the resources available to you. While the trend-following strategy may perform well in trending markets, the mean reversion strategy is more suited to sideways or range-bound markets.

For new traders, a hybrid approach that combines elements of both strategies may be the best option. This allows traders to benefit from the strengths of both approaches while mitigating their weaknesses.

Latest Trends in Crypto Quantitative Trading

Integration of Machine Learning and AI

One of the latest trends in quantitative trading is the integration of machine learning (ML) and artificial intelligence (AI) algorithms. These technologies allow for more sophisticated models that can learn from data and adapt to changing market conditions. Machine learning algorithms can automatically adjust their parameters based on new data, making them more flexible and robust than traditional models.

Use of Sentiment Analysis

Sentiment analysis is another emerging trend in quantitative crypto trading. By analyzing social media posts, news articles, and other sources of information, traders can gauge the market’s sentiment and make more informed trading decisions. For example, an algorithm might detect a shift in sentiment towards a particular cryptocurrency and generate a buy or sell signal accordingly.

Decentralized Finance (DeFi) and Quantitative Trading

With the rise of decentralized finance (DeFi), new opportunities for quantitative trading have emerged. DeFi protocols offer decentralized exchanges, lending platforms, and other financial services that can be integrated into quantitative trading strategies. This allows traders to access a broader range of assets and markets, potentially improving their profitability.

FAQ: Common Questions About Quantitative Trading in Crypto

- How can I start quantitative trading in crypto?

To start quantitative trading in crypto, you need to:

Learn the Basics: Familiarize yourself with quantitative trading concepts, algorithms, and the cryptocurrency market.

Choose a Platform: Select a trading platform that supports algorithmic trading and offers access to crypto markets.

Develop a Strategy: Choose a quantitative strategy (e.g., trend following, mean reversion) and develop an algorithm.

Backtest Your Strategy: Test your strategy on historical data to see how it would have performed.

Start Trading: Once you’re confident in your strategy, deploy it in live markets with real capital.

For a step-by-step guide on starting quantitative trading, check out our article on How to start quantitative trading in crypto on Reddit.

- What are the risks of quantitative trading in crypto?

While quantitative trading offers many benefits, it also comes with risks. Some of the key risks include:

Model Overfitting: A strategy that performs well on historical data may not necessarily perform well in live markets.

Market Volatility: Crypto markets are highly volatile, and even the best models may not always predict sudden price swings.

Technical Failures: Algorithmic trading systems are prone to technical issues, such as connectivity problems or software bugs.

- How do I choose the best quantitative trading model for crypto?

When choosing a quantitative trading model, consider the following:

Market Conditions: Different models perform better in different market conditions (e.g., trending vs. range-bound).

Backtesting Results: Ensure that your model has been backtested on historical data and has performed well.

Risk Management: Implement risk management techniques such as stop-loss orders and position sizing to protect your capital.

Conclusion: Embracing Quantitative Trading for Crypto Investment

Quantitative trading offers significant advantages for crypto investors, including enhanced accuracy, speed, and the elimination of emotional biases. By choosing the right strategy, such as trend following or mean reversion, and integrating modern technologies like machine learning and sentiment analysis, traders can gain a competitive edge in the fast-paced crypto market.

As the crypto market continues to evolve, adopting quantitative trading strategies will become increasingly important for investors looking to maximize their returns while managing risk effectively. If you’re interested in learning more about quantitative trading, be sure to explore resources like How to evaluate quantitative trading models for crypto and Best practices for quantitative trading in the crypto market.

Share This Article!

| Section | Key Points |

|---|---|

| Definition | Uses math models & algorithms for trades |

| Process | Data analysis → model development → execution |

| Benefits | Reduces bias, improves accuracy, speed, backtesting |

| Trend Following | Profits from trends; weak in sideways markets |

| Mean Reversion | Profits in range-bound markets; weak in trends |

| Strategy Choice | Depends on market, risk tolerance, resources |

| Trends | AI/ML integration, sentiment analysis, DeFi use |

| How to Start | Learn basics, pick platform, develop, backtest, trade |

| Risks | Overfitting, volatility, technical failures |

| Model Selection | Match market, backtest, manage risk |

0 Comments

Leave a Comment