=====================================================

Introduction

In today’s hyper-connected financial markets, latency—the time delay between when a trading signal is generated and when an order reaches the exchange—can make the difference between profit and loss. For high-frequency traders (HFTs), latency is measured in microseconds, but even for retail traders, it can impact slippage, spreads, and overall execution quality. Understanding why latency matters in trading is not only crucial for institutional investors but also for retail participants who rely on automated trading systems, mobile platforms, or even manual execution.

This article will provide a deep dive into the role of latency in trading, explore practical strategies to minimize it, compare different approaches, and highlight how traders at every level can gain a competitive edge. By integrating both technical expertise and real-world experience, we aim to offer actionable insights supported by the latest industry trends.

What Is Latency in Trading?

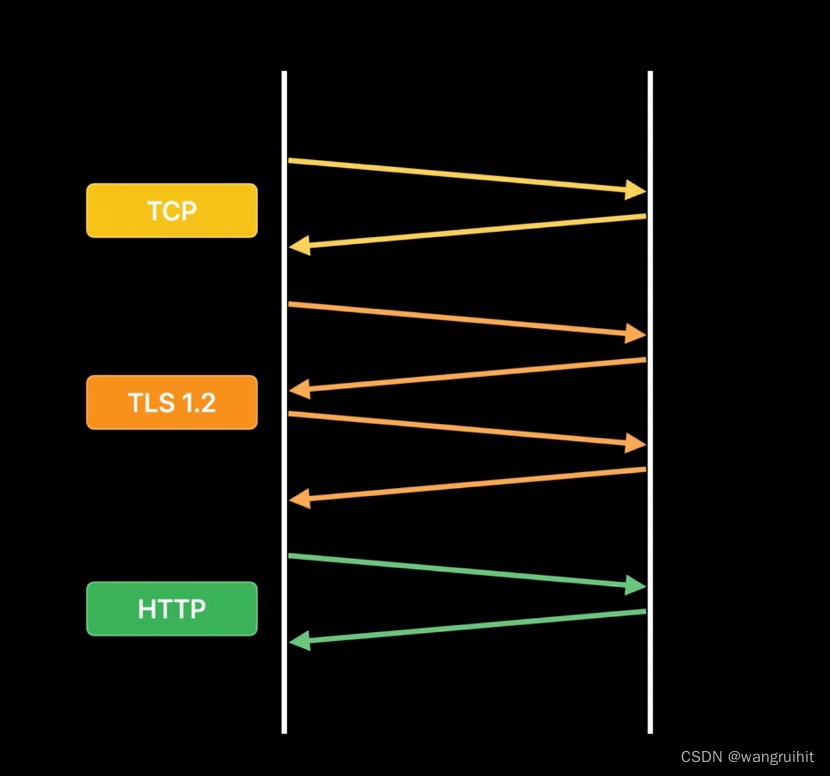

Latency in trading refers to the delay in processing financial information and executing trades. It can be broken into several components:

- Market Data Latency – The time it takes for price updates to reach your system.

- Decision Latency – The delay between receiving data and your system (or you) deciding to place an order.

- Transmission Latency – The time required to send an order to an exchange.

- Execution Latency – The delay between the exchange receiving the order and confirming execution.

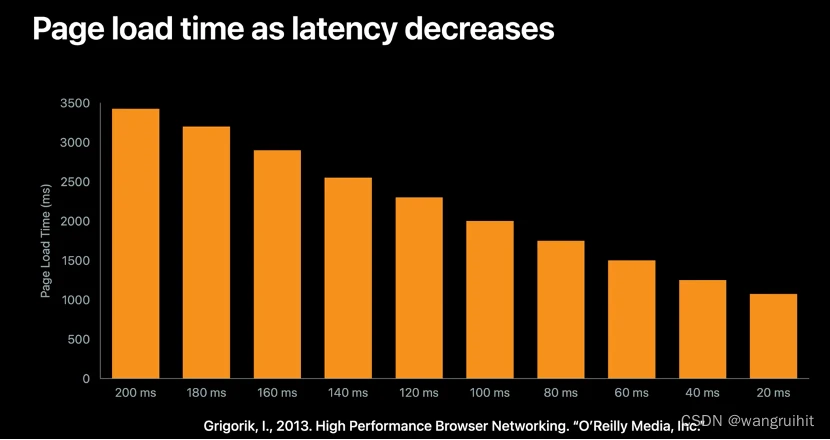

Even a small delay of milliseconds can significantly affect profitability when competing in markets where thousands of orders are processed every second.

Why Latency Matters in Trading

The Cost of Delay

In fast-moving markets, prices can shift within milliseconds. For example:

- A scalper aiming for a 0.5 pip gain in forex might see profits vanish if execution is delayed.

- An options trader executing an arbitrage strategy could lose the opportunity entirely if latency prevents capturing the spread.

Impact on Different Types of Traders

- High-Frequency Traders (HFTs): Latency defines success. Nanosecond advantages can produce millions in profit.

- Retail Traders: While the effect is smaller, slippage and order rejections due to latency can erode returns.

- Institutional Investors: Portfolio rebalancing, ETF arbitrage, and large block trades demand efficient execution to minimize impact costs.

Latency breakdown across trading infrastructure

Methods to Reduce Latency

1. Co-location of Servers

Co-location means placing your trading servers in the same data center as the exchange’s servers.

Pros:

- Minimal transmission latency

- Direct access to exchange market data feeds

- Widely used by institutional and algorithmic traders

- Minimal transmission latency

Cons:

- Expensive (often costing thousands of dollars monthly)

- Not accessible for most retail traders

- Expensive (often costing thousands of dollars monthly)

For professional traders, this is often the go-to solution. However, retail traders may benefit from broker partnerships that offer virtual proximity hosting.

2. Optimized Network Infrastructure

Network quality plays a critical role. Using dedicated fiber-optic connections or advanced protocols reduces transmission latency.

Pros:

- Improves reliability and consistency

- Can be tailored for specific trading strategies

- Improves reliability and consistency

Cons:

- Requires significant investment

- Maintenance and monitoring needed

- Requires significant investment

Here, choosing brokers with robust infrastructure is essential. For instance, brokers that offer low-latency routing help retail traders improve execution without direct co-location.

This is closely related to how latency affects quantitative trading, since quantitative strategies rely on fast, accurate data for decision-making.

3. Cloud-Based Trading Solutions

Cloud services allow traders to host strategies closer to major financial hubs without physical servers.

Pros:

- Affordable for retail traders

- Scalable and flexible

- Easy integration with algorithmic trading systems

- Affordable for retail traders

Cons:

- Shared infrastructure may still introduce latency

- Security risks if not configured properly

- Shared infrastructure may still introduce latency

This approach is gaining popularity as brokers and fintech companies expand cloud-based low-latency solutions tailored for algorithmic traders.

4. Software Optimization

Even if network speed is excellent, poorly designed trading software can introduce latency. Optimizations include:

- Using low-latency programming languages (C++, Rust)

- Streamlining algorithms to reduce processing time

- Efficient order routing logic

These improvements fall under latency reduction techniques in trading, a critical area for traders building custom systems.

Comparing Different Approaches

| Method | Best For | Cost | Effectiveness |

|---|---|---|---|

| Co-location | HFTs & institutions | Very High | Extremely Effective |

| Network Optimization | Institutions & advanced retail | High | Very Effective |

| Cloud Hosting | Retail & semi-professional | Moderate | Effective |

| Software Optimization | All traders | Low-Moderate | Highly Effective (if well-designed) |

Recommendation: For retail traders, the most cost-effective balance is cloud hosting + software optimization. Institutions and HFTs should invest in co-location and dedicated infrastructure.

Industry Trends in Latency Management

- AI-Driven Order Routing: Machine learning models predict market microstructure changes and route orders accordingly.

- Edge Computing in Trading: Processing trades closer to the exchange reduces both market data and decision latency.

- Hybrid Models: Combining cloud hosting with selective co-location to balance cost and performance.

These innovations highlight why reducing latency is crucial in trading, not only to maximize returns but also to adapt to increasingly competitive environments.

Low-latency servers positioned close to major trading exchanges

FAQ: Latency in Trading

1. How much latency is acceptable for retail traders?

For most retail traders, latency under 50–100 milliseconds is sufficient. However, scalpers and algorithmic traders should aim for under 10 milliseconds to minimize slippage.

2. Does broker choice affect latency?

Yes. Brokers with direct market access (DMA), optimized data feeds, and proximity to exchanges usually offer lower latency. Always test broker execution speed before committing capital.

3. Can I reduce latency without expensive infrastructure?

Yes. Retail traders can use VPS hosting, optimize algorithms, and select brokers with strong execution speed. While you may not achieve HFT-level performance, these steps significantly improve trade execution.

Conclusion

Understanding why latency matters in trading is critical for success in modern markets. While microsecond advantages dominate institutional and high-frequency trading, even retail traders benefit from reducing delays.

- Institutions should prioritize co-location and advanced networks.

- Retail traders should combine cloud hosting, optimized brokers, and software improvements for the best cost-performance ratio.

As markets continue to evolve, those who address latency effectively will consistently outperform those who ignore it.

If you found this article valuable, share it with fellow traders, comment with your latency experiences, and spread the word on social media. The conversation around latency is growing—your input could help others refine their strategies.

Would you like me to also create a visual latency comparison chart (execution speed vs trader type) that you can embed alongside the tables and images? It would make the article even more engaging.

0 Comments

Leave a Comment