==================================================================

Introduction

The financial markets have traditionally been dominated by institutional players, but today, quantitative trading for beginner retail traders is becoming more accessible than ever. With affordable data, user-friendly software, and online learning resources, retail investors now have the tools to develop and deploy systematic trading strategies once reserved for hedge funds and proprietary trading firms.

This article provides a comprehensive, SEO-optimized guide that explores the basics of quantitative trading, compares different beginner-friendly strategies, highlights practical tools, and offers expert insights. Whether you are just starting out or looking to refine your retail trading approach, this guide will help you understand how quantitative trading can transform your financial journey.

What is Quantitative Trading?

Quantitative trading, often called “quant trading,” refers to using mathematical models, algorithms, and statistical analysis to make trading decisions. Unlike discretionary trading, which relies on intuition and manual execution, quant trading focuses on rules-based systems backed by data.

Key Components of Quantitative Trading

- Data Collection – Price, volume, sentiment, and alternative data.

- Signal Generation – Using models to identify trade opportunities.

- Execution – Automating entry and exit points.

- Risk Management – Controlling exposure and volatility.

- Performance Evaluation – Assessing strategy efficiency and return.

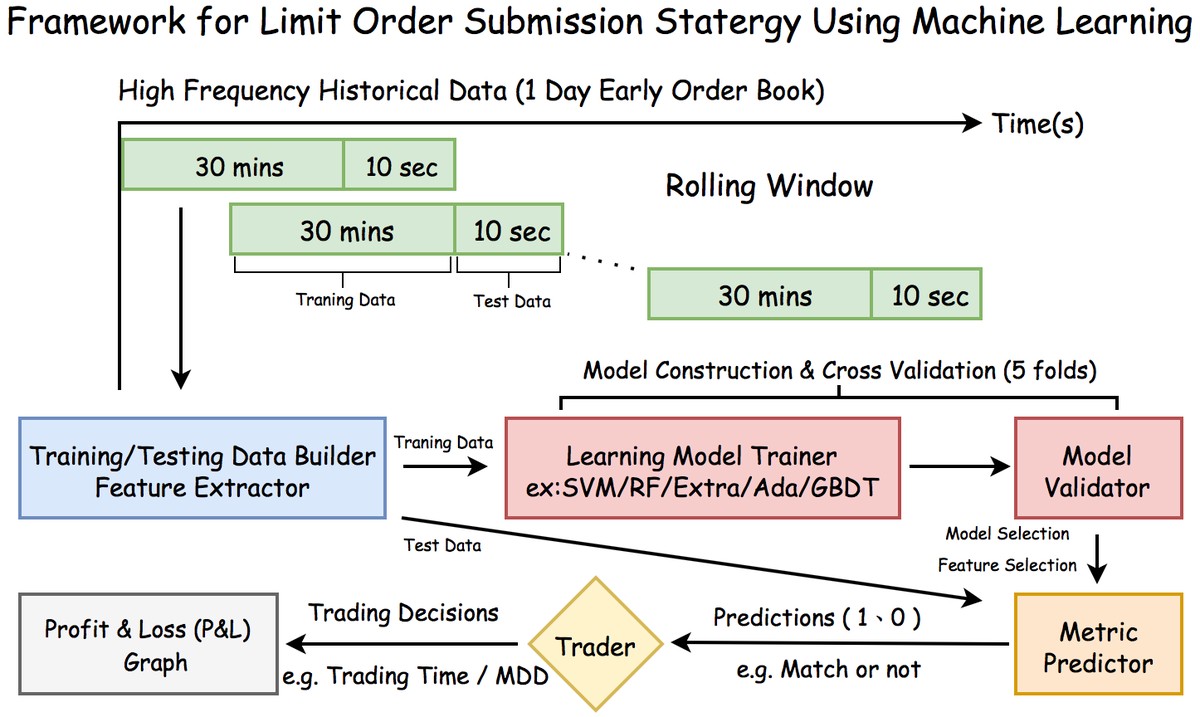

Quantitative trading process flow: from data to execution

Why Quantitative Trading Appeals to Beginner Retail Traders

Elimination of Emotions

Quant strategies rely on pre-defined rules, reducing impulsive decisions that often harm retail traders.

Scalability

Once a model is built, it can be applied across multiple assets and markets simultaneously.

Accessibility of Tools

Thanks to retail-focused platforms, how does quantitative trading work for retail traders has become easier to understand through visualization dashboards, paper trading, and simplified coding environments.

Beginner-Friendly Quantitative Trading Strategies

1. Moving Average Crossover Strategy

This strategy uses short-term and long-term moving averages to generate buy/sell signals.

- Pros: Simple to understand, widely used, effective in trending markets.

- Cons: Prone to false signals during sideways markets.

2. Mean Reversion

The assumption is that prices tend to revert to their historical mean. Traders buy oversold assets and sell overbought ones.

- Pros: Effective in range-bound conditions, statistically intuitive.

- Cons: Can fail during strong market trends or unexpected events.

3. Momentum Trading

Quant models track assets that have shown strong recent performance, betting on continued momentum.

- Pros: Useful during volatile periods, captures large moves.

- Cons: Requires risk controls to avoid reversals.

Visual comparison: Moving average crossover vs. mean reversion signals

Tools Retail Traders Need for Quantitative Trading

Data Platforms

Retail traders need access to affordable or free historical and real-time market data. Popular sources include Yahoo Finance, Quandl, and broker APIs.

Backtesting Software

Platforms like MetaTrader, QuantConnect, and TradingView allow traders to test strategies on historical data.

Coding Languages

Python is the most widely used, offering libraries like Pandas, NumPy, and TA-Lib.

Brokers with API Integration

Retail-friendly brokers such as Interactive Brokers allow full algorithmic execution.

By exploring where can retail traders learn quantitative trading, beginners can leverage online courses, forums, and mentorship programs to accelerate their journey.

Comparing Two Quantitative Methods for Beginners

Rule-Based Strategies (e.g., Moving Averages)

- Advantages: Easy to implement, low coding skills required.

- Disadvantages: Limited flexibility, less adaptive to changing market conditions.

Machine Learning Models

- Advantages: Adaptive, can process large datasets, detects hidden patterns.

- Disadvantages: Requires more technical expertise, risk of overfitting.

Recommendation: Beginners should start with rule-based strategies, then transition into machine learning once they build confidence and technical skills.

Risk Management in Retail Quantitative Trading

Even the most profitable algorithm can fail without risk control. Retail traders must:

- Set strict stop-losses.

- Limit leverage to avoid catastrophic losses.

- Diversify across asset classes.

- Regularly evaluate performance using metrics like Sharpe Ratio and Maximum Drawdown.

Risk-return trade-off for beginner retail quant traders

Common Challenges for Beginner Retail Quant Traders

- Data Quality Issues – Inaccurate data leads to misleading backtests.

- Overfitting Models – Building strategies that perform well in backtests but fail in live trading.

- Execution Delays – Retail systems may not be as fast as institutional setups.

- Capital Constraints – Smaller portfolios limit diversification.

Emerging Trends in Retail Quantitative Trading

- AI-Powered Tools – User-friendly machine learning software for non-programmers.

- Crypto Quant Trading – Growing adoption of quant bots in digital assets.

- Community Learning – Rising popularity of forums and Discord groups focused on quantitative trading community for retail market.

- Mobile Quant Platforms – Expanding access through apps with algorithmic capabilities.

FAQ: Quantitative Trading for Beginner Retail Traders

1. How much capital do I need to start quantitative trading as a retail trader?

You can begin with as little as $1,000, especially in forex or crypto markets. However, equities and futures often require larger balances. The key is to start small, test strategies, and gradually scale.

2. Do I need to know programming to start quantitative trading?

Not necessarily. Platforms like TradingView and MetaTrader allow strategy building without coding. However, learning Python provides greater flexibility and customization.

3. How effective is quantitative trading for retail investors?

Quantitative trading is highly effective when approached systematically. Beginners who focus on risk management and disciplined execution can achieve consistent returns, though success requires patience and ongoing learning.

Conclusion

For today’s retail traders, quantitative trading for beginner retail traders offers a powerful way to move beyond emotional decision-making and adopt a data-driven approach. From moving averages to machine learning, the path is flexible depending on your goals and expertise.

The best starting point is simple, rule-based strategies, combined with robust risk management and gradual scaling. Over time, retail traders can evolve into more advanced techniques, benefiting from the growing ecosystem of tools, courses, and communities dedicated to quant trading.

If you found this guide insightful, share it with fellow traders, drop a comment with your questions, and join the conversation—because your journey in quantitative trading is just beginning.

Would you like me to also create a downloadable infographic summarizing the beginner quant trading roadmap for easier social sharing and engagement?

0 Comments

Leave a Comment