================================================================================================

Introduction

In today’s competitive financial markets, traders are no longer relying on intuition alone. Instead, they leverage powerful optimization tools for trading to enhance their strategies, manage risk, and maximize returns. Whether you are a retail investor, a quant researcher, or a hedge fund manager, knowing where to find optimization tools for trading is crucial to staying ahead.

This guide provides a detailed roadmap for identifying, comparing, and implementing optimization solutions. Drawing from both personal experience and the latest industry trends, we will explore multiple optimization methods, compare their pros and cons, and recommend the best practices.

What Are Optimization Tools in Trading?

Definition

Optimization tools in trading are software or algorithms designed to improve strategy performance, risk management, and portfolio allocation. These tools allow traders to test different parameters, evaluate outcomes, and identify the most effective configurations.

Why Traders Need Optimization

As outlined in why optimization is important in quantitative trading, markets are dynamic, and strategies that perform well under one set of conditions may fail in another. Optimization ensures adaptability and resilience by constantly refining models.

Core Functions of Optimization Tools

- Backtesting Enhancements: Improve reliability of historical testing.

- Parameter Tuning: Adjust trading model inputs for higher efficiency.

- Risk Optimization: Balance return with volatility and drawdowns.

- Real-Time Adjustments: Adapt strategies to changing market conditions.

Where to Find Optimization Tools for Trading

1. Professional Trading Platforms

Many professional trading platforms integrate optimization tools. Platforms like MetaTrader, NinjaTrader, and TradingView offer optimization features that help retail and professional traders fine-tune their strategies.

Pros: Easy to access, user-friendly interfaces.

Cons: Limited scalability for institutional-level trading.

2. Quantitative Research Software

Tools like MATLAB, R, and Python-based libraries provide advanced optimization frameworks. Quant professionals rely on these for custom strategy building and optimization.

Pros: Highly flexible, suitable for complex models.

Cons: Requires programming knowledge and steep learning curve.

3. Institutional-Grade Solutions

Hedge funds and investment banks often use specialized optimization software such as QuantConnect, AlgoTrader, or Bloomberg Terminal optimization modules.

Pros: Scalable, integrates with institutional trading systems.

Cons: Expensive, requires technical infrastructure.

4. Open-Source Tools

There is a growing ecosystem of open-source optimization tools for quantitative researchers. Libraries like scikit-learn, PyPortfolioOpt, and TensorFlow enable traders to apply machine learning and advanced optimization.

Pros: Cost-effective, cutting-edge innovation.

Cons: Requires continuous maintenance and expertise.

Two Key Methods of Optimization

Method 1: Parameter Optimization

Description

Traders adjust specific parameters (e.g., moving average periods, stop-loss levels) within a trading model to maximize performance.

Advantages

- Easy to implement.

- Works well for rule-based strategies.

Disadvantages

- Risk of overfitting: Strategies may perform well in backtests but fail in live markets.

- Limited adaptability to sudden market changes.

Method 2: Machine Learning Optimization

Description

Algorithms use machine learning models to analyze large datasets and dynamically optimize trading parameters.

Advantages

- Adaptive to changing market conditions.

- Can uncover hidden patterns missed by human analysis.

Disadvantages

- Requires large amounts of data.

- Complex and resource-intensive.

Strategy Comparison

| Method | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Parameter Optimization | Retail traders, beginners | Simple, effective for small-scale strategies | High risk of overfitting |

| Machine Learning Optimization | Hedge funds, quant professionals | Adaptive, data-driven | Requires advanced expertise |

Recommendation: For most traders, start with parameter optimization for simplicity, and gradually adopt machine learning optimization as experience grows.

How to Implement Optimization in Trading

As highlighted in how to apply optimization in trading models, implementation requires three steps:

- Data Preparation: Collect reliable historical and real-time market data.

- Optimization Process: Test different scenarios using statistical or ML models.

- Validation: Use out-of-sample testing to avoid overfitting.

This ensures your strategy is both robust and scalable.

Personal Experience with Optimization Tools

When I first started algorithmic trading, I relied solely on backtesting in MetaTrader. While this gave me confidence, I quickly realized that my strategies struggled in live conditions. By transitioning to Python-based optimization frameworks, I could integrate real-time optimization for algo traders, improve execution, and drastically reduce drawdowns. The experience highlighted the importance of adaptability in optimization.

Industry Trends in Optimization Tools

1. AI-Driven Optimization

Artificial intelligence is revolutionizing how optimization works, allowing for self-learning algorithms that adapt automatically.

2. Cloud-Based Optimization Platforms

Traders now use cloud-based solutions to scale optimization processes, reducing infrastructure costs.

3. Risk-Focused Optimization

Institutional investors are prioritizing risk optimization for portfolio managers, ensuring strategies can handle systemic shocks.

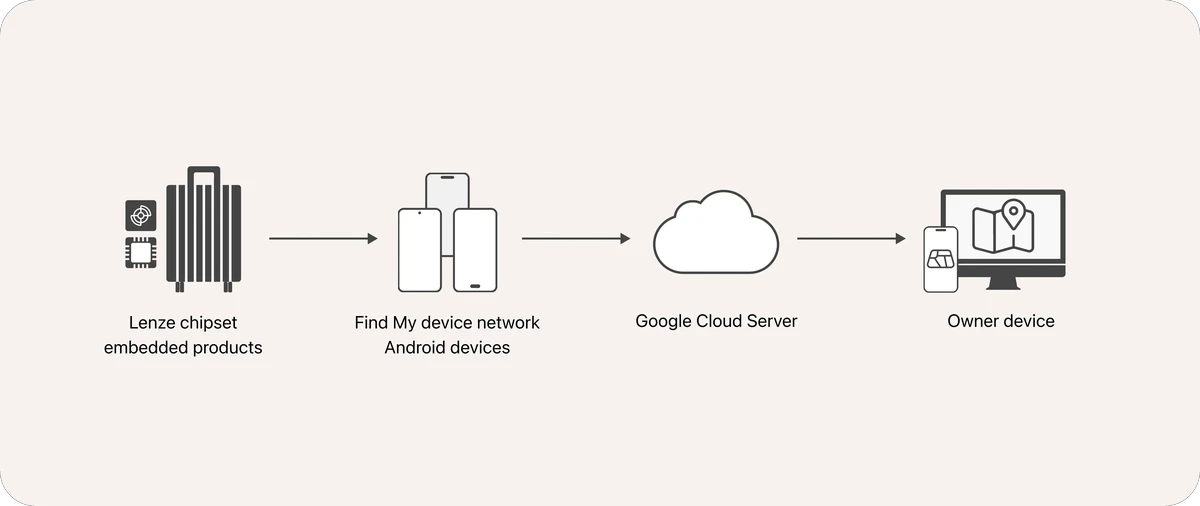

Visual Representation

A step-by-step visualization of how optimization tools integrate into trading workflows.

Practical Checklist for Finding Optimization Tools

- Define Your Trading Needs: Retail, professional, or institutional.

- Evaluate Platform Features: Backtesting, real-time optimization, reporting.

- Compare Costs: Subscription fees vs. open-source solutions.

- Assess Scalability: Can it handle growth in trade volume and complexity?

- Check Community and Support: Active developer communities add long-term value.

- Prioritize Risk Controls: Ensure optimization includes volatility and drawdown analysis.

FAQ: Where to Find Optimization Tools for Trading

1. What is the best optimization tool for beginners?

Beginners should start with MetaTrader or TradingView, as they are user-friendly and provide built-in optimization features without requiring coding.

2. Are open-source optimization tools reliable?

Yes, open-source tools like scikit-learn and PyPortfolioOpt are widely used by quant professionals. However, traders must have the technical skills to maintain and update these systems.

3. How do professionals use optimization tools?

Professionals use tools that combine backtesting, real-time monitoring, and risk analysis. They also integrate machine learning to adapt models continuously. As discussed in how to optimize backtesting for trading strategies, validation and out-of-sample testing are crucial for institutional adoption.

Conclusion

Knowing where to find optimization tools for trading is a game-changer for modern traders. From retail platforms to institutional-grade solutions, optimization enhances performance, manages risk, and builds sustainable strategies.

Whether you’re a beginner or a quant professional, the path to success lies in selecting the right toolset, balancing parameter tuning with machine learning optimization, and ensuring robust validation.

Call to Action

If this guide helped you understand trading optimization tools, share it with your network and leave a comment below about your favorite optimization method. Let’s build a stronger trading community by exchanging insights on the best optimization practices.

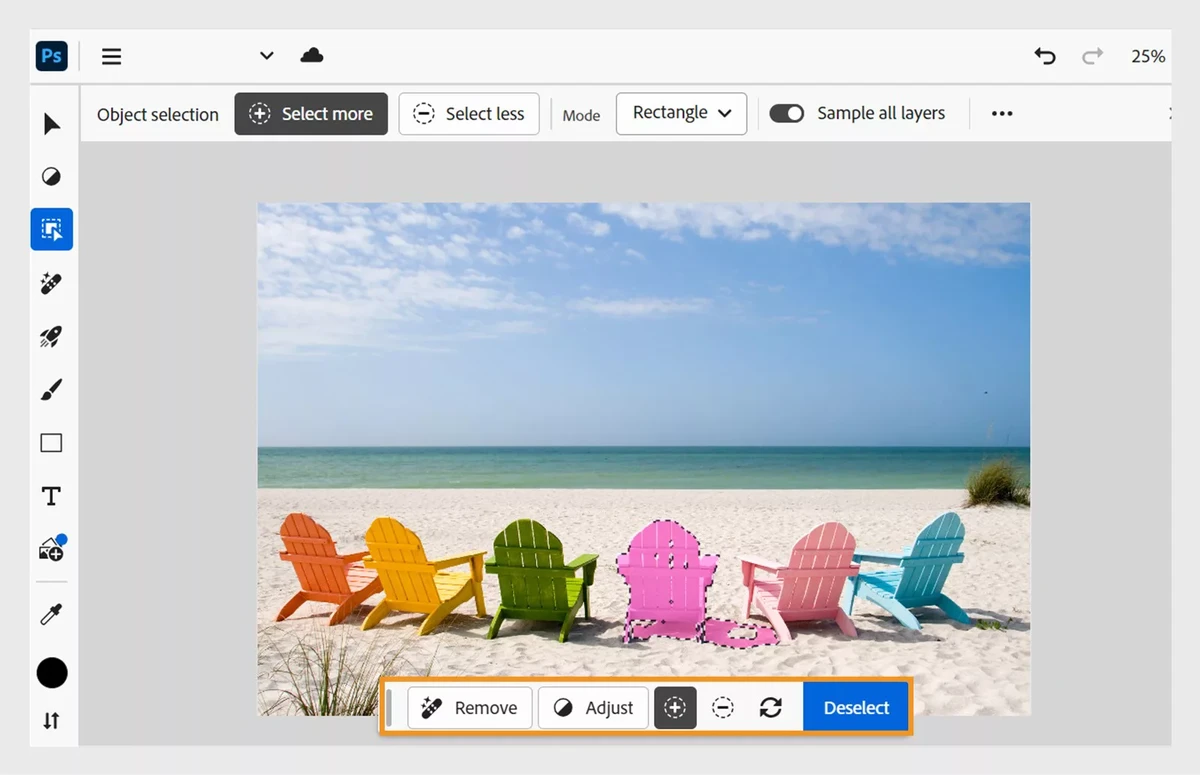

An illustration showing optimization tools enhancing algorithmic trading performance.

0 Comments

Leave a Comment