====================================================

In the realm of quantitative finance and algorithmic trading, genetic algorithms (GAs) have proven to be a powerful tool for optimizing trading strategies, model selection, and risk management. Their ability to search for solutions in large and complex solution spaces makes them an invaluable asset for quantitative analysts, traders, and financial engineers. This article delves deep into the various applications of genetic algorithms (GAs) in quant strategies, exploring their strengths, weaknesses, and real-world implementations. We will also provide practical advice on how to effectively leverage these methods in different trading contexts.

What is a Genetic Algorithm and Why It’s Useful in Quantitative Trading

1. Overview of Genetic Algorithms

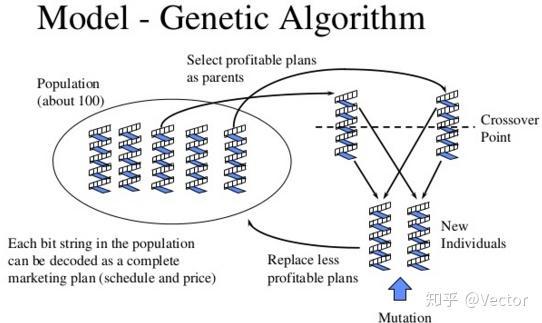

A genetic algorithm is an optimization technique inspired by the process of natural selection. It uses mechanisms such as selection, crossover (recombination), and mutation to evolve solutions to optimization problems. In quantitative trading, these algorithms can be used to evolve trading strategies by selecting the best parameters or rules from a population of potential solutions.

2. Why Genetic Algorithms Are Effective in Trading

Genetic algorithms are well-suited for trading due to their ability to search vast and complex spaces for optimal solutions, particularly when the relationships between variables are nonlinear or unknown. Here’s why they are particularly effective:

- Robustness: GAs can navigate noisy and volatile data, making them suitable for financial markets.

- Optimization: They can help find the best parameters for trading models, enhancing performance.

- Adaptability: GAs adapt over time, making them ideal for environments like financial markets, where conditions constantly change.

Where to Apply Genetic Algorithms in Quant Strategies

1. Optimizing Trading Parameters

One of the most common applications of genetic algorithms in quantitative trading is optimizing the parameters of trading strategies. Many quantitative models require tuning of parameters such as stop-loss levels, moving average periods, and risk-reward ratios. GAs can efficiently search for the combination of parameters that yields the best performance, ensuring that the strategy is tailored to the market conditions.

Example:

For a moving average crossover strategy, GAs could optimize the lengths of the fast and slow moving averages to maximize returns while minimizing drawdowns.

2. Portfolio Optimization

Genetic algorithms can be used to optimize portfolio allocations by searching for the best distribution of assets that maximizes returns or minimizes risk. This is especially useful in the context of multi-asset portfolios where the relationships between assets are complex and nonlinear. The ability of GAs to handle large solution spaces makes them ideal for finding the optimal allocation under varying risk preferences and market conditions.

Example:

A GA can be used to optimize a portfolio by adjusting weights of stocks, bonds, commodities, or other assets based on historical performance data, volatility, and expected returns.

3. Trading Strategy Development and Testing

Developing and testing new trading strategies is a time-consuming process that often involves trial and error. By using GAs, traders can automate the process of generating and testing new strategies. The GA evolves a population of strategies over time, selecting the best-performing ones, while discarding those that perform poorly. This process helps identify novel strategies that might not have been considered using traditional methods.

Example:

A GA can generate different rule-based trading systems that use indicators like Relative Strength Index (RSI), Bollinger Bands, and Fibonacci retracement levels, evolving the system to maximize profitability.

4. Risk Management and Stop-Loss Strategy

Risk management is crucial in trading, and genetic algorithms can be applied to determine the best risk management rules, such as stop-loss and take-profit levels. A GA can evolve these parameters to ensure that the risk-reward ratio is optimal and losses are minimized. It can also adapt to changing market conditions, ensuring that risk management strategies are always effective.

Example:

A GA can optimize the placement of stop-loss orders based on historical volatility and price action, ensuring that they are neither too tight nor too loose.

5. Algorithmic Trading Model Design

Genetic algorithms are also used to design the underlying models for algorithmic trading. In this context, GAs are applied to find the best structure and parameters for machine learning models, including decision trees, neural networks, and support vector machines (SVMs). These models are then used to predict market behavior or generate trading signals.

Example:

A GA could be used to optimize the architecture of a neural network by selecting the best number of layers, neurons per layer, and activation functions that result in the most accurate market predictions.

Advantages and Disadvantages of Using Genetic Algorithms in Quantitative Trading

Advantages:

- Global Search Capability: Unlike gradient-based optimization methods, GAs can search a broad range of solutions and are less likely to get stuck in local optima.

- Flexibility: GAs can be applied to various problems, from strategy development to risk management, making them versatile in the trading domain.

- Adaptability: GAs can continuously evolve and adapt their strategies, making them well-suited for dynamic and volatile markets.

Disadvantages:

- Computationally Intensive: GAs require significant computational resources, especially when dealing with large populations or complex models.

- Slow Convergence: Although GAs are robust, they may take longer to converge to an optimal solution compared to other optimization techniques like gradient descent.

- Overfitting Risk: If not carefully managed, GAs can lead to overfitting, especially when evolving strategies based on historical data.

How to Effectively Implement Genetic Algorithms in Quantitative Trading

1. Define Clear Objectives

Before applying a genetic algorithm, it is crucial to define what you are optimizing for. Are you maximizing profit, minimizing risk, or improving predictive accuracy? Clearly defining the objectives will guide the design of your genetic algorithm and ensure that the solutions it generates are aligned with your trading goals.

2. Choose the Right Fitness Function

The fitness function determines how the GA evaluates the quality of a solution. In quantitative trading, the fitness function could be based on profit factors, Sharpe ratio, maximum drawdown, or other performance metrics. Choosing an appropriate fitness function is essential to ensure that the GA evolves strategies that are both profitable and sustainable.

3. Control the Population Size and Evolutionary Process

The population size and the evolutionary process of genetic algorithms should be tuned for the specific problem. Larger populations may improve the search for optimal solutions but require more computational power. Additionally, the mutation and crossover rates need to be fine-tuned to balance exploration and exploitation in the search process.

4. Backtest and Validate Strategies

As with any quantitative strategy, backtesting and validation are essential to assess the performance of the evolved strategies. Ensure that the strategies generated by the GA are robust and perform well out-of-sample. This helps avoid overfitting and ensures that the strategies can handle new, unseen market conditions.

5. Continuous Optimization

Once you deploy the strategies, use the GA for continuous optimization. Financial markets are dynamic, and trading strategies that work well in one market condition may not perform as effectively in another. By periodically running the GA to adjust the parameters or strategies, you can ensure that your trading system remains competitive over time.

FAQ

1. How can genetic algorithms improve modeling accuracy in quantitative finance?

Genetic algorithms can improve modeling accuracy by optimizing the model’s parameters, finding the best combination of features, and adapting to complex, non-linear market conditions. GAs are particularly useful when the relationship between inputs and outputs is not well understood or is highly volatile.

2. What are some challenges when applying genetic algorithms to trading?

One of the main challenges is computational cost. GAs require significant computational resources, particularly when working with large populations and complex models. Another challenge is the risk of overfitting, as the GA may evolve strategies that perform well on historical data but fail in live trading environments.

3. Can genetic algorithms be used for high-frequency trading?

Yes, genetic algorithms can be used in high-frequency trading (HFT) for tasks like optimizing trading parameters, risk management, and even designing models for market prediction. However, HFT requires ultra-low latency, so the computationally intensive nature of GAs may require parallel processing or specialized hardware for real-time applications.

In conclusion, genetic algorithms offer powerful optimization tools for quantitative traders looking to refine their strategies, improve portfolio performance, and manage risks. While they present challenges such as computational intensity and the risk of overfitting, their ability to explore vast solution spaces and adapt to market changes makes them a valuable asset in the evolving world of algorithmic trading. By carefully applying these algorithms and optimizing their parameters, traders can enhance their decision-making processes and gain a competitive edge in the markets.

0 Comments

Leave a Comment