===============================================

In today’s financial markets, the buy side—including hedge funds, asset managers, pension funds, and private equity firms—relies heavily on quantitative strategies to generate alpha, manage risk, and optimize portfolio performance. Aspiring analysts, traders, and portfolio managers often ask: Where to learn buy side quantitative strategies? This article provides a comprehensive guide, covering educational pathways, industry resources, practical training methods, and insider perspectives on how to master the quantitative skills needed to succeed in the buy side environment.

Understanding Buy Side Quantitative Strategies

Before diving into learning resources, it’s crucial to understand what buy side quantitative strategies entail.

What Are Buy Side Quantitative Strategies?

These are systematic approaches developed to allocate capital, manage risk, and outperform benchmarks. Unlike the sell side, which focuses on trade execution and market-making, the buy side emphasizes long-term value creation and portfolio growth.

Key Applications

- Alpha Generation: Identifying inefficiencies in equities, fixed income, or derivatives.

- Risk Management: Using models to hedge exposures across asset classes.

- Portfolio Optimization: Applying algorithms to balance return objectives with risk constraints.

- Execution Algorithms: Minimizing transaction costs in large trades.

Analysts highlight that understanding how buy side quantitative trading works is foundational before pursuing specialized courses or certifications.

Pathways to Learning Buy Side Quantitative Strategies

1. Formal Academic Programs

Many universities now offer specialized quantitative finance programs, often under the umbrella of financial engineering or applied mathematics.

- Pros: Structured learning, access to professors with industry experience, strong recruiting pipelines.

- Cons: Expensive, often theoretical, may not cover cutting-edge hedge fund practices.

Top programs often integrate coding, stochastic calculus, and econometrics, which are directly applicable to buy side strategies.

2. Professional Certifications

Credentials such as CFA (Chartered Financial Analyst) or CQF (Certificate in Quantitative Finance) are highly valued in the buy side industry.

- CFA: Focuses on investment management, ethics, and portfolio theory.

- CQF: Specialized in advanced quantitative techniques, derivatives, and programming.

While CFA builds a strong foundation in portfolio management, CQF is better suited for those looking to design and implement trading algorithms.

3. Online Courses and MOOCs

For flexibility and affordability, online platforms provide courses in:

- Machine Learning for Trading (Coursera, Udacity)

- Python for Finance (DataCamp, QuantInsti)

- Advanced Quantitative Trading Strategies (edX, QuantInsti EPAT program)

These allow learners to build practical skills at their own pace.

4. On-the-Job Training and Internships

Real-world experience is irreplaceable. Interning at hedge funds, asset managers, or proprietary trading firms allows students to see how theories are implemented in practice.

This also helps aspiring professionals understand why choose buy side over sell side—as the buy side typically offers greater autonomy in investment decision-making and direct exposure to performance-driven incentives.

5. Self-Directed Learning and Research

Analysts stress the importance of hands-on projects such as:

- Backtesting strategies in Python or R.

- Exploring academic papers on factor models and portfolio construction.

- Reading buy side research publications and white papers.

Many successful quant traders have built careers by combining formal education with independent exploration.

Core Strategies to Learn

1. Factor-Based Strategies

Factor investing uses variables such as value, momentum, size, and quality to explain returns.

- Strengths: Strong academic foundation, widely applied in institutional investing.

- Weaknesses: Crowded trades, potential for diminishing returns.

2. Statistical Arbitrage

This involves exploiting pricing inefficiencies using mean reversion and co-integration models.

- Strengths: Market-neutral, reduces systemic exposure.

- Weaknesses: Requires high-frequency data and strong execution systems.

3. Machine Learning Models

With advances in data science, ML techniques are being used to predict asset price movements, detect regime shifts, and optimize execution.

- Strengths: Ability to process alternative data (satellite images, social media, sentiment).

- Weaknesses: Risk of overfitting, lack of interpretability.

Comparing strategies, analysts often recommend factor-based investing for beginners due to its simplicity, while advanced learners can explore machine learning and statistical arbitrage.

Practical Skills Required

Programming Languages

- Python: Widely used for backtesting and data analysis.

- R: Strong in econometrics and statistical analysis.

- C++: Used in high-frequency trading environments.

Quantitative Methods

- Time series analysis

- Optimization techniques

- Monte Carlo simulations

- Stochastic calculus

Financial Knowledge

- Derivatives pricing

- Portfolio theory

- Risk management frameworks

Recommended Resources

Books

- Quantitative Equity Portfolio Management by Ludwig Chincarini & Daehwan Kim

- Advances in Financial Machine Learning by Marcos López de Prado

- Quantitative Equity Portfolio Management by Ludwig Chincarini & Daehwan Kim

Communities and Forums

- Quantitative Finance Stack Exchange

- QuantConnect, QuantInsti community

- Quantitative Finance Stack Exchange

Industry Reports

- McKinsey, BlackRock, and Goldman Sachs research papers on buy side trends

- McKinsey, BlackRock, and Goldman Sachs research papers on buy side trends

Future Trends in Buy Side Quantitative Strategies

- AI and Deep Learning: Increasingly adopted to process unstructured data.

- Alternative Data: Satellite imagery, credit card transactions, and ESG signals.

- RegTech Integration: Quant strategies now incorporate compliance automation.

- Personalized Portfolios: Asset managers tailoring strategies to retail clients.

These trends highlight why buy side quantitative trading is important for shaping future portfolio management and institutional investment.

FAQ: Where to Learn Buy Side Quantitative Strategies

1. What is the best way to start learning buy side quantitative strategies?

The best approach is to combine theory and practice. Start with foundational courses in finance and programming, then move to advanced topics like factor modeling and statistical arbitrage. Hands-on projects and internships add real-world perspective.

2. Do I need a PhD to work in buy side quant roles?

Not necessarily. While many quant researchers hold advanced degrees in mathematics or computer science, practical coding skills, financial knowledge, and trading experience are equally valuable. Certifications like CQF or CFA can bridge knowledge gaps.

3. How can retail investors apply buy side quantitative strategies?

Retail investors can implement simplified versions of factor investing and algorithmic trading using platforms like QuantConnect or Interactive Brokers. The key is to manage risk properly and avoid overleveraging.

Conclusion

Learning buy side quantitative strategies requires a mix of academic study, certifications, practical training, and self-driven exploration. With markets evolving rapidly, staying updated with the latest tools, data, and strategies is essential for long-term success.

If you’re exploring where to learn buy side quantitative strategies, start by building core quantitative and coding skills, then deepen your expertise with specialized programs, research, and on-the-job experience.

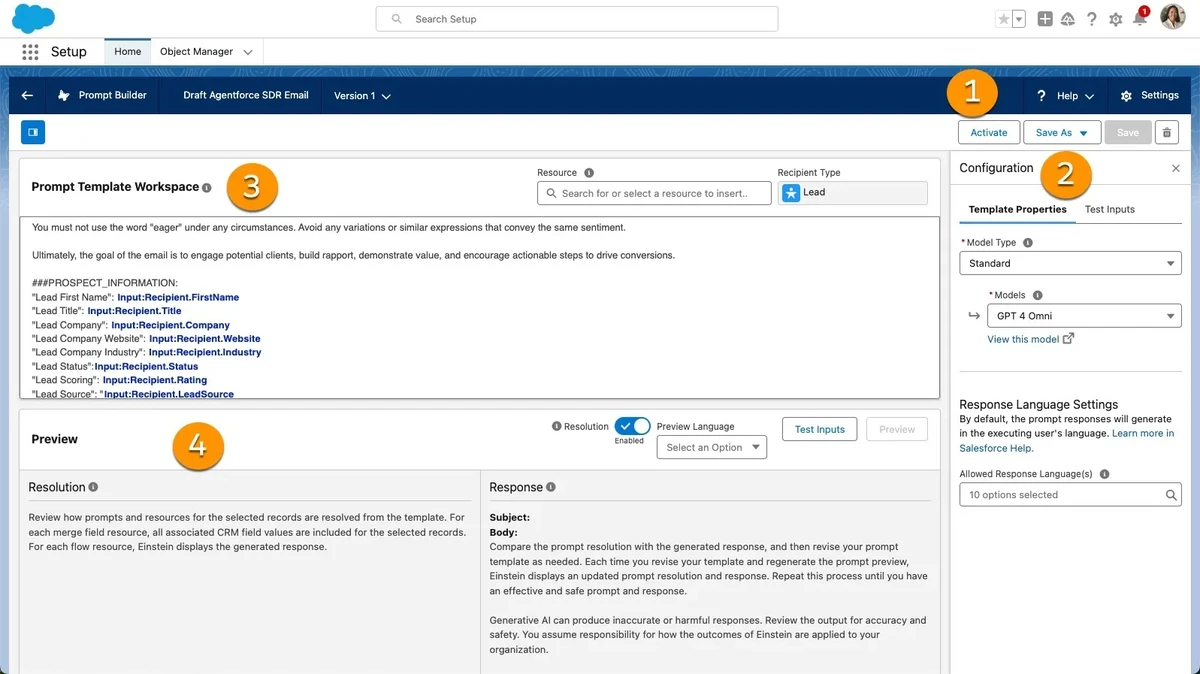

A structured roadmap for mastering buy side quantitative strategies, from foundational knowledge to advanced machine learning applications.

If you found this article insightful, share it with peers, drop a comment on your learning journey, and let’s continue building a knowledge-sharing community for aspiring buy side professionals.

0 Comments

Leave a Comment