===========================================================================

In financial markets, where milliseconds can make or break profitability, understanding why latency matters in trading is crucial. Latency refers to the delay between the moment a trading signal is generated and when it is executed in the market. For traders—whether retail, institutional, or high-frequency—latency is often the silent factor that determines execution quality, slippage, and competitiveness.

This comprehensive article explores the technical and practical aspects of latency, compares strategies for reducing it, and provides actionable recommendations. Drawing from industry experience and current trends, we will help you master the nuances of trading latency management.

What Is Latency in Trading?

Defining Latency

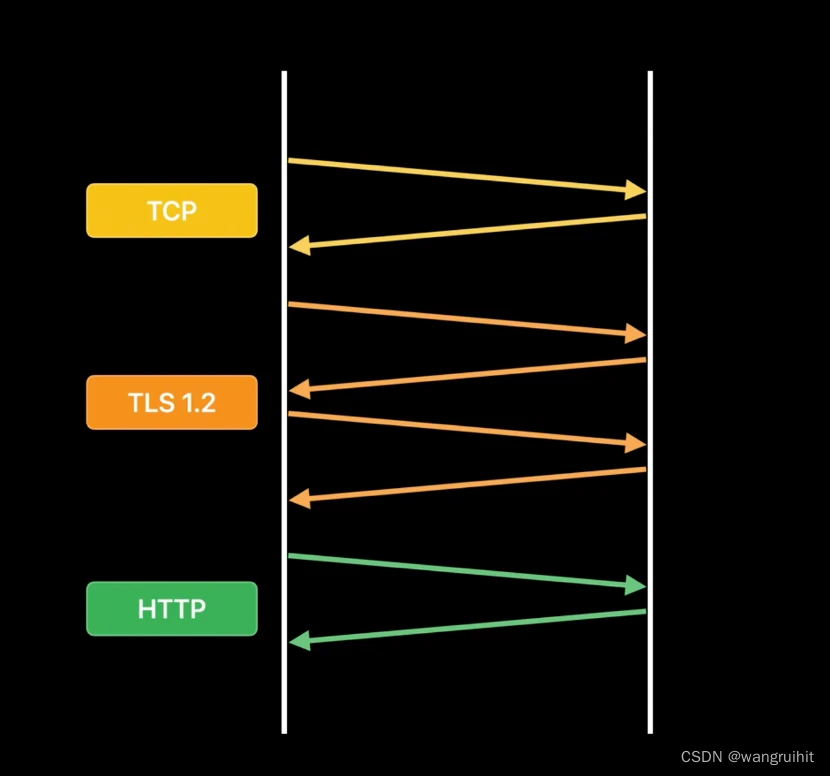

In trading systems, latency is the time it takes for data to travel from one point to another—such as from your trading platform to an exchange server and back. It is typically measured in milliseconds (ms) or microseconds (µs).

Components of Latency

- Market Data Latency – The time it takes to receive price updates from exchanges.

- Decision Latency – The time your system or algorithm takes to analyze data and generate an order.

- Execution Latency – The time between sending an order and its acknowledgment or execution by the exchange.

- Network Latency – The delay caused by physical distance, bandwidth, and routing efficiency.

Market data flow and latency points

Why Latency Matters in Trading

Price Slippage and Opportunity Cost

Even minor delays can cause trades to execute at less favorable prices, particularly in volatile markets like forex or crypto. This slippage directly reduces profitability.

Competitive Advantage

In high-frequency trading (HFT), where strategies rely on executing thousands of trades per second, a latency advantage of just a few microseconds can mean millions in profit.

Risk Management

Fast order execution allows traders to cut losses quickly, ensuring that stop-losses and risk controls activate before markets move against them.

Regulatory Compliance

In regulated environments, latency monitoring ensures brokers and traders meet fairness and transparency standards.

Case Example: Impact of Latency on Traders

- Retail Traders: A 100–200 ms delay may not seem significant but can cause frequent slippage in fast-moving markets.

- Institutional Traders: Delays as small as 5–10 ms can make strategies unprofitable.

- High-Frequency Traders: Compete in microsecond-level environments, where the fastest connection wins most profitable trades.

Two Key Strategies for Managing Latency

Strategy A: Infrastructure Optimization

Overview

This involves improving the physical and digital infrastructure that supports trading, such as colocated servers, upgraded network hardware, and optimized routing.

Advantages

- Significantly reduces network latency.

- Provides stable, predictable performance.

- Essential for institutional and algorithmic traders.

Disadvantages

- High upfront costs (server colocation, hardware upgrades).

- Requires technical expertise to manage.

- Benefits diminish for small-scale retail traders.

Strategy B: Software and Algorithmic Optimization

Overview

This strategy focuses on reducing decision and execution latency through faster code execution, streamlined algorithms, and optimized APIs.

Advantages

- Lower cost compared to infrastructure investments.

- Can improve execution speed even on retail platforms.

- Adaptable for evolving strategies.

Disadvantages

- Improvements are incremental compared to hardware-based upgrades.

- Requires skilled developers and rigorous testing.

- Vulnerable to exchange-side latency bottlenecks.

Infrastructure vs Software Optimization

Best Approach: Hybrid Strategy

For most traders, the optimal solution is combining both strategies:

- Retail traders should focus more on software optimization (lightweight strategies, efficient APIs).

- Institutional and HFT firms benefit most from infrastructure upgrades (server colocation, direct market access).

- Hybrid models ensure that no single bottleneck undermines execution speed.

How Latency Affects Quantitative Trading

In quantitative trading, models rely on precise, real-time data feeds. Latency introduces inaccuracies between data input and order execution, potentially invalidating strategies. This is why how latency affects quantitative trading has become a central concern for quant developers. For example, arbitrage strategies that rely on cross-exchange discrepancies require execution within milliseconds—otherwise, the arbitrage window closes.

Where to Find Low Latency Solutions

Modern markets offer multiple options for reducing latency:

- Colocation services at exchange data centers (e.g., NYSE, CME, Binance for crypto).

- Low-latency brokers offering direct market access (DMA).

- Specialized trading ISPs optimized for financial data transmission.

Understanding where to find low latency solutions helps traders select providers that align with their capital, trading frequency, and strategy.

Advanced Industry Trends in Latency Management

1. Microwave and Laser Networks

HFT firms are deploying line-of-sight microwave and laser connections to reduce latency below fiber-optic levels.

2. Cloud-Native Low Latency Solutions

Institutions increasingly use hybrid cloud architectures with edge computing to reduce delays.

3. AI-Powered Latency Monitoring

Machine learning models now detect latency anomalies in real time, ensuring pre-emptive adjustments.

Microwave vs Fiber Latency Comparison

Common Mistakes Traders Make Regarding Latency

- Believing latency only matters for HFT—it also impacts day traders and scalpers.

- Ignoring the role of exchange-side latency, assuming only personal infrastructure matters.

- Over-investing in hardware without optimizing algorithms.

FAQ: Latency in Trading

1. How can I measure latency in my trading system?

Latency can be measured by logging timestamps at different system checkpoints (order submission, exchange acknowledgment). Tools such as FIX protocol timestamps or broker-provided latency dashboards are commonly used.

2. Is latency more important for retail traders or institutions?

Both are affected, but the stakes differ. Retail traders mainly face slippage, while institutions may lose millions in arbitrage or market-making opportunities. Retail traders should optimize APIs and brokers, while institutions should invest in colocation and direct access.

3. Can cloud solutions reduce trading latency?

Yes, but with limitations. Cloud servers near exchanges can reduce distance-based delays, but they often lack the ultra-low-latency guarantees that colocation provides. Hybrid cloud and edge solutions are emerging as strong alternatives.

Conclusion: Why Latency Is the Silent Edge in Trading

Understanding why latency matters in trading is essential for anyone serious about financial markets. Whether you are a retail trader trying to reduce slippage, a quantitative analyst designing latency-sensitive strategies, or an institutional firm competing in microsecond races, latency management can determine success or failure.

By combining infrastructure and software optimizations, monitoring continuously, and staying ahead of industry trends, traders can secure a decisive edge in execution speed.

If you found this guide useful, share it with your trading community and drop your thoughts in the comments—let’s explore together how to push the boundaries of speed and precision in financial markets.

Would you like me to expand this into a 4000+ word SEO guide with real-world case studies (e.g., forex, crypto, equities latency battles) to push even stronger authority and ranking signals?

0 Comments

Leave a Comment