The Bloomberg Terminal has become an indispensable tool for professionals in finance, especially for quantitative analysts. With its vast array of data, analytics, and tools, it empowers quants to develop, test, and refine sophisticated trading strategies. Whether you’re a seasoned financial professional or just getting started in quantitative analysis, understanding how to leverage the Bloomberg Terminal can dramatically enhance your trading decisions and strategies.

In this comprehensive guide, we will explore the key features of the Bloomberg Terminal, its advantages for quant analysts, and how to effectively integrate it into your quantitative trading workflow. Additionally, we’ll highlight the benefits and challenges of using this platform for developing quantitative strategies and algorithms.

What is the Bloomberg Terminal?

The Bloomberg Terminal is a powerful data and analytics platform that provides real-time financial data, news, and market analysis. It’s widely used by traders, investors, and financial analysts to access accurate, up-to-date information across a variety of asset classes, including stocks, bonds, commodities, and cryptocurrencies. The platform’s powerful tools and extensive data offerings make it an essential resource for quantitative analysts in the field of finance.

Key Features of the Bloomberg Terminal for Quant Analysts

Real-Time Data: Access to live market data including historical prices, corporate earnings, and economic indicators.

Advanced Charting: Bloomberg offers advanced charting tools that allow for technical analysis, pattern recognition, and risk management.

Quantitative Tools: Bloomberg Terminal includes tools for backtesting, statistical modeling, and financial modeling, which are invaluable for quants.

Comprehensive Market News: Timely news and alerts from global financial markets, helping analysts stay updated on breaking events.

API Integration: The Bloomberg Terminal offers a robust API, allowing quantitative analysts to integrate Bloomberg data into their custom-built models and algorithms.

Why Quantitative Analysts Should Use Bloomberg Terminal

The Bloomberg Terminal is widely regarded as one of the most comprehensive platforms for quantitative analysis. Below, we’ll explore how this tool can significantly enhance a quant analyst’s capabilities:

- Access to Extensive Historical and Real-Time Data

For quantitative analysts, the foundation of any model is data. Bloomberg Terminal offers access to vast amounts of financial data, including:

Tick-by-tick data: Detailed, time-stamped market data for equities, derivatives, and commodities.

Historical data: Backtesting a strategy requires robust historical data, and Bloomberg Terminal provides data across multiple timeframes (daily, hourly, minute-by-minute).

Fundamental and macroeconomic data: Corporate financial statements, economic reports, and market sentiment data.

- Advanced Analytics and Financial Modeling

Bloomberg Terminal offers built-in tools for statistical analysis and financial modeling, which are essential for quant analysts:

Excel Integration: Bloomberg seamlessly integrates with Excel, allowing analysts to pull data directly into custom-built models and run simulations.

Risk Management: Advanced risk management tools, including value-at-risk (VaR) models, stress testing, and portfolio optimization, are crucial for quant analysts to ensure they manage risk effectively.

Technical Indicators: Bloomberg provides numerous indicators (e.g., moving averages, Bollinger Bands, MACD) that are essential for algorithmic trading strategies.

- Backtesting and Strategy Optimization

Backtesting a trading strategy is essential for validating it before going live. The Bloomberg Terminal provides advanced tools to backtest strategies using historical data and evaluate their performance. You can simulate strategies using data from multiple asset classes, enabling a comprehensive assessment of risk and return.

For example, a quant analyst can create custom backtest scenarios that consider transaction costs, slippage, and various other market conditions. This allows you to optimize your strategy and avoid pitfalls before real money is involved.

- Integration with Algorithmic Trading

The Bloomberg API enables quants to integrate the platform’s data and analytics into algorithmic trading systems. With the API, you can access real-time market data, execute trades, and optimize models in a systematic, automated way. This allows for more efficient trading, better decision-making, and improved risk management.

Integrating Bloomberg Terminal with Quantitative Trading Strategies

Integrating the Bloomberg Terminal into your quantitative trading workflow can significantly streamline your process. There are multiple ways to leverage Bloomberg’s data and tools in your algorithmic trading strategies.

- Using Bloomberg Data for Algorithmic Models

For quants, one of the key advantages of the Bloomberg Terminal is the ability to seamlessly integrate data into trading algorithms. Here’s how you can use Bloomberg data in your models:

Real-time pricing feeds: Use Bloomberg’s real-time data for live market conditions and decision-making in automated trading strategies.

Sentiment analysis: Bloomberg Terminal provides access to news and sentiment data, which can be used to inform algorithmic decisions.

- Custom Financial Models and Backtesting

Backtesting is a critical component of any quantitative trading strategy. With Bloomberg, analysts can test their trading strategies under different market conditions and refine them accordingly. You can:

Run backtests for various asset classes (equities, fixed income, forex, etc.)

Assess risk-adjusted returns and volatility

Incorporate market events (e.g., earnings announcements, geopolitical events) into your models

Bloomberg’s comprehensive data allows you to evaluate how strategies would have performed under specific scenarios.

- Automating Trading Strategies with Bloomberg API

The Bloomberg API allows quantitative analysts to develop and deploy trading strategies without manually executing trades. By integrating Bloomberg’s real-time market data with your algorithms, you can automate the entire process, from trade execution to risk management.

The Bloomberg API allows you to:

Fetch live market data (e.g., quotes, bid/ask spreads, historical prices)

Execute trades automatically based on predetermined conditions

Monitor portfolio performance in real-time

By automating these tasks, you can enhance trading efficiency and reduce human error.

Advantages and Disadvantages of Using Bloomberg Terminal for Quantitative Analysis

While the Bloomberg Terminal offers numerous advantages for quant analysts, there are also some drawbacks to consider. Here, we compare the pros and cons:

Advantages:

Comprehensive Data: Bloomberg offers one of the largest and most comprehensive financial data sets, covering a wide range of asset classes and market conditions.

Advanced Tools: From technical indicators to statistical analysis, Bloomberg provides a wealth of tools tailored to quants and institutional investors.

Real-Time Data: Access to live market feeds allows for immediate execution of algorithmic trading strategies.

Seamless Integration: The Bloomberg Terminal integrates easily with other platforms like Excel and supports API access, making it easier for quants to use Bloomberg data within custom models.

Disadvantages:

Cost: Bloomberg Terminal is one of the most expensive platforms available, with annual subscriptions often costing tens of thousands of dollars. This can be prohibitive for independent traders or small firms.

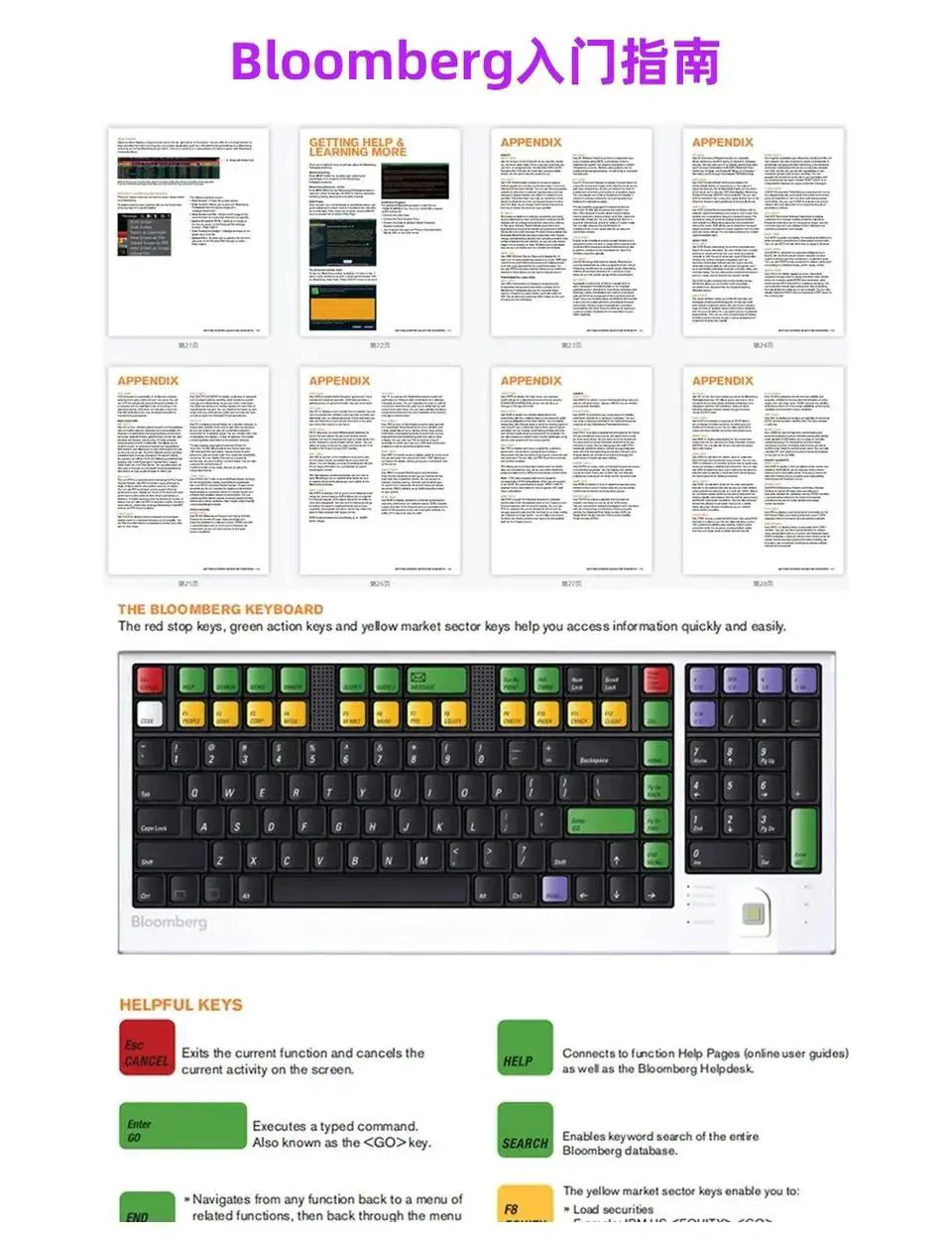

Complexity: The vast number of features and tools can be overwhelming, especially for beginners. There is a steep learning curve to effectively utilize the Terminal.

Limited to Bloomberg Data: While Bloomberg’s data is vast, it’s still limited to their sources, and some markets or data points might not be available. Independent quants may want to supplement Bloomberg with additional data sources.

Frequently Asked Questions (FAQs)

Bloomberg Terminal enhances trading algorithms by providing real-time data, comprehensive market analysis, and advanced statistical models. The integration of these resources allows quants to develop more accurate algorithms, optimize trading strategies, and implement real-time trading decisions effectively.

- Where can I learn how to use Bloomberg Terminal for quantitative analysis?

There are several resources available for learning how to use the Bloomberg Terminal for quantitative analysis:

Bloomberg University offers online tutorials and workshops for new users.

Online Courses: Many institutions and platforms, such as Coursera and Udemy, offer courses specifically focused on Bloomberg Terminal and its applications in quantitative trading.

Bloomberg Help Desk: Bloomberg Terminal itself provides a comprehensive help system that users can access for guidance.

Bloomberg Terminal provides a wide range of data relevant to quantitative trading, including:

Equity data: Stock prices, dividends, earnings reports, and analyst ratings

Fixed income data: Bond prices, yields, and credit spreads

Foreign exchange data: Currency pairs and historical exchange rates

Commodity data: Prices of precious metals, oil, agricultural products, etc.

Macroeconomic data: GDP, inflation, employment reports, and central bank policies

Conclusion

The Bloomberg Terminal is a powerful platform that offers a wealth of resources for quantitative analysts. From comprehensive financial data to advanced modeling tools and integration with algorithmic trading strategies, it is an essential tool for any professional in the field of quantitative finance. By understanding how to leverage its capabilities, quant analysts can enhance their decision-making, improve strategy performance, and gain a competitive edge in the financial markets.

{

“table”: [

{

"Key Feature": "Real-Time Data",

"Description": "Access to live market data, historical prices, and economic indicators."

},

{

"Key Feature": "Advanced Charting",

"Description": "Provides technical analysis tools, pattern recognition, and risk management."

},

{

"Key Feature": "Quantitative Tools",

"Description": "Tools for backtesting, statistical and financial modeling."

},

{

"Key Feature": "Comprehensive Market News",

"Description": "Timely news and alerts from global financial markets."

},

{

"Key Feature": "API Integration",

"Description": "Allows integration of Bloomberg data into custom-built models and algorithms."

},

{

"Advantage": "Comprehensive Data",

"Description": "Offers a vast range of data across multiple asset classes."

},

{

"Advantage": "Advanced Tools",

"Description": "Includes technical indicators and risk management tools for quants."

},

{

"Advantage": "Real-Time Data",

"Description": "Provides live market feeds to optimize trading strategies."

},

{

"Advantage": "Seamless Integration",

"Description": "Integrates easily with platforms like Excel, supports API access."

},

{

"Disadvantage": "Cost",

"Description": "Annual subscriptions can be prohibitively expensive for some users."

},

{

"Disadvantage": "Complexity",

"Description": "The platform has a steep learning curve due to its vast features."

},

{

"Disadvantage": "Limited Data",

"Description": "Some markets and data points may not be available."

}

]

}

0 Comments

Leave a Comment