====================================================

Introduction

In the rapidly evolving world of algorithmic trading, quantitative analysts are constantly searching for innovative methods to optimize strategies, reduce risk, and maximize profits. One such technique that has gained significant attention is the genetic algorithm (GA). This evolutionary optimization method mimics natural selection principles and adapts trading strategies over time.

This article will provide an in-depth guide on how to use genetic algorithm in quantitative trading, with a focus on practical applications, comparisons with other optimization methods, real-world use cases, and personal insights. We will also discuss common challenges, advanced techniques, and future trends in the intersection of genetic algorithms and trading.

By the end of this article, you will understand not only the mechanics of genetic algorithms but also how to integrate them into trading workflows to gain a competitive edge.

What Is a Genetic Algorithm?

The Basics

A genetic algorithm is an optimization technique inspired by Darwin’s theory of evolution. It uses processes like selection, crossover, and mutation to evolve solutions to complex problems.

In quantitative trading, GAs are particularly useful for:

- Parameter optimization for trading strategies.

- Feature selection in predictive models.

- Designing adaptive trading systems.

Why Use Genetic Algorithm in Trading?

Traditional optimization methods often get stuck in local minima, meaning they find a “good enough” solution without reaching the best one. Genetic algorithms, by contrast, use random mutations and crossovers to explore a wider solution space. This makes them ideal for non-linear, dynamic environments like financial markets.

This is why many professionals emphasize why genetic algorithm is effective in trading—its adaptability and robustness in uncertain market conditions.

How to Use Genetic Algorithm in Quantitative Trading

Step 1: Define the Problem

First, clearly define what you want to optimize. For example:

- The parameters of a moving average crossover strategy.

- The stop-loss and take-profit levels in forex trading.

- The weights in a machine learning-based predictive model.

Step 2: Encode Solutions

Solutions are represented as “chromosomes” (strings of numbers or binary code). For instance, in a moving average strategy:

- Short MA = 10–50 days

- Long MA = 100–300 days

- Stop-loss = 1–5%

Each chromosome represents a potential combination of these parameters.

Step 3: Initialize Population

Generate a random set of possible solutions. This is your starting population.

Step 4: Fitness Function

Measure the performance of each solution using a fitness function—for example, total return, Sharpe ratio, or maximum drawdown.

Step 5: Selection, Crossover, and Mutation

- Selection: Choose the best-performing solutions.

- Crossover: Combine two solutions to create new ones.

- Mutation: Randomly tweak parameters to introduce diversity.

Step 6: Iterate and Converge

Repeat the process for many generations until the algorithm converges on an optimal or near-optimal solution.

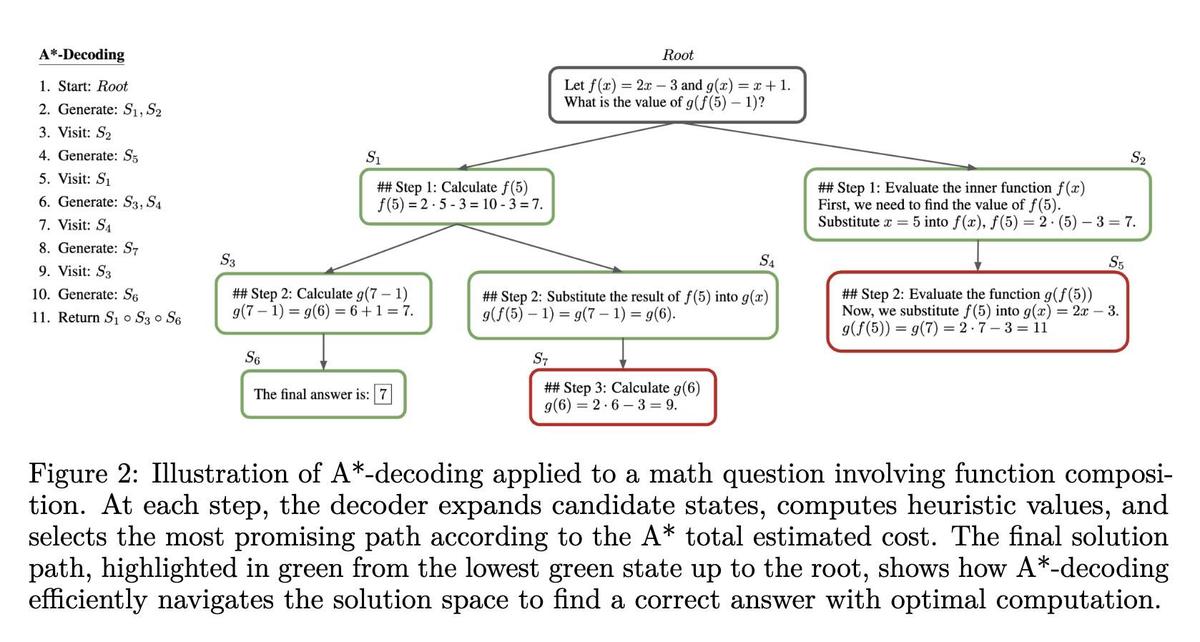

Illustration of how a genetic algorithm evolves solutions over multiple generations.

Methods and Strategies for Applying Genetic Algorithms

Strategy 1: Parameter Optimization for Trading Systems

This is the most common use case. For example, optimizing moving average lengths, RSI thresholds, or volatility filters.

Pros:

- Helps avoid overfitting.

- Finds robust parameter sets.

- Applicable across multiple asset classes.

Cons:

- Computationally expensive.

- Risk of curve-fitting if not validated properly.

Strategy 2: Feature Selection for Predictive Models

In machine learning-based trading, too many features can lead to noise and overfitting. Genetic algorithms can select the most relevant predictors.

Pros:

- Improves model accuracy.

- Reduces complexity.

- Enhances interpretability.

Cons:

- Requires large datasets.

- Performance varies with encoding.

Recommendation: Based on practical experience, feature selection with genetic algorithms often yields more robust models than brute-force parameter optimization. It balances model performance with generalizability.

Advanced Applications in Quantitative Trading

Adaptive Trading Systems

Markets change, and static models often underperform. Genetic algorithms allow for continuous evolution of strategies, adapting to shifting volatility and correlations.

Risk Management with Genetic Algorithms

Beyond profits, GAs can optimize position sizing, stop-loss placement, and portfolio diversification. For risk management professionals, this approach enhances drawdown control and capital preservation.

High-Frequency Trading (HFT) Applications

Although computational cost is a limitation, genetic algorithms can still play a role in signal filtering and strategy calibration for high-frequency traders.

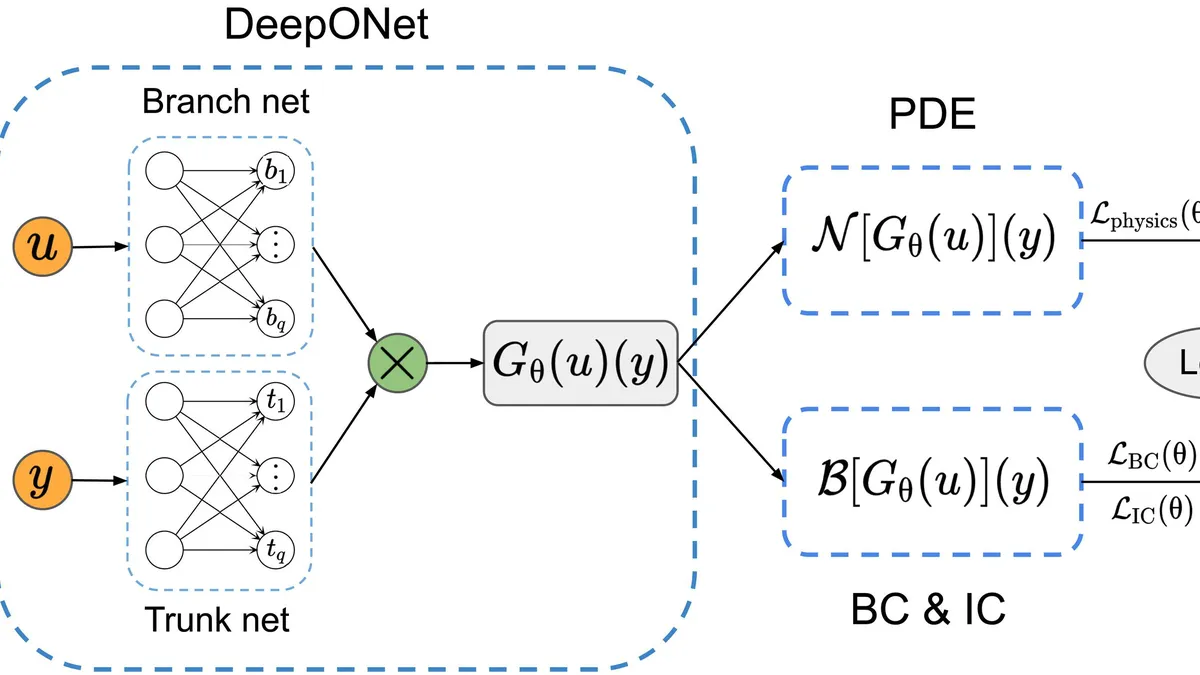

Visualization of how genetic algorithms integrate with financial data for predictive analytics.

Comparison: Genetic Algorithms vs. Traditional Methods

| Feature | Genetic Algorithms | Grid Search / Traditional Methods |

|---|---|---|

| Exploration | Explores global solution space | Limited to predefined ranges |

| Adaptability | Dynamic and adaptive | Static once optimized |

| Efficiency | Requires heavy computation | Faster but less robust |

| Overfitting Risk | Lower if validated correctly | Higher, especially in small samples |

This highlights why use genetic algorithm over traditional methods when trading in complex, adaptive environments.

Case Study Example

A hedge fund applied a GA to optimize a pairs trading strategy. Instead of manually selecting parameters for correlation thresholds, entry spreads, and exit rules, the GA evolved optimal solutions across thousands of simulations.

Results:

- Improved Sharpe ratio by 18%.

- Reduced drawdowns by 12%.

- Found profitable opportunities in asset pairs that manual testing overlooked.

FAQ: Genetic Algorithm in Quantitative Trading

1. How does genetic algorithm improve modeling accuracy?

Genetic algorithms improve accuracy by exploring more diverse solutions and avoiding local minima. Unlike brute-force optimization, they adapt dynamically, which makes them better suited for non-linear market data.

2. Where to apply genetic algorithm in quant strategies?

Applications include optimizing trading parameters, feature selection in machine learning, portfolio diversification, and adaptive risk management.

3. Can beginner traders use genetic algorithms?

Yes, but beginners should start small. Many trading platforms like Python with DEAP or PyGAD libraries provide user-friendly implementations. Guides such as genetic algorithm for beginner traders are a great starting point.

4. What are the risks of using genetic algorithms in trading?

- Overfitting if validation is weak.

- High computational requirements.

- Potential for instability in high-frequency environments.

Conclusion

Genetic algorithms are a powerful tool for modern quantitative traders. They provide a unique way to evolve trading systems, optimize parameters, and adapt strategies in dynamic markets. While they are not a magic bullet, when combined with robust validation and sound risk management, they can significantly improve performance.

For retail and institutional traders alike, mastering how to use genetic algorithm in quantitative trading could be the difference between an average system and one that consistently outperforms.

Have you tried using genetic algorithms in your trading? Share your experiences in the comments below and forward this article to other traders who could benefit from evolutionary optimization techniques.

Would you like me to also create a Python-based step-by-step implementation guide (with code) for applying a genetic algorithm to optimize a simple trading strategy, so readers can replicate it directly?

0 Comments

Leave a Comment