Execution algorithms are the backbone of modern trading, enabling institutional investors, hedge funds, and even advanced retail traders to execute orders efficiently, minimize costs, and reduce market impact. Understanding how execution algorithm works is essential for anyone who wants to grasp how financial markets handle large orders without significantly disrupting prices.

This article explores the mechanics of execution algorithms, compares key strategies, examines their benefits and drawbacks, and offers practical guidance on how to integrate them into trading workflows.

Table of Contents

Introduction: What Are Execution Algorithms?

Core Principles of Execution Algorithms

Market Impact Reduction

Transaction Cost Minimization

Speed vs. Discretion

Popular Execution Algorithm Strategies

VWAP (Volume-Weighted Average Price)

TWAP (Time-Weighted Average Price)

Implementation Shortfall

Liquidity-Seeking Algorithms

Methodology A: Rule-Based Execution

Methodology B: Adaptive and AI-Driven Execution

Comparing Rule-Based vs. Adaptive Execution

Execution Algorithms in Practice

Common Pitfalls and Why Execution Algorithms Fail

FAQ

Conclusion and Call to Action

Introduction: What Are Execution Algorithms?

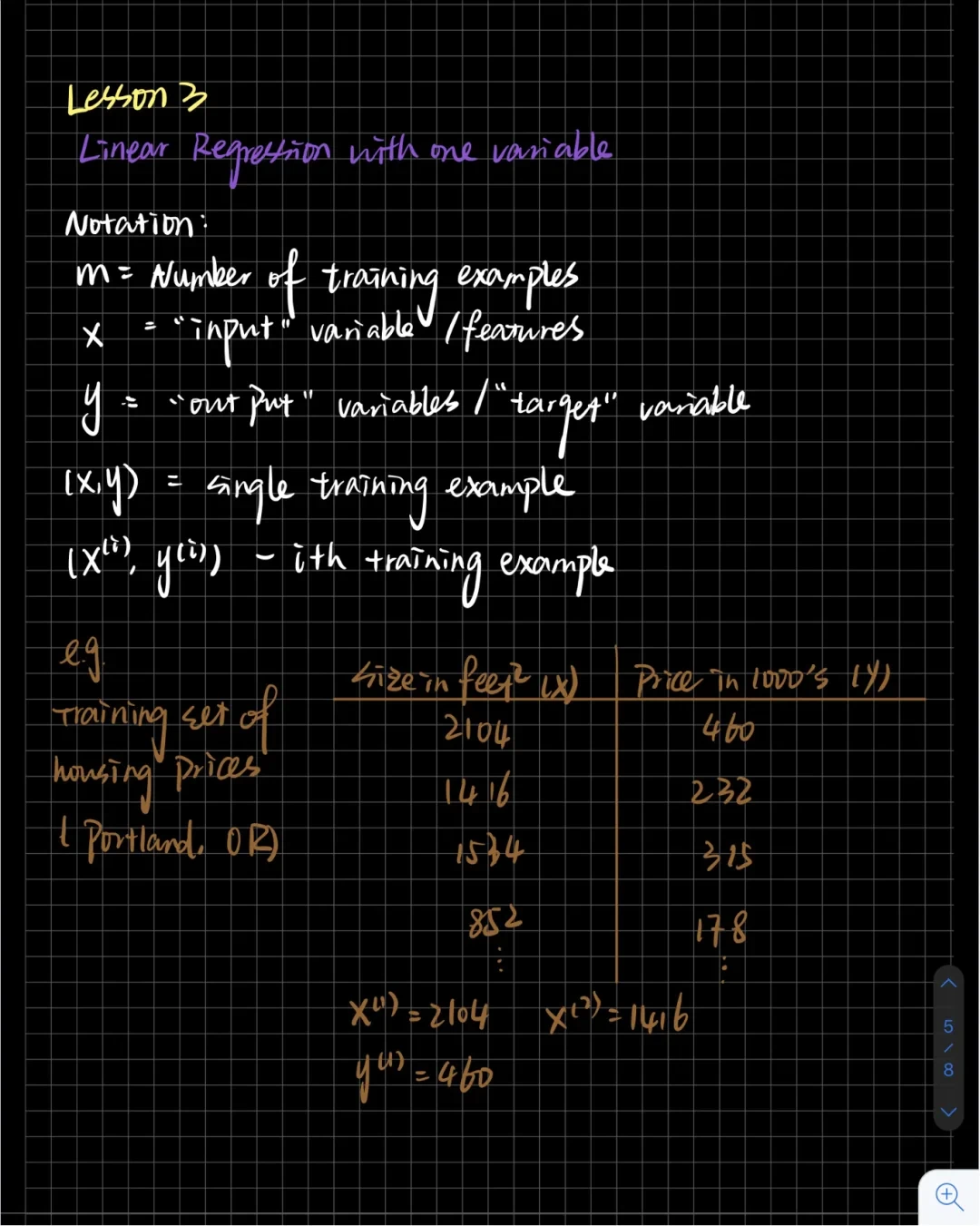

An execution algorithm is a computer program designed to place and manage trading orders in financial markets. Instead of submitting one large block trade, the algorithm breaks it into smaller orders and executes them strategically over time to reduce market impact, improve fill quality, and optimize trading costs.

Execution algorithms are widely used by institutional traders, hedge funds, and professional trading desks. However, as technology advances, they are also becoming accessible to retail traders through broker platforms.

This makes it important for traders at all levels to understand how execution algorithm works, not only for performance but also for strategic decision-making.

Core Principles of Execution Algorithms

Execution algorithms are built around a few fundamental principles:

Market Impact Reduction

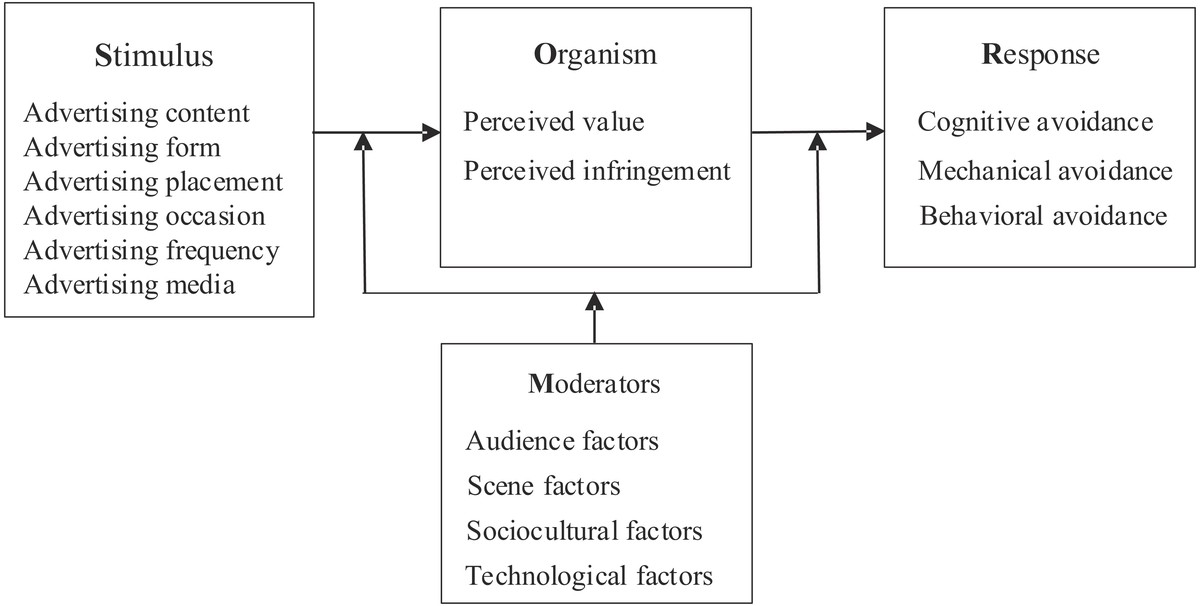

Large orders can move the market against the trader. Algorithms minimize this by slicing orders into smaller pieces and distributing them across venues.

Transaction Cost Minimization

Execution cost includes spreads, fees, and slippage. Algorithms monitor live market conditions to achieve the best possible execution price.

Speed vs. Discretion

Some strategies prioritize speed (e.g., in high-frequency trading), while others prioritize stealth to avoid detection by other market participants.

Popular Execution Algorithm Strategies

Different execution algorithms serve different trading objectives.

VWAP (Volume-Weighted Average Price)

VWAP seeks to execute trades in line with market volume distribution. It is most effective in highly liquid markets where large trades can blend with natural volume.

VWAP execution curve aligning with intraday market volume

TWAP (Time-Weighted Average Price)

TWAP divides orders evenly over a specific period. It is useful when volume patterns are unpredictable but the trader wants steady participation.

Implementation Shortfall

This method focuses on minimizing the difference between the decision price (when the order was initiated) and the execution price. It adapts dynamically based on market conditions.

Liquidity-Seeking Algorithms

These algorithms hunt for hidden liquidity in dark pools and fragmented markets. They are often used by institutional traders who want to minimize footprint in visible order books.

Methodology A: Rule-Based Execution

Traditional execution algorithms are rule-based, meaning they follow pre-defined instructions such as “trade 10% of market volume every 15 minutes.”

Advantages:

Simple, transparent, and easy to audit.

Widely supported by broker platforms.

Good for steady execution of large trades.

Disadvantages:

Cannot adapt to changing market volatility.

May result in poor fills during abnormal conditions.

This method is particularly suited for execution algorithms for beginners, as rules are straightforward and easier to monitor.

Methodology B: Adaptive and AI-Driven Execution

Modern execution algorithms use machine learning, reinforcement learning, and real-time analytics to adapt orders dynamically.

Key Features:

Continuous monitoring of order book depth and liquidity.

Adjustment of order placement in milliseconds.

Use of predictive models for volatility and liquidity.

Advantages:

Better performance in fast-moving or fragmented markets.

Can optimize execution based on market microstructure.

Disadvantages:

More complex and costly to implement.

Risk of overfitting or malfunction in extreme scenarios.

This is why how institutional traders use execution algorithm often involves AI-driven methods, as institutions have the data and infrastructure to support them.

Comparing Rule-Based vs. Adaptive Execution

Factor Rule-Based Execution Adaptive/AI-Driven Execution Best Use Case

Complexity Low High Beginners → Rule-Based; Institutions → AI-Driven

Transparency High Medium Client reporting → Rule-Based

Adaptability Low High Volatile markets → AI-Driven

Cost Low High Retail → Rule-Based; Hedge Funds → AI-Driven

Conclusion: A hybrid approach is often best. Retail traders may start with rule-based execution, while institutions can layer adaptive algorithms on top for better performance.

Execution Algorithms in Practice

Execution algorithms are deployed across multiple contexts:

Hedge Funds: Reducing impact in large multi-asset portfolios.

Day Traders: Using TWAP or VWAP for steady intraday trading.

High-Frequency Traders: Deploying AI-driven strategies for millisecond execution.

Portfolio Managers: Ensuring compliance with best execution policies.

Common Pitfalls and Why Execution Algorithms Fail

Even the best algorithms can fail under certain conditions:

Market Liquidity Collapse – Sudden dry-ups (e.g., flash crashes).

Over-Reliance on Historical Data – Poor adaptability to unprecedented scenarios.

Poor Parameter Calibration – Misaligned with actual trading objectives.

Latency Issues – Delays in execution infrastructure.

Transparency Problems – Some brokers’ algorithms may prioritize their interests.

FAQ

- How do execution algorithms improve trading?

Execution algorithms improve trading by reducing costs, minimizing slippage, and enhancing order efficiency. Instead of a large market order that could spike prices, algorithms spread trades intelligently across venues and times.

- Are execution algorithms only for institutional traders?

No. While institutions pioneered them, many brokers now offer execution algorithms for retail traders. These simplified versions include VWAP, TWAP, and iceberg orders, making them accessible to smaller accounts.

- Can execution algorithms guarantee better results?

Not always. They improve efficiency, but outcomes depend on market conditions, chosen strategy, and algorithm parameters. A poorly calibrated algorithm can underperform compared to manual execution.

Conclusion and Call to Action

Execution algorithms are no longer a niche tool; they are essential in modern trading. Understanding how execution algorithm works empowers traders to optimize execution quality, manage risk, and align with best practices.

👉 Do you currently rely on execution algorithms in your trading? Share your experience—did you find rule-based or adaptive approaches more effective? Join the discussion and exchange insights with other traders.

Would you like me to expand this into a full 3000+ word long-form article with multiple images, case studies, and structured data (JSON-LD) for SEO, or keep this detailed draft as the foundation?

0 Comments

Leave a Comment