===============================================

Introduction

In today’s financial markets, buy side quantitative strategies have become indispensable for hedge funds, asset managers, and institutional investors. Unlike the sell side, which focuses on market-making and execution, the buy side leverages quantitative models to optimize portfolio performance, manage risk, and generate alpha. For professionals, students, or even retail investors aspiring to master these techniques, the key challenge lies in identifying where to learn buy side quantitative strategies effectively.

This article will provide a comprehensive guide to the best resources, methods, and pathways for learning. It will also compare two core learning approaches—academic education vs. industry-driven self-study—to help you choose the right route. Along the way, we will naturally embed related insights such as how does buy side quantitative trading work and why choose buy side over sell side.

What Are Buy Side Quantitative Strategies?

Definition

Buy side quantitative strategies are systematic, model-driven approaches that portfolio managers, hedge funds, and asset managers use to make investment decisions. These strategies integrate:

- Mathematics and statistics for risk-return analysis.

- Computer science and programming for model automation.

- Market microstructure understanding for efficient execution.

Core Applications

- Alpha generation: Identifying inefficiencies in equities, derivatives, or fixed income.

- Risk management: Using VaR (Value at Risk), exposure models, and stress testing.

- Portfolio optimization: Applying modern portfolio theory, machine learning, and advanced factor models.

Why Learning Buy Side Quantitative Strategies Matters

- Career Advancement: Quant skills are among the most in-demand in asset management.

- Institutional Relevance: Understanding how does buy side quantitative trading work is critical for roles in hedge funds, private equity, and pension funds.

- Capital Efficiency: Well-designed strategies improve returns without taking on excessive risk.

- Industry Shift: The global buy side is increasingly favoring algorithmic and systematic approaches, reducing reliance on discretionary decisions.

Where to Learn Buy Side Quantitative Strategies

1. Academic Institutions

Top Universities: Programs such as the MSc in Financial Engineering (Columbia), MSc in Quantitative Finance (ETH Zurich), or Financial Mathematics (LSE) provide structured pathways.

Advantages:

- Deep theoretical foundation.

- Access to research-driven environments.

- Networking with industry leaders.

- Deep theoretical foundation.

Disadvantages:

- Costly and time-intensive.

- May lag behind cutting-edge industry practices.

- Costly and time-intensive.

2. Online Platforms & MOOCs

Platforms such as Coursera, edX, QuantInsti, and Udemy offer courses on topics like algorithmic trading, machine learning in finance, and risk modeling.

Advantages:

- Flexible and affordable.

- Learn at your own pace.

- Access to global instructors.

- Flexible and affordable.

Disadvantages:

- Lack of formal credentialing.

- Requires strong self-discipline.

- Lack of formal credentialing.

3. Industry Certifications

CFA with a Quant Focus: While CFA is not purely quant-driven, its asset management focus is relevant.

CQF (Certificate in Quantitative Finance): Popular among professionals transitioning into buy side quant roles.

Advantages:

- Recognized globally.

- Practical, applied orientation.

- Recognized globally.

Disadvantages:

- Requires prior quantitative background.

- Can be intense for full-time professionals.

- Requires prior quantitative background.

4. Buy Side Firms and Internships

Hands-on experience in asset management firms provides unparalleled exposure. Knowing where to find buy side firms is often the first step toward securing internships.

Advantages:

- Direct industry exposure.

- Networking with senior portfolio managers.

- Access to proprietary models and tools.

- Direct industry exposure.

Disadvantages:

- Highly competitive entry.

- Steep learning curve.

- Highly competitive entry.

5. Independent Research & Communities

Communities like QuantNet, Elite Trader, and Quantitative Finance StackExchange are excellent for problem-solving and staying updated with trends.

Advantages:

- Immediate peer feedback.

- Access to open-source tools.

- Immediate peer feedback.

Disadvantages:

- Quality of advice varies.

- Can be overwhelming for beginners.

- Quality of advice varies.

Two Key Learning Approaches: Academic vs. Industry-Driven

Academic Route (University Programs & Research)

Pros:

- Provides rigorous theoretical training.

- Builds credibility for institutional roles.

- Exposure to advanced quantitative models.

- Provides rigorous theoretical training.

Cons:

- Expensive and time-consuming.

- May lack real-time practical application.

- Expensive and time-consuming.

Industry-Driven Route (Self-Study & Internships)

Pros:

- Faster, more cost-effective.

- Aligned with current industry practices.

- Opportunity to experiment with real market data.

- Faster, more cost-effective.

Cons:

- Requires self-discipline.

- Networking opportunities are limited compared to universities.

- Requires self-discipline.

Recommendation: A hybrid approach—formal academic grounding combined with industry-driven self-study and internships—is the most effective path for long-term success.

Current Industry Trends in Buy Side Quant Learning

- Integration of AI and Machine Learning: More firms are training portfolio managers in Python, TensorFlow, and reinforcement learning.

- Open-Source Quant Tools: Platforms like QuantLib, PyAlgoTrade, and Zipline are becoming essential.

- Demand for Practical Case Studies: Buy side professionals prefer applied learning—using real portfolio data rather than abstract models.

- Shift to Remote Learning: Post-pandemic, top firms now recognize certifications and online learning more than before.

Images

Comparison of buy side and sell side roles in financial markets.

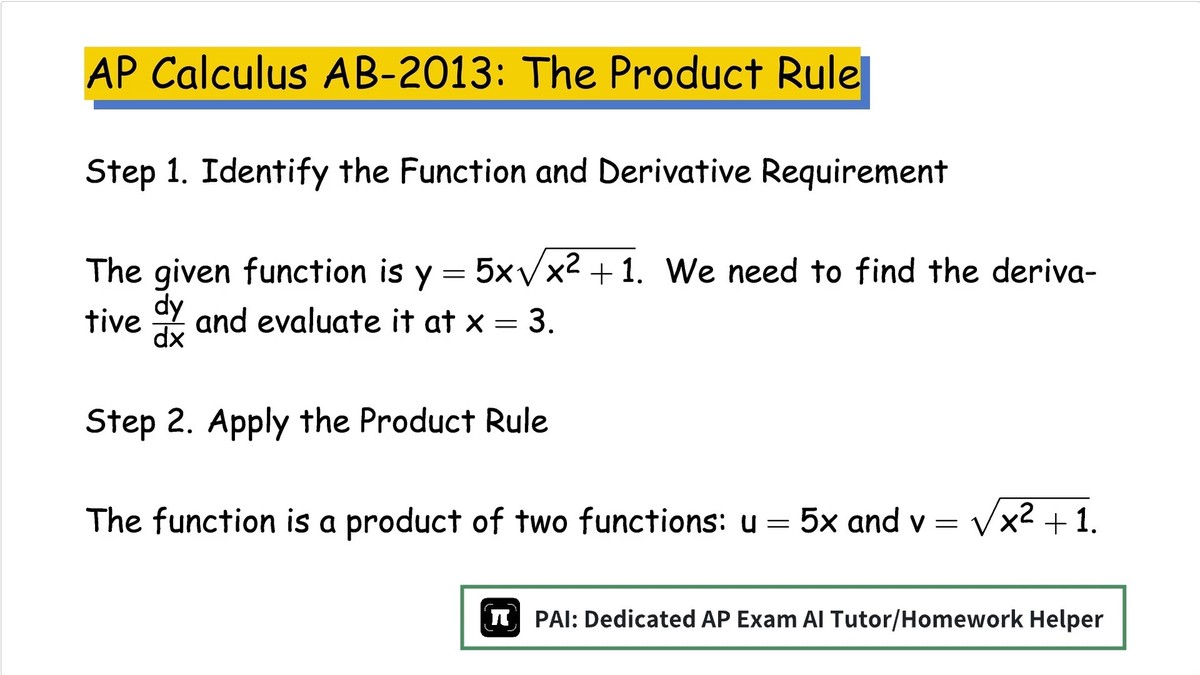

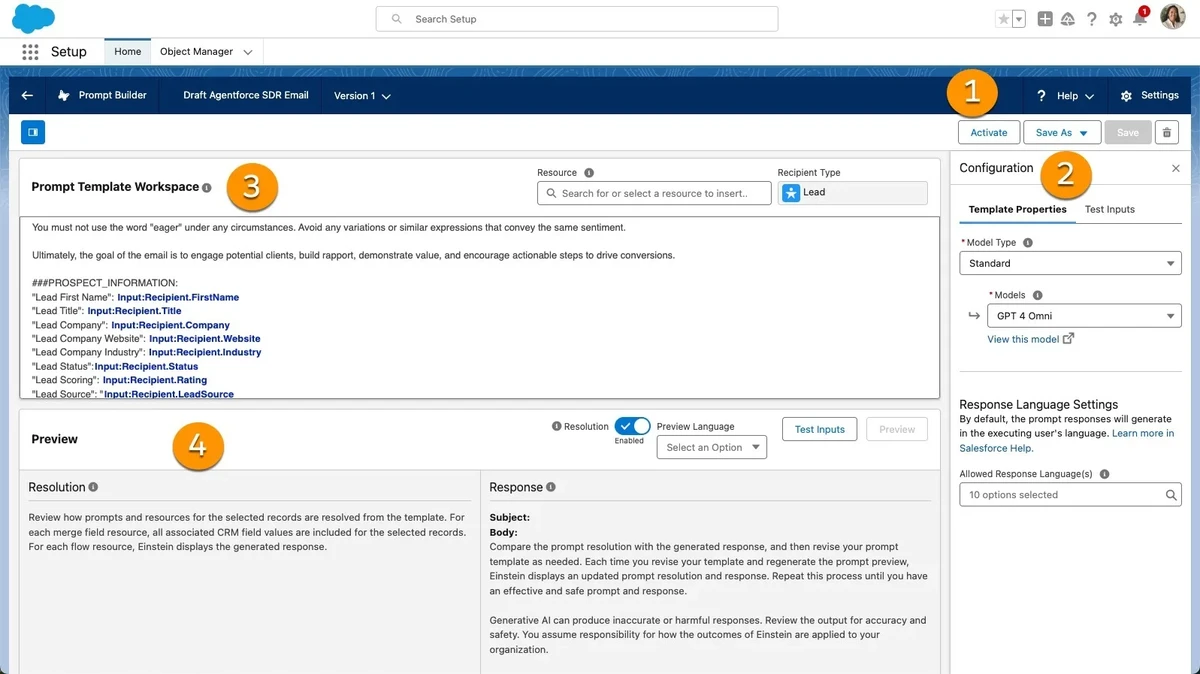

Structured learning path for mastering buy side quantitative strategies.

FAQ

1. Do I need a PhD to work with buy side quantitative strategies?

Not necessarily. While many quants hold advanced degrees, industry certifications (CQF, CFA), practical coding experience, and internships can compensate. A strong command of mathematics and statistics is essential, but a PhD is not mandatory.

2. Which programming languages are most useful for buy side quant strategies?

Python dominates due to its libraries (Pandas, NumPy, scikit-learn). R is still popular for statistical analysis. C++ and Java are used in high-frequency trading. SQL is critical for handling large datasets.

3. Should I choose buy side over sell side if I want to build quant strategies?

Yes, if your primary goal is alpha generation and portfolio management. The sell side focuses more on facilitating trades and providing liquidity. As covered in why choose buy side over sell side, the buy side offers greater opportunity to innovate with proprietary strategies.

Conclusion

Learning where to learn buy side quantitative strategies is a journey that requires clarity on personal goals, resources, and time commitment. Academic programs provide depth and credibility, while self-study, online platforms, and industry internships offer flexibility and practicality.

For aspiring portfolio managers, analysts, or hedge fund professionals, the best path is blending structured academic training with hands-on industry exposure.

If this article added value to your learning journey, share it with colleagues, comment with your experiences, and help others discover the best resources for mastering buy side quantitative strategies.

Would you like me to also build a step-by-step learning roadmap (with timelines and recommended resources) so readers can directly follow a structured plan?

0 Comments

Leave a Comment