================================================================================================

Introduction

In recent years, quantitative trading courses for retail investors have become increasingly popular. With the rise of algorithmic trading platforms, affordable data access, and user-friendly programming tools, retail traders now have opportunities that were once reserved for hedge funds and large institutions. However, choosing the right course and applying quantitative methods effectively can be challenging without proper guidance.

This article provides a comprehensive guide to understanding the landscape of quantitative trading education for retail investors. We will explore different types of courses, compare two major approaches to learning, analyze their pros and cons, and provide practical recommendations based on personal experience and current industry trends. By the end, you will have a clear path to mastering quantitative trading as a retail investor.

What Is Quantitative Trading and Why It Matters for Retail Investors

Quantitative trading involves using mathematical models, statistics, and algorithms to make trading decisions. Unlike discretionary trading, which relies heavily on intuition, quantitative trading leverages data and automation to achieve consistency.

Key Advantages for Retail Investors

- Data-Driven Decisions: Eliminates emotional bias.

- Scalability: Algorithms can process large amounts of data in seconds.

- Backtesting: Allows investors to test strategies before deploying real capital.

- Diversification: Multiple strategies can run simultaneously to reduce risk.

The accessibility of affordable APIs, cloud computing, and free open-source tools (like Python libraries) means retail traders are no longer locked out of this sophisticated trading style.

Types of Quantitative Trading Courses for Retail Investors

Retail investors now have a wide range of quantitative trading courses to choose from, catering to beginners, intermediate learners, and advanced practitioners.

1. University-Affiliated Online Programs

Many top universities offer online certifications in financial engineering or data-driven finance. Examples include MITx, Coursera collaborations, and Stanford Online.

- Strengths: Strong academic foundation, credibility, structured curriculum.

- Weaknesses: Expensive, longer duration, sometimes less practical for small retail portfolios.

2. Independent Specialized Training Platforms

Websites like QuantInsti, Udemy, and QuantConnect Academy focus directly on quantitative trading for individuals.

- Strengths: Affordable, practical, hands-on coding examples, focus on Python and R.

- Weaknesses: Quality varies across instructors, some lack depth in risk management.

3. Mentorship and Community-Based Learning

Some platforms offer quantitative trading mentorship for aspiring retail traders through interactive communities, peer discussions, and one-on-one coaching.

- Strengths: Real-world experience, networking, personalized guidance.

- Weaknesses: Limited availability, depends on mentor expertise.

Two Popular Learning Approaches: Self-Learning vs Structured Courses

Self-Learning (DIY Method)

Many retail investors prefer to build their own knowledge using free resources. Platforms like YouTube, GitHub, and financial blogs provide tutorials on coding strategies, backtesting, and live trading integration.

Pros:

- Free or low cost.

- Flexible schedule.

- Exposure to diverse ideas.

Cons:

- Lack of structure.

- Time-consuming to filter quality content.

- No personalized feedback.

Structured Courses (Formal Training)

On the other hand, structured quantitative trading courses for retail investors provide a step-by-step learning journey.

Pros:

- Clear roadmap.

- Professional guidance.

- Includes projects and certifications.

Cons:

- Higher cost.

- Less flexibility in pace.

Comparison chart showing advantages and drawbacks of two learning methods.

Industry Trends Influencing Quantitative Trading Courses

The quantitative trading landscape is rapidly evolving, and courses are adapting to keep up.

Trend 1: Focus on Python and Machine Learning

Python has become the gold standard for retail quantitative trading due to its extensive libraries (Pandas, NumPy, scikit-learn). Courses are increasingly integrating machine learning for predictive modeling.

Trend 2: Cloud-Based Algorithm Deployment

Platforms now offer cloud execution for backtests and live trading. Retail investors can run strategies without high-end hardware.

Trend 3: Low-Cost Data Accessibility

Retail traders can access high-quality data at affordable prices from providers like Alpaca, Polygon.io, and Interactive Brokers.

How Does Quantitative Trading Work for Retail Traders?

For retail traders, quantitative trading usually involves four stages:

- Idea Generation: Define a hypothesis (e.g., mean reversion, momentum).

- Backtesting: Use historical data to validate the idea.

- Execution: Automate trades using a brokerage API.

- Risk Management: Set stop-losses, portfolio allocation, and capital preservation rules.

Retail-friendly platforms like QuantConnect, MetaTrader, and Interactive Brokers APIs make this process more accessible than ever.

Case Study: Two Learning Journeys

Student A – Self-Learner

- Relied on YouTube tutorials and GitHub repositories.

- Built a simple moving average crossover strategy.

- Faced challenges in risk management, leading to inconsistent results.

Student B – Structured Course Attendee

- Took a quantitative trading course for retail investors from QuantInsti.

- Learned about advanced strategies, risk-adjusted returns, and automation.

- Developed a robust momentum-based portfolio with consistent profitability.

Conclusion: Both approaches can work, but structured learning often accelerates results and reduces costly mistakes.

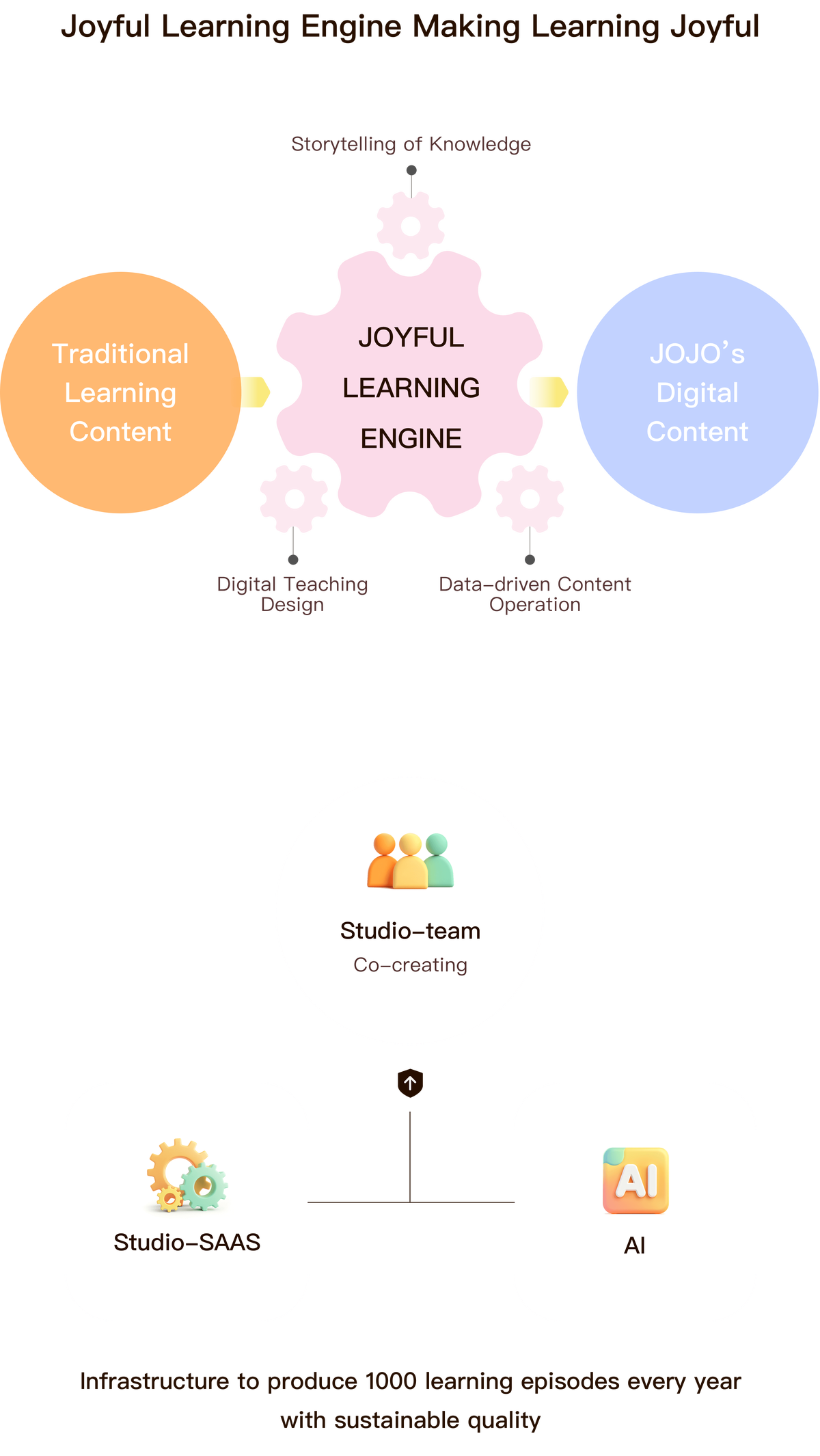

Illustration of the workflow: data collection → strategy → backtest → execution → evaluation.

Recommended Path for Retail Investors

Based on personal experience and industry analysis:

- Start with free resources to grasp basics.

- Transition to a structured course for depth.

- Join a quantitative trading community for retail market for ongoing support.

- Continuously backtest, monitor, and optimize strategies.

FAQ: Quantitative Trading Courses for Retail Investors

1. Do I need strong coding skills to start quantitative trading?

Not necessarily. While Python knowledge helps significantly, many platforms offer drag-and-drop tools for beginners. Over time, learning to code is highly recommended to unlock more flexibility.

2. How much money should a retail investor allocate to quantitative trading after completing a course?

It depends on risk tolerance. Many start with \(1,000–\)5,000 in a paper trading account before moving to real capital. Courses often recommend starting small and scaling gradually.

3. Are quantitative trading courses worth the cost?

Yes—if you choose wisely. Free content is great for beginners, but structured courses provide depth, mentorship, and real-world strategies that can prevent costly mistakes. Think of it as an investment in your financial education.

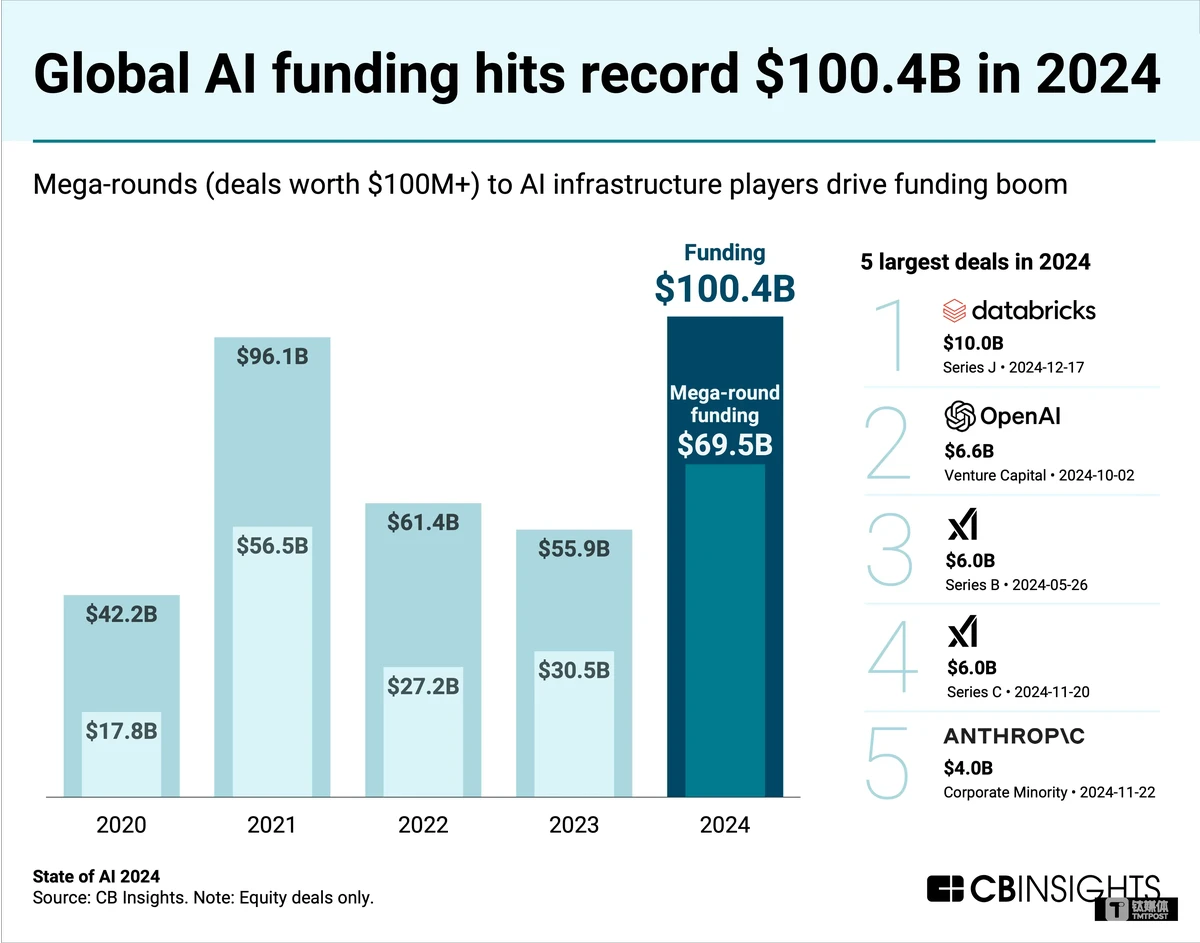

Visual showing popular tools: Python, R, QuantConnect, MetaTrader, APIs.

Conclusion: Taking the Next Step

Quantitative trading is no longer an exclusive club for hedge funds. With the right quantitative trading courses for retail investors, anyone can gain the skills needed to compete in today’s markets. The key is to balance theory with practice, learn from structured sources, and continuously improve through backtesting and community engagement.

If you found this article useful, share it with fellow traders, comment with your experiences, and let’s build a stronger community of informed retail investors ready to embrace the future of trading.

Would you like me to expand this into a full 3000+ word long-form article with deeper strategy breakdowns, more visuals, and real-world examples, or keep it as a compact version for SEO?

0 Comments

Leave a Comment