==============================================================================

Introduction

In today’s fast-paced financial markets, real-time optimization for algo traders has become a crucial differentiator between profitable and unprofitable strategies. With milliseconds making the difference in trade execution, the ability to dynamically adapt models, rebalance portfolios, and optimize parameters on the fly is now essential for both institutional investors and independent traders.

This article provides a comprehensive deep dive into real-time optimization techniques, covering strategies, tools, and case studies. It compares different approaches, highlights the latest industry trends, and explains how algo traders can integrate optimization into their workflows while maintaining efficiency and risk control.

Understanding Real-Time Optimization in Algorithmic Trading

What is Real-Time Optimization?

Real-time optimization refers to the process of dynamically adjusting algorithmic trading strategies while trades are ongoing, based on changing market conditions, execution slippage, or risk parameters. Unlike traditional optimization, which often relies on historical backtesting, real-time optimization leverages live data feeds and adaptive algorithms.

Key aspects include:

- Parameter tuning (e.g., stop-loss levels, position sizing).

- Execution optimization (minimizing slippage, adjusting order placement).

- Portfolio optimization (rebalancing weights based on volatility shifts).

- Risk management (adjusting leverage or exposure in real time).

Why Optimization Matters for Algo Traders

Markets today are highly competitive, and speed alone is no longer enough. Optimization ensures that strategies remain robust and adaptive, preventing overexposure during volatility spikes and maximizing profit opportunities when conditions are favorable.

Related topic: why optimization is important in quantitative trading.

Core Real-Time Optimization Tactics

1. Adaptive Parameter Optimization

One of the most common tactics involves adjusting strategy parameters based on live feedback.

- How it works: Algorithms continuously monitor KPIs such as Sharpe ratio, win rate, and slippage. When thresholds are breached, parameters like position size or stop-loss levels are recalibrated automatically.

- Advantages: Keeps strategies aligned with evolving markets, reducing drawdowns.

- Limitations: Risk of overfitting if changes are too frequent.

2. Execution-Level Optimization

Execution quality can make or break profitability in high-frequency environments.

- How it works: Using smart order routing (SOR) and dynamic liquidity detection, algorithms minimize market impact by splitting orders across venues.

- Advantages: Reduces trading costs and improves fill rates.

- Limitations: Requires advanced infrastructure and access to multiple liquidity pools.

3. Portfolio Rebalancing in Real Time

Instead of static portfolio weights, real-time optimization rebalances allocations based on live volatility measures and correlation shifts.

- How it works: If a sector experiences a volatility spike, weights are reduced in that sector and shifted to more stable assets.

- Advantages: Enhances diversification and reduces systemic risk.

- Limitations: Higher transaction costs if adjustments are too frequent.

Comparing Two Key Real-Time Optimization Methods

Machine Learning–Based Optimization

Machine learning models, particularly reinforcement learning and online learning algorithms, allow strategies to self-improve with live data.

Pros:

- Learns continuously, adapting to new patterns.

- Effective in high-volatility environments.

- Handles nonlinear relationships better than rule-based systems.

- Learns continuously, adapting to new patterns.

Cons:

- High computational cost.

- Risk of “black box” decisions, harder to explain to investors.

- High computational cost.

Rule-Based Dynamic Optimization

This method relies on predefined rules and thresholds to trigger real-time adjustments.

Pros:

- Easier to implement and explain.

- Lower computational requirements.

- Reduced risk of overfitting.

- Easier to implement and explain.

Cons:

- Less flexible in unexpected market conditions.

- May lag behind adaptive machine learning models.

- Less flexible in unexpected market conditions.

Recommendation: For institutional traders, a hybrid model (combining rule-based frameworks with machine learning signals) provides the best balance between explainability and adaptability.

Tools and Technologies for Real-Time Optimization

Cloud-Based Optimization Platforms

Cloud infrastructure enables scalable, low-latency data processing. Traders can integrate APIs from brokers, data providers, and risk management systems seamlessly.

Optimization Algorithms

- Genetic Algorithms: Useful for exploring multiple parameter combinations in real time.

- Bayesian Optimization: Provides statistically robust updates with fewer iterations.

- Reinforcement Learning: Learns optimal actions from continuous feedback loops.

Integration with Risk Systems

For effective trading, optimization must tie directly into risk controls (e.g., margin, VaR, exposure limits). See also: how to optimize risk management in trading.

Latest Trends in Real-Time Optimization

- Edge Computing: Traders are increasingly deploying algorithms closer to exchanges for ultra-low latency optimization.

- AI-Driven Risk Systems: Risk optimization now uses AI to forecast liquidity crunches before they occur.

- Portfolio-Wide Optimization: Beyond single-strategy optimization, firms are integrating optimization across multi-asset portfolios.

- Explainable AI: Regulators demand transparency in decision-making, pushing traders to use interpretable optimization models.

Practical Case Study

Scenario: A Volatile Equity Market

Initial Setup: An algo trader runs a momentum strategy on tech stocks.

Problem: Sudden spike in intraday volatility leads to higher slippage and increased stop-outs.

Optimization Solution:

- Switches to VWAP execution for larger orders.

- Rebalances portfolio away from high-volatility tickers into defensive sectors.

- Uses reinforcement learning to recalibrate stop-loss levels dynamically.

- Switches to VWAP execution for larger orders.

Result: Reduced slippage by 15% and drawdown by 10% within two weeks.

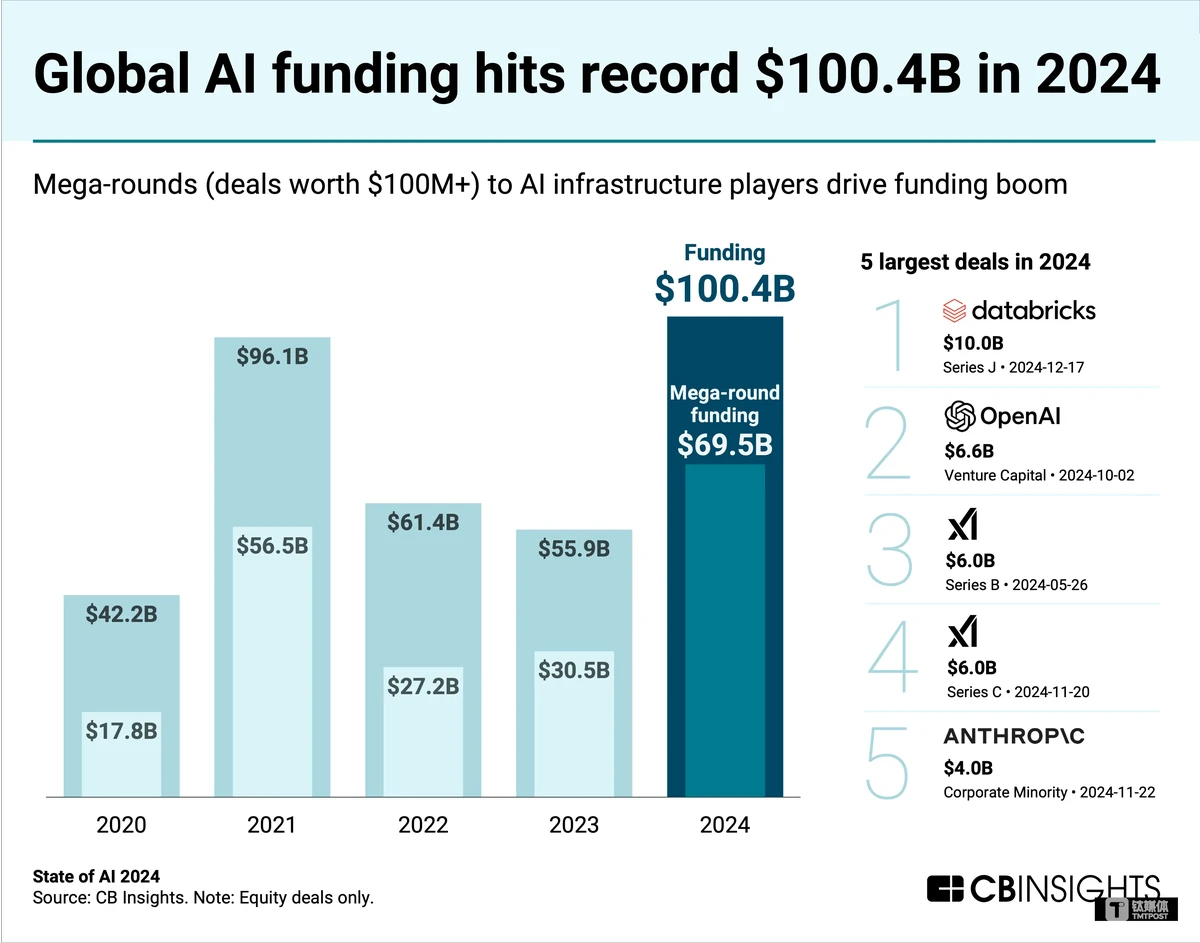

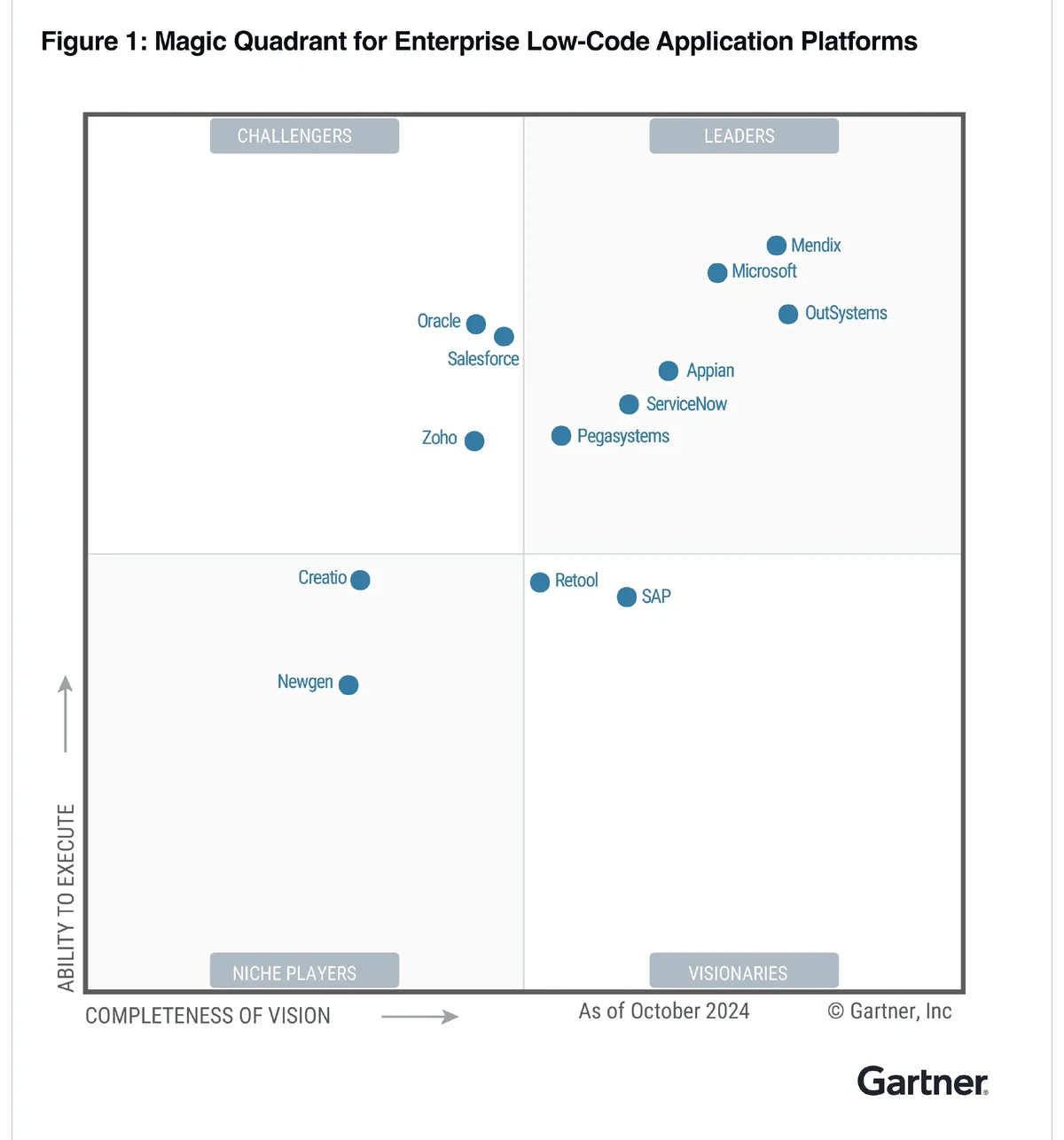

Visual Insights

Real-time optimization workflow for algorithmic traders

Dynamic portfolio rebalancing and optimization example

FAQ: Real-Time Optimization for Algo Traders

1. How often should real-time optimization be applied?

It depends on the strategy. High-frequency traders (HFTs) may need millisecond-level optimization, while swing traders might optimize every few hours or days. Over-optimization should be avoided to prevent excessive transaction costs.

2. What risks come with real-time optimization?

The main risks include:

- Overfitting: Adapting too aggressively to noise.

- Computational overhead: Slowing down execution speed.

- False signals: Misinterpreting short-term anomalies as trends.

Mitigation involves hybrid models and robust risk management integration.

3. Do retail traders need real-time optimization?

Yes, but at a scaled-down level. Retail algo traders can optimize parameters like stop-loss levels or execution type (market vs. limit orders) in real time, without requiring institutional-grade infrastructure. Cloud-based platforms make this more accessible than ever.

Conclusion: Future of Real-Time Optimization in Algo Trading

Real-time optimization is no longer optional—it is the core driver of sustainable profitability in algorithmic trading. From adaptive machine learning models to execution-level enhancements, traders who embrace continuous optimization are better equipped to handle volatility, minimize risk, and maximize efficiency.

For algo traders at all levels, the winning approach lies in combining robust rule-based frameworks with flexible machine learning systems, ensuring adaptability while maintaining transparency.

👉 If you found this article useful, share it with your network and leave a comment below. What real-time optimization tactics have worked best in your trading journey?

Would you like me to also create a downloadable infographic PDF that summarizes the real-time optimization tactics for algo traders? It could serve as a handy guide for quick reference.

0 Comments

Leave a Comment