=================================================================

The take profit strategy is an essential tool for traders across various financial markets, such as forex, stocks, crypto, and commodities. By defining an exit point in advance, traders can lock in profits before the market reverses, thus safeguarding their gains. However, the key challenge for traders lies in determining where to apply the take profit strategy effectively. In this guide, we’ll explore different approaches to setting take profit levels, the factors to consider, and practical strategies to maximize your returns while managing risk.

Understanding Take Profit Strategy

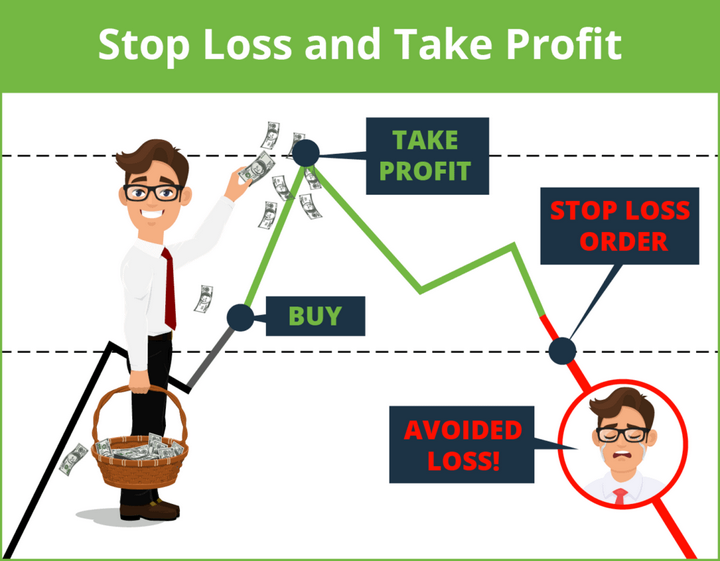

Before delving into the specifics of where to apply the take profit strategy, let’s first understand what it is. A take profit order is an automatic instruction to close a trade when the price reaches a predetermined level, securing a profit. It’s the opposite of a stop loss, which is used to limit losses by closing a trade when the price reaches a certain point against your position.

Benefits of Using a Take Profit Strategy

- Locks in Profits: A well-placed take profit level ensures that you capture profits at a favorable price point without having to constantly monitor the market.

- Emotion-Free Trading: By having a predefined exit point, you eliminate the emotional decisions that can negatively impact your trading.

- Risk Management: A take profit order helps balance your risk-reward ratio, ensuring you don’t let gains evaporate when the market moves against you.

Where Does the Take Profit Strategy Work Best?

To apply the take profit strategy effectively, it’s important to understand the market conditions and the types of trades where it excels. Whether you’re trading stocks, forex, or cryptocurrencies, knowing where to set your take profit is crucial for maximizing your profits while minimizing unnecessary risks.

1. In Trending Markets

Take profit orders are especially effective in trending markets, where prices tend to move in one direction for a prolonged period. In such cases, setting a take profit level at a reasonable distance from the entry point can help you capture profits while allowing room for the trend to continue.

Example:

If you’re trading stocks in an upward trend, you might set a take profit order at a level where the price has historically faced resistance, such as a previous high or a significant moving average. This ensures that you can capture gains before the trend faces a reversal.

2. In Range-Bound Markets

In range-bound or sideways markets, price fluctuates between support and resistance levels. Setting a take profit strategy in such markets works best when you anticipate the price will hit resistance after a move higher or support after a move lower.

Example:

When trading forex pairs in a range-bound market, you could set your take profit near the resistance level for long trades or the support level for short trades. This strategy works well in situations where price action lacks strong momentum.

3. During High Volatility Events

Take profit levels can also be crucial when trading during high volatility events, such as earnings reports, central bank announcements, or major economic data releases. In such scenarios, price swings are often larger and more unpredictable, and a take profit order helps lock in profits before prices reverse dramatically.

Example:

In cryptocurrency markets, significant news events or updates can trigger huge price movements. Setting a take profit order can protect profits after an initial spike in price, preventing you from giving up gains if the price swings back.

How to Set Take Profit Levels Effectively

Setting take profit levels isn’t a one-size-fits-all approach. There are different strategies and tools you can use to determine optimal exit points. Let’s compare two common methods: technical analysis-based take profit levels and fundamental analysis-based take profit levels.

1. Using Technical Analysis for Take Profit

Technical analysis relies on price patterns, support and resistance levels, trend lines, and other indicators to identify where the price is likely to reverse or stall. By using these tools, traders can set take profit levels that are consistent with the market’s behavior.

Key Technical Tools to Set Take Profit:

- Support and Resistance: Placing take profit orders near these levels ensures that you exit the trade before a price reversal.

- Fibonacci Retracement: Many traders use Fibonacci levels (38.2%, 50%, 61.8%) to set take profit levels in trending markets, as these levels often correspond to areas where the price may reverse.

- Moving Averages: Setting take profit near key moving averages (such as the 50-period or 200-period MA) can act as dynamic support or resistance.

Pros of Technical Analysis-Based Take Profit:

- Data-Driven: Based on past price action, providing objective levels.

- Market Behavior Insights: Helps understand where the price is likely to reverse based on established patterns.

Cons:

- Lagging Indicator: Technical indicators might not always predict future price movements accurately, especially in volatile markets.

- False Signals: Support or resistance levels may be broken, leading to premature exits.

2. Using Fundamental Analysis for Take Profit

For those trading based on economic data or company performance (stocks, forex, commodities), fundamental analysis can guide the setting of take profit levels. This method involves assessing the intrinsic value of an asset and forecasting its future price movement.

Key Fundamental Factors to Set Take Profit:

- Earnings Reports: After a strong earnings report, stock prices tend to rise, and a take profit order could be set at a reasonable level above the current price.

- Interest Rates (for Forex): For currency pairs, understanding central bank policies and interest rate decisions can help set profit-taking levels.

- Economic Indicators: Economic data like GDP, inflation, and unemployment can influence asset prices and guide where to place take profit levels.

Pros of Fundamental Analysis-Based Take Profit:

- Holistic View: Takes into account the broader economic environment and long-term trends.

- Long-Term Perspective: Ideal for longer-term traders or investors.

Cons:

- Unpredictability: Economic factors can change rapidly, making it harder to predict exact price targets.

- Complexity: Requires understanding of macroeconomic trends and financial reports, which can be time-consuming.

Advanced Take Profit Strategies for Different Markets

Let’s now explore some advanced strategies to optimize the take profit method across different trading environments, including forex, stocks, and cryptocurrency.

1. Take Profit for Forex Traders

Forex markets are highly liquid and volatile, making it essential to set take profit orders at strategic levels. Forex traders often use a combination of technical indicators (like RSI or MACD) and support/resistance zones to define these levels.

- Dynamic Take Profit: Forex traders can use trailing stop orders to lock in profits as the market moves in their favor, adjusting the take profit level automatically.

2. Take Profit for Stock Investors

Stock investors may prefer a fundamental-based approach for setting take profit levels, particularly for long-term positions. A good strategy could be setting a price target based on earnings growth expectations, price-to-earnings (P/E) ratios, or technical analysis of the stock chart.

3. Take Profit for Crypto Enthusiasts

Cryptocurrency markets are known for their extreme volatility, making the use of a take profit strategy even more critical. For crypto traders, a hybrid approach using technical analysis for short-term trades and fundamental analysis for long-term investments can be very effective.

- Smart Take Profit Levels: Set take profit orders using key resistance levels identified through trend lines, Fibonacci retracements, or previous swing highs.

FAQ: Frequently Asked Questions

1. What is the best method to determine a take profit level?

The best method depends on your trading style. If you’re a technical trader, support/resistance levels or Fibonacci retracement levels might work best. If you’re a fundamental trader, consider economic data or earnings reports for stock trading.

2. Can I use trailing stops in combination with take profit?

Yes, trailing stops can be used to lock in profits as the market moves in your favor. This is especially useful in volatile markets, such as forex or crypto, where prices can change rapidly.

3. How often should I adjust my take profit levels?

Take profit levels should be adjusted based on market conditions and the time frame of your trade. In fast-moving markets, you may need to adjust frequently, while longer-term investors might adjust take profit levels quarterly or based on major news events.

Conclusion

Applying a take profit strategy effectively is crucial for achieving consistent gains while managing risks in any market. Whether you’re trading forex, stocks, or cryptocurrencies, understanding where and how to set your take profit levels is key to maximizing your returns. By using technical and fundamental analysis, along with advanced techniques like trailing stops, traders can optimize their profit-taking strategy for consistent success.

Encourage Social Sharing

If you found this guide helpful, feel free to share it with fellow traders! If you have any questions or would like to share your experiences with take profit strategies, drop a comment below.

0 Comments

Leave a Comment