In the evolving landscape of quantitative finance, the development and application of custom genetic algorithms (GAs) have emerged as a powerful tool for optimizing trading strategies. GAs offer quants the ability to search for optimal solutions in complex, high-dimensional spaces, making them ideal for developing and fine-tuning trading algorithms. This article will explore how to develop custom genetic algorithms tailored for quantitative trading, the benefits and challenges associated with them, and how they can be leveraged to enhance trading performance.

Understanding Genetic Algorithms in Quantitative Trading

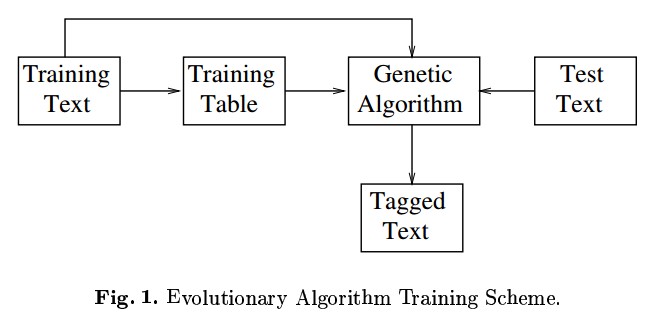

Genetic algorithms are search heuristics inspired by the process of natural selection. They use mechanisms such as selection, crossover, mutation, and inheritance to evolve a population of candidate solutions toward an optimal solution over successive generations. For quants, genetic algorithms offer a robust method for solving optimization problems, especially in complex financial models where traditional approaches may struggle.

How Genetic Algorithms Work

At their core, genetic algorithms mimic the process of natural evolution. Here’s a brief breakdown of how they function:

Initialization: A population of potential solutions (individuals) is randomly generated. Each solution is typically encoded as a chromosome (or string of values).

Selection: Based on a fitness function (which measures how well a solution performs), individuals are selected for reproduction. The fittest individuals are more likely to “reproduce” and pass on their genetic material.

Crossover: Two selected individuals are combined to create a new solution (offspring), mimicking biological crossover. This allows for the exchange of information between solutions.

Mutation: With a small probability, the offspring undergo mutation, introducing slight variations in their genetic code to explore new areas of the solution space.

Replacement: The new generation of solutions replaces the old one, and the process repeats for many generations until an optimal or satisfactory solution is found.

Why Genetic Algorithms Are Effective in Quantitative Finance

In quantitative finance, the complexity and non-linearity of financial models make optimization difficult using traditional methods. Genetic algorithms are particularly effective because they:

Can handle large, complex solution spaces.

Are less likely to get stuck in local optima, unlike gradient-based optimization methods.

Can be easily adapted to a wide range of financial problems, from portfolio optimization to trading strategy design.

Key Strategies for Developing Custom Genetic Algorithms for Quantitative Trading

When developing custom GAs for quantitative trading, there are several strategies quants can employ to ensure optimal performance. Let’s explore two of the most popular approaches: parameter optimization and portfolio construction.

- Parameter Optimization Using Genetic Algorithms

One of the most common applications of genetic algorithms in quantitative trading is optimizing the parameters of a trading strategy. Many trading algorithms rely on a set of parameters—such as moving averages, thresholds, or risk limits—that significantly affect performance. Genetic algorithms can be used to fine-tune these parameters by searching through a wide range of possible values.

How It Works:

Define the Parameters: Select the parameters that influence your trading strategy. These could include indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), or Bollinger Bands.

Fitness Function: The fitness function in this case is typically based on the performance of the strategy, such as total return, Sharpe ratio, or drawdown. The genetic algorithm aims to maximize this fitness function by evolving the parameters over time.

Evolutionary Process: Through selection, crossover, and mutation, the GA iteratively adjusts the parameters to improve strategy performance.

Advantages:

Can explore a wide search space to find optimal parameters.

Can adapt to market conditions by re-optimizing parameters periodically.

Disadvantages:

Computationally expensive, especially when dealing with large data sets or multiple parameters.

Overfitting can occur if the fitness function is not carefully designed.

- Portfolio Construction Using Genetic Algorithms

Another powerful application of genetic algorithms is portfolio construction. A well-optimized portfolio should balance risk and return, and genetic algorithms can help find the best asset allocation based on historical performance, risk tolerance, and other factors.

How It Works:

Asset Selection: The algorithm first selects a set of assets (e.g., stocks, bonds, commodities) to form the universe of potential investments.

Fitness Function: The fitness function evaluates portfolios based on their performance metrics, such as expected return, volatility, and Sharpe ratio.

Evolutionary Process: The genetic algorithm iteratively adjusts the weightings of assets in the portfolio, seeking the optimal balance between risk and return.

Advantages:

Can handle large and complex portfolios with many assets.

Provides a flexible and adaptive approach to portfolio optimization.

Disadvantages:

Computationally intensive, especially when working with many assets and large data sets.

Requires careful calibration of risk tolerance to avoid overfitting.

Comparison of Genetic Algorithms and Traditional Optimization Methods

While genetic algorithms are powerful tools, they are not always the best solution for every problem. It’s essential to compare them to traditional optimization methods, such as gradient descent or quadratic programming, to determine when to use each approach.

Genetic Algorithms vs. Gradient Descent

Genetic Algorithms: Do not require derivatives and can optimize non-differentiable, non-convex functions. They are less prone to getting stuck in local optima and are more suitable for complex problems like portfolio optimization.

Gradient Descent: Requires the objective function to be differentiable and may struggle with non-convex functions. It is efficient for problems with smooth, well-behaved objective functions but may not perform well in highly complex or noisy environments.

Genetic Algorithms vs. Quadratic Programming

Genetic Algorithms: Can handle large and non-linear problems, making them suitable for portfolio optimization with complex constraints.

Quadratic Programming: Works well for linear and quadratic optimization problems but can be computationally expensive and less effective for non-linear optimization tasks.

Conclusion: When to Use Genetic Algorithms

In general, genetic algorithms are most useful when:

The problem is highly non-linear or involves large search spaces.

Traditional optimization methods are unable to escape local minima or maxima.

The solution requires a flexible and adaptive approach, such as in portfolio construction or trading parameter optimization.

FAQ: Common Questions About Developing Custom Genetic Algorithms for Quants

- How do genetic algorithms improve modeling accuracy in quantitative trading?

Genetic algorithms improve modeling accuracy by allowing quants to explore a wide range of solutions and adaptively refine models over time. By optimizing parameters or selecting assets for a portfolio, GAs can identify combinations that maximize performance metrics like returns, risk-adjusted returns, and Sharpe ratios, ultimately improving the accuracy of predictive models.

- What are the key challenges when using genetic algorithms in trading?

One of the main challenges is the risk of overfitting, as the algorithm may adapt too closely to historical data and fail to generalize to new market conditions. Additionally, GAs are computationally expensive and require substantial processing power, especially when working with large datasets or many parameters.

- Can genetic algorithms be used for real-time trading?

While genetic algorithms can be applied to real-time trading, they are typically used for optimizing strategies off-line and adjusting parameters periodically. For real-time execution, quants often use simpler, faster models, while GAs are employed for optimizing parameters or strategies in backtesting.

Conclusion

Custom genetic algorithms offer an exciting and powerful tool for quantitative traders seeking to optimize their strategies and portfolios. By developing tailored GAs, quants can unlock more accurate models, adaptive strategies, and robust trading systems. While there are challenges, such as computational costs and the risk of overfitting, the benefits of using GAs for complex financial problems are undeniable. With the right approach, genetic algorithms can significantly enhance the performance of trading strategies in a dynamic market environment.

For more insights on genetic algorithms in quantitative finance, check out these resources:

0 Comments

Leave a Comment